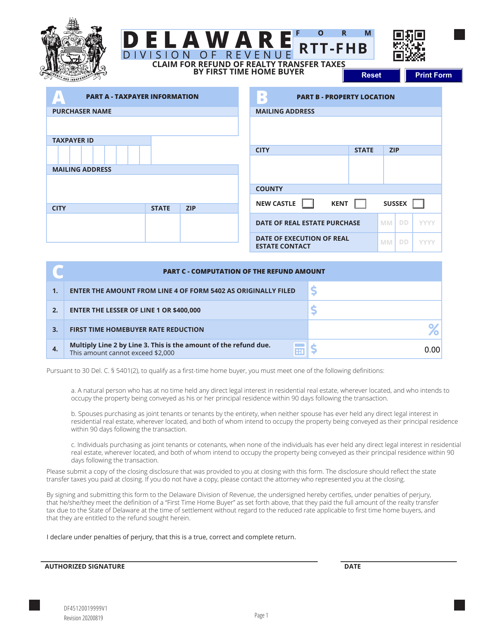

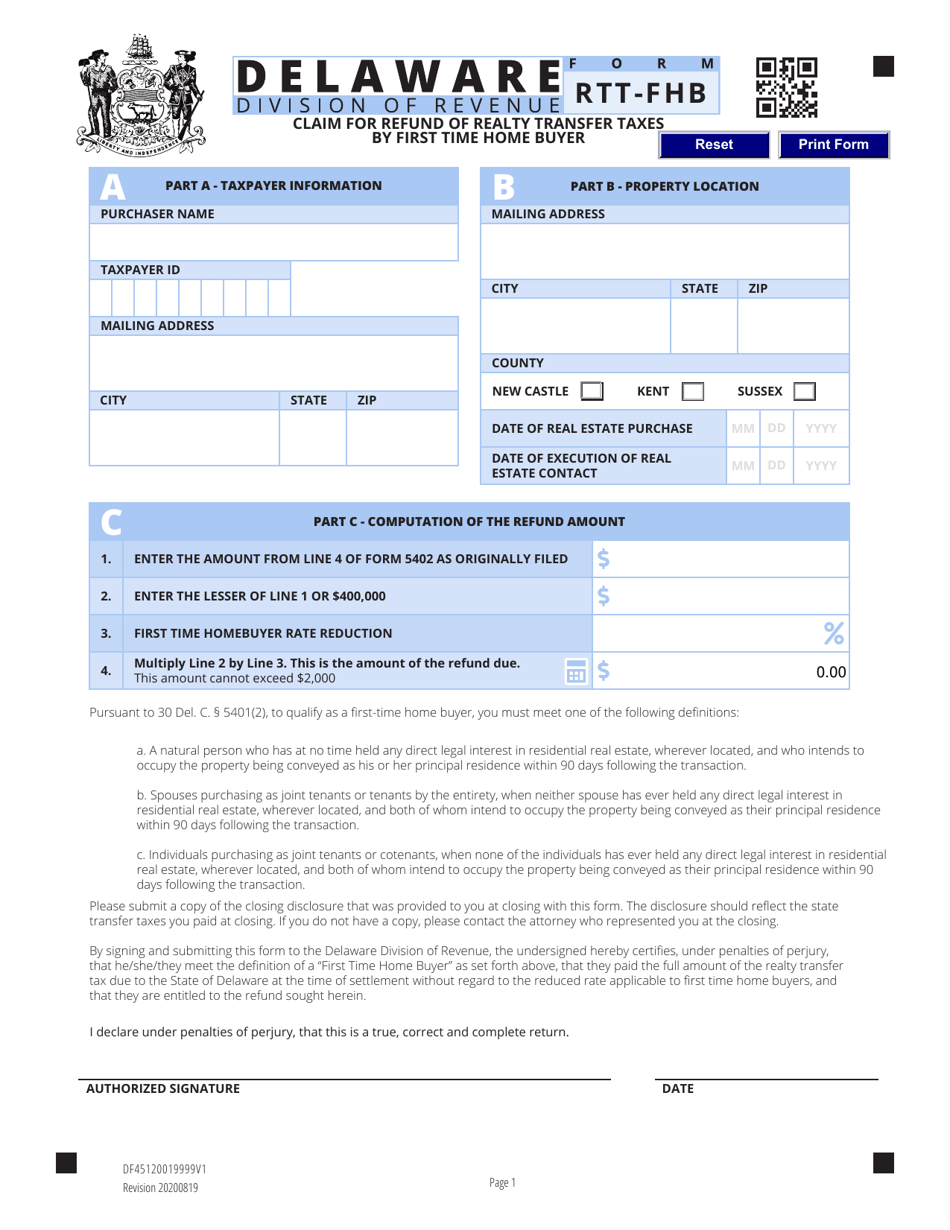

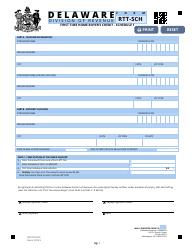

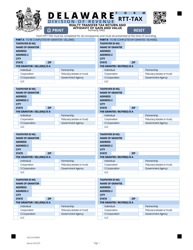

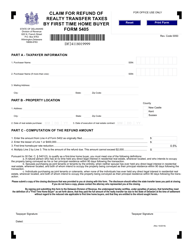

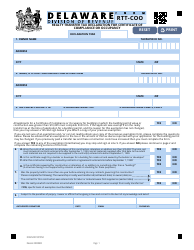

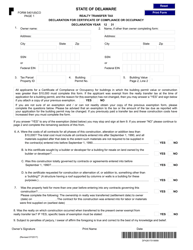

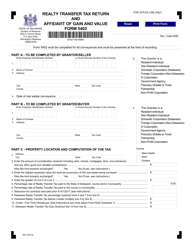

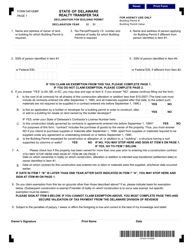

Form RTT-FHB Claim for Refund of Realty Transfer Taxes by First Time Home Buyer - Delaware

What Is Form RTT-FHB?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a RTT-FHB claim?

