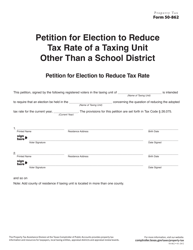

This version of the form is not currently in use and is provided for reference only. Download this version of

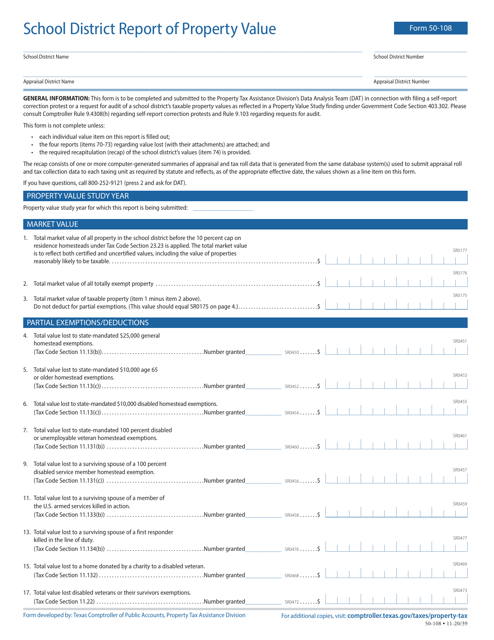

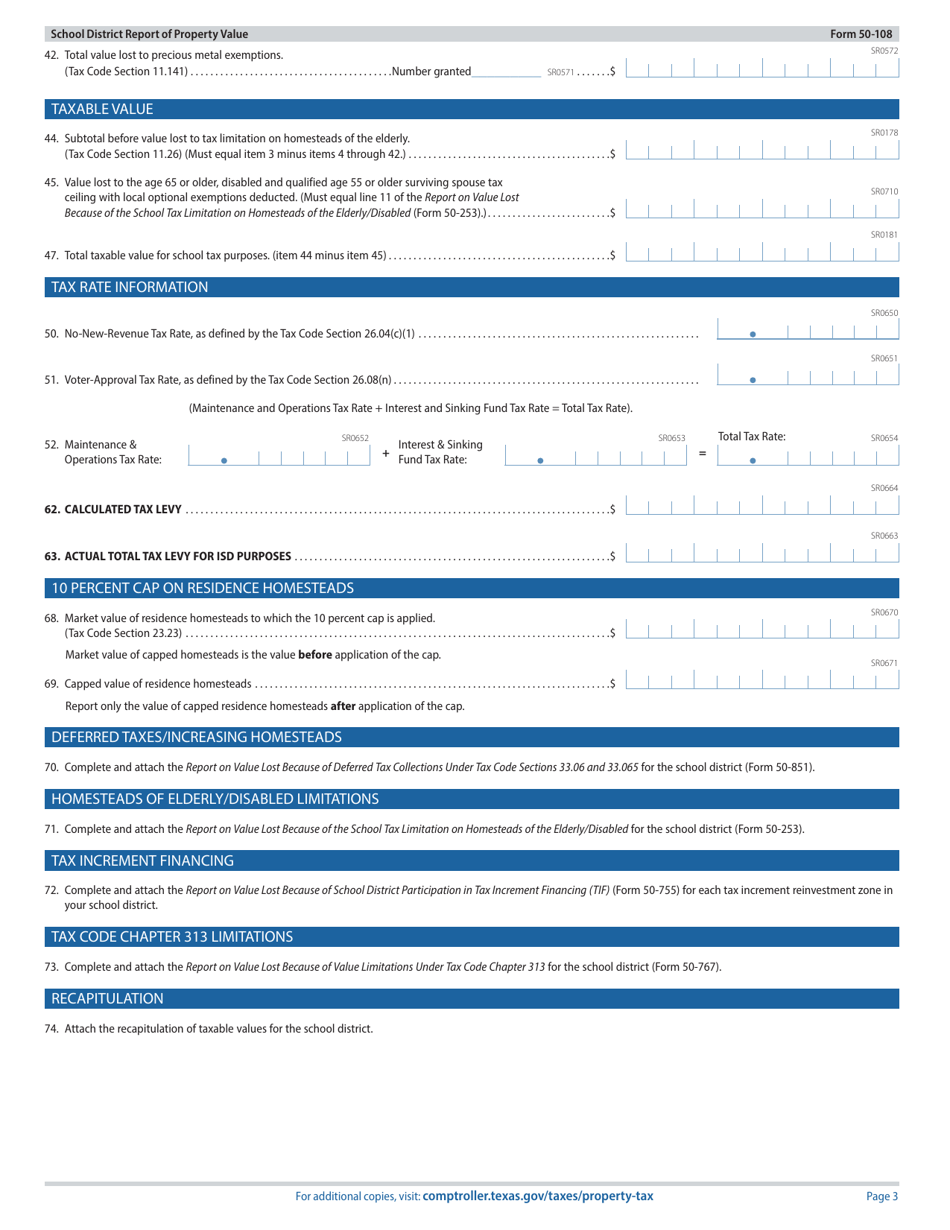

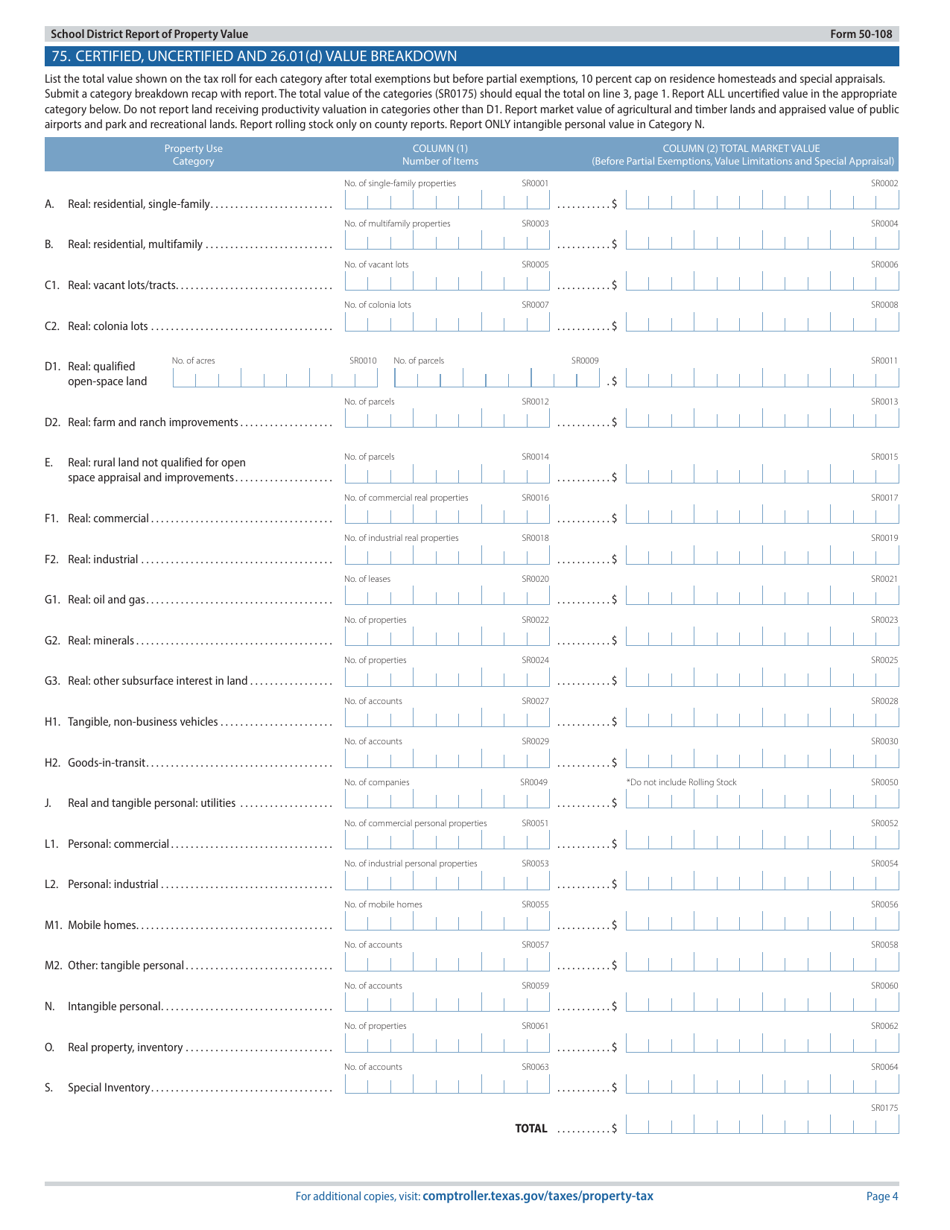

