This version of the form is not currently in use and is provided for reference only. Download this version of

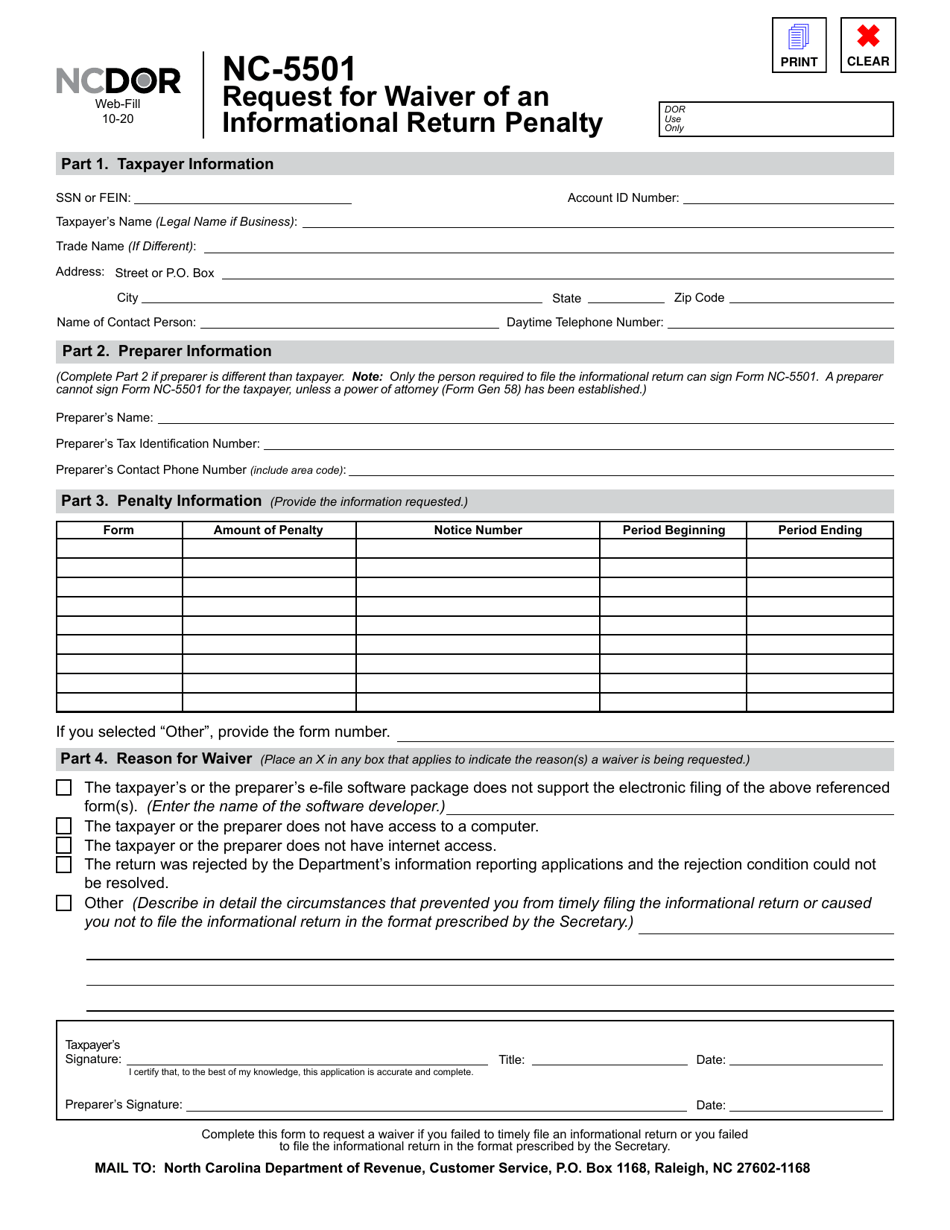

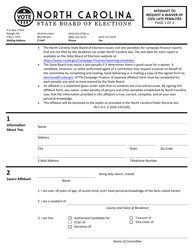

Form NC-5501

for the current year.