A: RTT-FHB claim is a claim for refund of Realty Transfer Taxes by a First Time Home Buyer.

Q: Who is eligible to file a RTT-FHB claim?

A: A First Time Home Buyer in Delaware is eligible to file a RTT-FHB claim.

Q: What is considered a First Time Home Buyer?

A: A First Time Home Buyer is someone who has not owned a principal residence in the past three years.

Q: What are Realty Transfer Taxes?

A: Realty Transfer Taxes are taxes imposed on the transfer of real property.

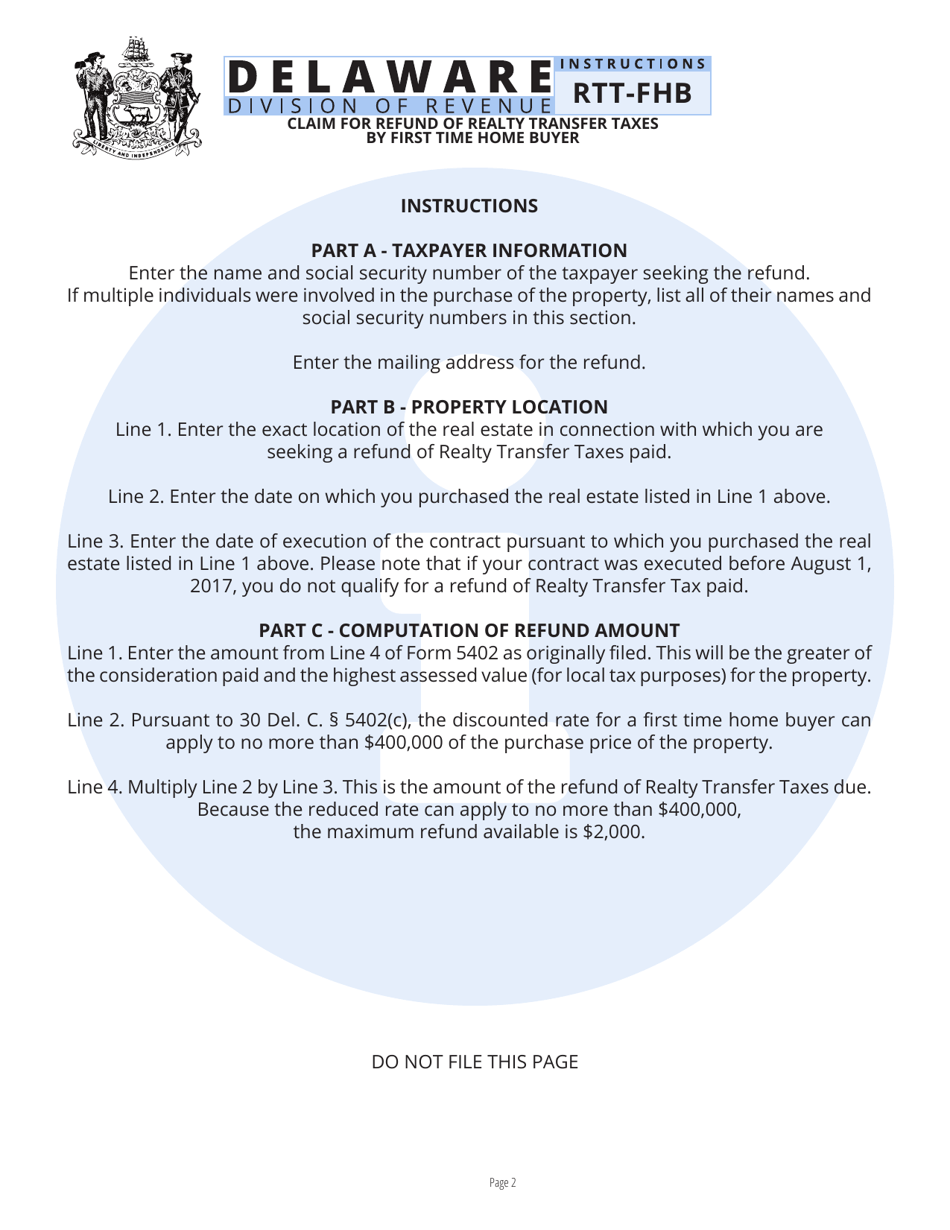

Q: How do I file a RTT-FHB claim?

A: To file a RTT-FHB claim, you need to complete and submit the appropriate form to the Delaware Division of Revenue.

Q: What documents do I need to include with my RTT-FHB claim?

A: You will need to include a copy of your settlement sheet, a copy of your HUD-1 statement, and any other supporting documentation.

Q: When should I file my RTT-FHB claim?

A: You should file your RTT-FHB claim within three years of the date of the real estate closing.

Q: How long does it take to receive a refund for a RTT-FHB claim?

A: It typically takes 8-12 weeks to process a RTT-FHB claim and receive a refund.

Q: Are there any fees associated with filing a RTT-FHB claim?

A: There are no fees associated with filing a RTT-FHB claim.

Form Details:

- Released on August 19, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTT-FHB by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.