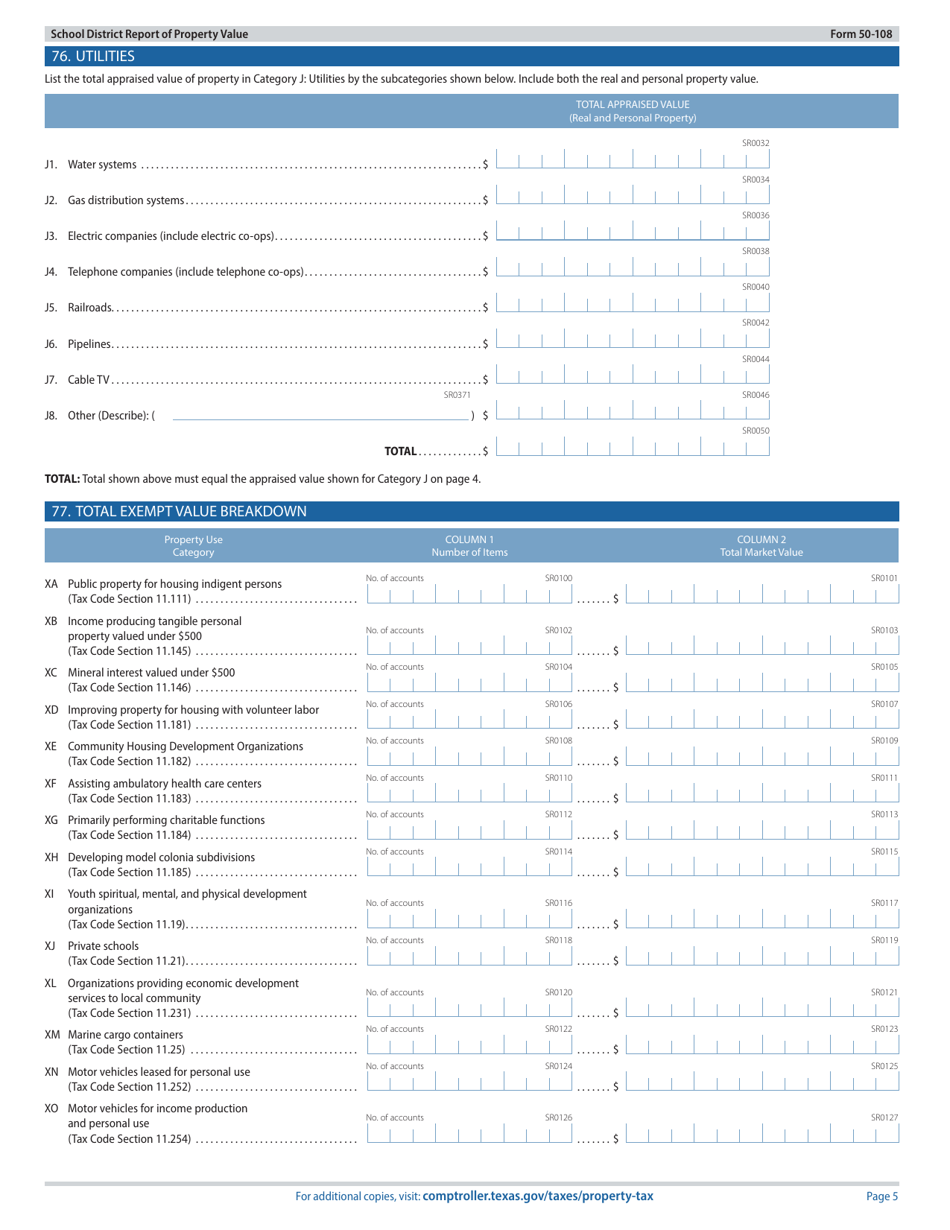

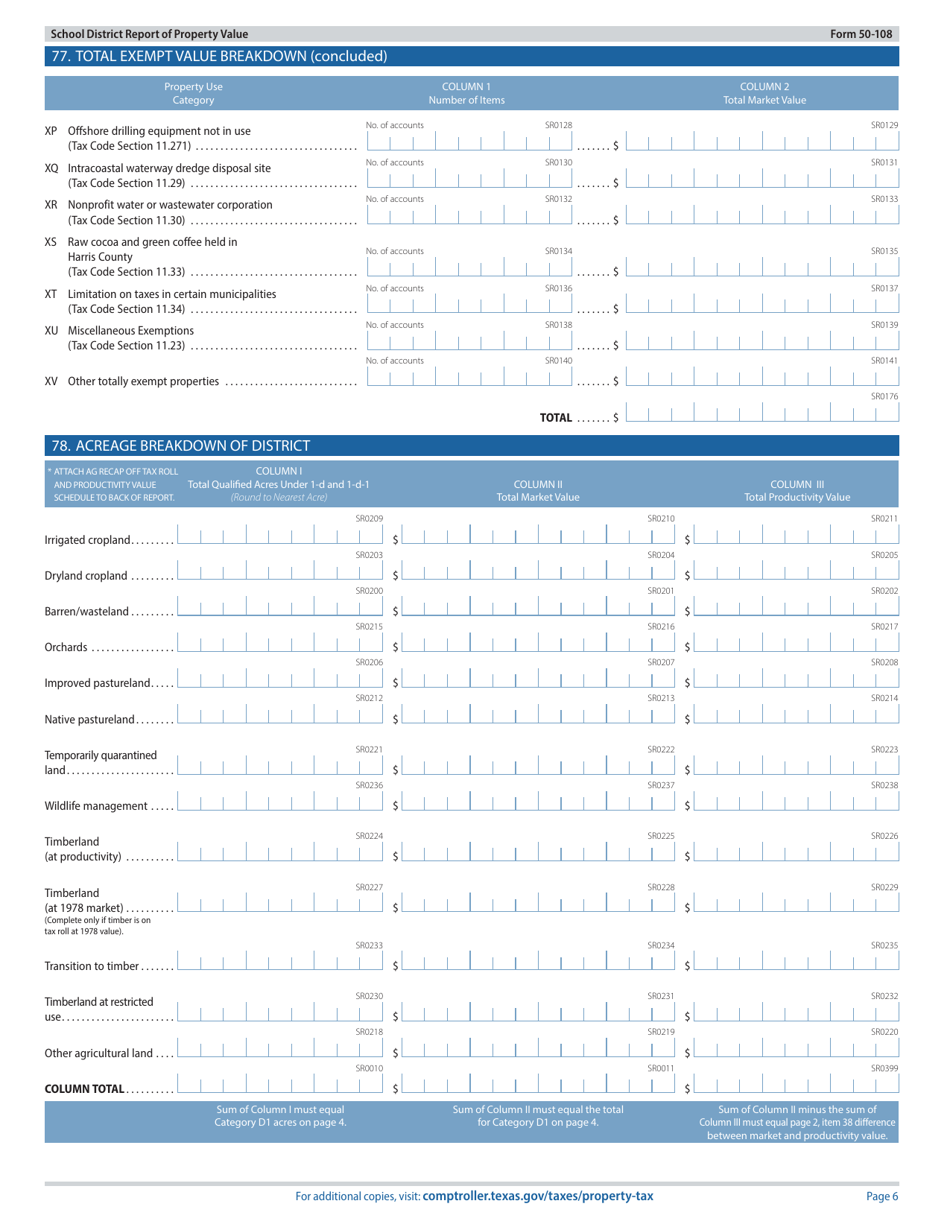

