Partnership Restructure - California

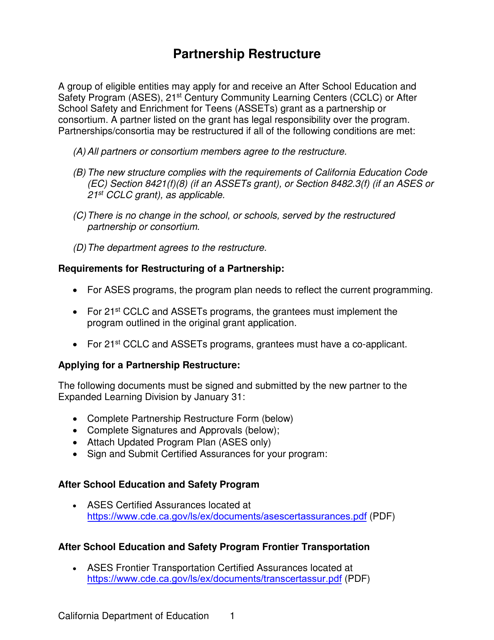

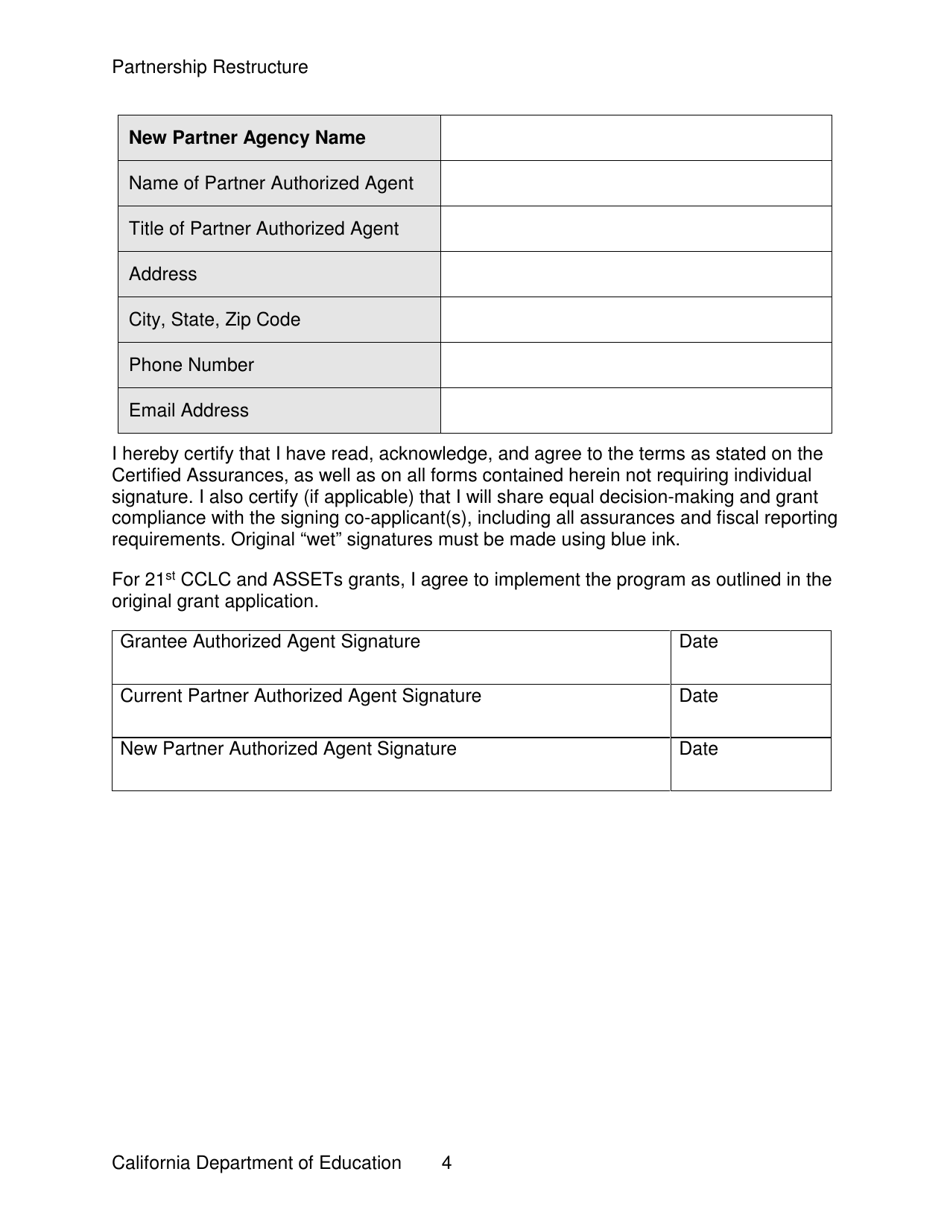

