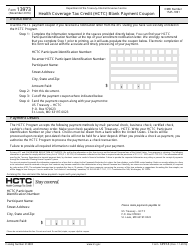

Instructions for IRS Form 1099-H Health Coverage Tax Credit (Hctc) Advance Payments

This document contains official instructions for IRS Form 1099-H , Health Coverage Tax Credit (Hctc) Advance Payments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-H is available for download through this link.

FAQ

Q: What is IRS Form 1099-H?

A: IRS Form 1099-H is a tax document used to report Health Coverage Tax Credit (HCTC) advance payments.

Q: What are Health Coverage Tax Credit (HCTC) advance payments?

A: Health Coverage Tax Credit (HCTC) advance payments are monthly payments made to eligible individuals for a portion of their qualified health insurance premiums.

Q: Who receives Form 1099-H?

A: Form 1099-H is received by individuals who received Health Coverage Tax Credit (HCTC) advance payments during the tax year.

Q: What information is included on Form 1099-H?

A: Form 1099-H includes the amount of Health Coverage Tax Credit (HCTC) advance payments received by the individual.

Q: Do I need to report Form 1099-H on my tax return?

A: Yes, you need to report the information from Form 1099-H on your tax return.

Q: Are Health Coverage Tax Credit (HCTC) advance payments taxable?

A: No, Health Coverage Tax Credit (HCTC) advance payments are not taxable.

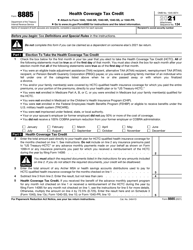

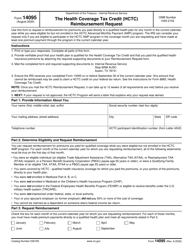

Q: Can I claim the Health Coverage Tax Credit (HCTC) on my tax return?

A: Yes, you can claim the Health Coverage Tax Credit (HCTC) on your tax return if you meet the eligibility requirements.

Q: What are the eligibility requirements for the Health Coverage Tax Credit (HCTC)?

A: To be eligible for the Health Coverage Tax Credit (HCTC), you must be receiving Trade Adjustment Assistance (TAA) or Pension Benefit Guaranty Corporation (PBGC) payments, among other requirements.

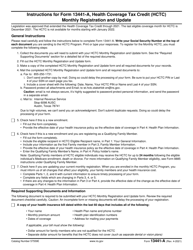

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.