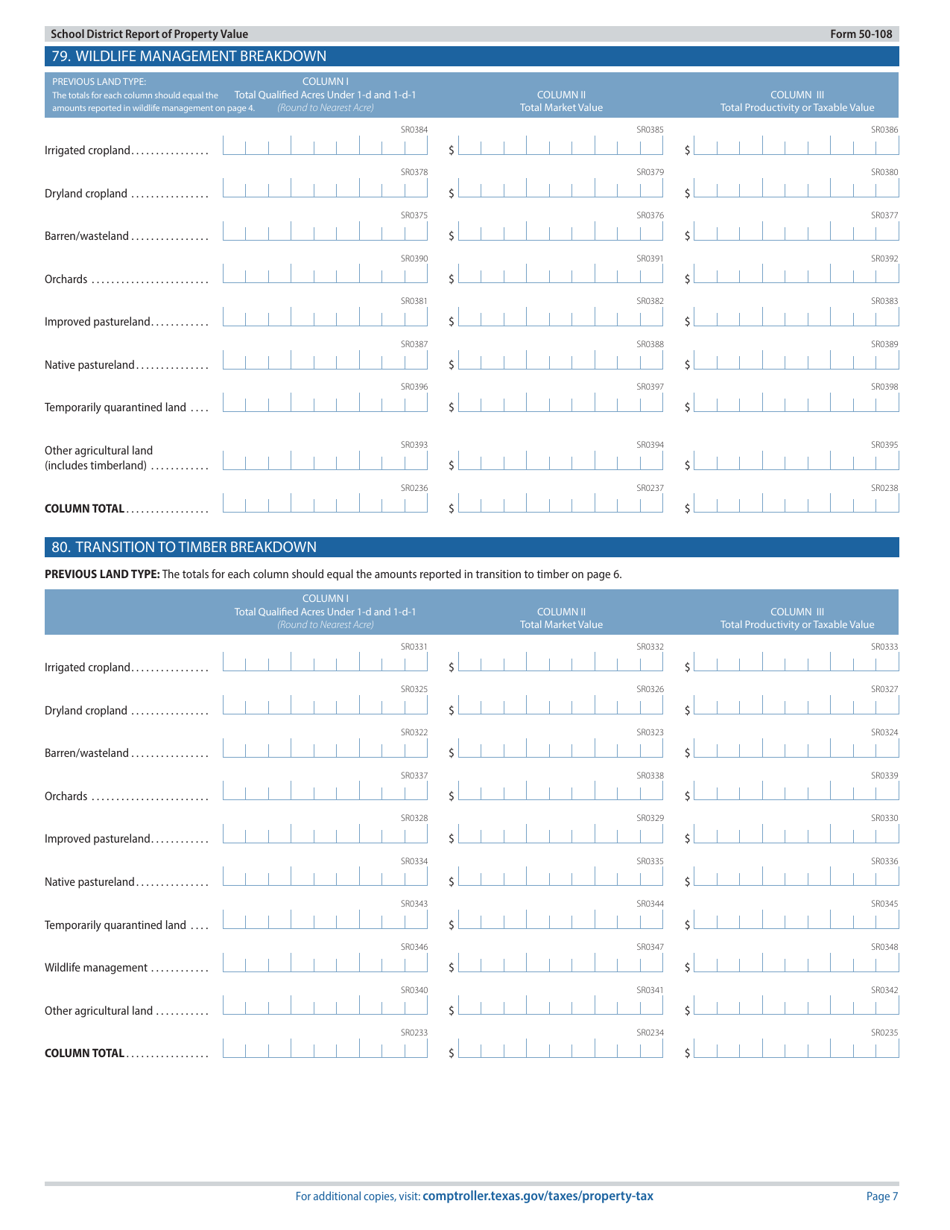

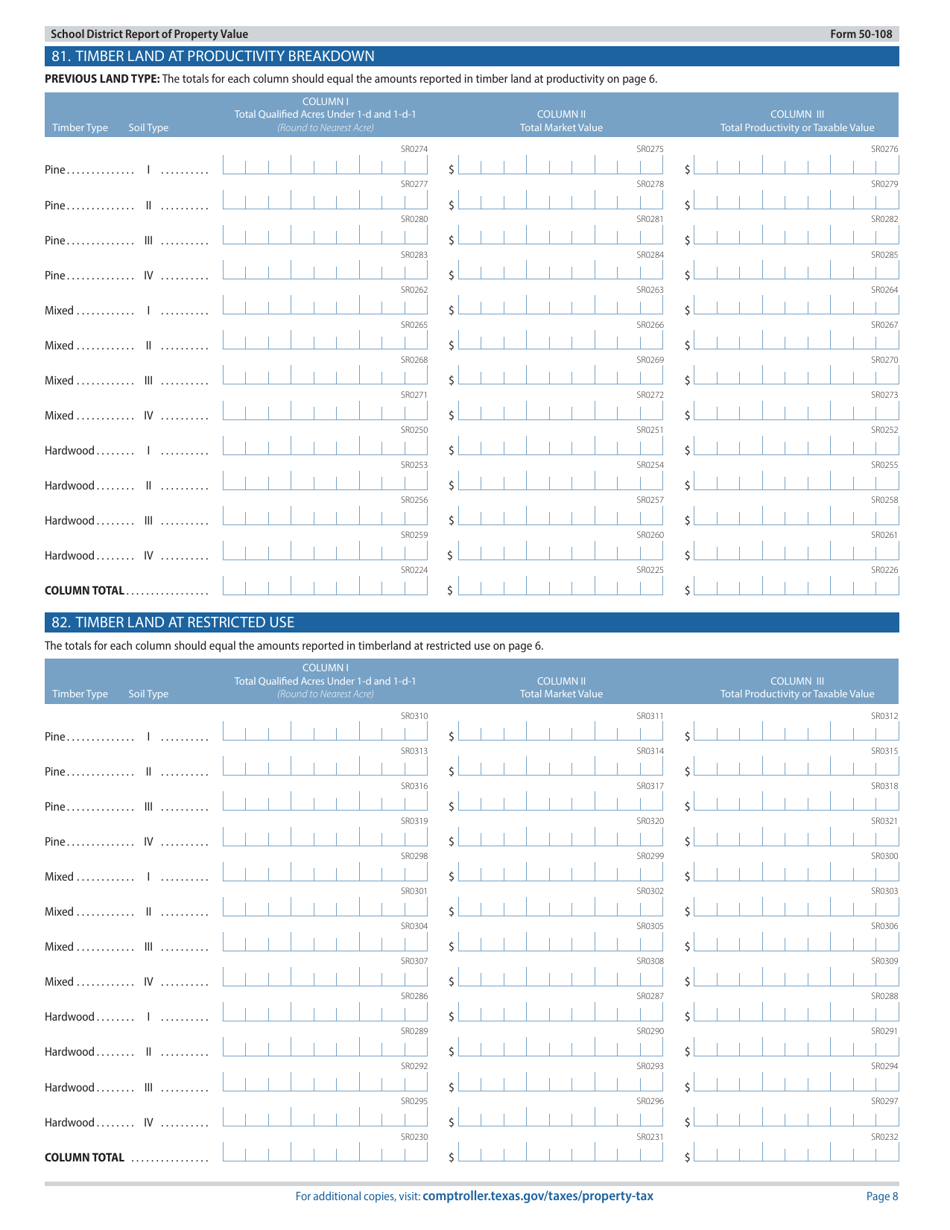

