This version of the form is not currently in use and is provided for reference only. Download this version of

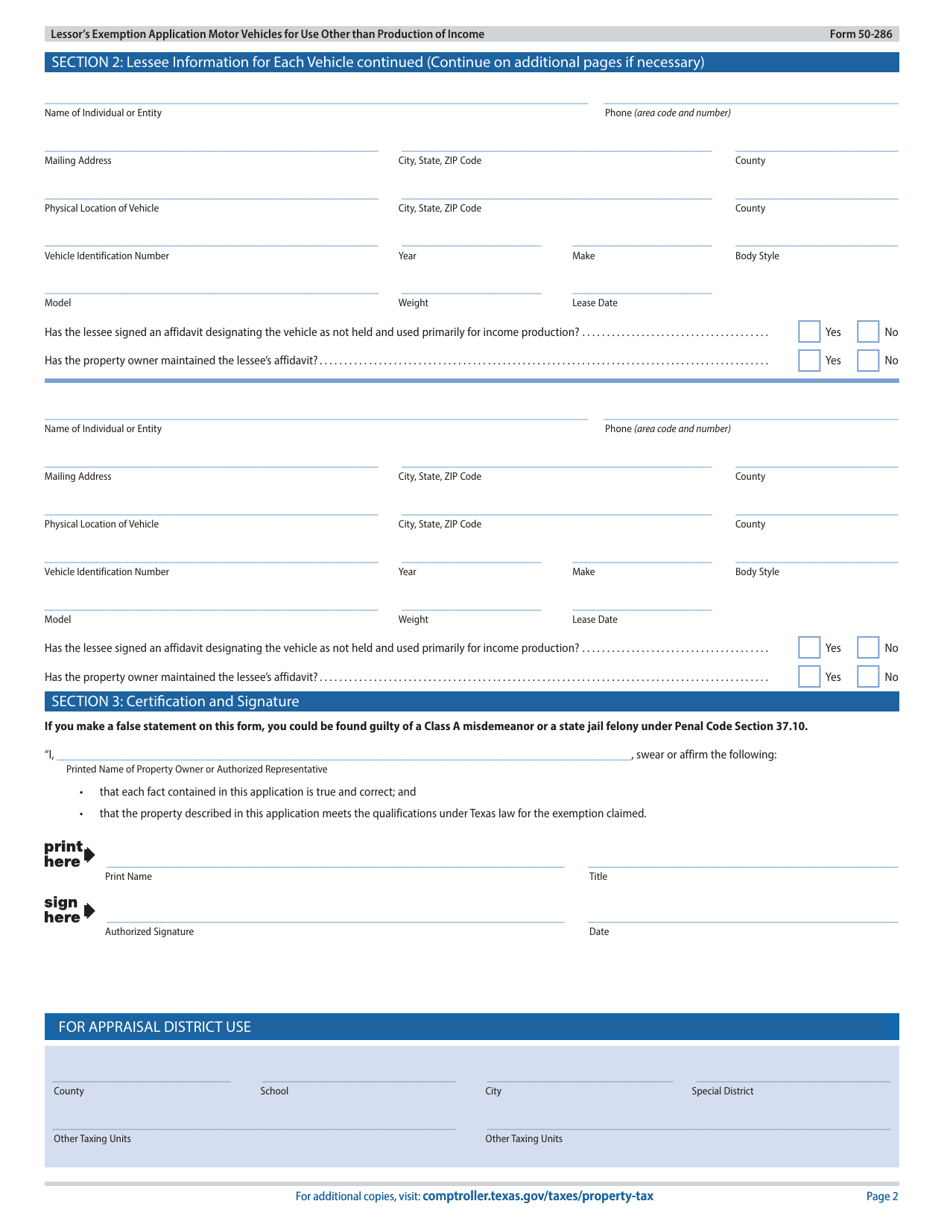

Form 50-286

for the current year.

