This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

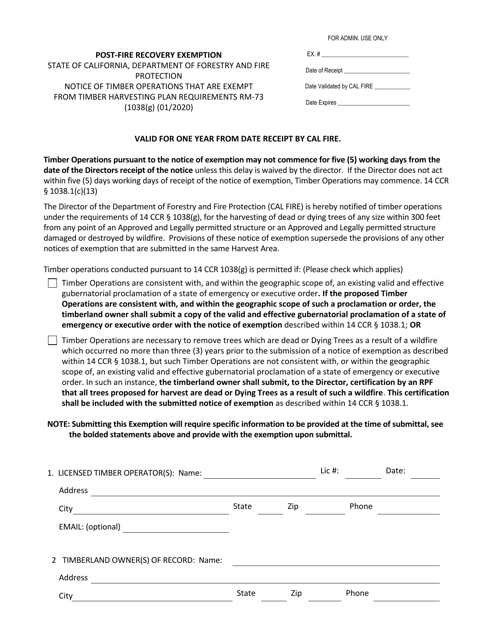

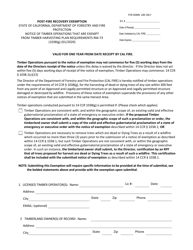

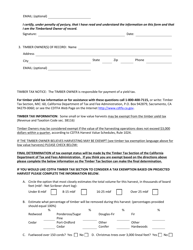

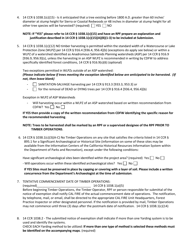

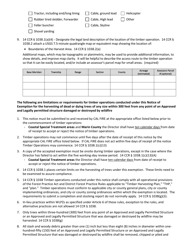

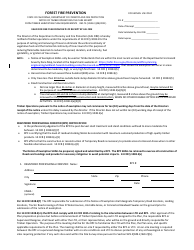

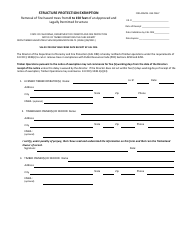

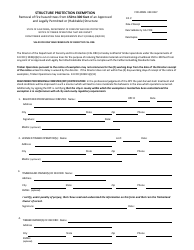

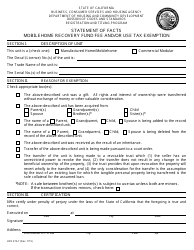

Post-fire Recovery Exemption - California

Post-fire Recovery Exemption is a legal document that was released by the California Department of Forestry & Fire Protection - a government authority operating within California.

FAQ

Q: What is the Post-fire Recovery Exemption?

A: The Post-fire Recovery Exemption is a property tax relief program in California.

Q: Who is eligible for the Post-fire Recovery Exemption?

A: Homeowners who have suffered at least $10,000 in damage to their property due to a fire are eligible for the exemption.

Q: What does the Post-fire Recovery Exemption provide?

A: The exemption allows eligible homeowners to receive a reduction in their property taxes for the fiscal year following the fire.

Q: How much reduction in property taxes does the exemption provide?

A: The exemption provides a reduction of up to $250,000 in assessed value, depending on the extent of the damage.

Q: How can homeowners apply for the Post-fire Recovery Exemption?

A: Homeowners can apply for the exemption through their county assessor's office. They will need to provide documentation of the fire damage.

Q: Is the Post-fire Recovery Exemption available in all counties in California?

A: Yes, the exemption is available in all counties in California.

Q: Are there any deadlines for applying for the exemption?

A: Yes, homeowners must apply for the exemption within 12 months of the date on which the fire damaged their property.

Q: What other types of property tax relief are available for fire-affected homeowners in California?

A: In addition to the Post-fire Recovery Exemption, there are other programs available, such as the Base Year Value Transfer and the Temporary Housing Exemption.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the California Department of Forestry & Fire Protection;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Forestry & Fire Protection.