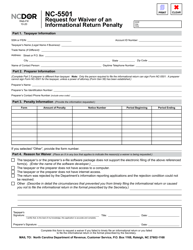

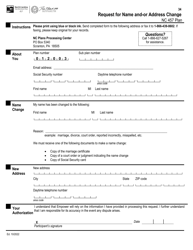

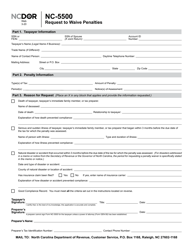

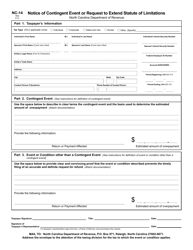

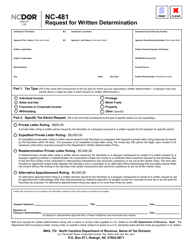

Form NC-5501 Request for Waiver of an Informational Return Penalty - North Carolina

What Is Form NC-5501?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-5501?

A: Form NC-5501 is a document used in North Carolina to request a waiver of an informational return penalty.

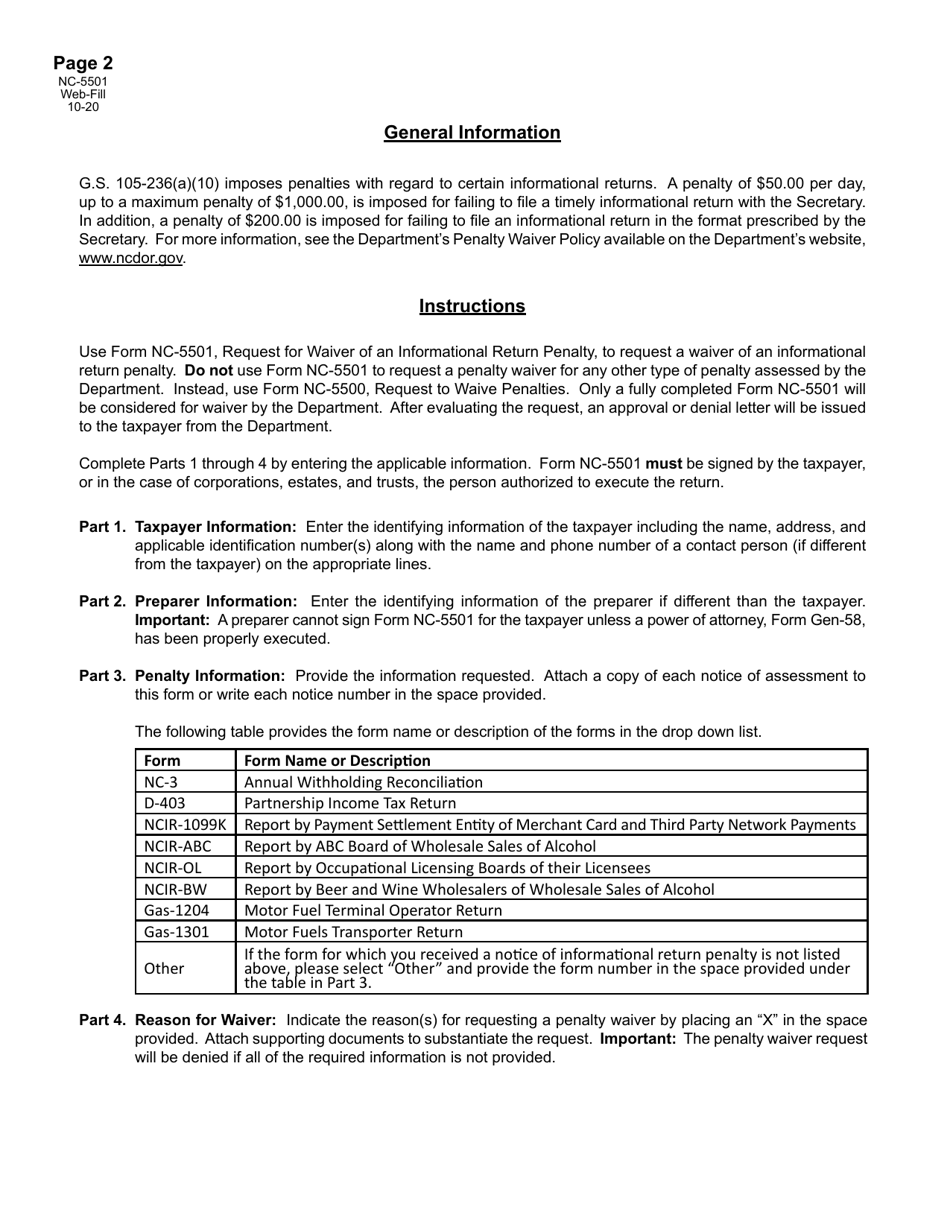

Q: What is an informational return penalty?

A: An informational return penalty is a penalty imposed for failure to file or submit required information returns.

Q: Why would someone need to request a waiver of an informational return penalty?

A: Someone may need to request a waiver if they have a valid reason for not filing or submitting the required information returns.

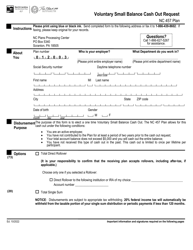

Q: Who can use Form NC-5501?

A: Form NC-5501 can be used by individuals, businesses, and organizations in North Carolina.

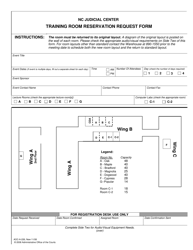

Q: What information is required on Form NC-5501?

A: Form NC-5501 requires information about the penalty being requested to be waived, the reasons for the waiver request, and any supporting documentation.

Q: Is there a fee to file Form NC-5501?

A: There is no fee to file Form NC-5501.

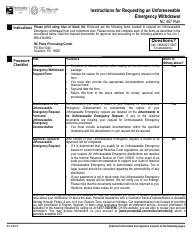

Q: How long does it take to process a waiver request on Form NC-5501?

A: The processing time for a waiver request on Form NC-5501 can vary, but it typically takes a few weeks to several months.

Q: Can Form NC-5501 be used to request a waiver for federal informational return penalties?

A: No, Form NC-5501 is specific to North Carolina and cannot be used to request a waiver for federal informational return penalties.

Q: Are there any penalties for submitting false information on Form NC-5501?

A: Yes, submitting false information on Form NC-5501 may result in penalties imposed by the North Carolina Department of Revenue.

Q: Can I request a waiver of an informational return penalty after it has already been assessed?

A: Yes, you can request a waiver of an informational return penalty after it has been assessed, but it is recommended to do so as soon as possible.

Q: What happens if my waiver request on Form NC-5501 is denied?

A: If your waiver request is denied, you may have to pay the penalty that was assessed.

Q: Can I appeal a denial of my waiver request on Form NC-5501?

A: Yes, you have the right to appeal a denial of your waiver request.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

