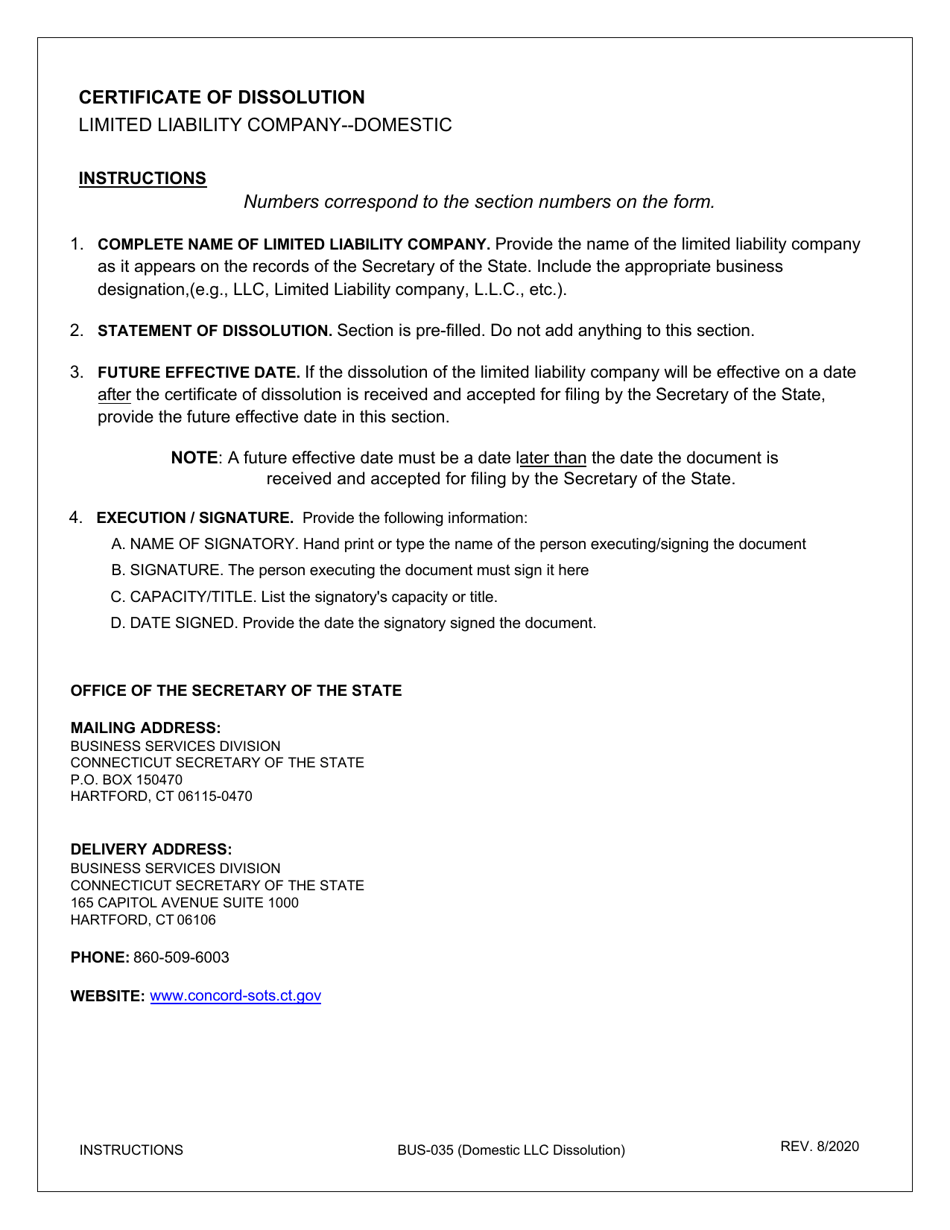

This version of the form is not currently in use and is provided for reference only. Download this version of

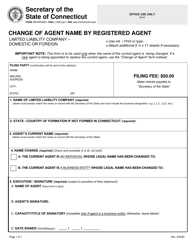

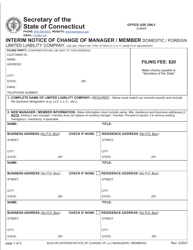

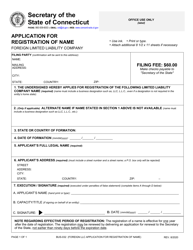

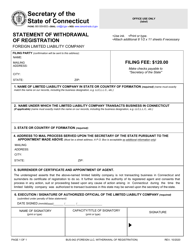

Form BUS-035

for the current year.

