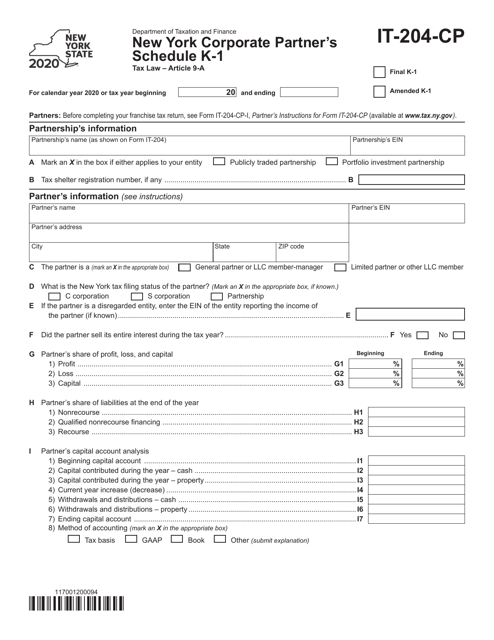

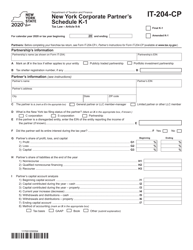

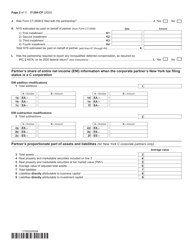

