This version of the form is not currently in use and is provided for reference only. Download this version of

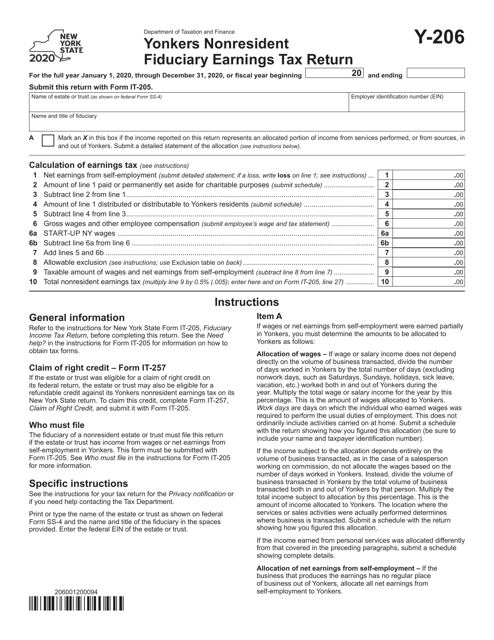

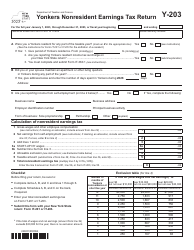

Form Y-206

for the current year.

Form Y-206 Yonkers Nonresident Fiduciary Earnings Tax Return - New York

What Is Form Y-206?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form Y-206?

A: Form Y-206 is the Yonkers Nonresident Fiduciary Earnings Tax Return for the state of New York.

Q: Who needs to file Form Y-206?

A: Nonresident fiduciaries who have taxable income from Yonkers, New York, must file Form Y-206.

Q: What is the purpose of Form Y-206?

A: Form Y-206 is used to report and pay the Yonkers Nonresident Fiduciary Earnings Tax.

Q: When is Form Y-206 due?

A: Form Y-206 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: What happens if I don't file Form Y-206?

A: If you don't file Form Y-206 or pay the tax due, you may be subject to penalties and interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Y-206 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.