This version of the form is not currently in use and is provided for reference only. Download this version of

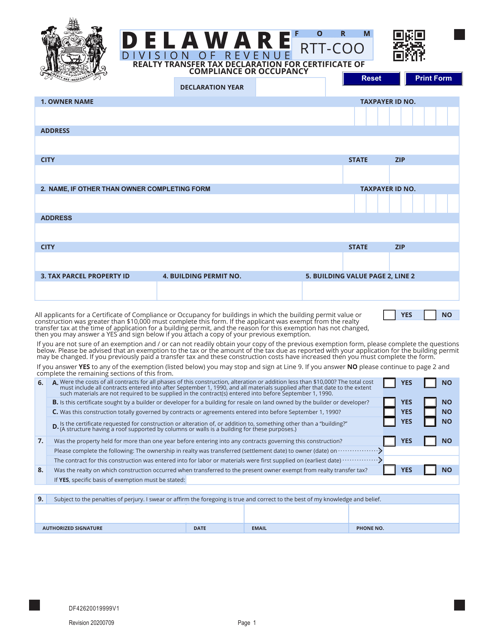

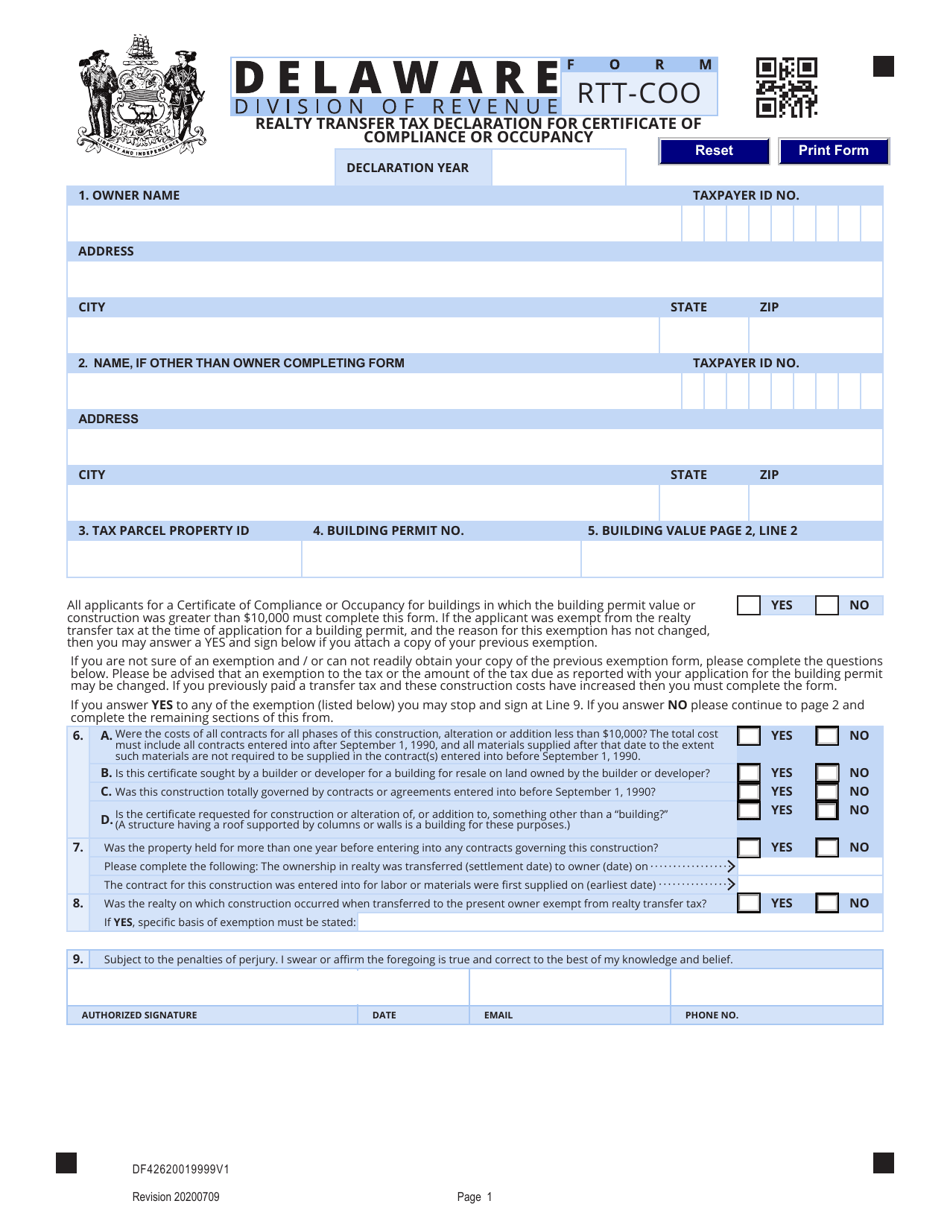

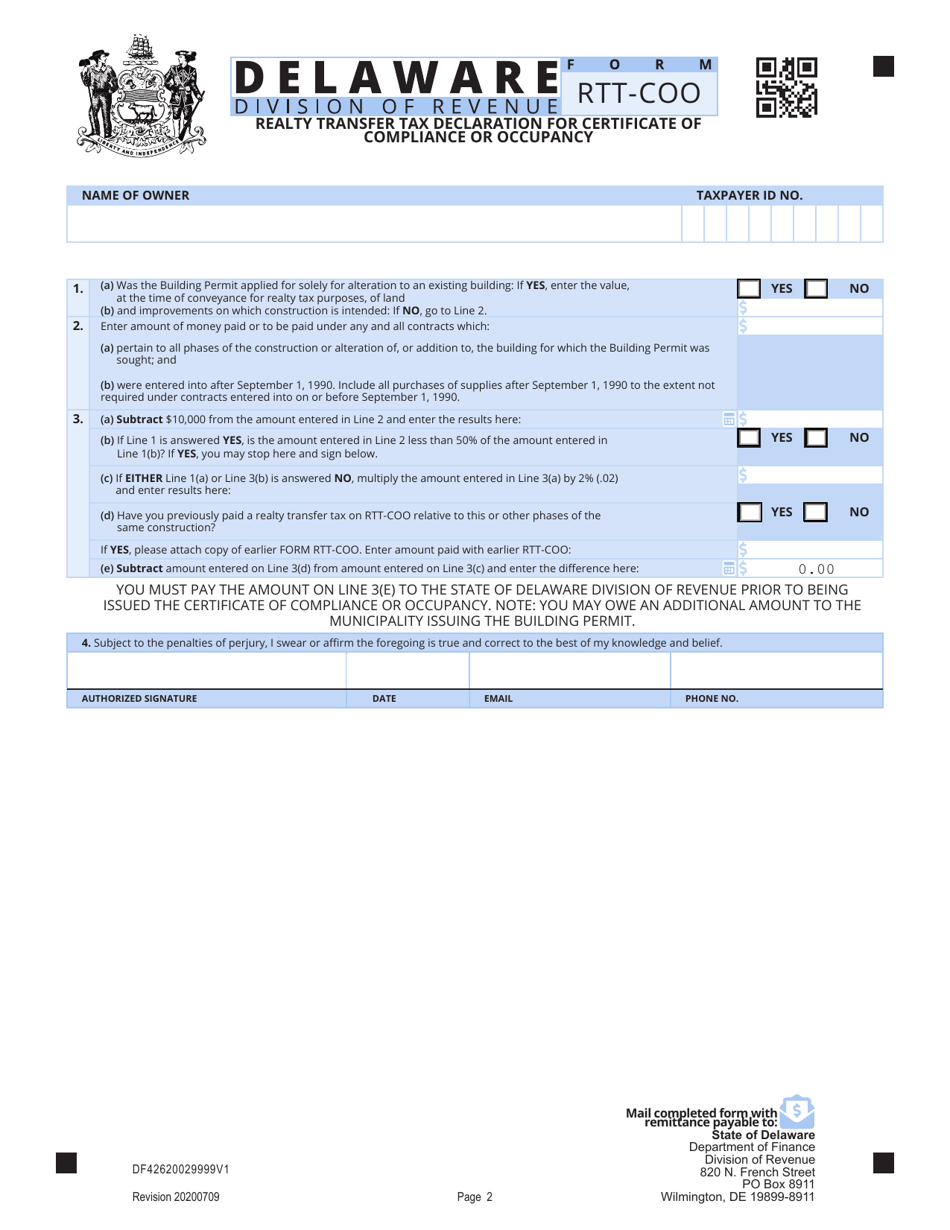

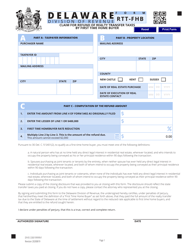

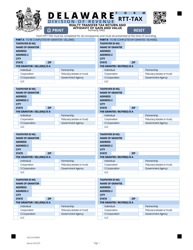

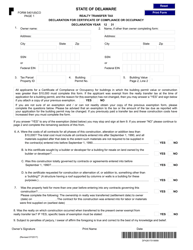

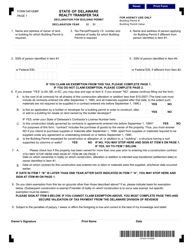

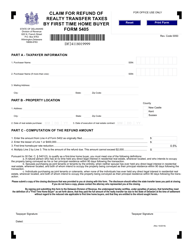

Form RTT-COO

for the current year.

Form RTT-COO Realty Transfer Tax Declaration for Certificate of Compliance or Occupancy - Delaware

What Is Form RTT-COO?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

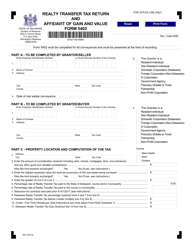

Q: What is the RTT-COO Realty Transfer Tax Declaration?

A: The RTT-COO Realty Transfer Tax Declaration is a form used in Delaware to declare the compliance or occupancy status of a property for the purpose of assessing realty transfer taxes.

