This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

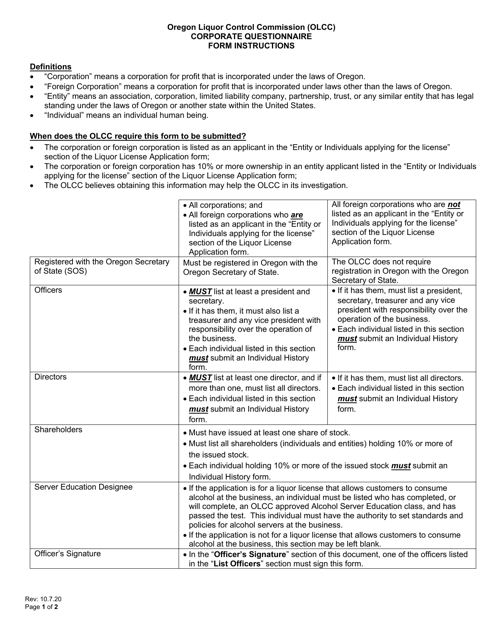

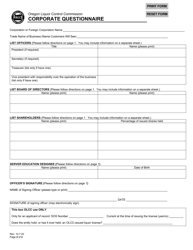

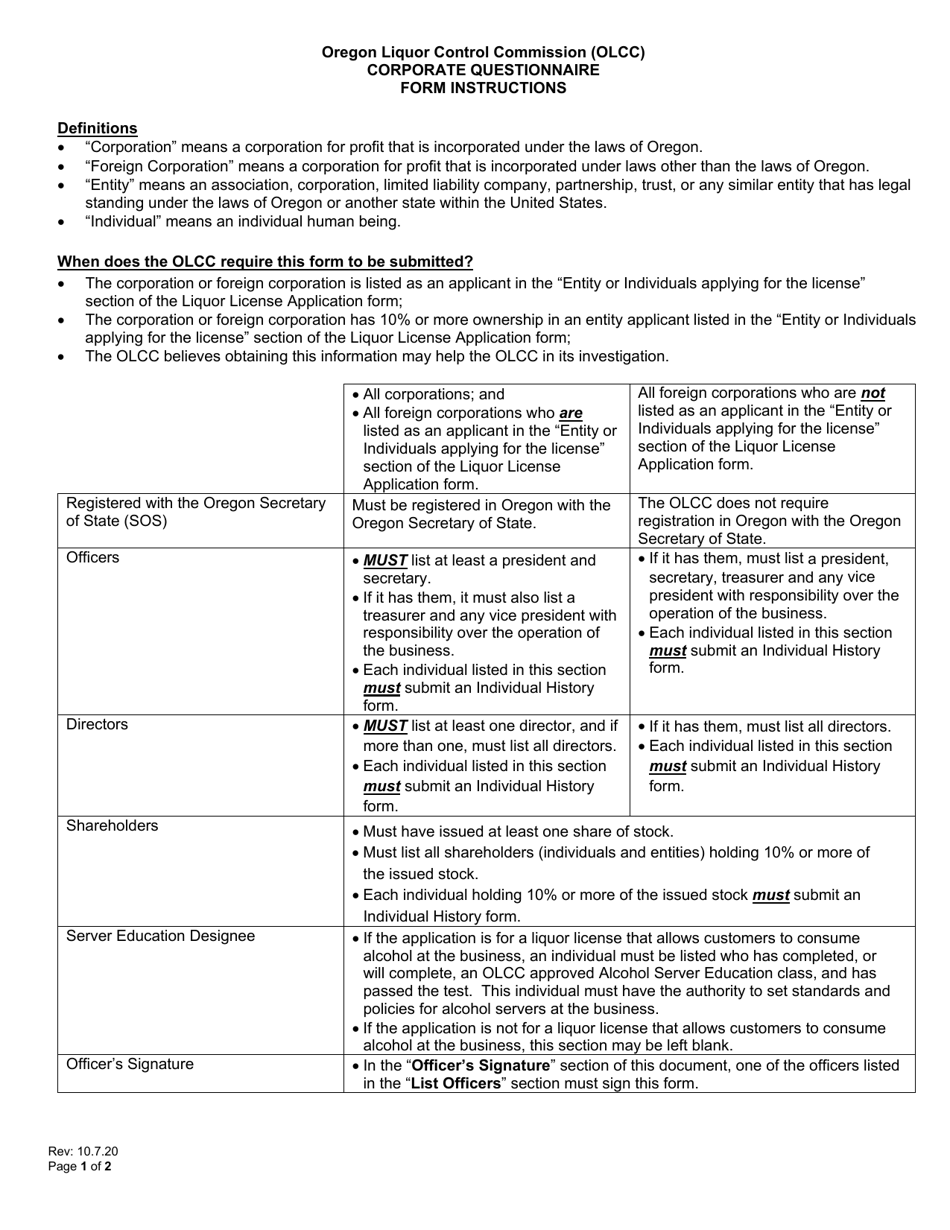

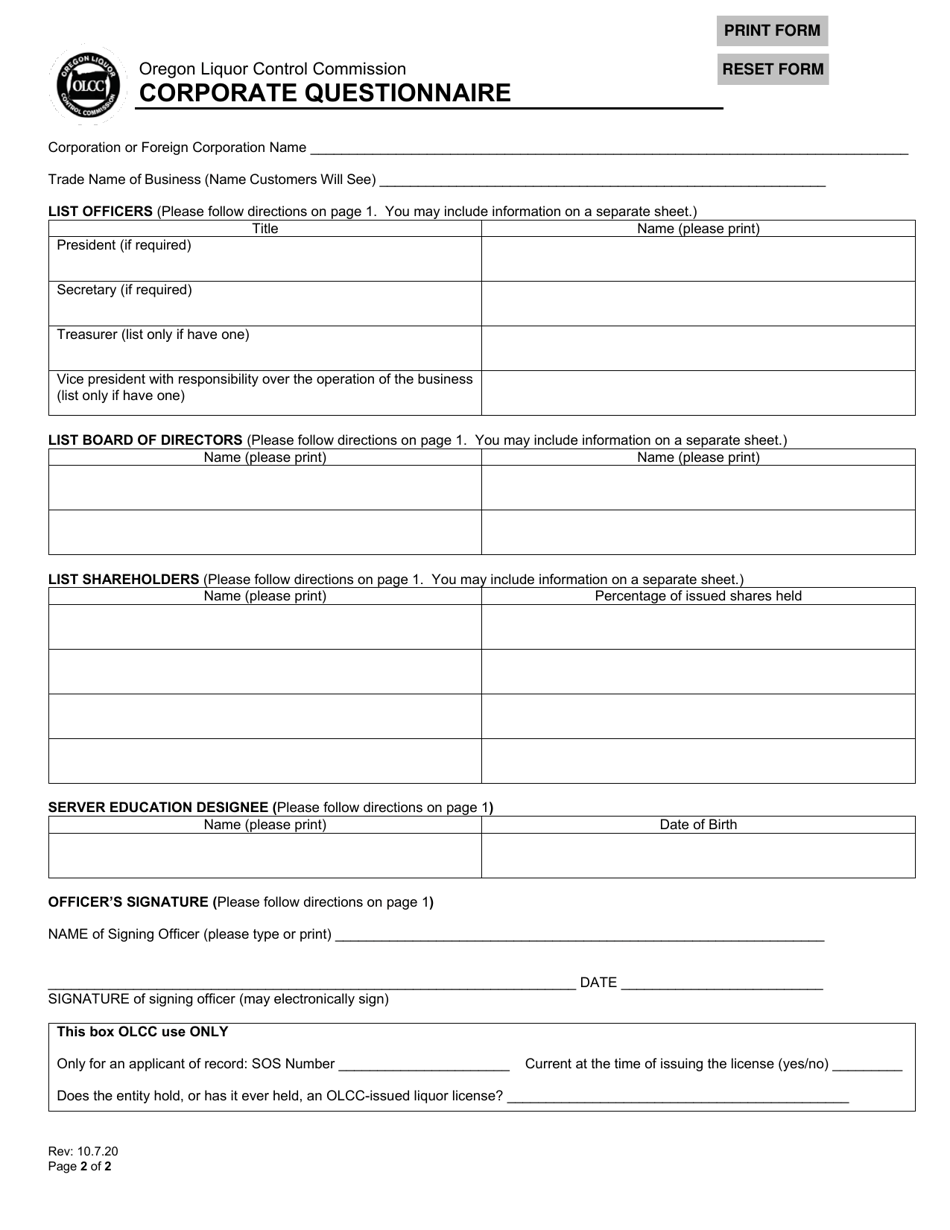

Corporate Questionnaire - Oregon

Corporate Questionnaire is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the corporate tax rate in Oregon?

A: The corporate tax rate in Oregon is 6.6%.

Q: Are there any incentives for corporations to invest in Oregon?

A: Yes, Oregon offers various incentives for corporations, such as the Strategic Investment Program (SIP) and the Business Energy Tax Credit (BETC).

Q: Are corporations required to pay a minimum tax in Oregon?

A: Yes, corporations are required to pay a minimum tax of $150 in Oregon.

Q: What is the process of registering a corporation in Oregon?

A: To register a corporation in Oregon, you need to file Articles of Incorporation with the Oregon Secretary of State and pay the associated filing fee.

Q: Is Oregon a good state for doing business?

A: Yes, Oregon is often ranked as a favorable state for doing business due to its business-friendly tax policies and skilled workforce.

Q: Are there any resources available for corporate training and development in Oregon?

A: Yes, Oregon offers resources such as the Oregon Employer Training Program and various workforce development services.

Q: Does Oregon have any specific regulations or requirements for corporations?

A: Yes, Oregon has various regulations and requirements for corporations, such as annual reporting and compliance with state tax laws.

Q: Are corporations in Oregon required to have a registered agent?

A: Yes, corporations in Oregon are required to have a registered agent who can receive legal documents on behalf of the corporation.

Q: What is the process of dissolving a corporation in Oregon?

A: To dissolve a corporation in Oregon, you need to file Articles of Dissolution with the Oregon Secretary of State and pay the associated filing fee.

Q: Are there any grants or funding opportunities available for corporations in Oregon?

A: Yes, Oregon offers various grants and funding opportunities for corporations through programs like the Oregon Business Development Fund and the Oregon Growth Account.

Form Details:

- Released on October 7, 2020;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.