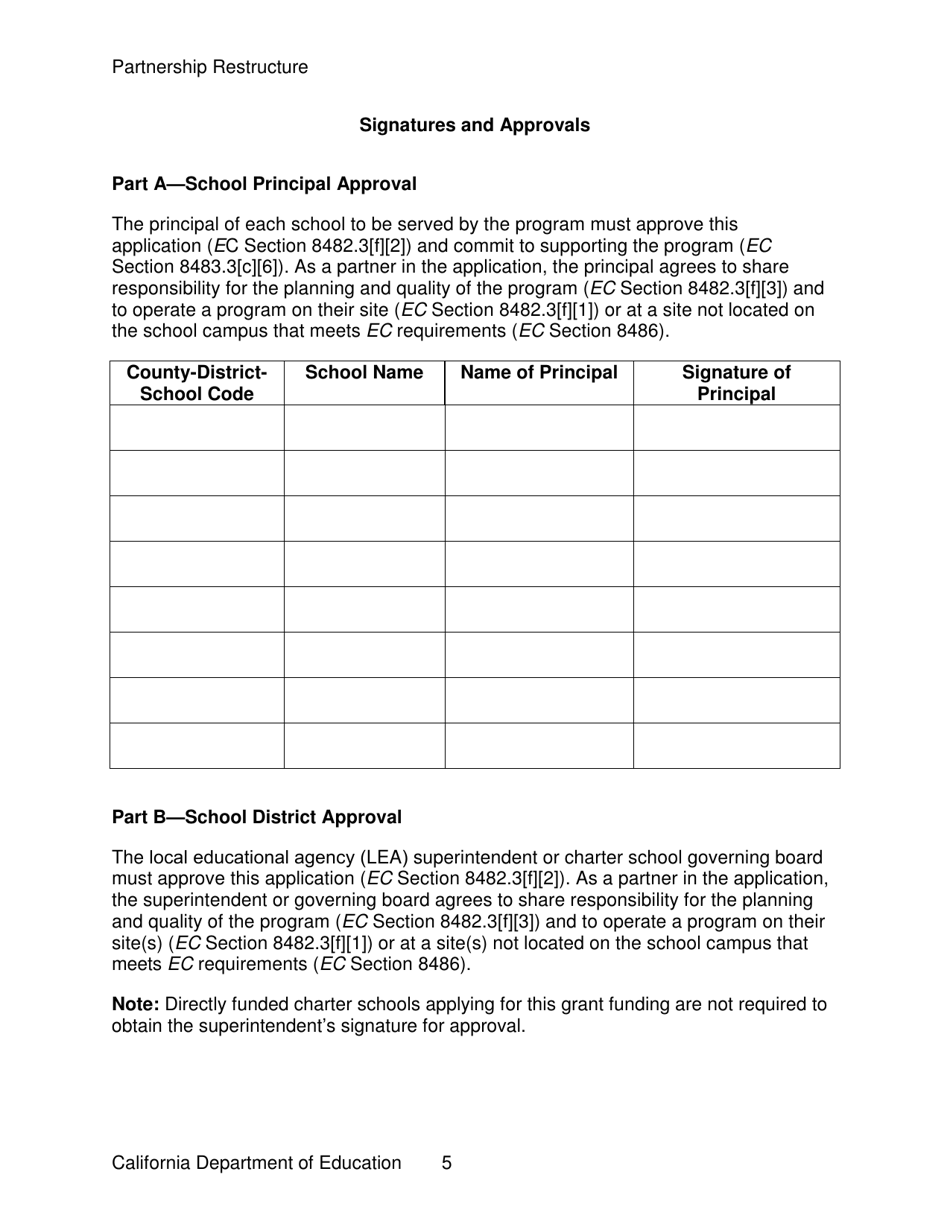

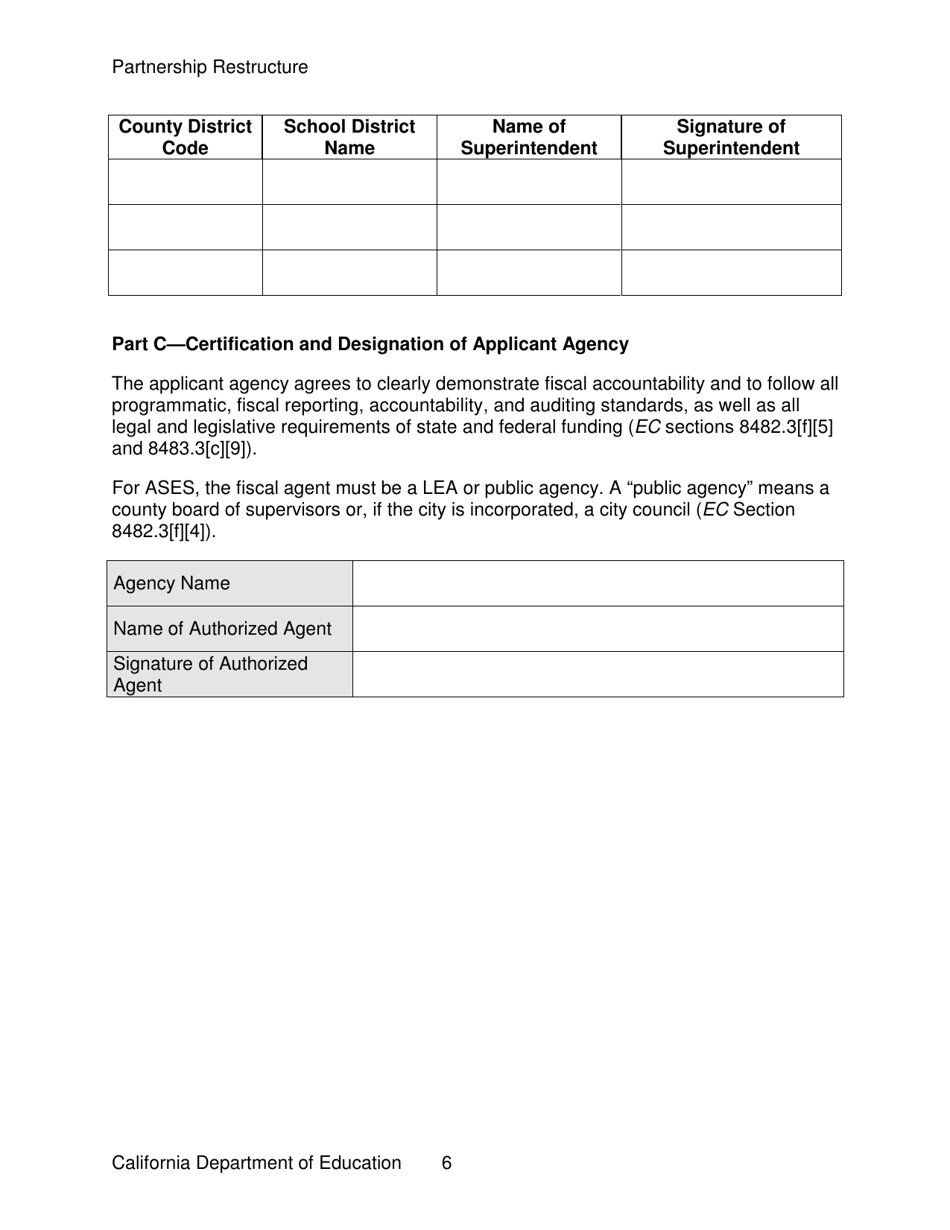

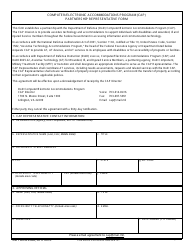

Partnership Restructure is a legal document that was released by the California Department of Education - a government authority operating within California.

