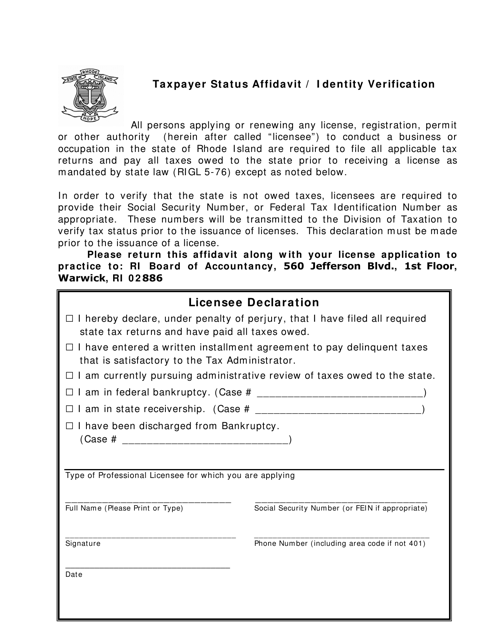

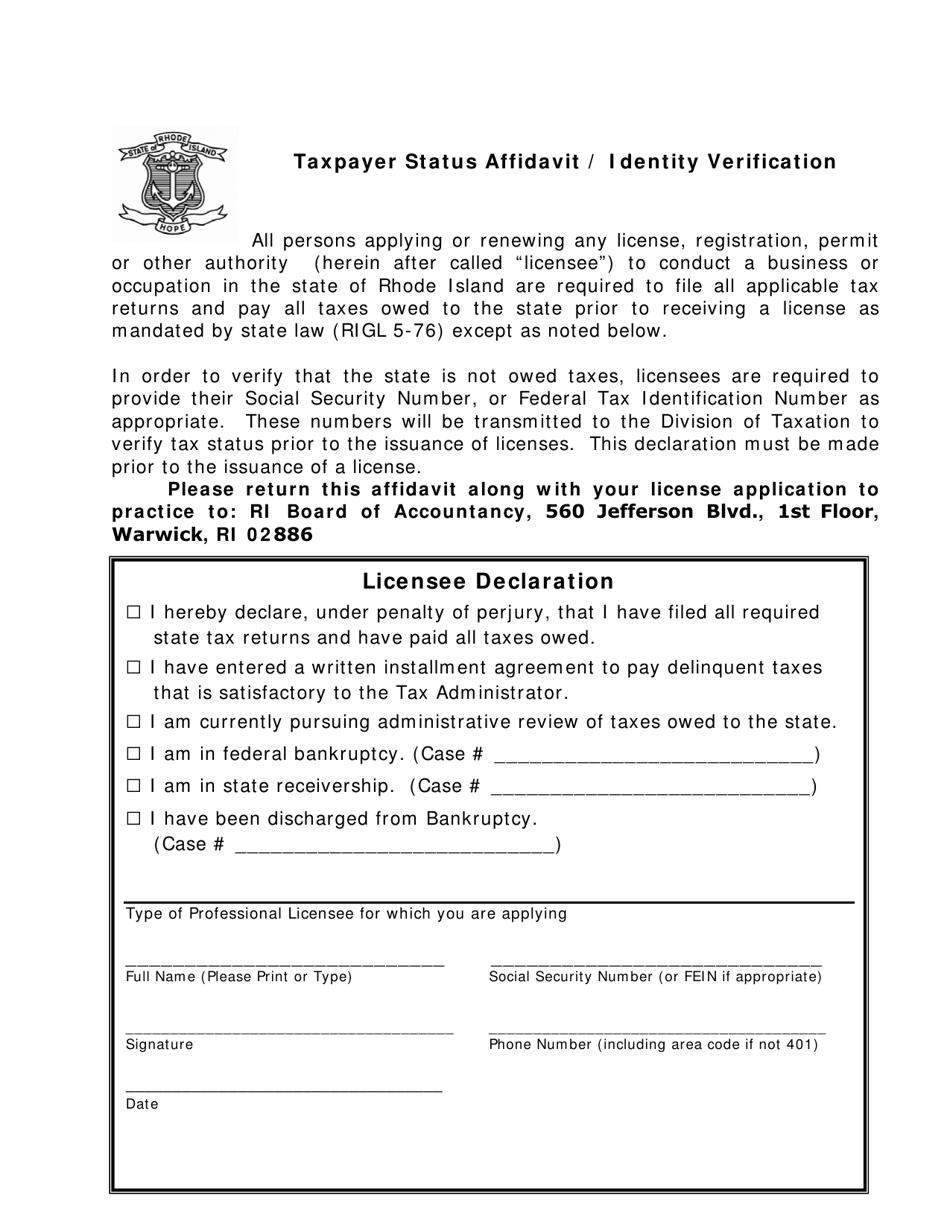

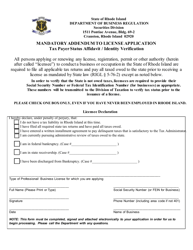

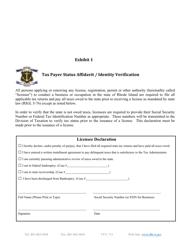

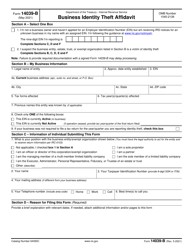

Taxpayer Status Affidavit / Identity Verification - Rhode Island

Taxpayer Status Affidavit/Identity Verification is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a Taxpayer Status Affidavit?

A: A Taxpayer Status Affidavit is a document used to verify a person's tax status in the state of Rhode Island.

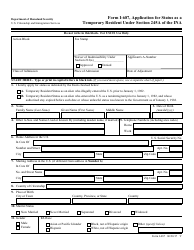

Q: Why is a Taxpayer Status Affidavit required?

A: A Taxpayer Status Affidavit is required to ensure that individuals are accurately reporting their tax status in order to comply with Rhode Island tax laws.

Q: What information is needed for a Taxpayer Status Affidavit?

A: A Taxpayer Status Affidavit typically requires personal information such as name, address, social security number, and may also require details about the tax year being reported.

Q: Can I file a Taxpayer Status Affidavit on behalf of someone else?

A: In most cases, a Taxpayer Status Affidavit must be completed and signed by the individual themselves. However, there may be certain circumstances where a authorized representative can file on behalf of someone else.

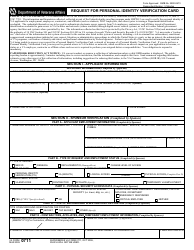

Form Details:

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.