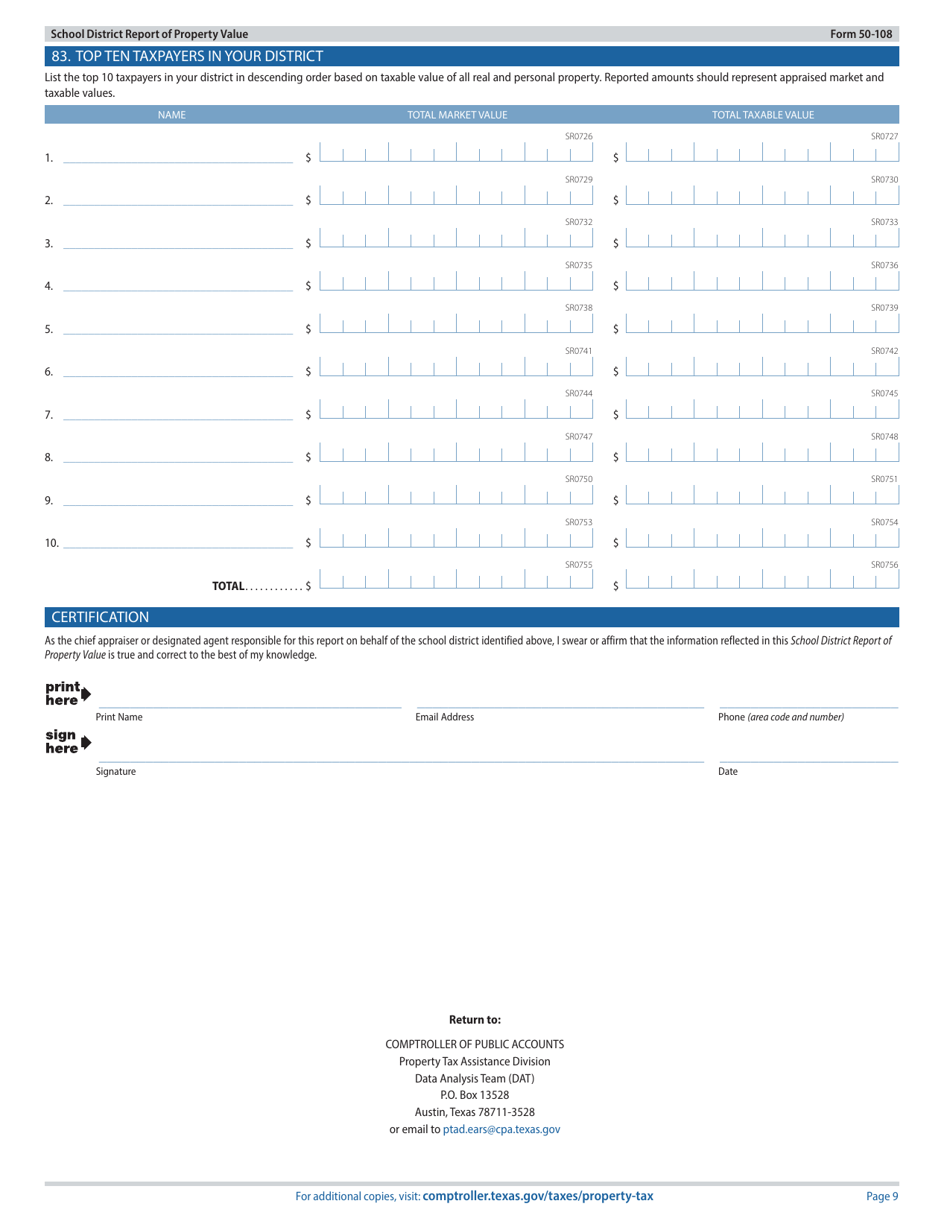

Form 50-108

for the current year.