FAQ

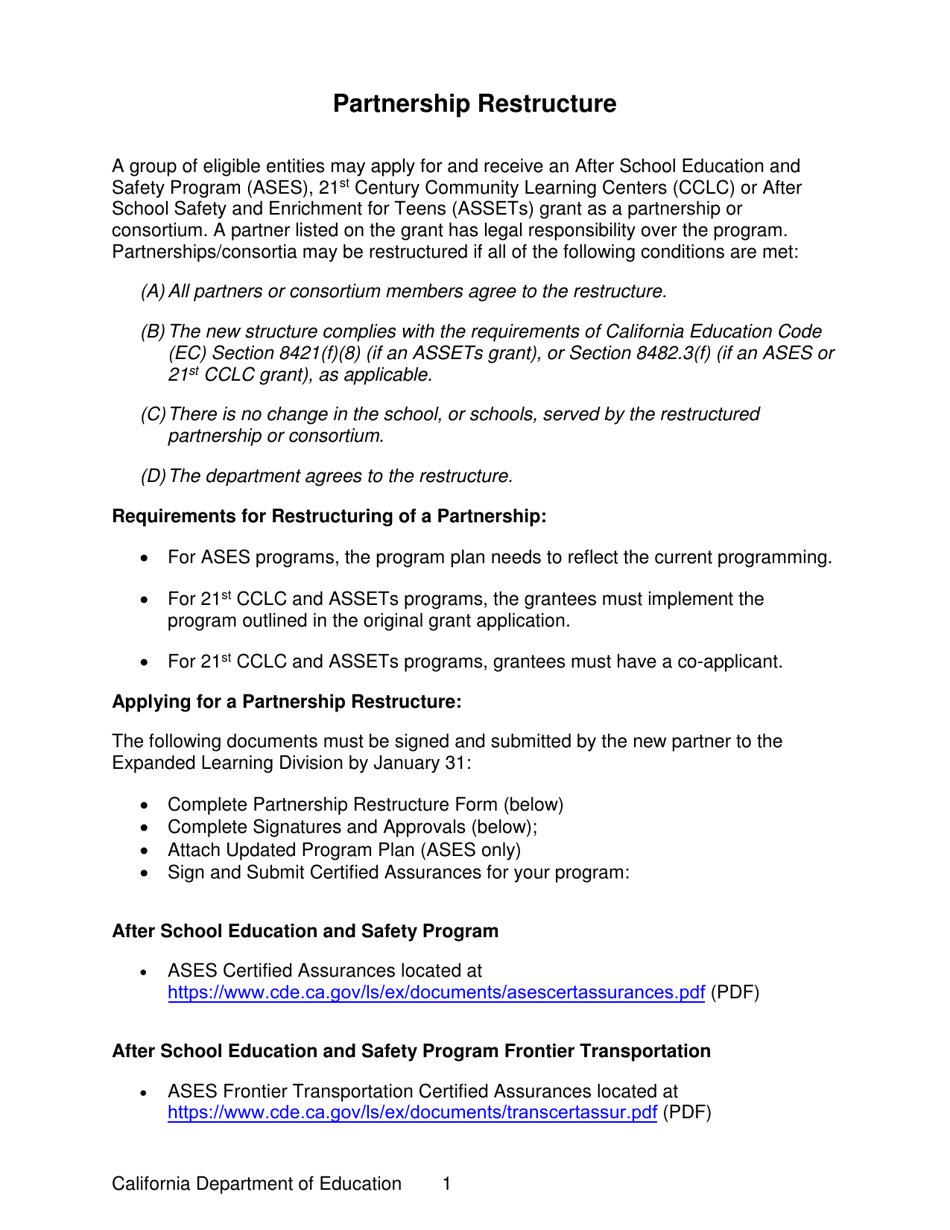

Q: What is a partnership restructure?

A: A partnership restructure is the process of making changes to the legal or financial structure of a partnership.

Q: Why would a partnership need to be restructured?

A: Partnerships may need to be restructured for various reasons, such as changes in ownership, business goals, or legal requirements.

