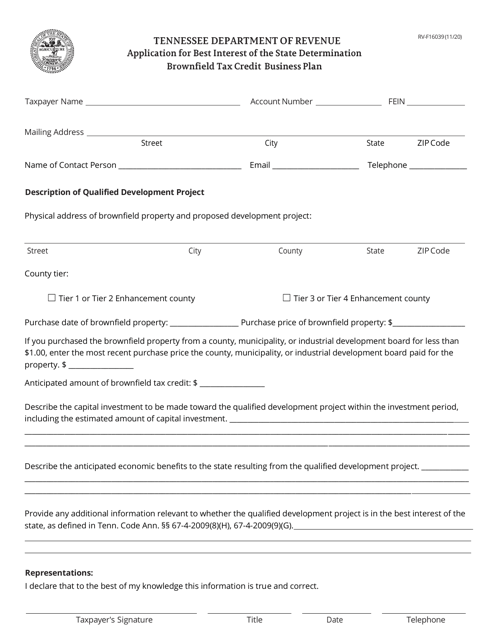

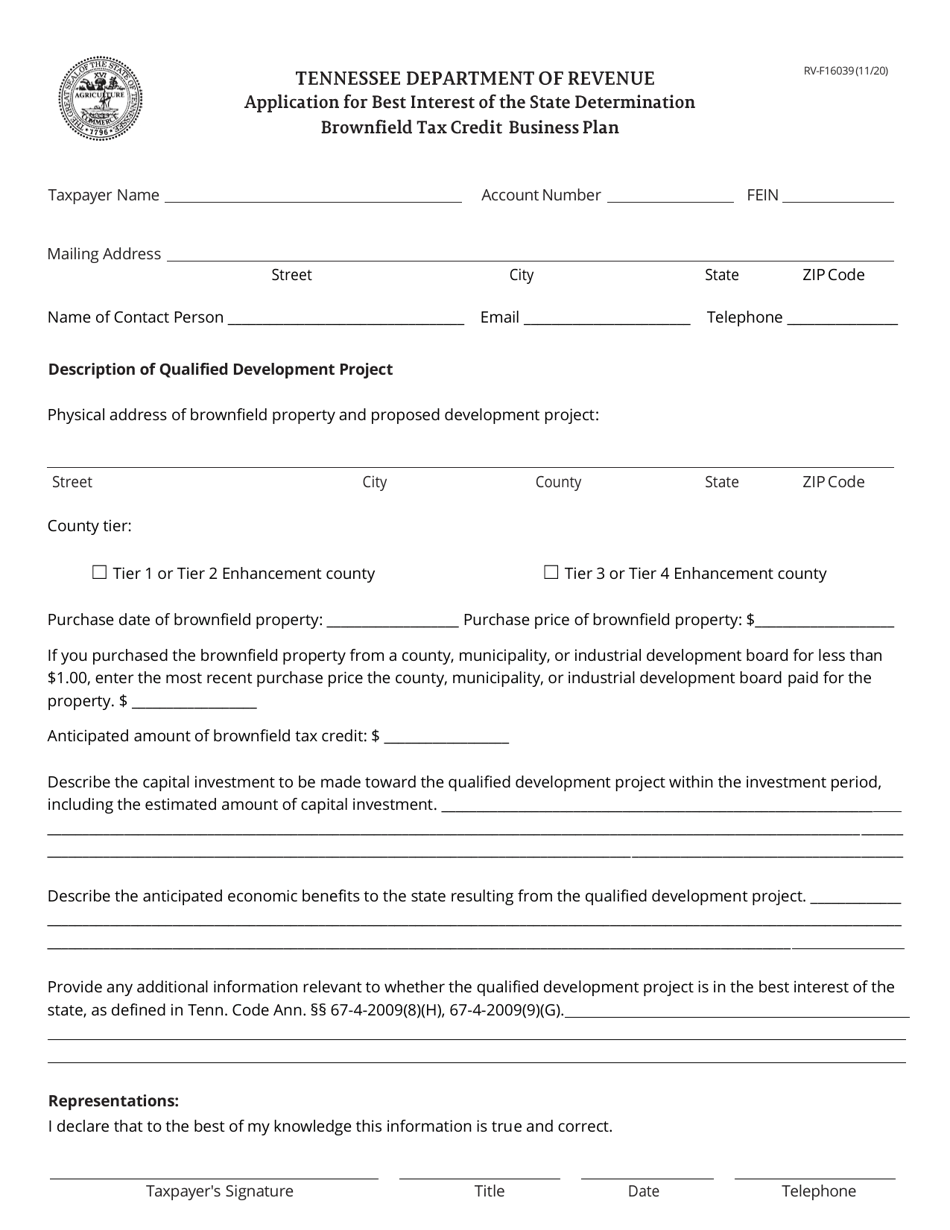

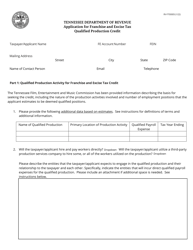

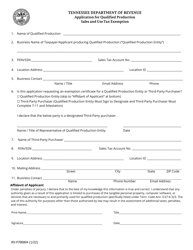

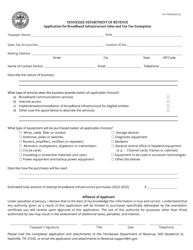

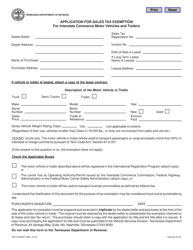

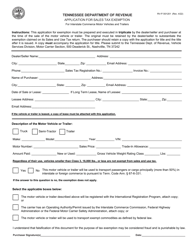

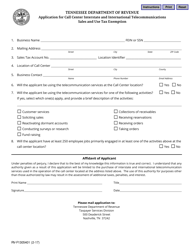

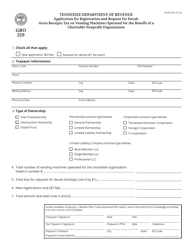

Form RV-F16039 Application for Best Interest of the State Determination Brownfield Tax Credit Business Plan - Tennessee

What Is Form RV-F16039?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F16039?