Q: When is the RTT-COO Realty Transfer Tax Declaration required?

A: The RTT-COO Realty Transfer Tax Declaration is required when transferring ownership of a property in Delaware.

Q: What is the purpose of the RTT-COO Realty Transfer Tax Declaration?

A: The purpose of the RTT-COO Realty Transfer Tax Declaration is to determine if realty transfer taxes are owed on the property transfer based on its compliance or occupancy status.

Q: Who is responsible for completing the RTT-COO Realty Transfer Tax Declaration?

A: The buyer or buyer's agent is typically responsible for completing the RTT-COO Realty Transfer Tax Declaration.

Q: What information is required on the RTT-COO Realty Transfer Tax Declaration?

A: The RTT-COO Realty Transfer Tax Declaration requires information about the property, the buyer, and details about compliance or occupancy.

Q: What happens after I submit the RTT-COO Realty Transfer Tax Declaration?

A: After you submit the RTT-COO Realty Transfer Tax Declaration, the Division of Revenue will review the form and assess any realty transfer taxes that may be due based on the property's compliance or occupancy status.

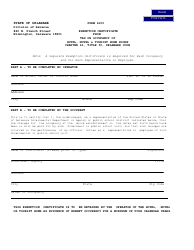

Q: Is the RTT-COO Realty Transfer Tax Declaration the same as a certificate of compliance or occupancy?

A: No, the RTT-COO Realty Transfer Tax Declaration is a separate form used specifically for assessing realty transfer taxes, while a certificate of compliance or occupancy is a document that verifies a property meets certain building code requirements.

Q: Can I use the RTT-COO Realty Transfer Tax Declaration for properties located outside of Delaware?

A: No, the RTT-COO Realty Transfer Tax Declaration is specific to properties located in Delaware. Other states may have their own forms for assessing realty transfer taxes.

Form Details:

- Released on July 9, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTT-COO by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.