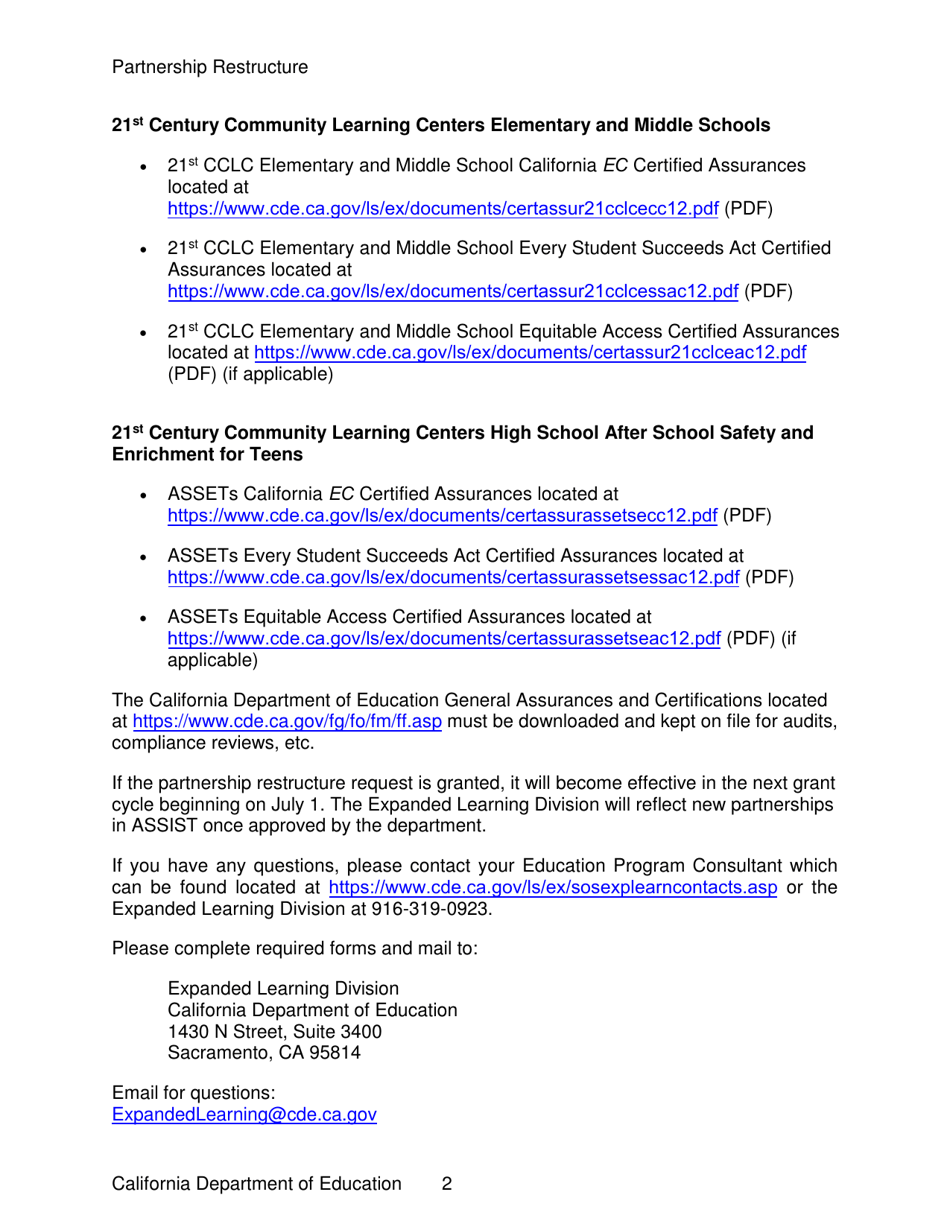

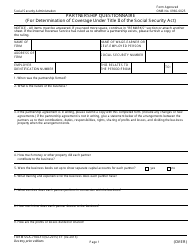

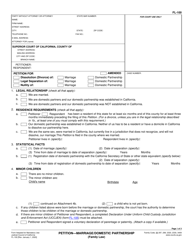

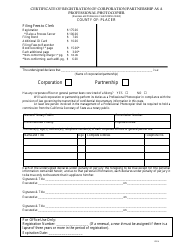

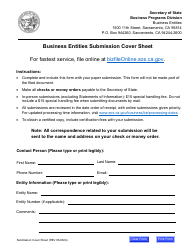

Q: What are the steps involved in partnership restructure in California?

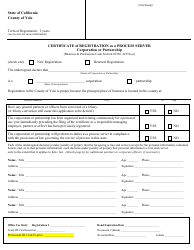

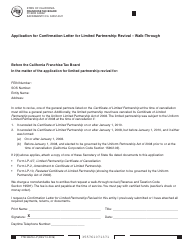

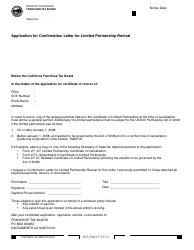

A: The steps involved in partnership restructure in California may vary depending on the specific circumstances, but generally involve legal documentation, filing necessary forms with the California Secretary of State, and complying with any relevant tax and regulatory requirements.

Q: Do all partners agree on the restructure?

A: Ideally, all partners should agree on the restructure, but sometimes disagreements may arise. In such cases, it is advisable to consult with legal professionals for guidance.

Q: Are there any tax implications of partnership restructure?

A: Yes, there may be tax implications when restructuring a partnership. It is recommended to consult with tax professionals or accountants to understand the specific implications for your situation.