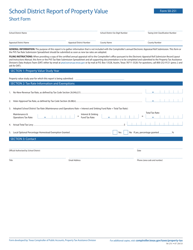

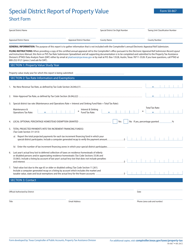

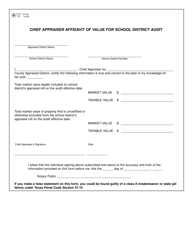

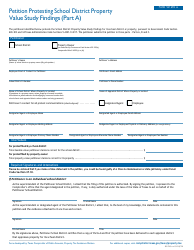

Form 50-108 School District Report of Property Value - Texas

What Is Form 50-108?

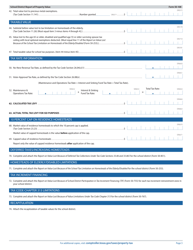

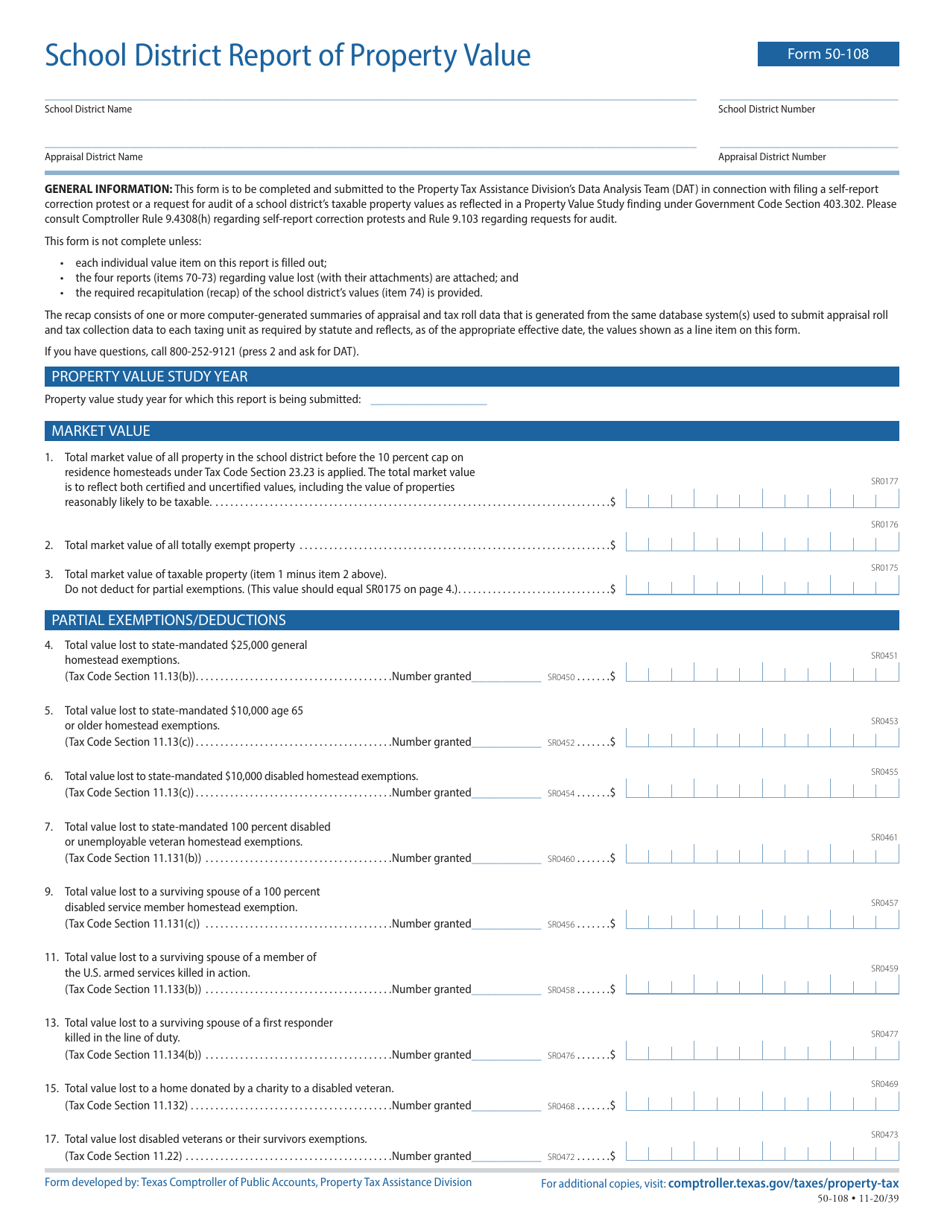

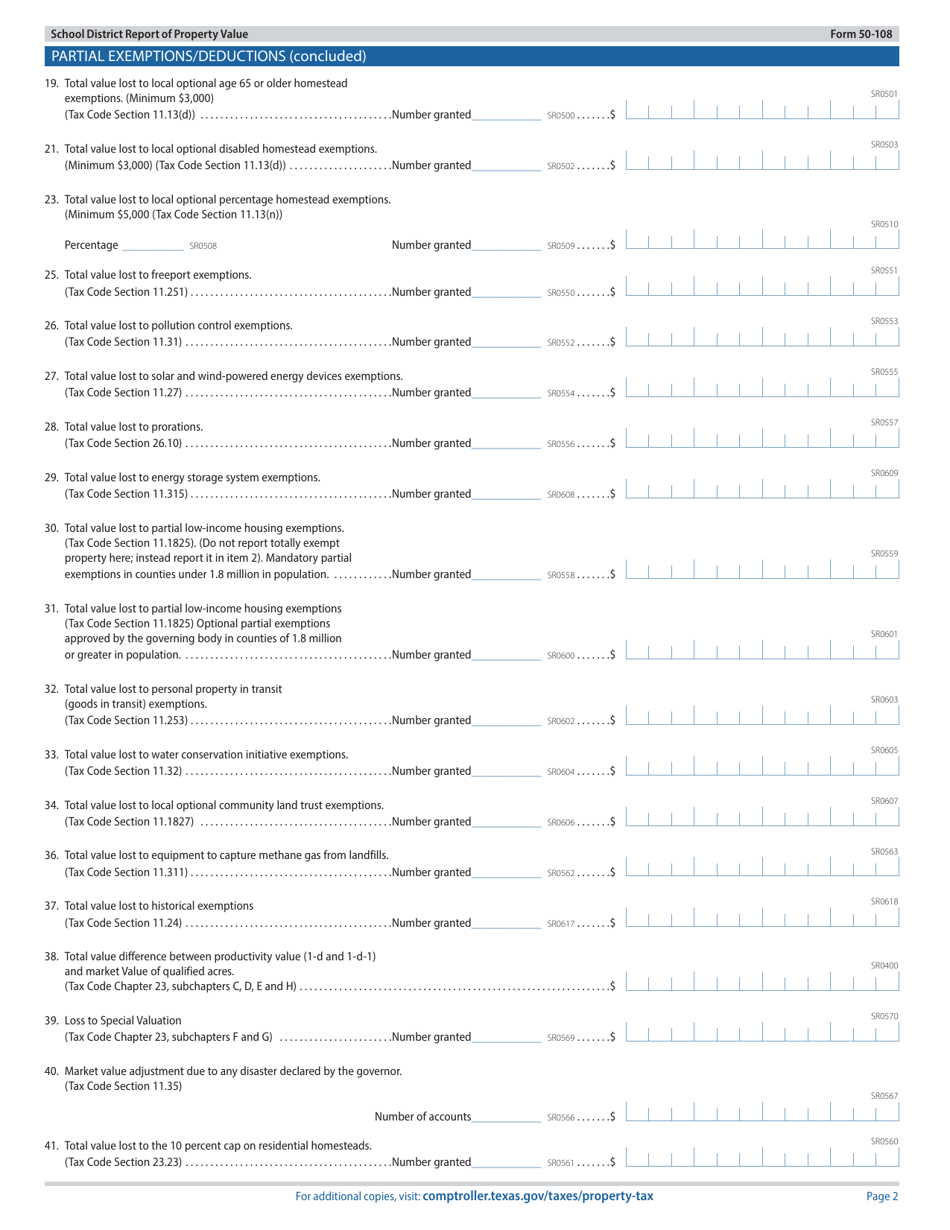

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-108?

A: Form 50-108 is the School District Report of Property Value in Texas.

Q: Who needs to file Form 50-108?

A: School districts in Texas are required to file Form 50-108.

Q: What is the purpose of Form 50-108?

A: The purpose of Form 50-108 is to report the property values of school districts in Texas.

Q: When is Form 50-108 due?

A: Form 50-108 is due on or before the first Monday in July each year.

Q: Is there a penalty for late filing of Form 50-108?

A: Yes, there is a penalty for late filing of Form 50-108. The penalty is $500 or 10% of the taxes due, whichever is greater.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-108 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.