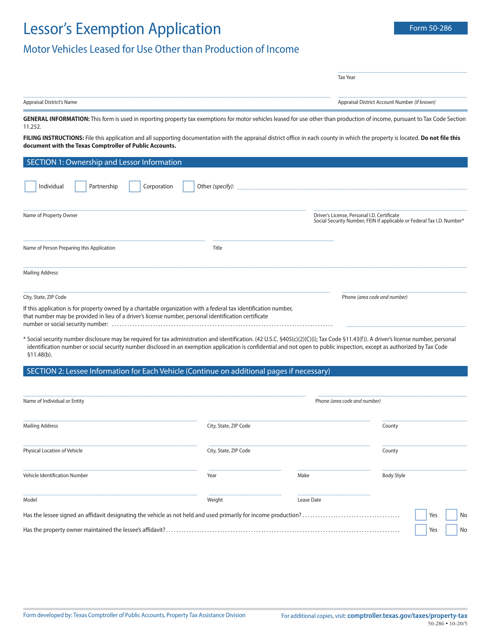

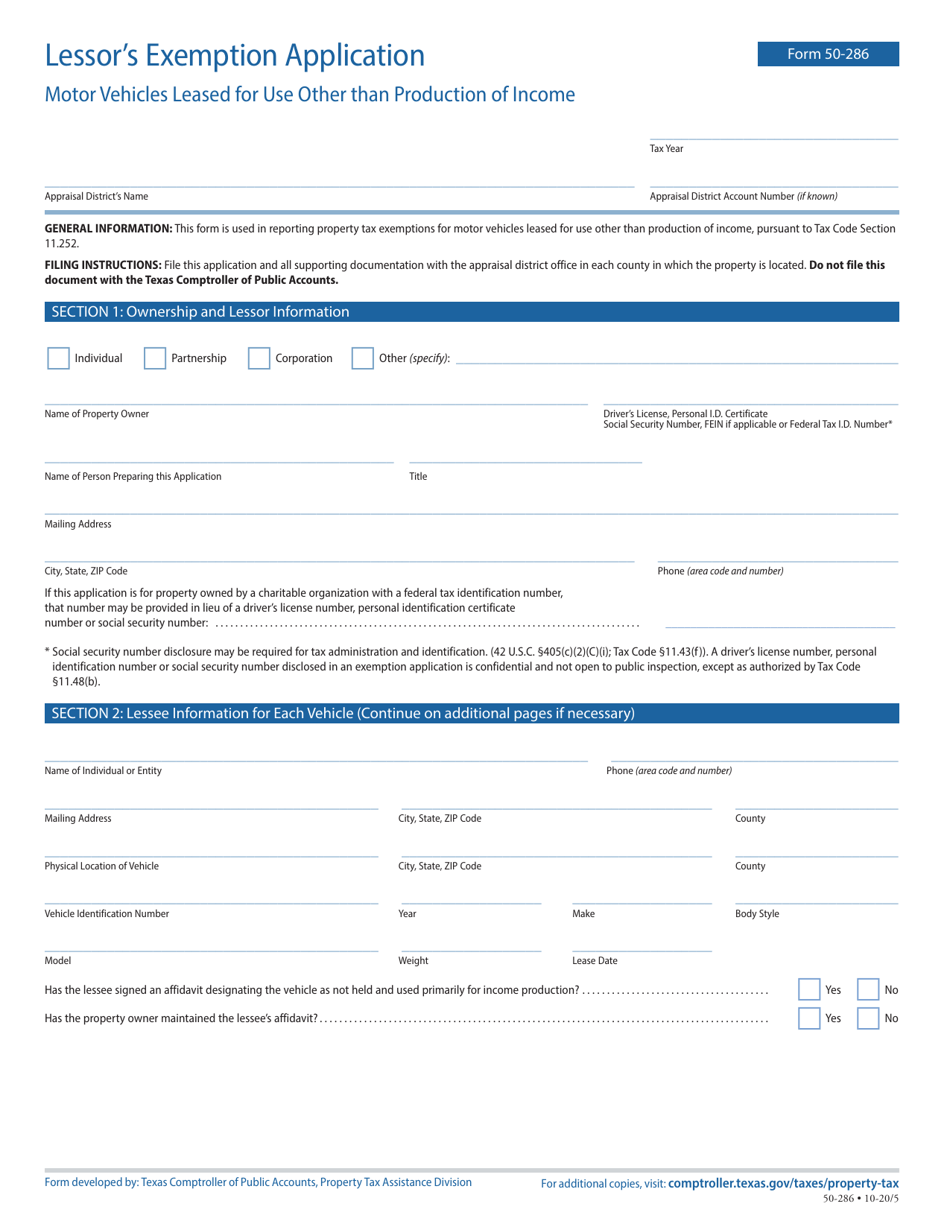

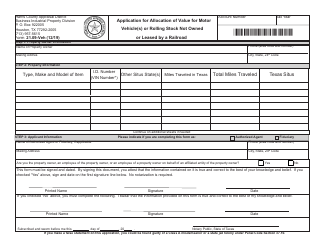

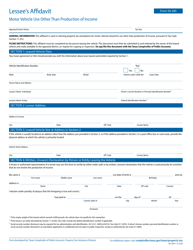

Form 50-286 Lessor's Exemption Application - Motor Vehicles Leased for Use Other Than Production of Income - Texas

What Is Form 50-286?

