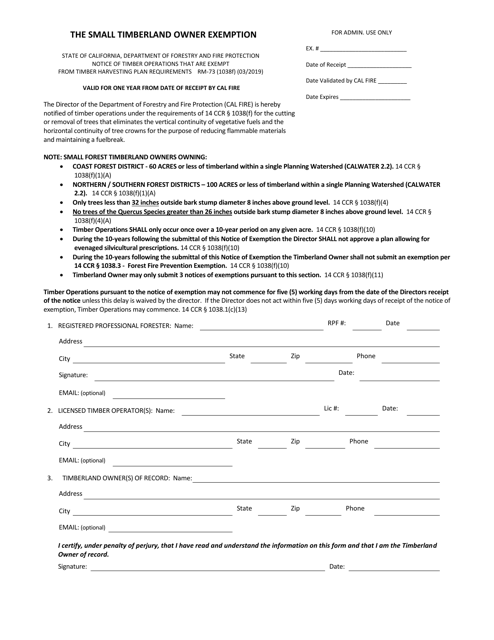

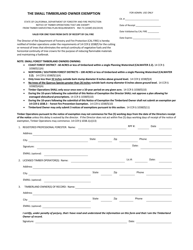

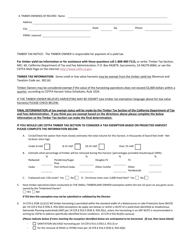

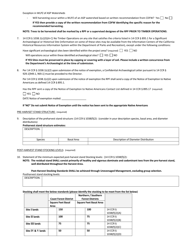

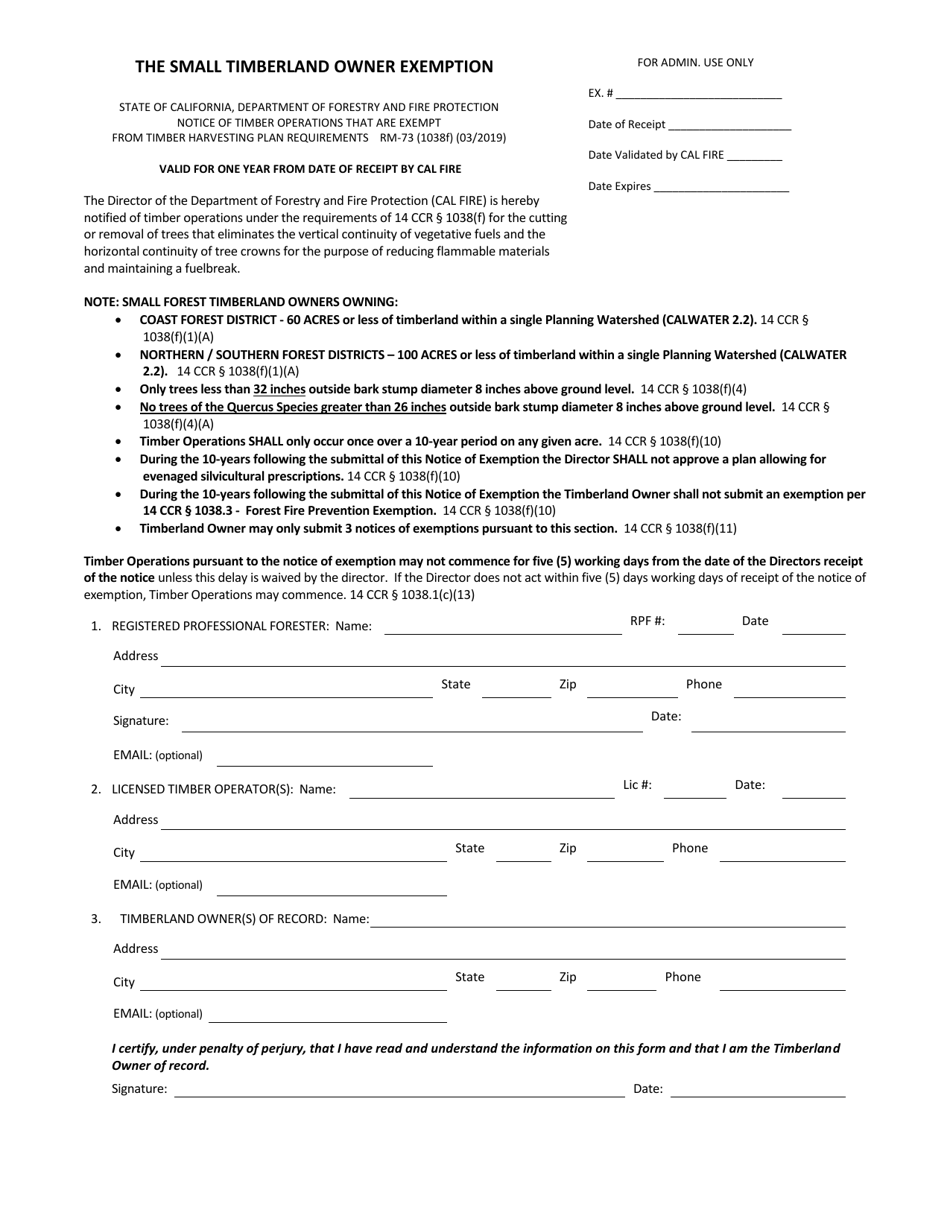

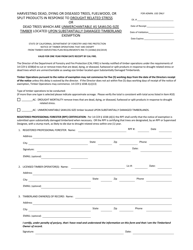

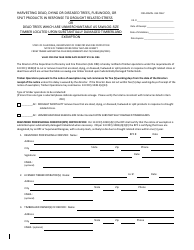

The Small Timberland Owner Exemption - California

The Small Timberland Owner Exemption is a legal document that was released by the California Department of Forestry & Fire Protection - a government authority operating within California.

FAQ

Q: What is the Small Timberland Owner Exemption?

A: The Small Timberland Owner Exemption is a program in California that provides certain tax benefits to small timberland owners.

Q: Who qualifies as a small timberland owner?

A: Small timberland owners are individuals or entities that own between 20 and 500 acres of timberland in California.

Q: What are the tax benefits provided by the exemption?

A: The exemption allows small timberland owners to receive a reduced property tax rate on their timberland properties.

Q: How much is the reduced property tax rate?

A: The reduced tax rate is set at $1 per acre per year for the first 20 acres, and $2.50 per acre per year for the remaining acres.

Q: Is there a limit on the number of acres that can receive the reduced tax rate?

A: No, all qualifying acres owned by a small timberland owner can receive the reduced tax rate.

Q: How do small timberland owners apply for the exemption?

A: Small timberland owners must file an application with the county assessor's office in the county where their timberland is located.

Q: Are there any restrictions or requirements for participating in the exemption?

A: Yes, small timberland owners must meet certain forestry management standards and submit an annual report to the county assessor's office.

Q: Is the Small Timberland Owner Exemption available in other states?

A: No, the exemption is specific to California and its timberland owners.

Form Details:

- Released on March 1, 2019;

- The latest edition currently provided by the California Department of Forestry & Fire Protection;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Forestry & Fire Protection.