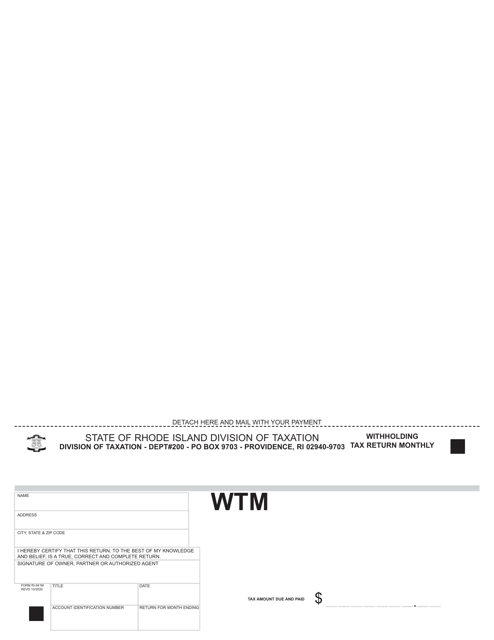

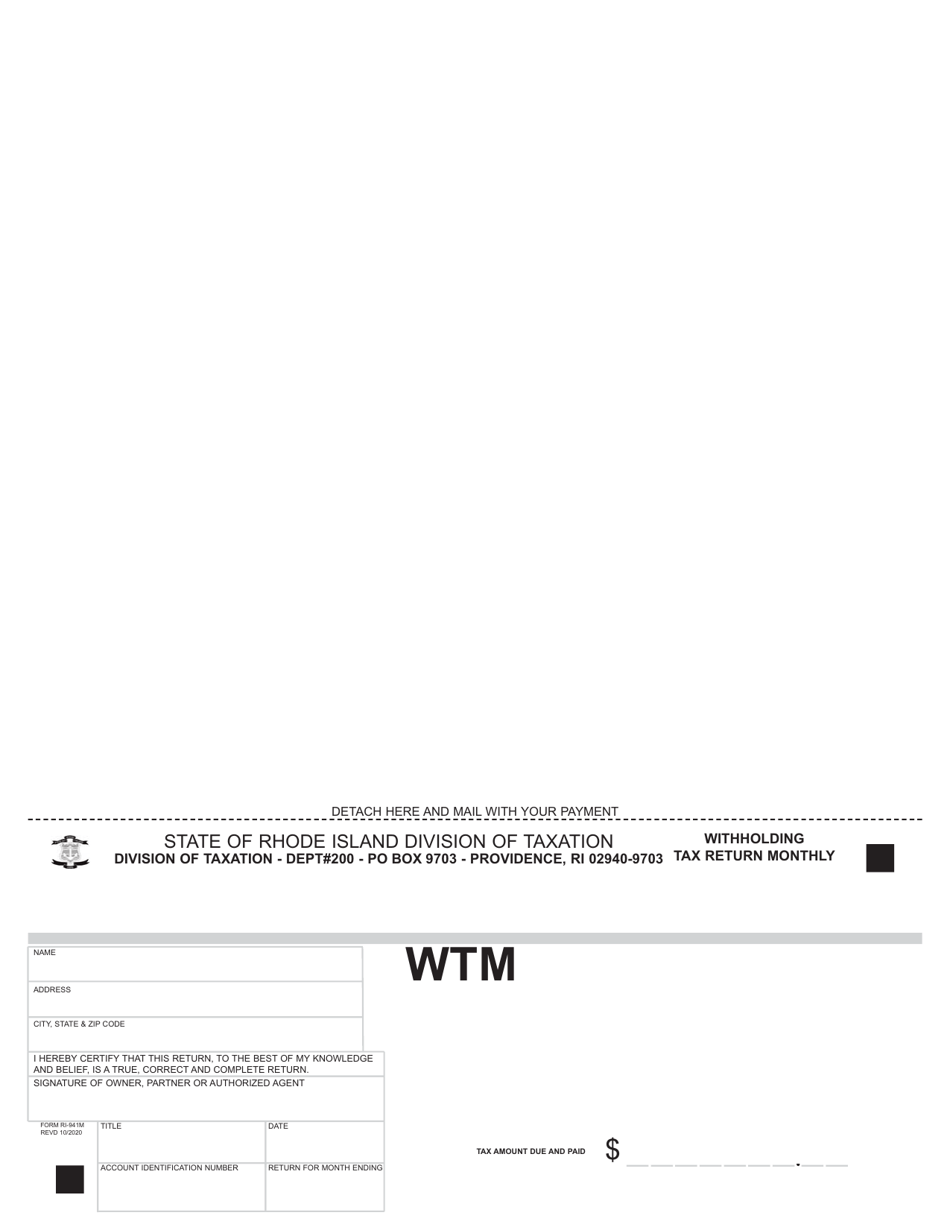

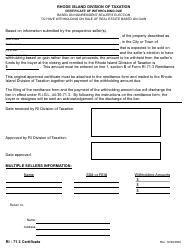

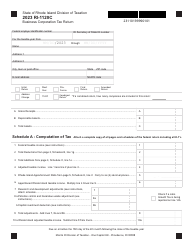

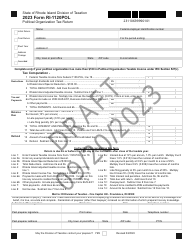

Form RI-941M Withholding Tax Return - Rhode Island

What Is Form RI-941M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-941M?

A: Form RI-941M is the Withholding Tax Return specifically for businesses in Rhode Island.

Q: Who needs to file Form RI-941M?

A: Businesses in Rhode Island that have employees and withhold income tax from their wages need to file Form RI-941M.

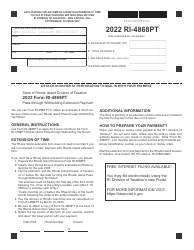

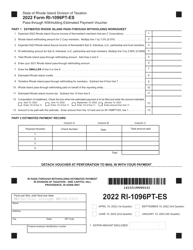

Q: When is Form RI-941M due?

A: Form RI-941M is due quarterly, with the following deadlines: April 30th, July 31st, October 31st, and January 31st.

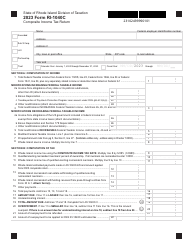

Q: What information is required on Form RI-941M?

A: Form RI-941M requires you to provide information about your business, employee wages, and the amount of income tax withheld.

Q: Are there any penalties for late filing of Form RI-941M?

A: Yes, there are penalties for late filing of Form RI-941M. The penalty is 5% of the tax due for each month the return is late, up to a maximum of 25% of the tax due.

Q: Is there a minimum amount of tax required to be withheld for Form RI-941M?

A: Yes, if your quarterly withholding tax liability is $400 or more, you must file Form RI-941M.

Q: Are there any exemptions or deductions available for Form RI-941M?

A: Yes, there are various exemptions and deductions available for Form RI-941M. Consult the instructions or contact the Rhode Island Division of Taxation for more information.

Q: What should I do if I make a mistake on Form RI-941M?

A: If you make a mistake on Form RI-941M, you should contact the Rhode Island Division of Taxation to correct the error.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-941M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.