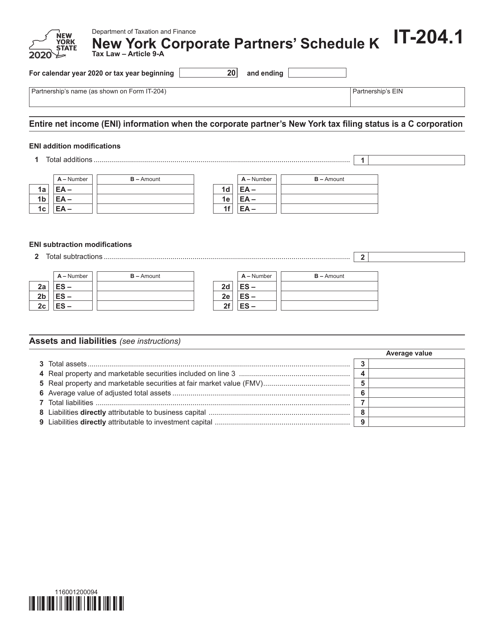

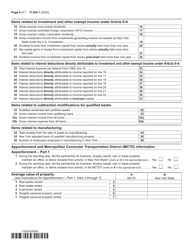

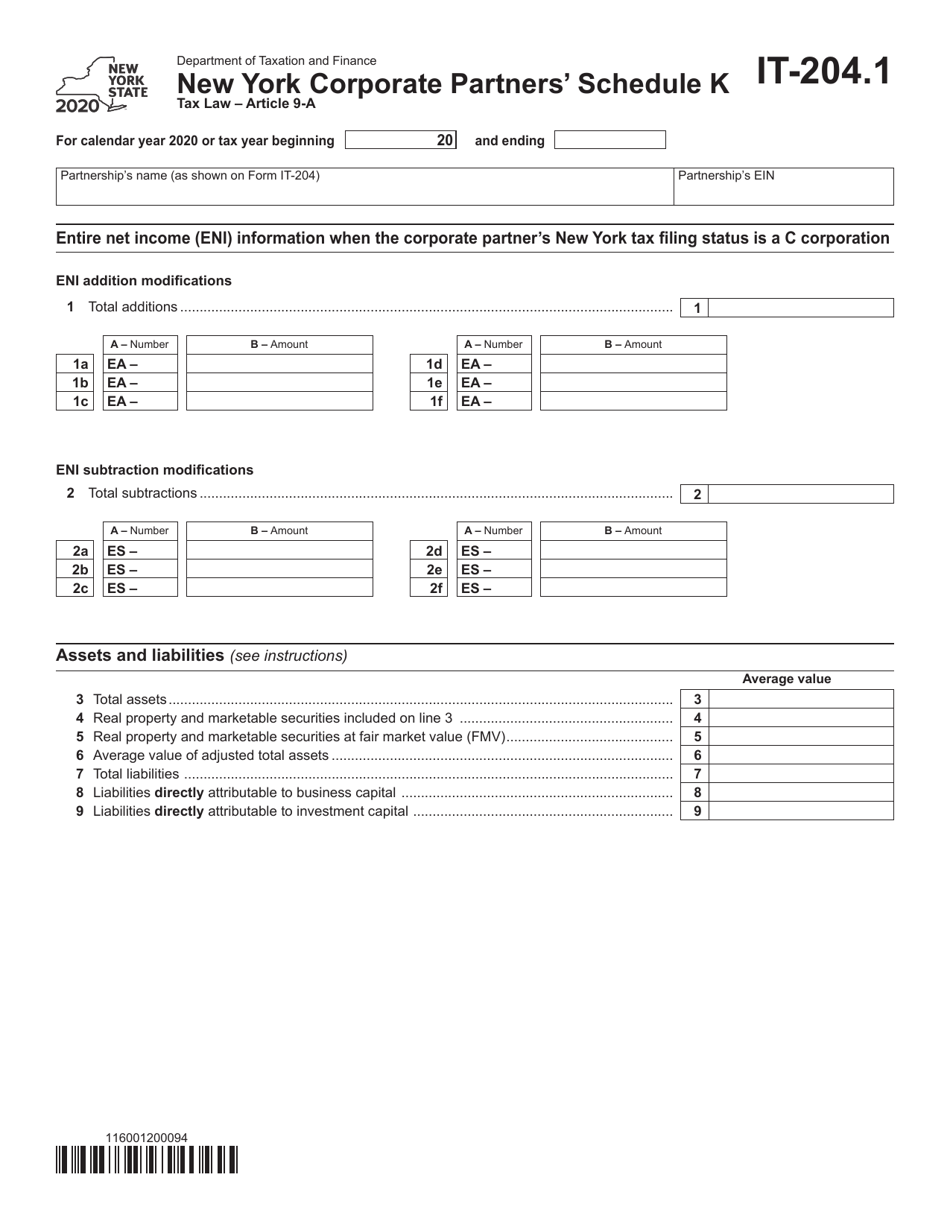

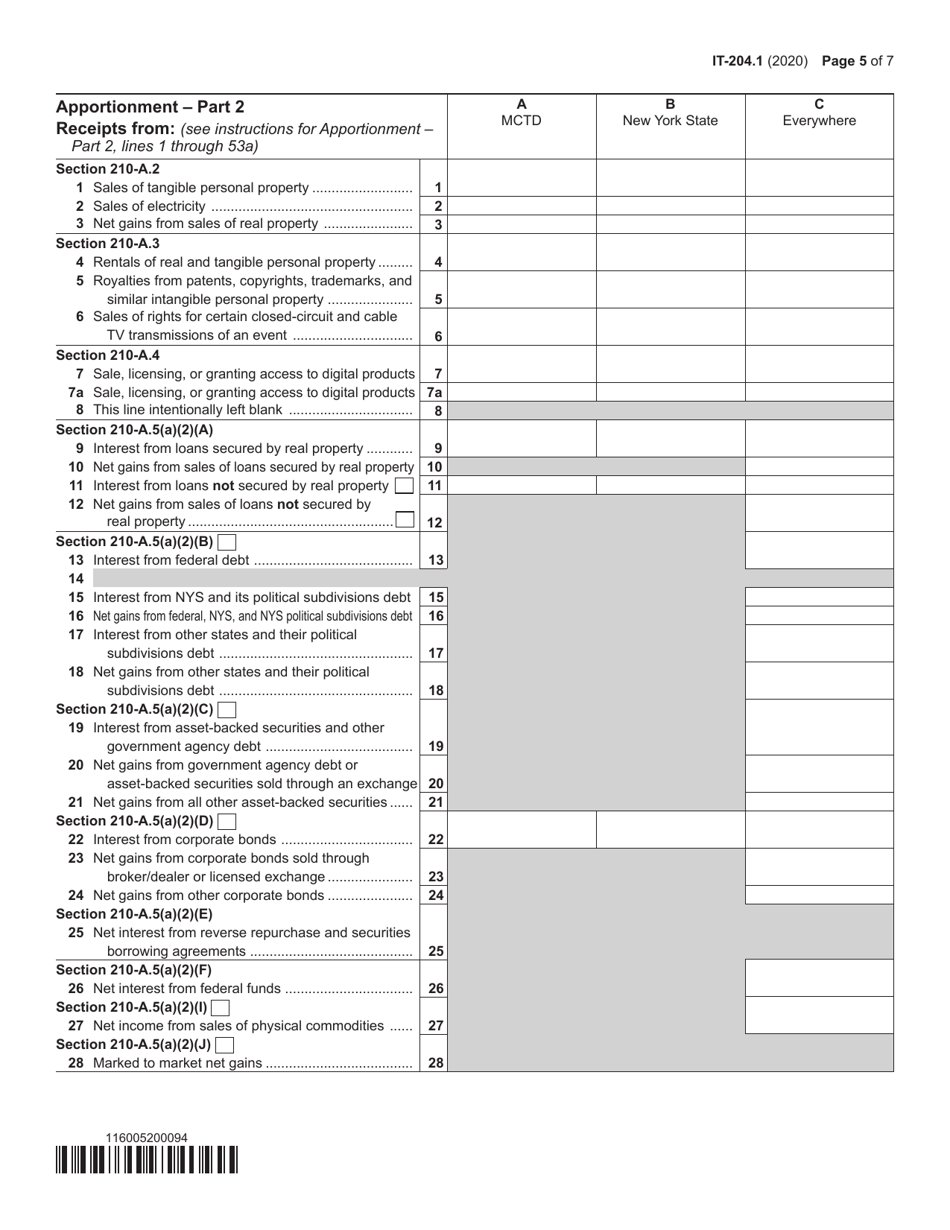

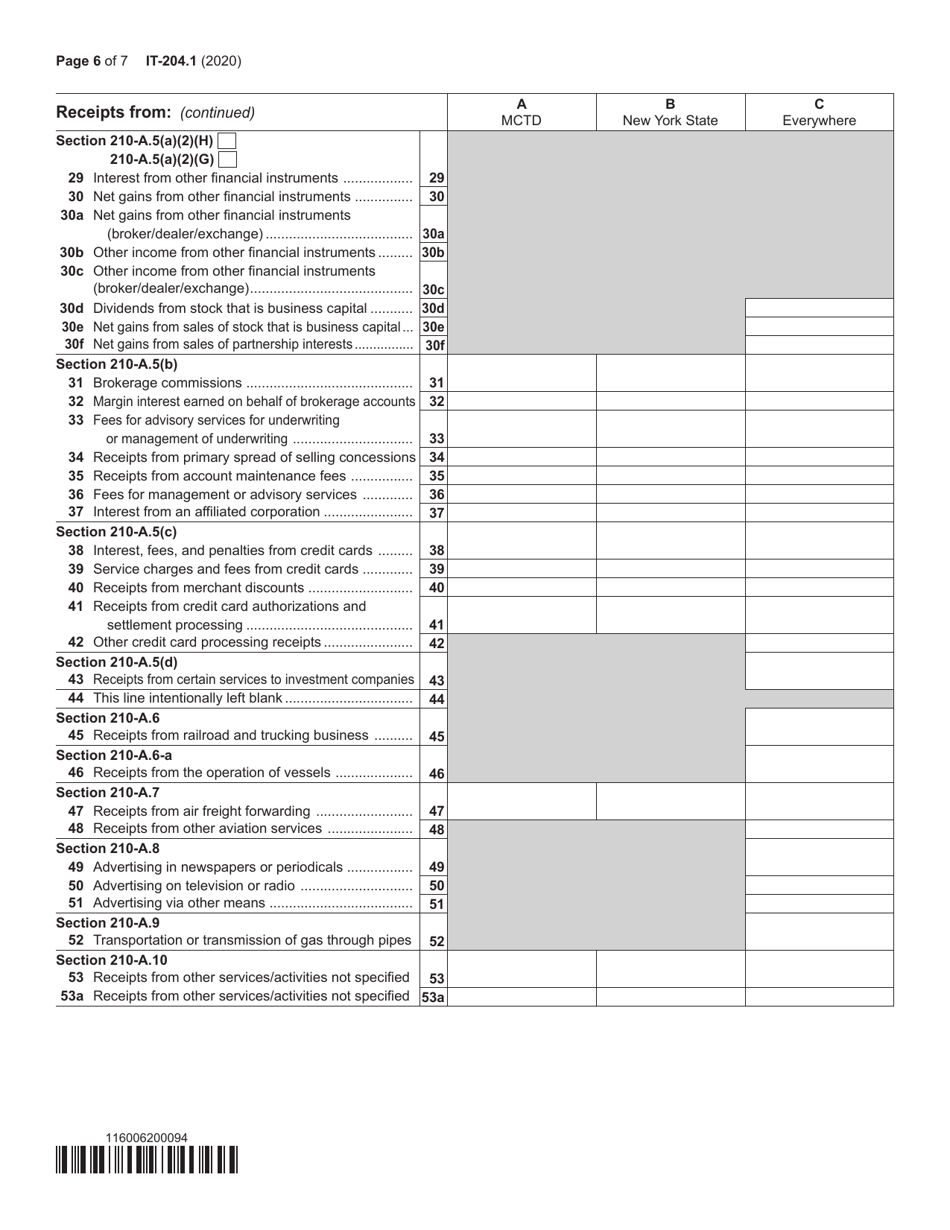

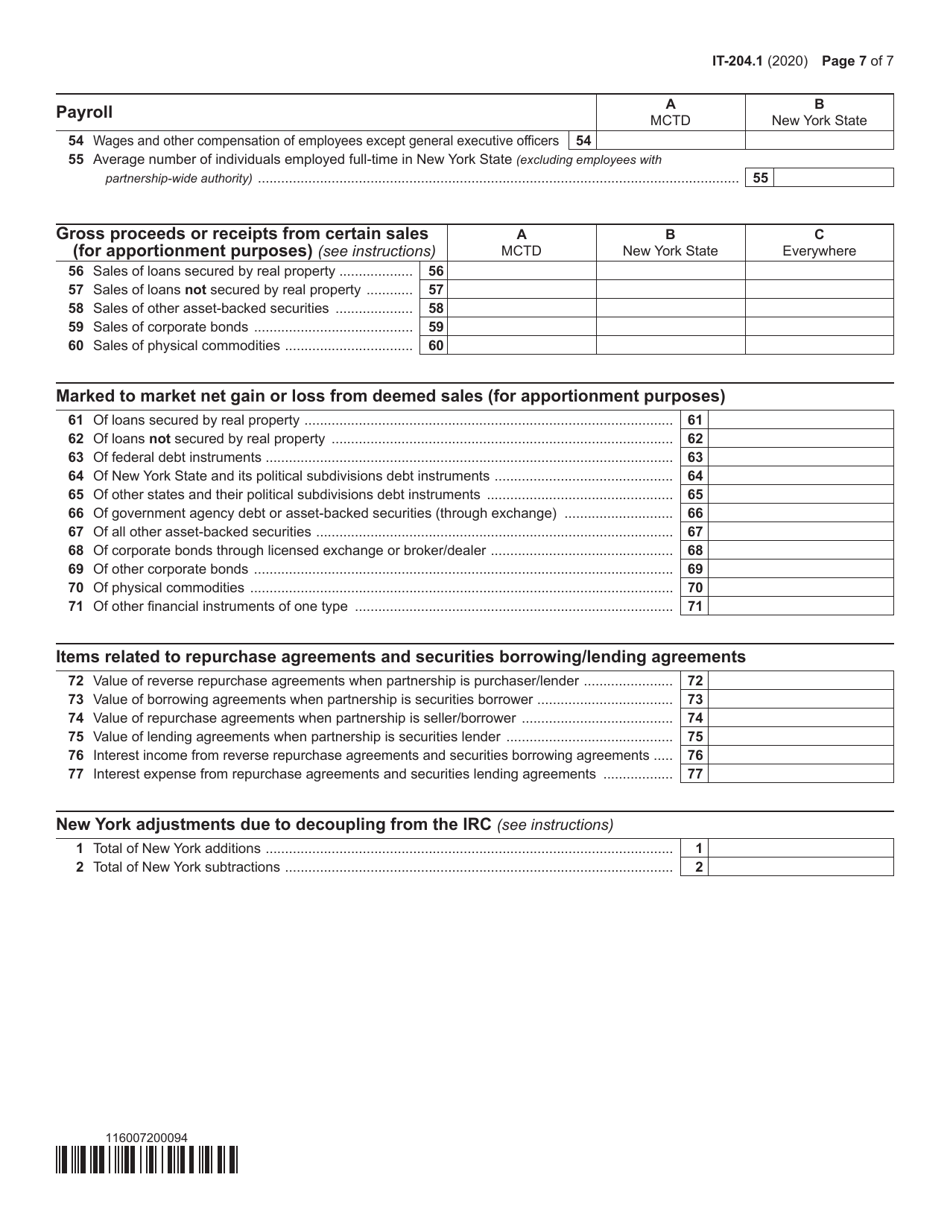

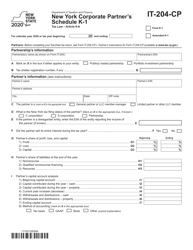

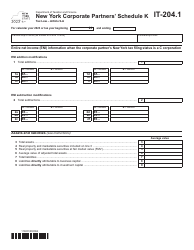

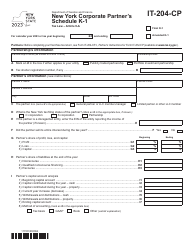

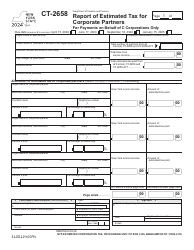

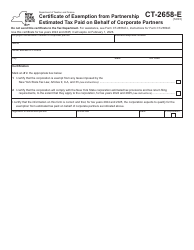

Form IT-204.1 New York Corporate Partners' Schedule K - New York

What Is Form IT-204.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204.1?

A: Form IT-204.1 is the New York Corporate Partners' Schedule K - New York.

Q: Who needs to file Form IT-204.1?

A: Form IT-204.1 should be filed by corporate partners who have income or loss from New York sources.

Q: What is the purpose of Form IT-204.1?

A: Form IT-204.1 is used to report a corporate partner's New York source income or loss.

Q: Do I need to file Form IT-204.1 if I have no income or loss from New York?

A: No, if you have no income or loss from New York, you do not need to file Form IT-204.1.

Q: When is the deadline to file Form IT-204.1?

A: The deadline to file Form IT-204.1 is the same as the deadline for filing your New York state partnership return, which is generally March 15th.

Q: Are there any penalties for late filing of Form IT-204.1?

A: Yes, late filing of Form IT-204.1 may result in penalties and interest charges.

Q: Can Form IT-204.1 be filed electronically?

A: Yes, Form IT-204.1 can be filed electronically using approved tax software or through a tax professional.

Q: Do I need to send any supporting documents with Form IT-204.1?

A: No, you do not need to send any supporting documents with Form IT-204.1. However, you should keep them for your records in case of an audit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.