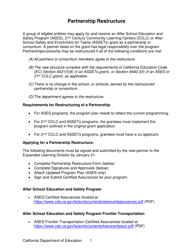

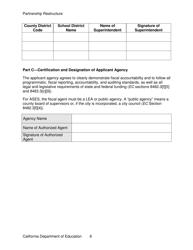

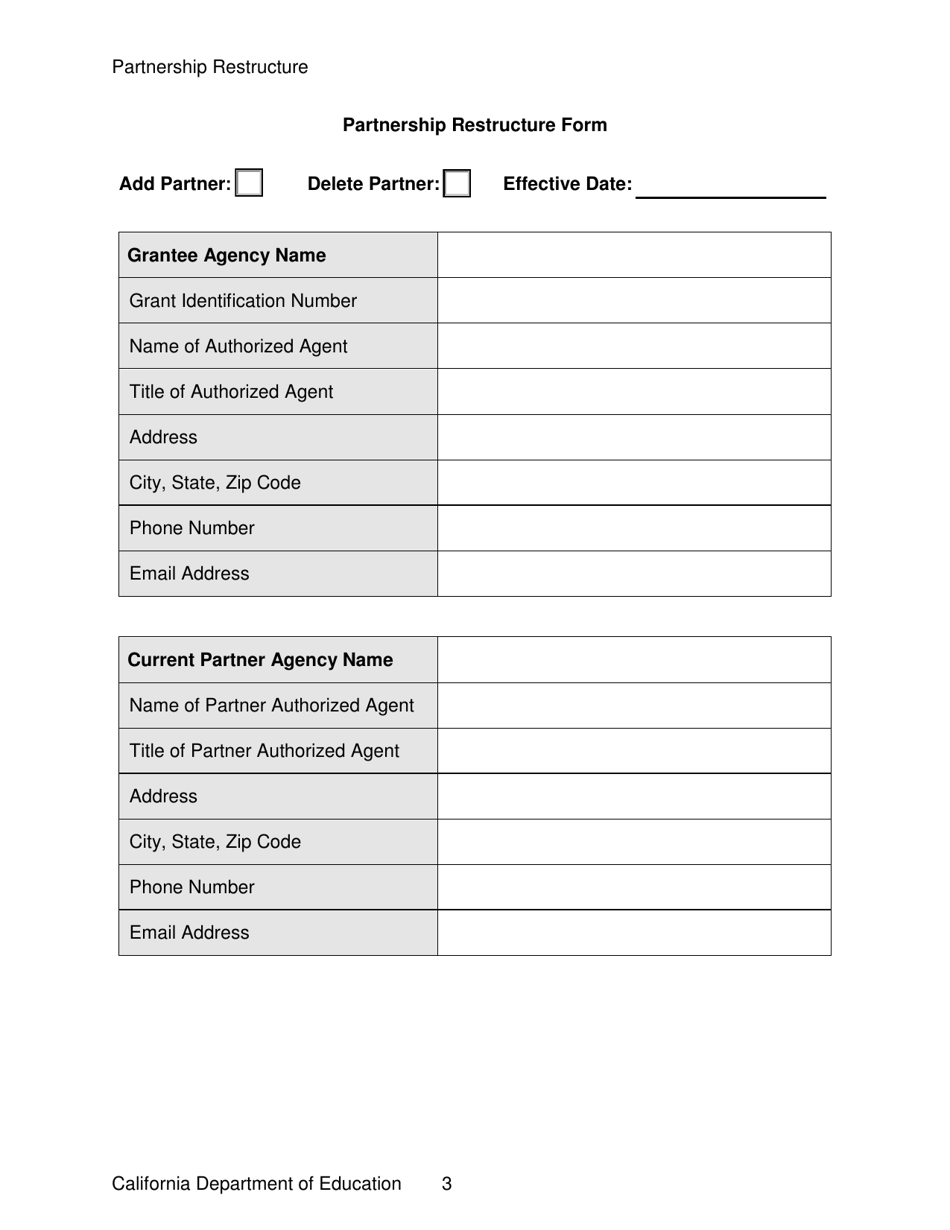

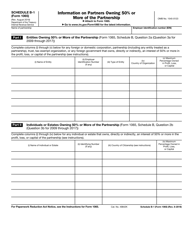

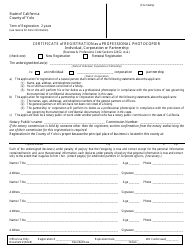

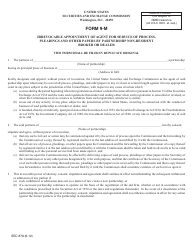

Form Details:

- Released on December 13, 2018;

- The latest edition currently provided by the California Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Education.