A: Form RV-F16039 is an application for Best Interest of the State Determination Brownfield Tax Credit Business Plan in Tennessee.

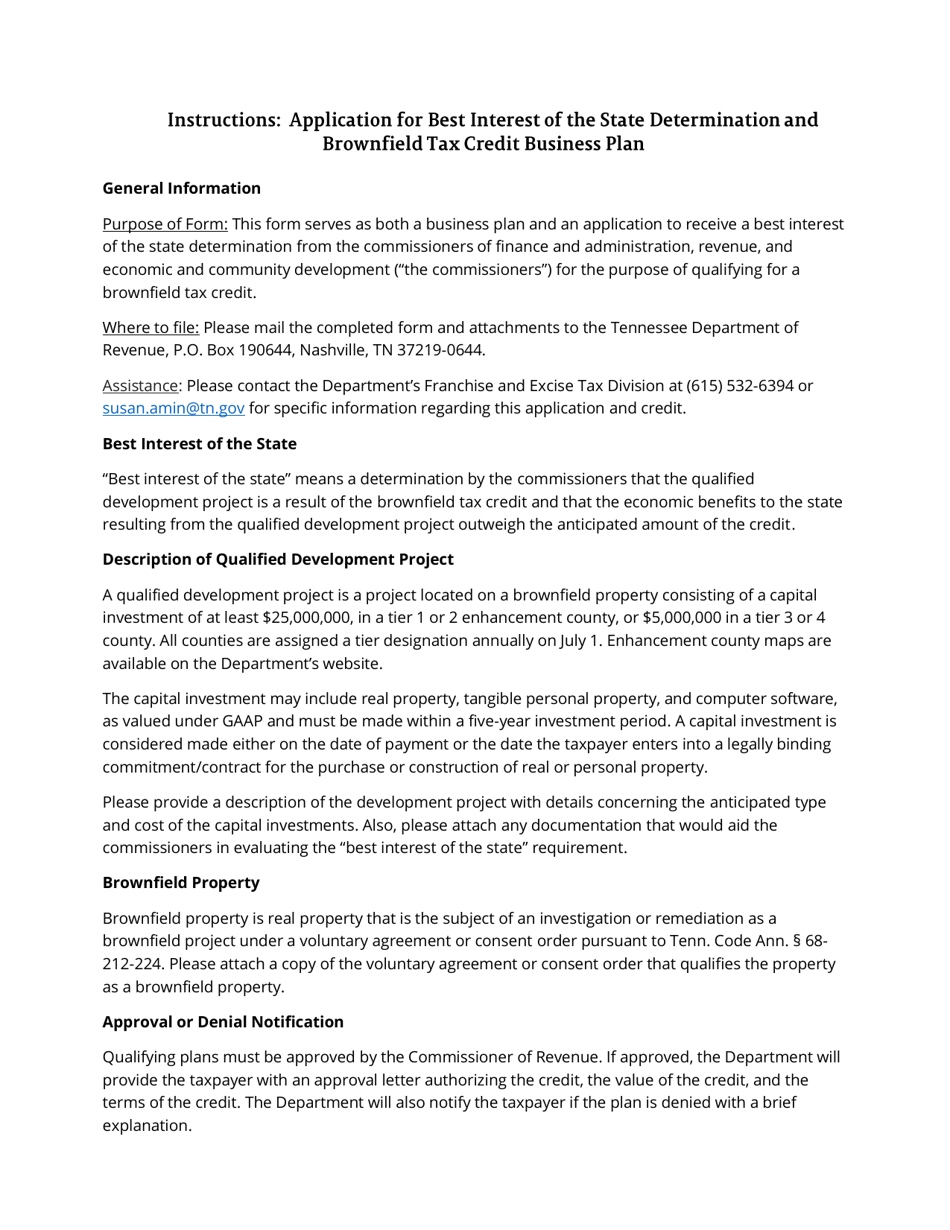

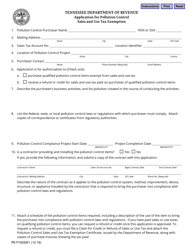

Q: What is the purpose of the form?

A: The purpose of the form is to apply for the Best Interest of the State Determination Brownfield Tax Credit Business Plan in Tennessee.

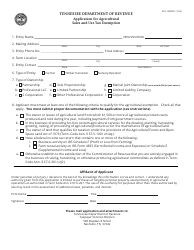

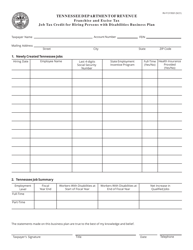

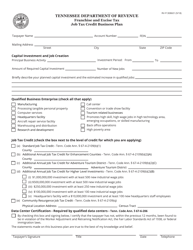

Q: What is the Brownfield Tax Credit Business Plan?

A: The Brownfield Tax Credit Business Plan is a program in Tennessee that provides tax credits for the redevelopment of contaminated properties.

Q: Who can use this form?

A: This form can be used by individuals or businesses who wish to apply for the Brownfield Tax Credit Business Plan in Tennessee.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F16039 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.