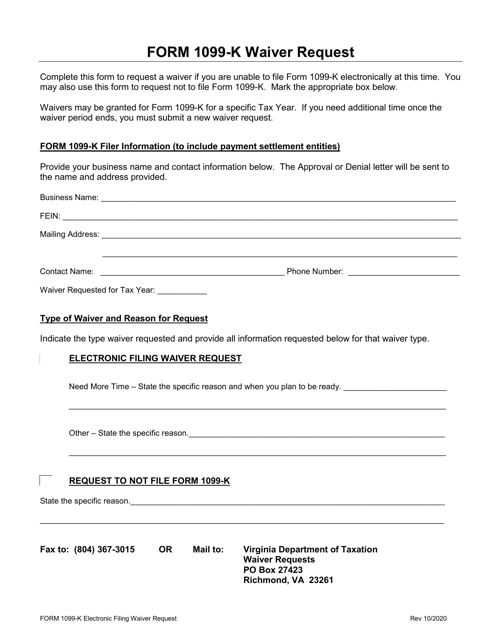

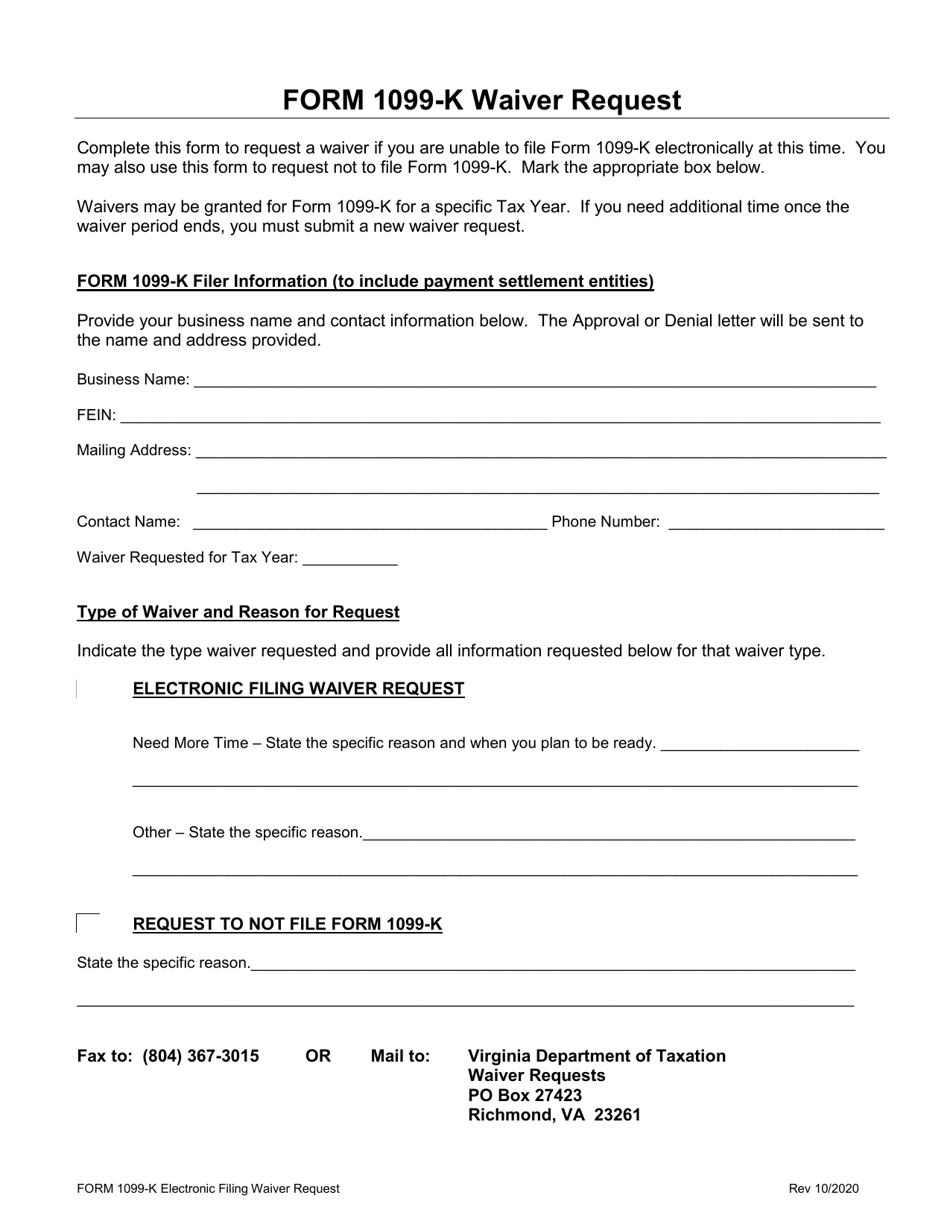

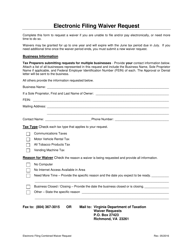

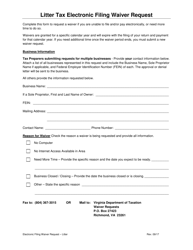

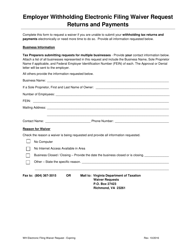

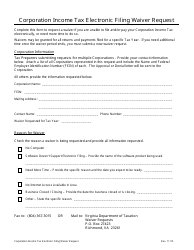

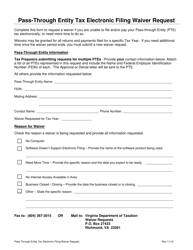

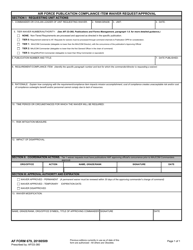

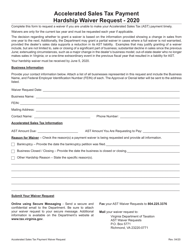

Form 1099-K Waiver Request - Virginia

What Is Form 1099-K?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 1099-K?

A: Form 1099-K is a tax form used to report income received from payment card transactions and third-party network transactions.

Q: What is a Form 1099-K waiver request?

A: A Form 1099-K waiver request is a request made to the state of Virginia to waive the requirement to file a Form 1099-K.

Q: Why would I want to request a waiver for Form 1099-K?

A: You may want to request a waiver for Form 1099-K if you believe that you are not required to file the form based on your specific circumstances.

Q: How do I request a waiver for Form 1099-K in Virginia?

A: To request a waiver for Form 1099-K in Virginia, you will need to follow the specific instructions provided by the Virginia Department of Taxation.

Q: Are there any eligibility requirements for a Form 1099-K waiver in Virginia?

A: Yes, there may be eligibility requirements for a Form 1099-K waiver in Virginia. You should review the guidance provided by the Virginia Department of Taxation to determine if you qualify.

Q: What should I do if my Form 1099-K waiver request is denied?

A: If your Form 1099-K waiver request is denied, you should comply with the filing requirements outlined by the Virginia Department of Taxation.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1099-K by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.