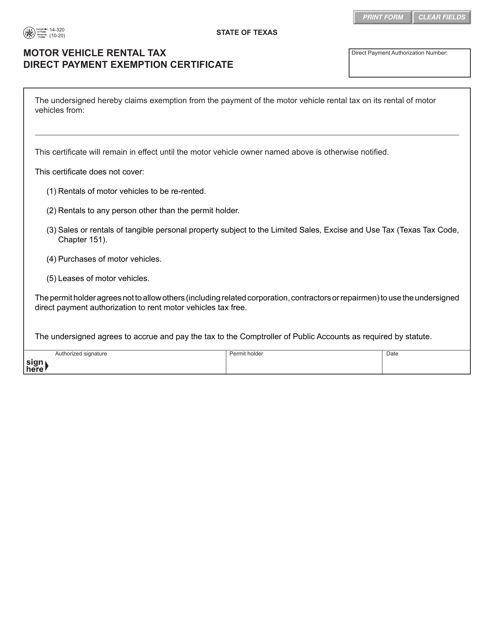

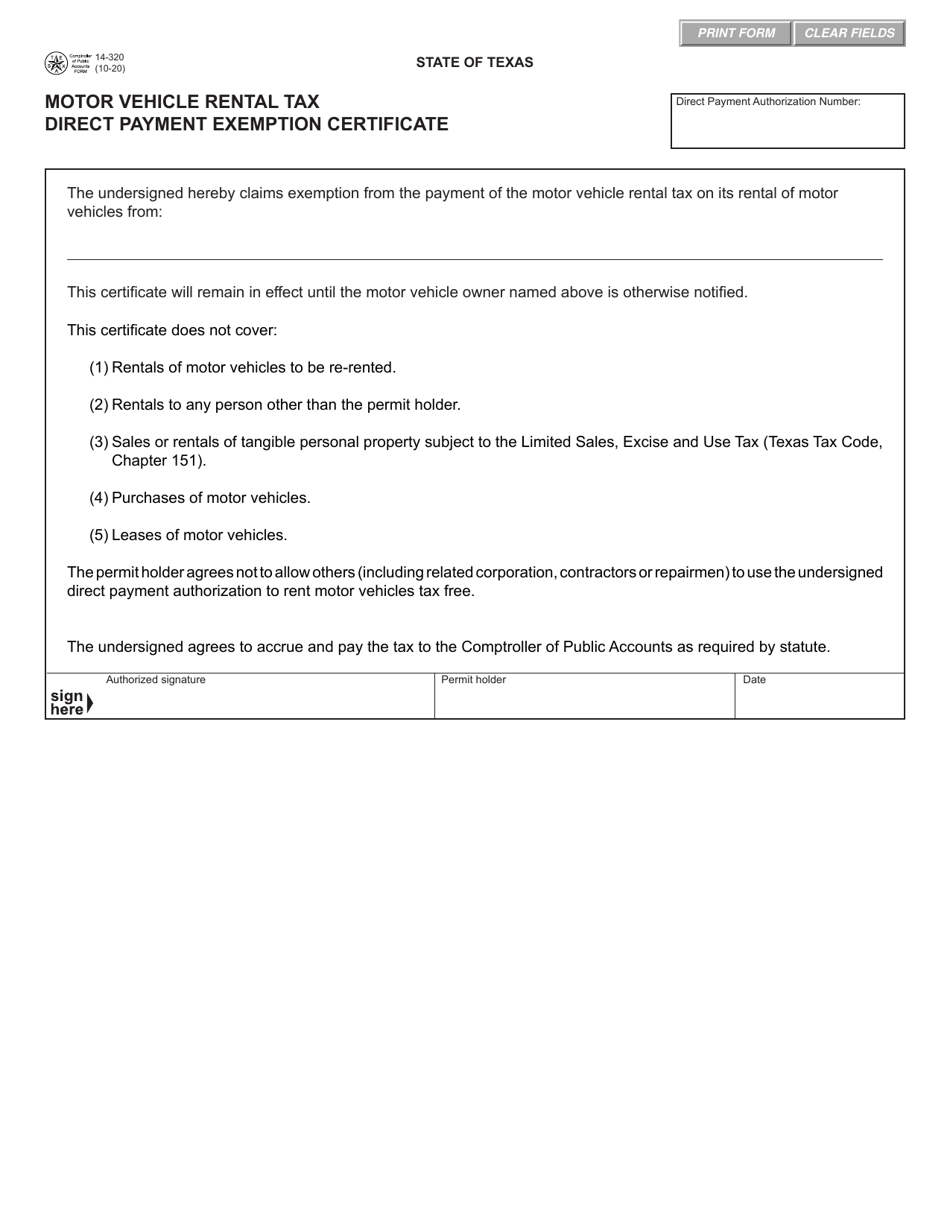

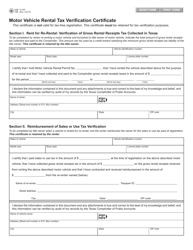

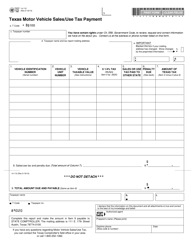

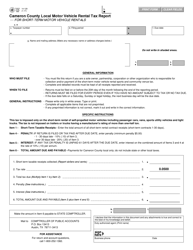

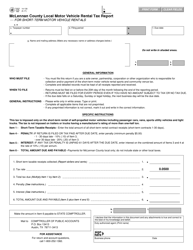

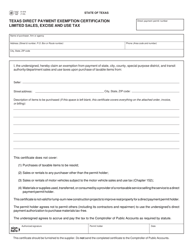

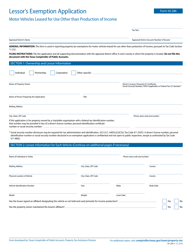

Form 14-320 Motor Vehicle Rental Tax Direct Payment Exemption Certificate - Texas

What Is Form 14-320?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-320?

A: Form 14-320 is the Motor Vehicle Rental Tax Direct Payment Exemption Certificate for Texas.

Q: What is the purpose of Form 14-320?

A: The purpose of Form 14-320 is to claim an exemption from paying motor vehiclerental tax directly to the state of Texas.

Q: Who needs to use Form 14-320?

A: Businesses or entities that are eligible for an exemption from motor vehicle rental tax in Texas.

Q: What information is required on Form 14-320?

A: Form 14-320 requires information such as the taxpayer's name, address, taxpayer identification number, and a description of the exempt rental transactions.

Q: Is there a fee to submit Form 14-320?

A: There is no fee to submit Form 14-320.

Q: Are there any filing deadlines for Form 14-320?

A: Form 14-320 should be filed before the due date of the motor vehicle rental tax return for the period.

Q: Can Form 14-320 be used for multiple rental transactions?

A: Yes, Form 14-320 can be used to claim an exemption for multiple rental transactions in Texas.

Q: What should I do if my exemption status changes?

A: If your exemption status changes, you should notify the Texas Comptroller of Public Accounts and may need to submit a revised Form 14-320.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 14-320 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.