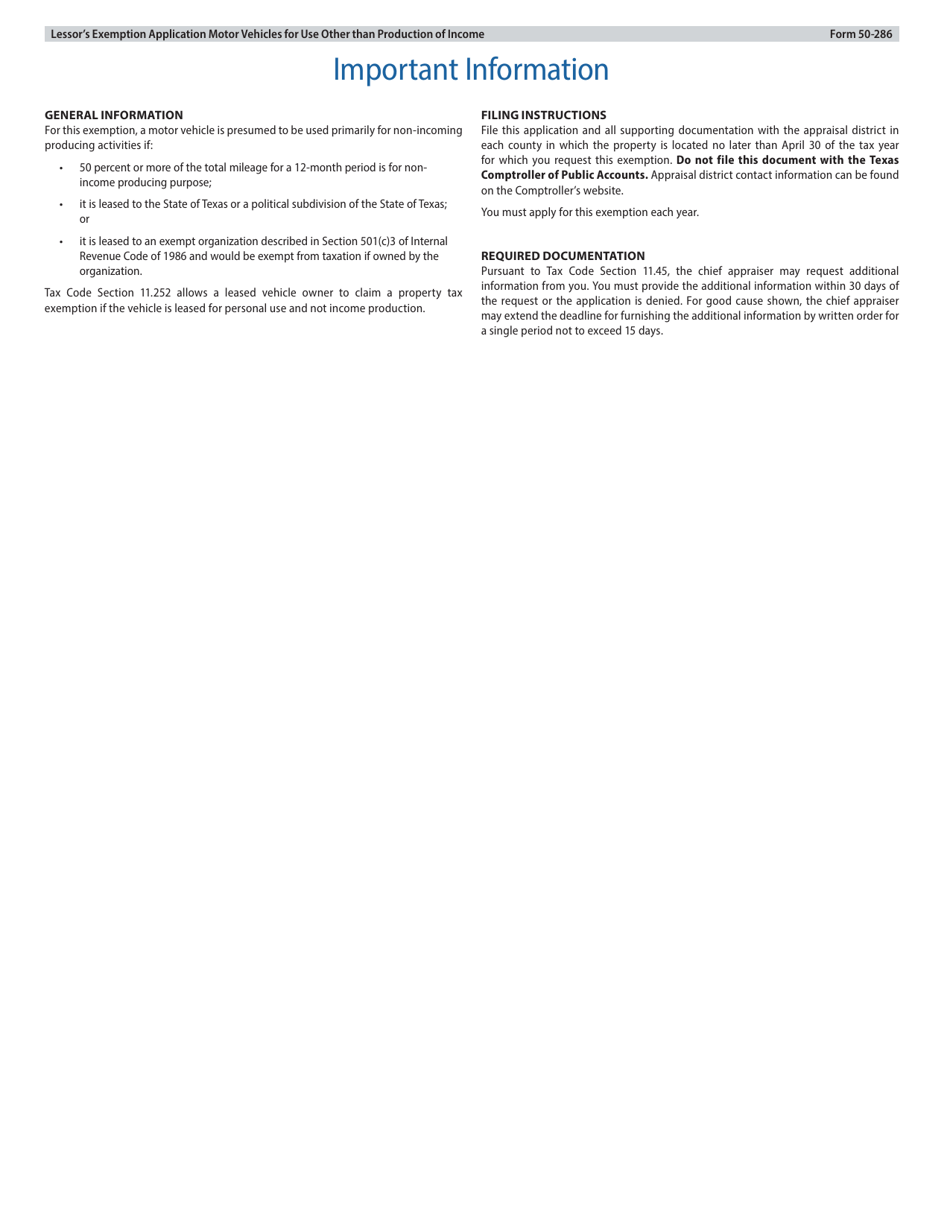

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 50-286?

A: Form 50-286 is the Lessor's Exemption Application for Motor Vehicles Leased for Use Other Than Production of Income in Texas.

Q: Who can apply for the Lessor's Exemption?

A: Anyone who leases motor vehicles for use other than production of income in Texas can apply for the Lessor's Exemption.

Q: What is the purpose of the Lessor's Exemption?

A: The Lessor's Exemption is intended to exempt motor vehicles that are leased for personal or non-income producing use from certain taxes in Texas.

Q: How do I fill out Form 50-286?

A: You must provide information about the lessor, lessee, and the leased motor vehicles, including the make, model, and vehicle identification number (VIN).

Q: What supporting documents should I include with Form 50-286?

A: You may need to include a copy of the lease agreement and any other documents that provide evidence of the non-income producing use of the leased motor vehicles.

Q: Can I claim the Lessor's Exemption for all leased motor vehicles?

A: No, the Lessor's Exemption can only be claimed for motor vehicles that are leased for personal or non-income producing use in Texas.

Q: Is there a deadline for submitting Form 50-286?

A: Yes, Form 50-286 must be submitted within 30 days from the date the motor vehicle is first leased in Texas.

Q: What happens if I fail to submit Form 50-286?

A: If you fail to submit Form 50-286, you may be subject to penalties and interest on the taxes due for the leased motor vehicles.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-286 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.