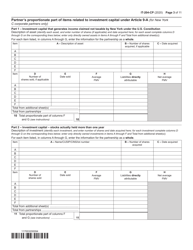

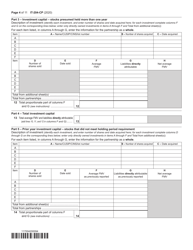

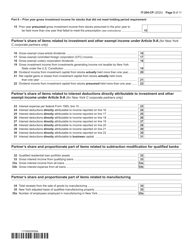

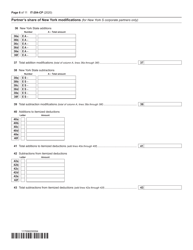

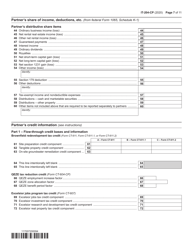

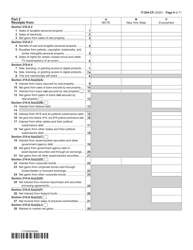

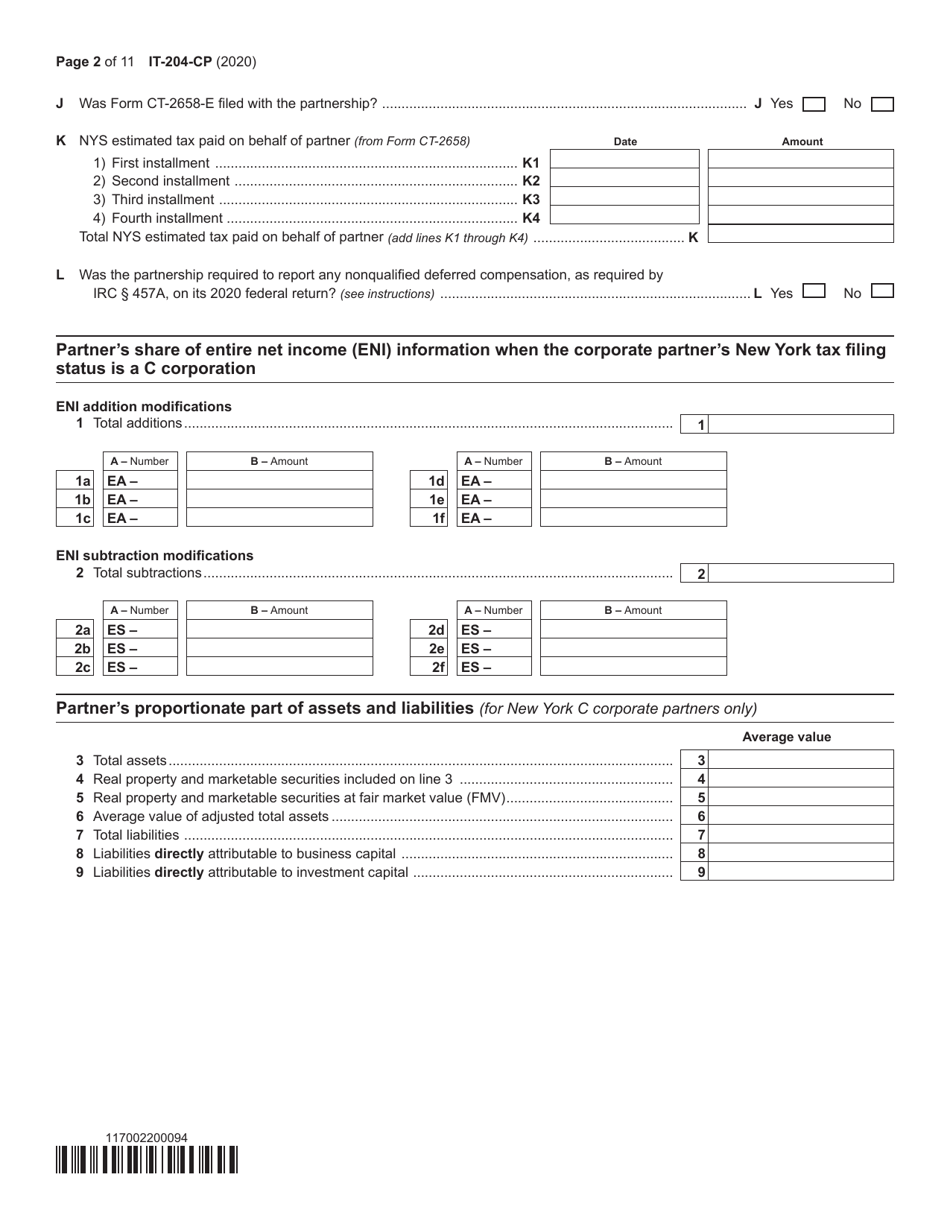

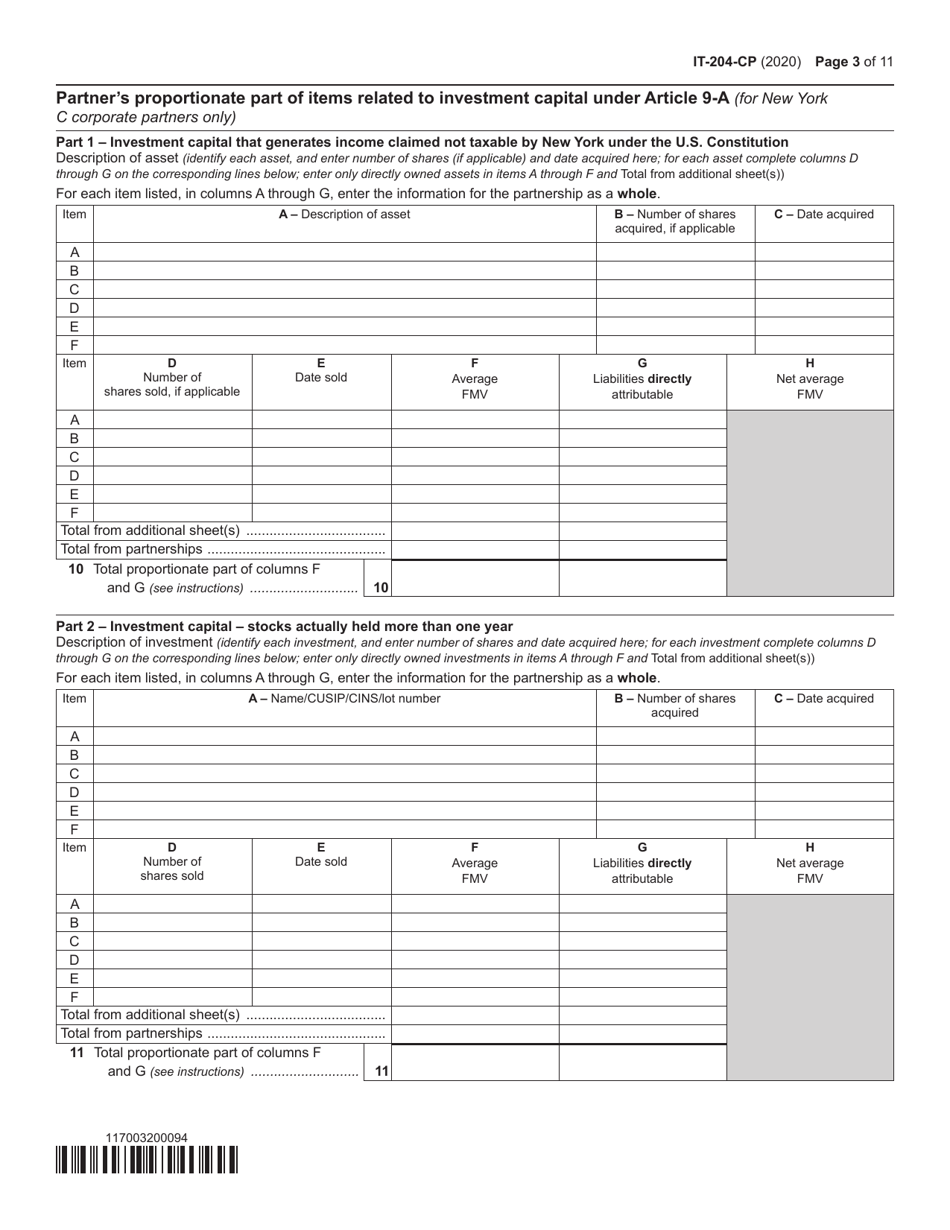

