This version of the form is not currently in use and is provided for reference only. Download this version of

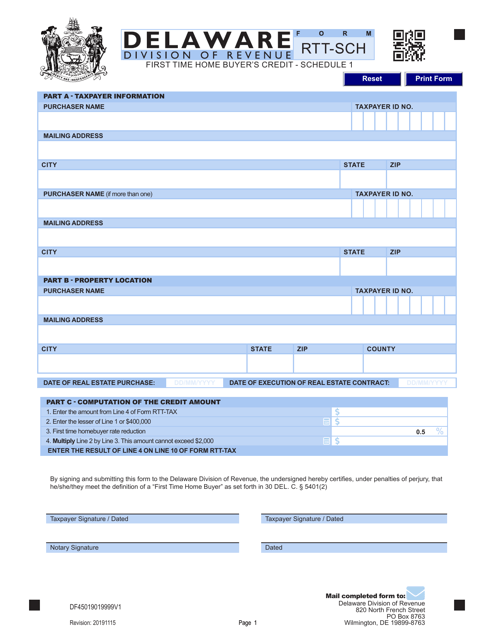

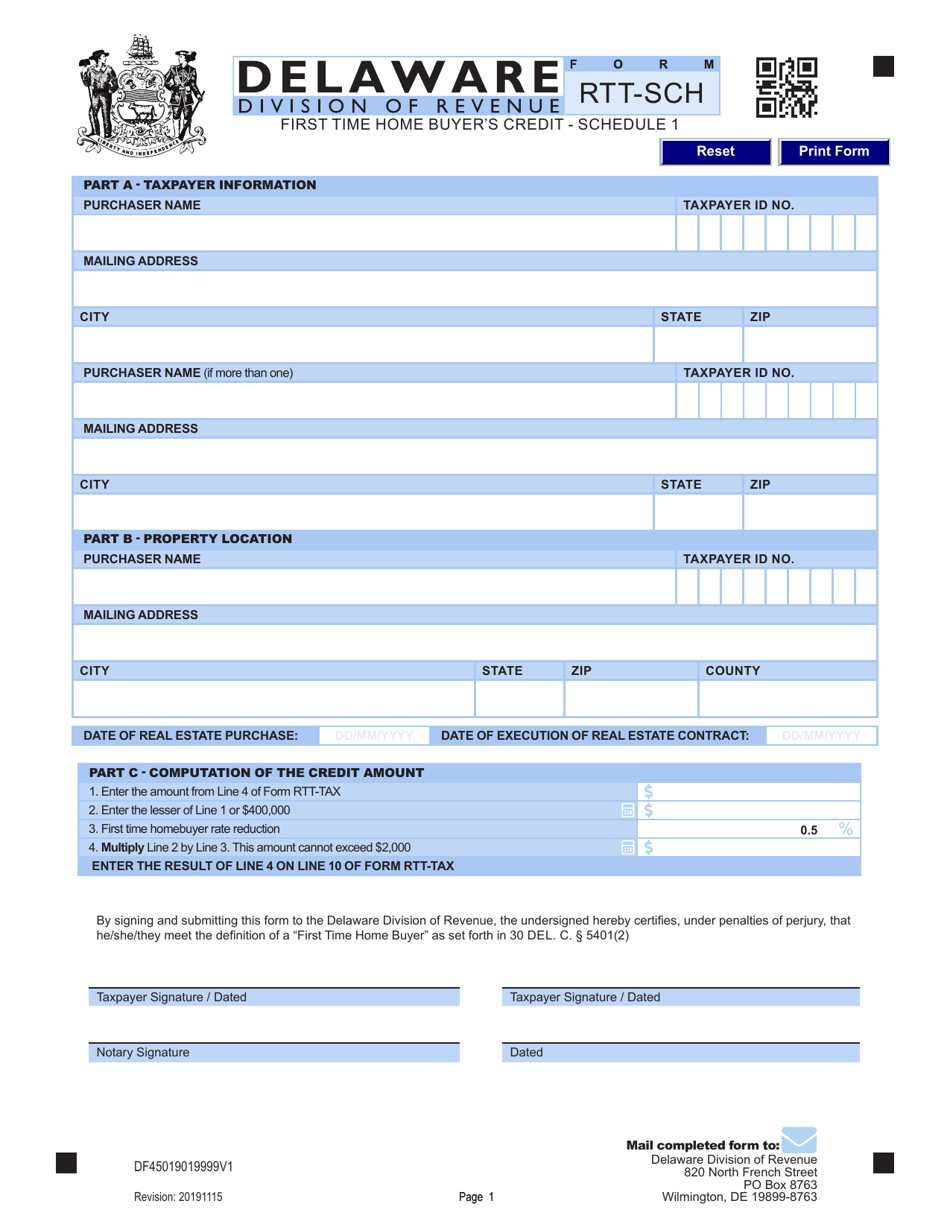

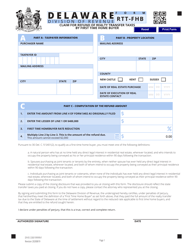

Form RTT-SCH Schedule 1

for the current year.

