This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-205-J

for the current year.

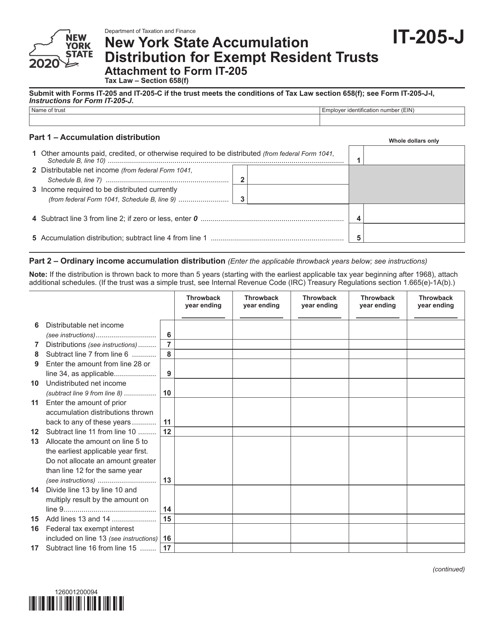

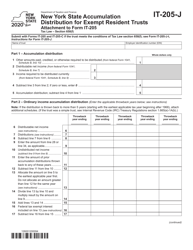

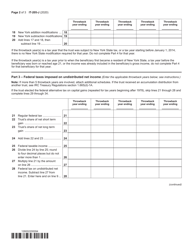

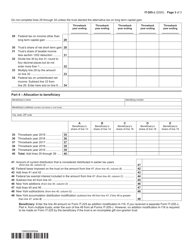

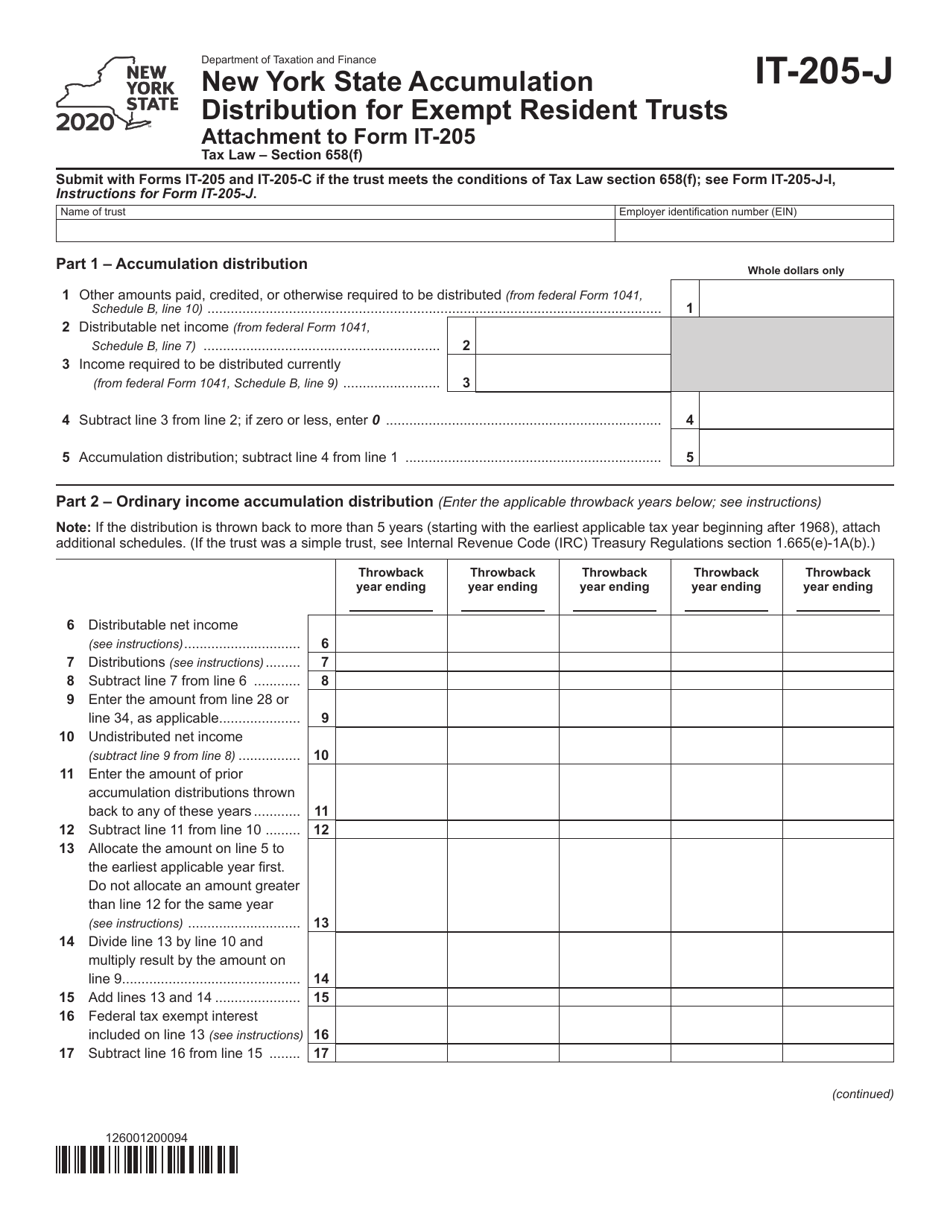

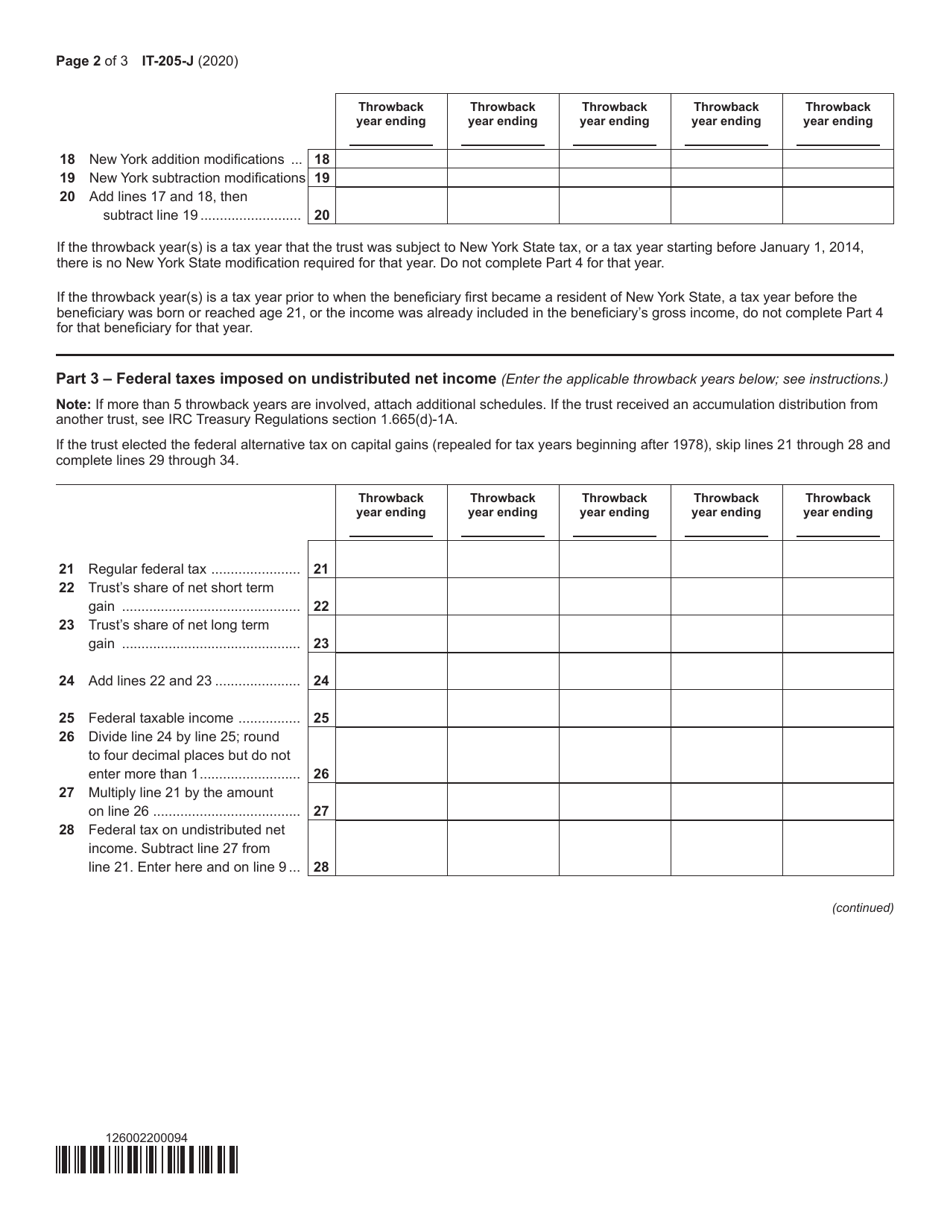

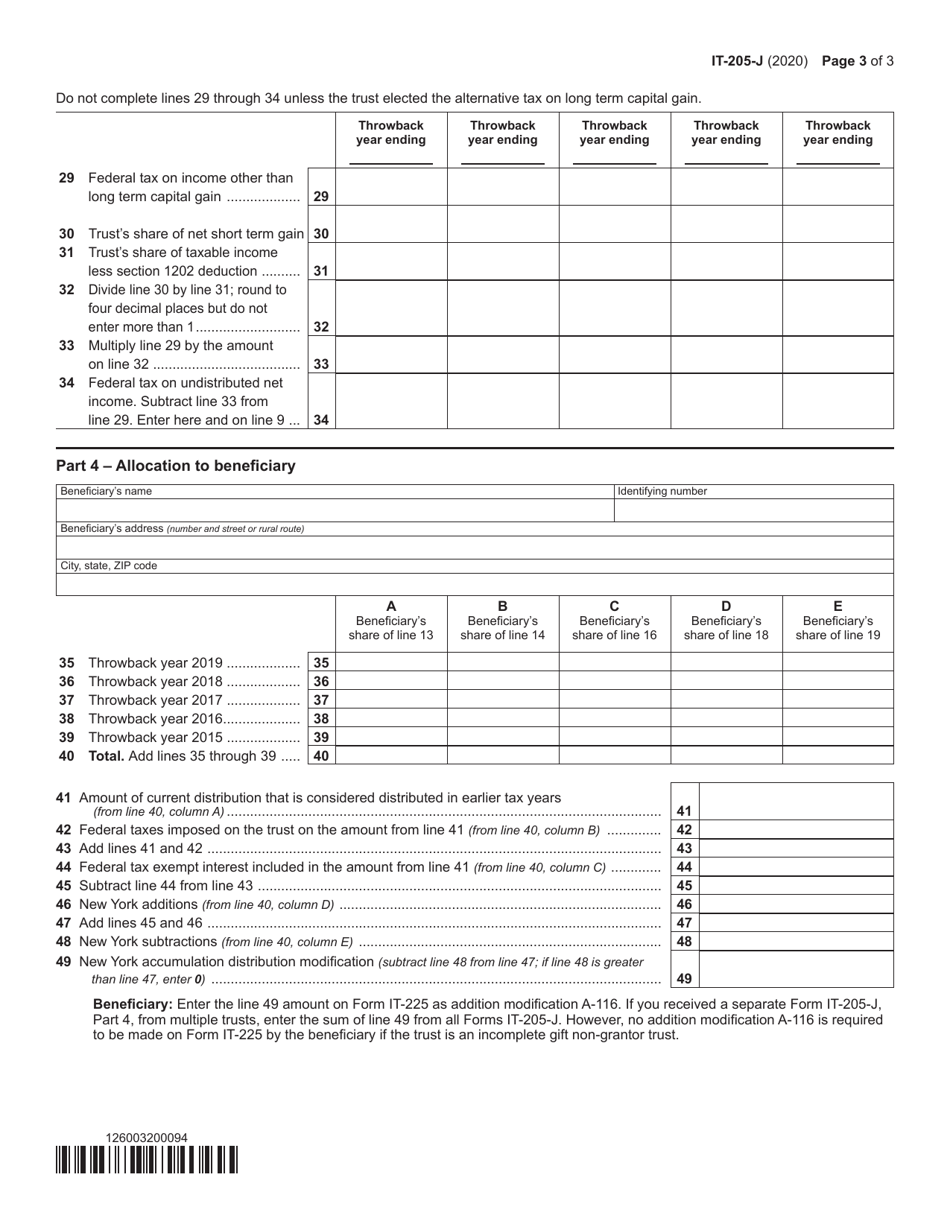

Form IT-205-J New York State Accumulation Distribution for Exempt Resident Trusts - New York

What Is Form IT-205-J?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-J?

A: Form IT-205-J is a tax form used in New York State to report the accumulation distribution of exempt resident trusts.

Q: Who needs to file Form IT-205-J?

A: Exempt resident trusts in New York State need to file Form IT-205-J to report accumulation distributions.

Q: What is an accumulation distribution?

A: An accumulation distribution is the distribution of income that a trust has accumulated and not distributed to its beneficiaries.

Q: Are all trusts required to file Form IT-205-J?

A: No, only exempt resident trusts in New York State are required to file Form IT-205-J.

Q: Is there a deadline for filing Form IT-205-J?

A: Yes, Form IT-205-J must be filed by the 15th day of the fourth month following the end of the trust's tax year.

Q: Are there any penalties for not filing Form IT-205-J?

A: Yes, there may be penalties for not filing Form IT-205-J or filing it late. It is important to file the form on time to avoid any penalties or interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-J by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.