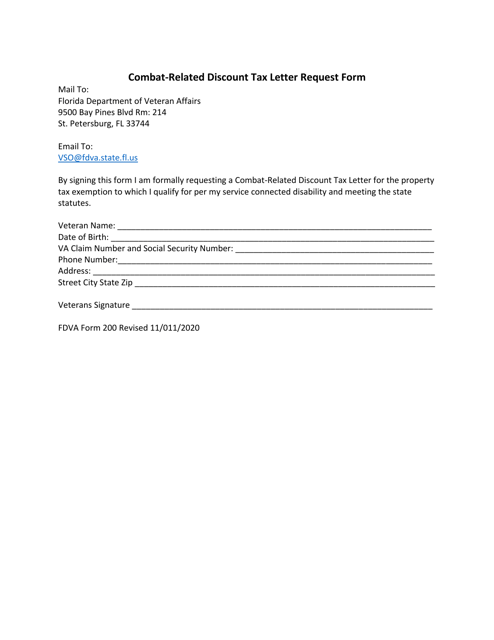

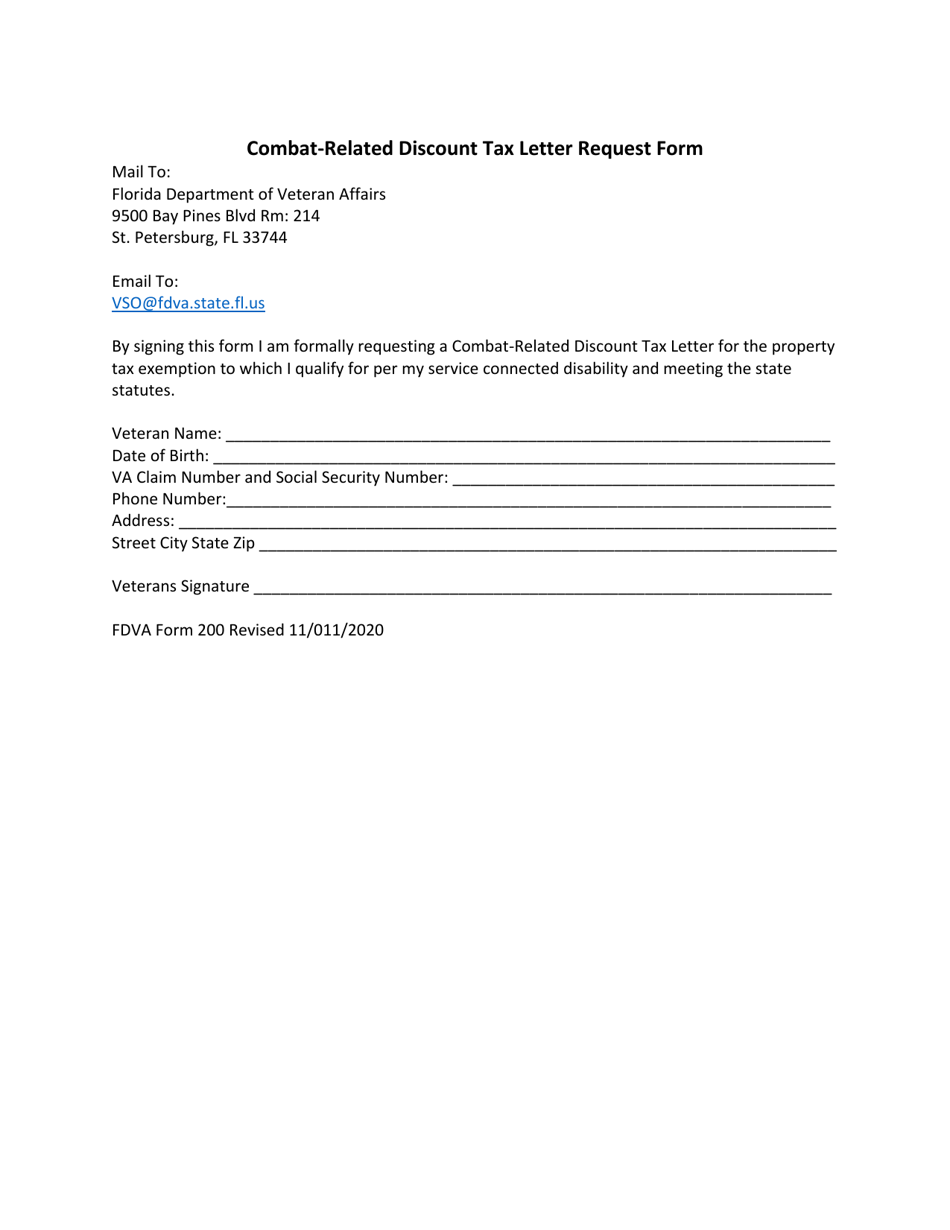

FDVA Form 200 Combat-Related Discount Tax Letter Request Form - Florida

What Is FDVA Form 200?

This is a legal form that was released by the Florida Department of Veterans Affairs - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FDVA Form 200?

A: FDVA Form 200 is the Combat-Related Discount Tax Letter Request Form in Florida.

Q: What is the purpose of FDVA Form 200?

A: The purpose of FDVA Form 200 is to request a combat-related discount on property taxes in Florida.

Q: Who can use FDVA Form 200?

A: FDVA Form 200 can be used by veterans who have a combat-related disability.

Q: How can I obtain FDVA Form 200?

A: You can obtain FDVA Form 200 by contacting the Florida Department of Veterans' Affairs.

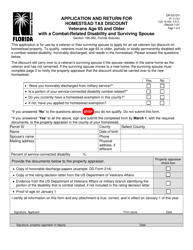

Q: What documentation do I need to submit with FDVA Form 200?

A: You will need to submit documentation proving your combat-related disability with FDVA Form 200.

Q: Is there a deadline for submitting FDVA Form 200?

A: Yes, FDVA Form 200 must be submitted by March 1st of each year to be eligible for the discount.

Q: What happens after I submit FDVA Form 200?

A: After submitting FDVA Form 200, the Florida Department of Veterans' Affairs will review your application and determine your eligibility for the combat-related discount.

Q: What is the combat-related discount?

A: The combat-related discount is a reduction in property taxes for veterans with a combat-related disability.

Q: Are there any other requirements for the combat-related discount?

A: Yes, in addition to having a combat-related disability, you must also meet any other eligibility requirements set by the Florida Department of Veterans' Affairs to receive the discount.

Q: Can I apply for the combat-related discount if I am not a Florida resident?

A: No, the combat-related discount is only available to veterans who are residents of Florida.

Form Details:

- Released on November 11, 2020;

- The latest edition provided by the Florida Department of Veterans Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of FDVA Form 200 by clicking the link below or browse more documents and templates provided by the Florida Department of Veterans Affairs.