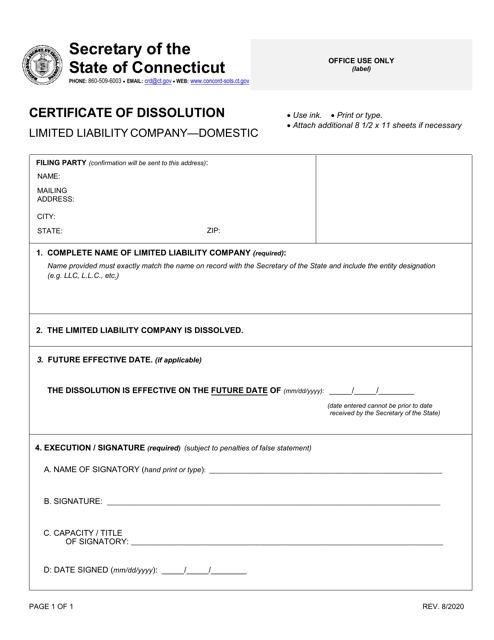

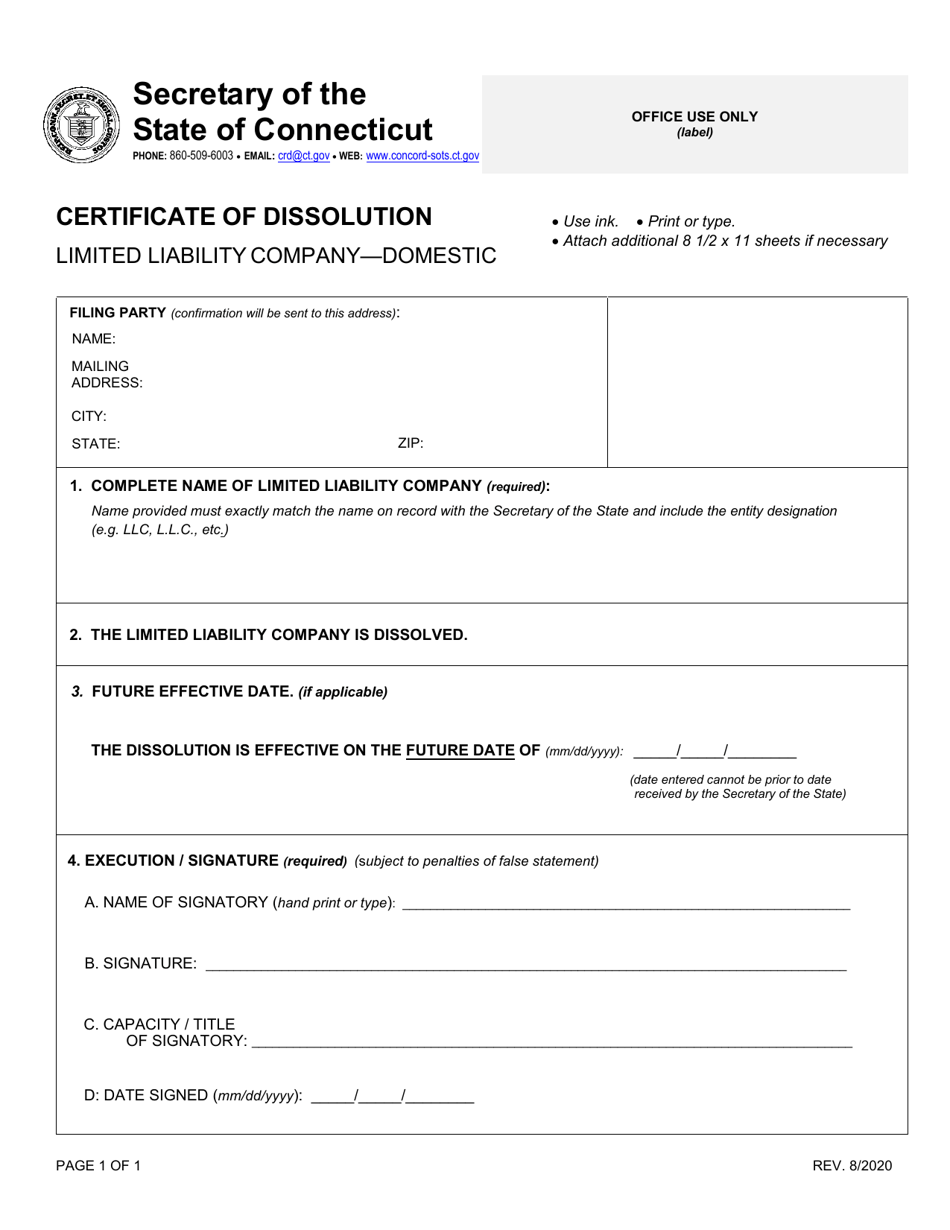

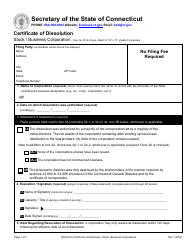

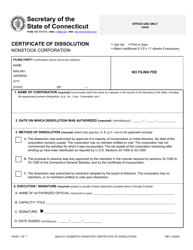

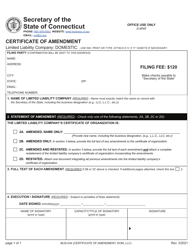

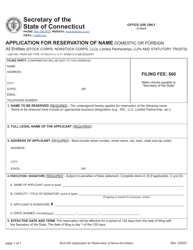

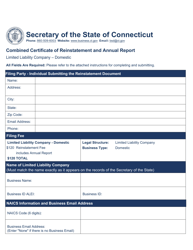

Form BUS-035 Certificate of Dissolution - Limited Liability Company - Domestic - Connecticut

What Is Form BUS-035?

This is a legal form that was released by the Connecticut Secretary of the State - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Certificate of Dissolution?

A: A Certificate of Dissolution is a legal document used to formally dissolve a limited liability company (LLC).

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company (LLC) is a business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Q: What does it mean to dissolve an LLC?

A: To dissolve an LLC means to legally terminate the existence of the company.

Q: Why would I dissolve my LLC?

A: LLCs can be dissolved for various reasons, such as the business is no longer operating, the owners want to retire or pursue other ventures, or the company is facing financial difficulties.

Q: Do I need to file a Certificate of Dissolution to dissolve an LLC in Connecticut?

A: Yes, in Connecticut, you are required to file a Certificate of Dissolution with the Secretary of State's office to officially dissolve an LLC.

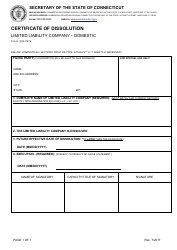

Q: What information is required to fill out a Certificate of Dissolution?

A: The Certificate of Dissolution typically requires information such as the name of the LLC, the date of dissolution, and the signatures of the LLC's members or managers.

Q: What happens after filing a Certificate of Dissolution?

A: Once the Certificate of Dissolution is filed and approved by the Secretary of State, the LLC's legal existence is terminated and it will no longer be able to conduct business.

Q: Do I need to notify other agencies or creditors when dissolving my LLC?

A: Yes, it is generally recommended to notify other relevant agencies, such as the IRS and state tax authorities, as well as any creditors or business partners of the LLC's dissolution.

Q: Can I change my mind after filing a Certificate of Dissolution?

A: Once a Certificate of Dissolution is filed and approved, it is typically difficult to reverse the dissolution process. If you change your mind, you may need to consult with an attorney to explore your options.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Connecticut Secretary of the State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BUS-035 by clicking the link below or browse more documents and templates provided by the Connecticut Secretary of the State.