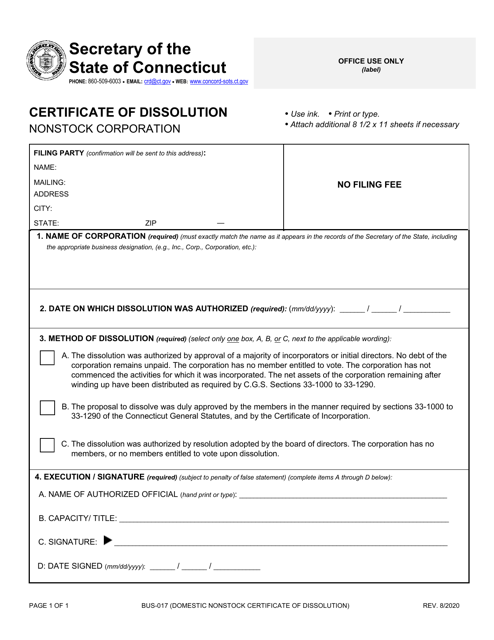

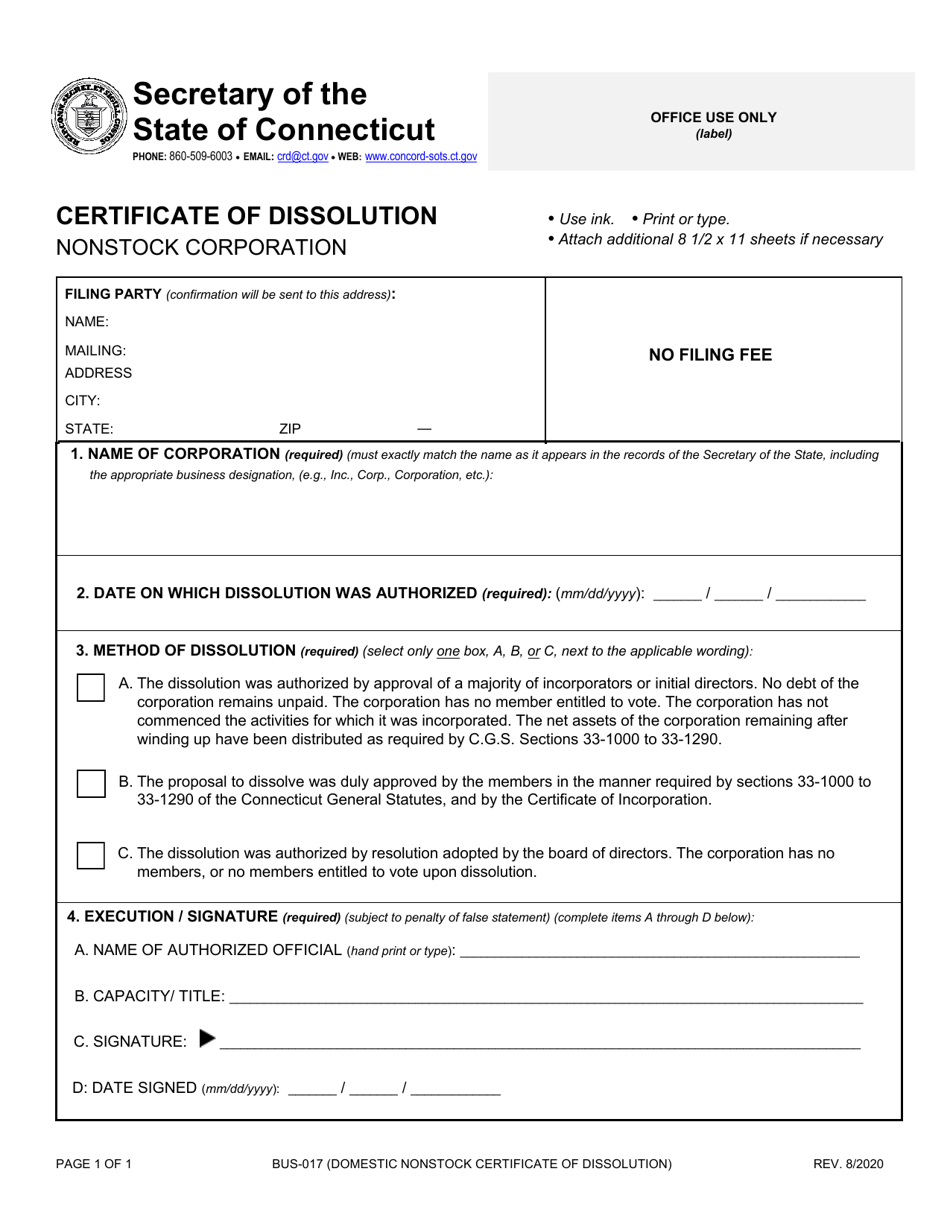

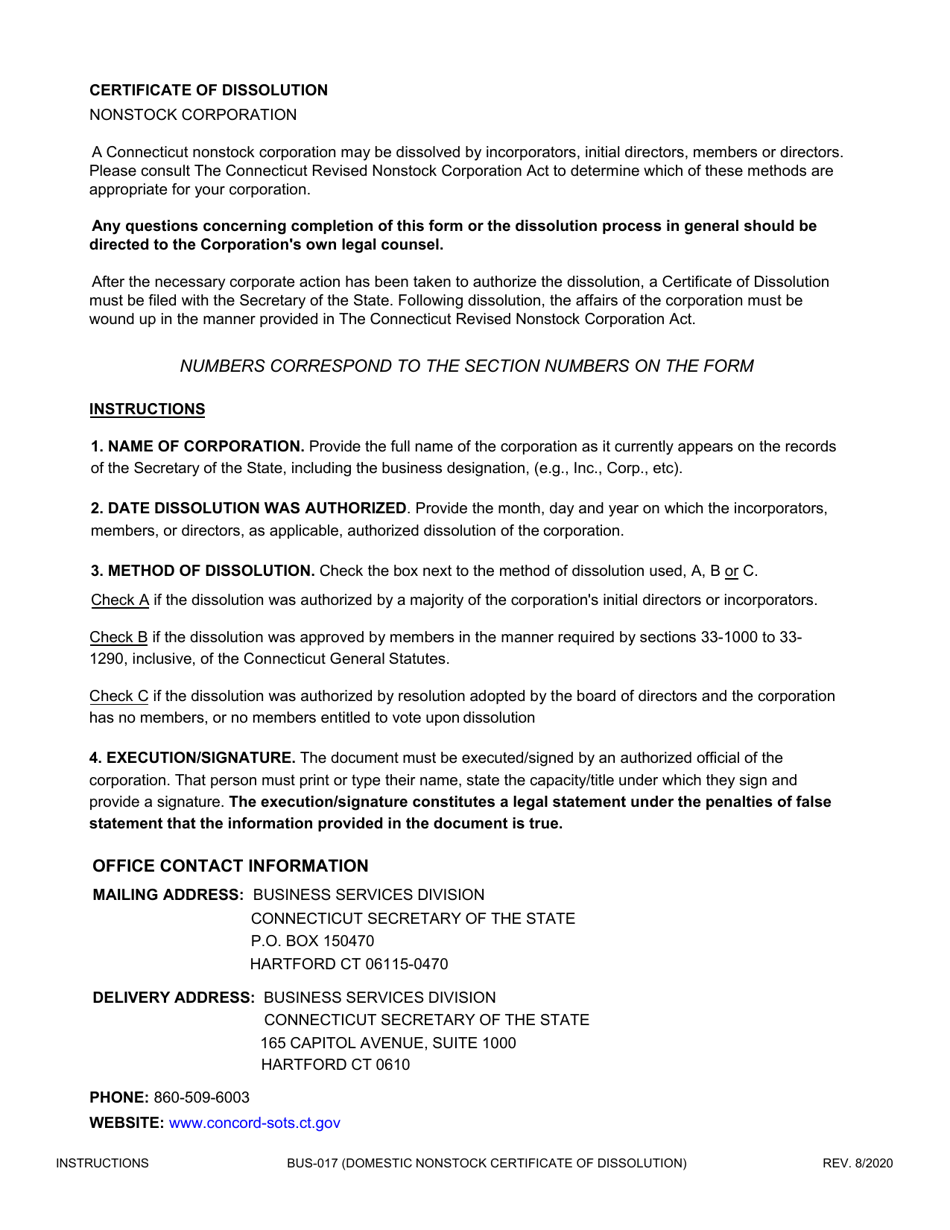

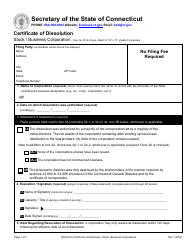

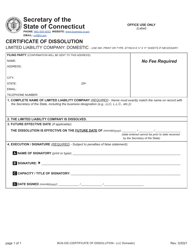

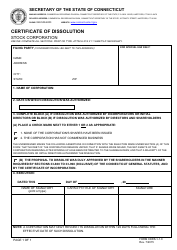

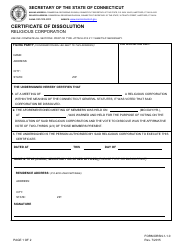

Form BUS-017 Certificate of Dissolution - Nonstock Corporation - Connecticut

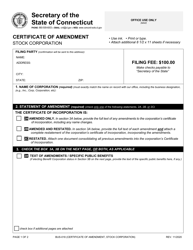

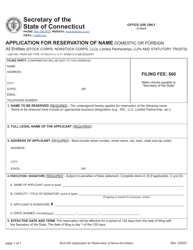

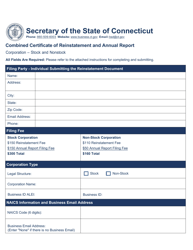

What Is Form BUS-017?

This is a legal form that was released by the Connecticut Secretary of the State - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

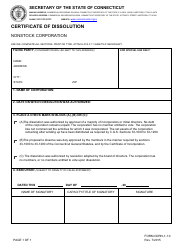

Q: What is a Certificate of Dissolution?

A: A Certificate of Dissolution is a legal document that officially terminates the existence of a corporation.

Q: What is a nonstock corporation?

A: A nonstock corporation is a type of corporation that is not owned by shareholders and does not issue stock.

Q: Who is eligible to file a Certificate of Dissolution for a nonstock corporation in Connecticut?

A: The directors or incorporators of a nonstock corporation may file a Certificate of Dissolution.

Q: What information is required on the Certificate of Dissolution?

A: The Certificate of Dissolution typically requires information such as the corporation's name, date of incorporation, reason for dissolution, and signatures of authorized individuals.

Q: What is the filing fee for the Certificate of Dissolution?

A: The filing fee for the Certificate of Dissolution for a nonstock corporation in Connecticut is $50.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Connecticut Secretary of the State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BUS-017 by clicking the link below or browse more documents and templates provided by the Connecticut Secretary of the State.