Form RTT-SCH Schedule 1 First Time Home Buyer's Credit - Delaware

What Is Form RTT-SCH Schedule 1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

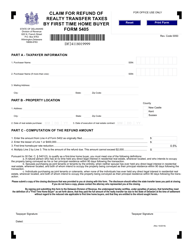

Q: What is the RTT-SCH Schedule 1?

A: The RTT-SCH Schedule 1 refers to the Delaware First Time Home Buyer's Credit form.

Q: What is the purpose of the First Time Home Buyer's Credit in Delaware?

A: The purpose of the First Time Home Buyer's Credit in Delaware is to provide eligible first-time home buyers with a tax credit.

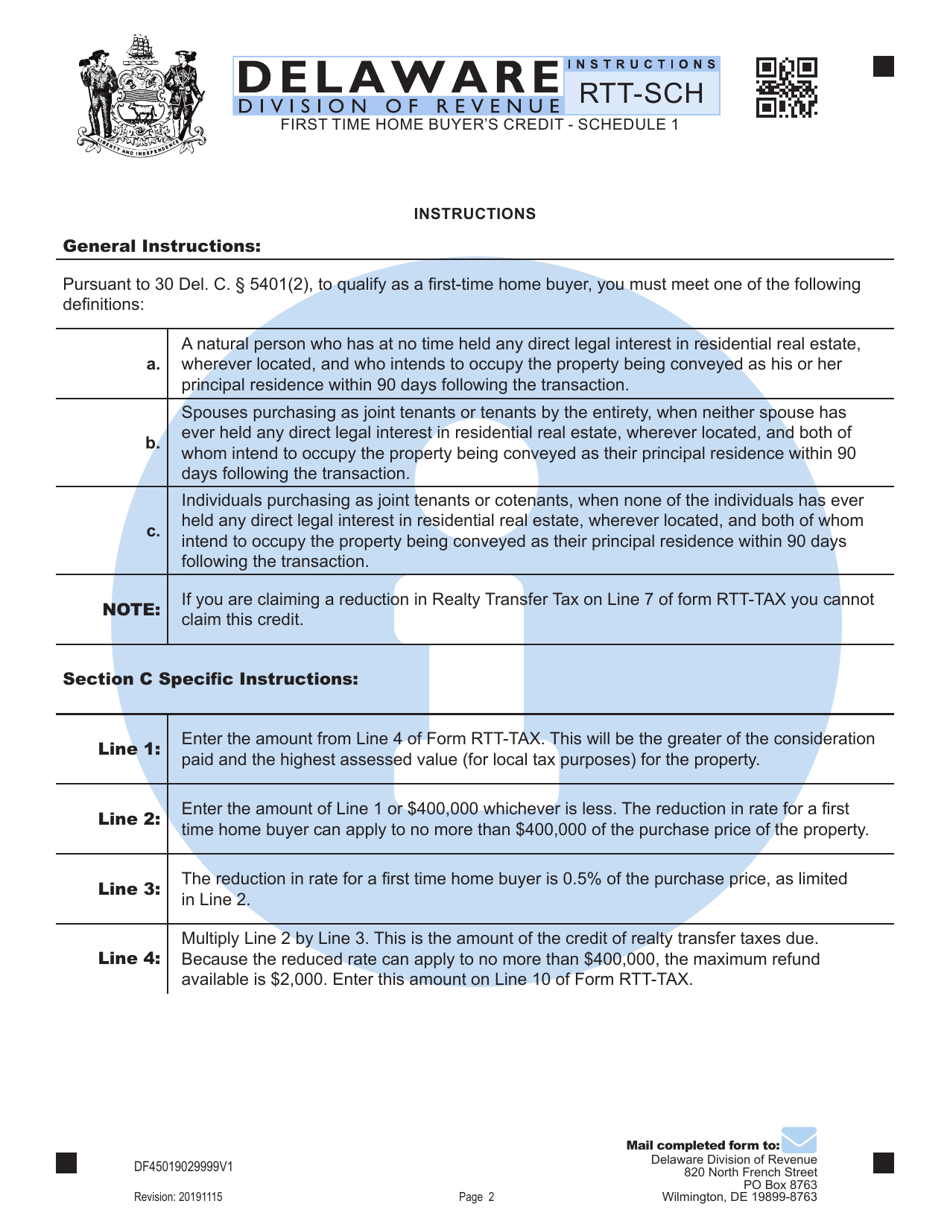

Q: Who is eligible for the First Time Home Buyer's Credit?

A: Eligible individuals, who meet the requirements, can claim the First Time Home Buyer's Credit in Delaware.

Q: What are the requirements to be eligible for the First Time Home Buyer's Credit?

A: To be eligible for the First Time Home Buyer's Credit in Delaware, an individual must meet certain residency, income, and purchase price criteria.

Q: How much is the tax credit for first-time home buyers in Delaware?

A: The tax credit amount for first-time home buyers in Delaware is specified in the RTT-SCH Schedule 1 form.

Form Details:

- Released on November 15, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTT-SCH Schedule 1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.