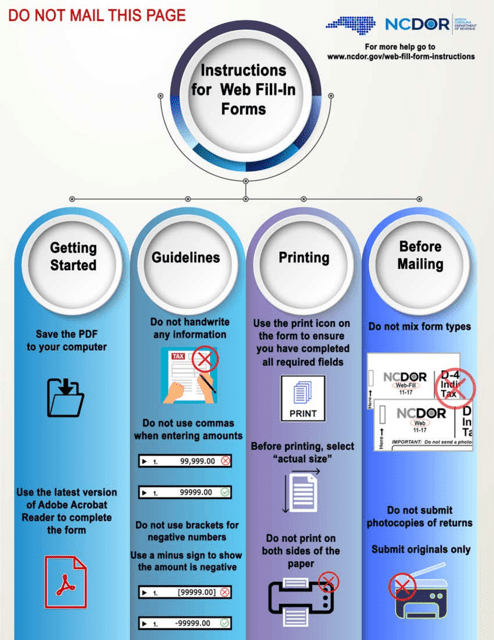

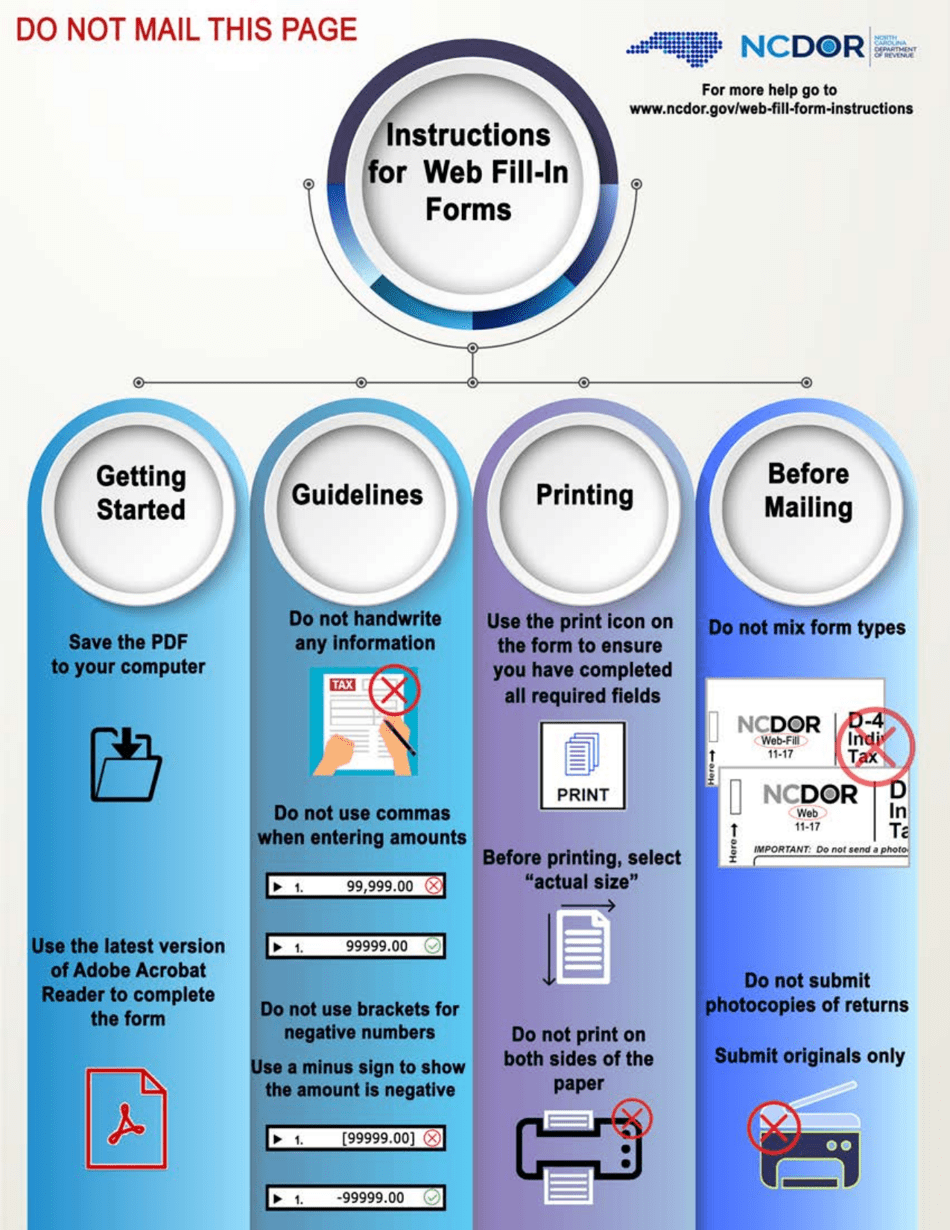

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-5501 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.