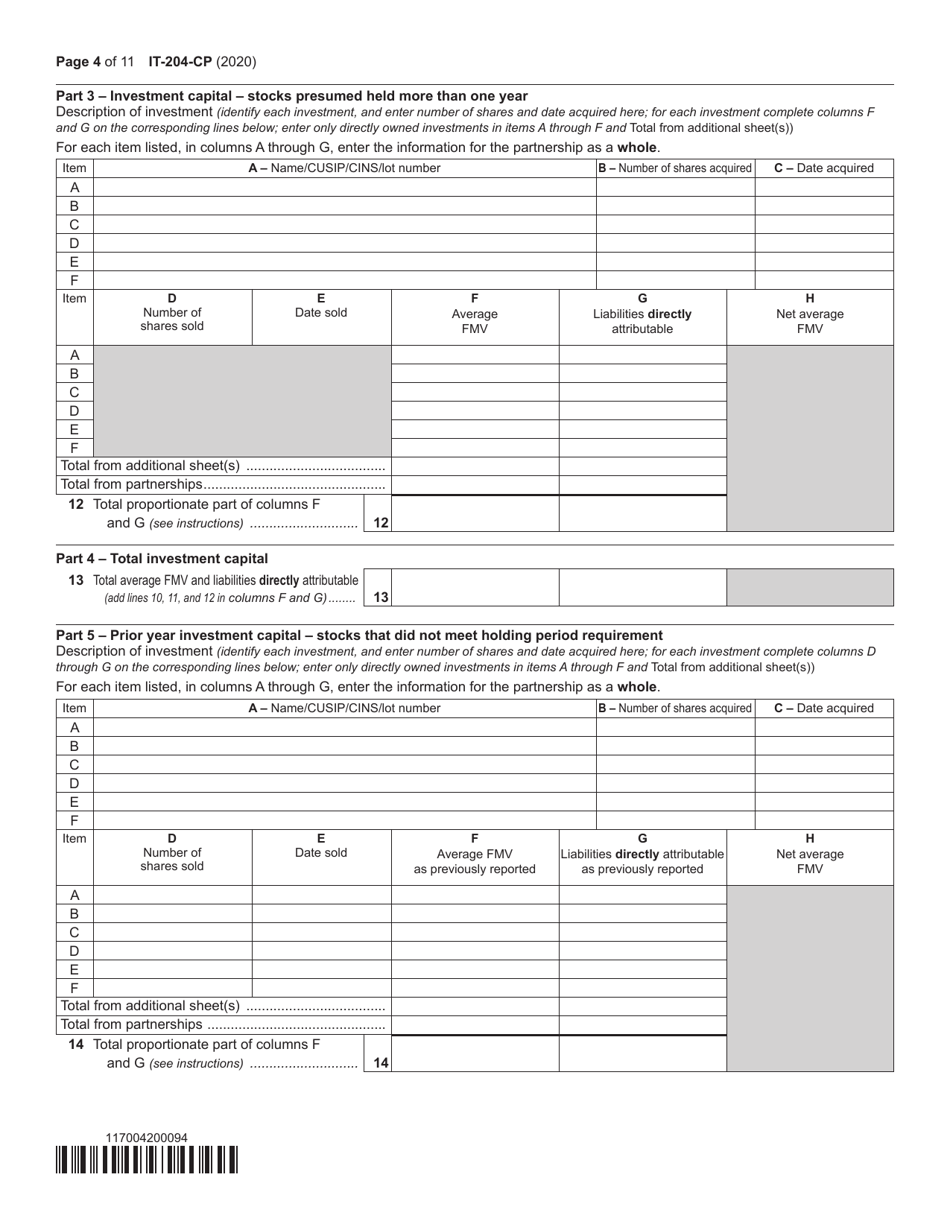

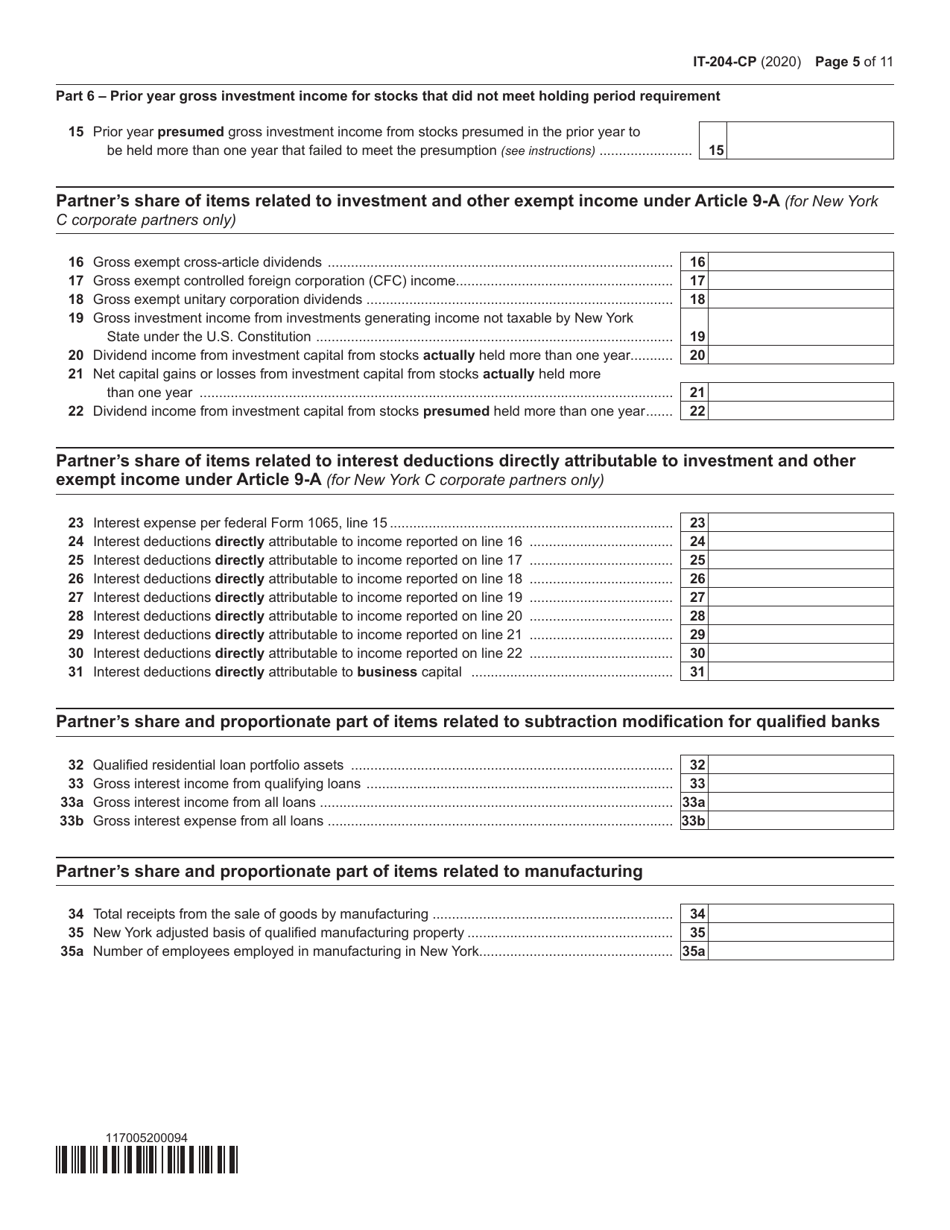

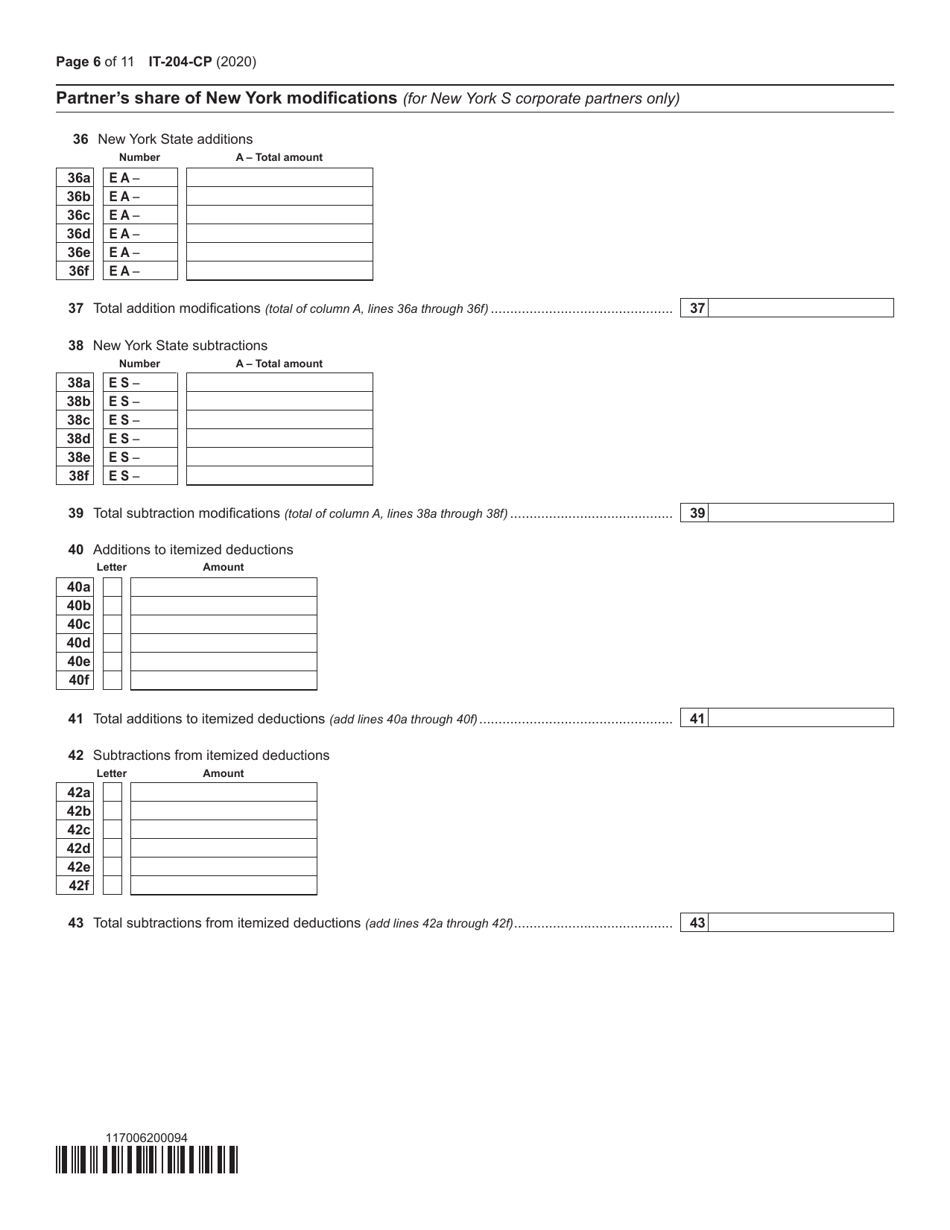

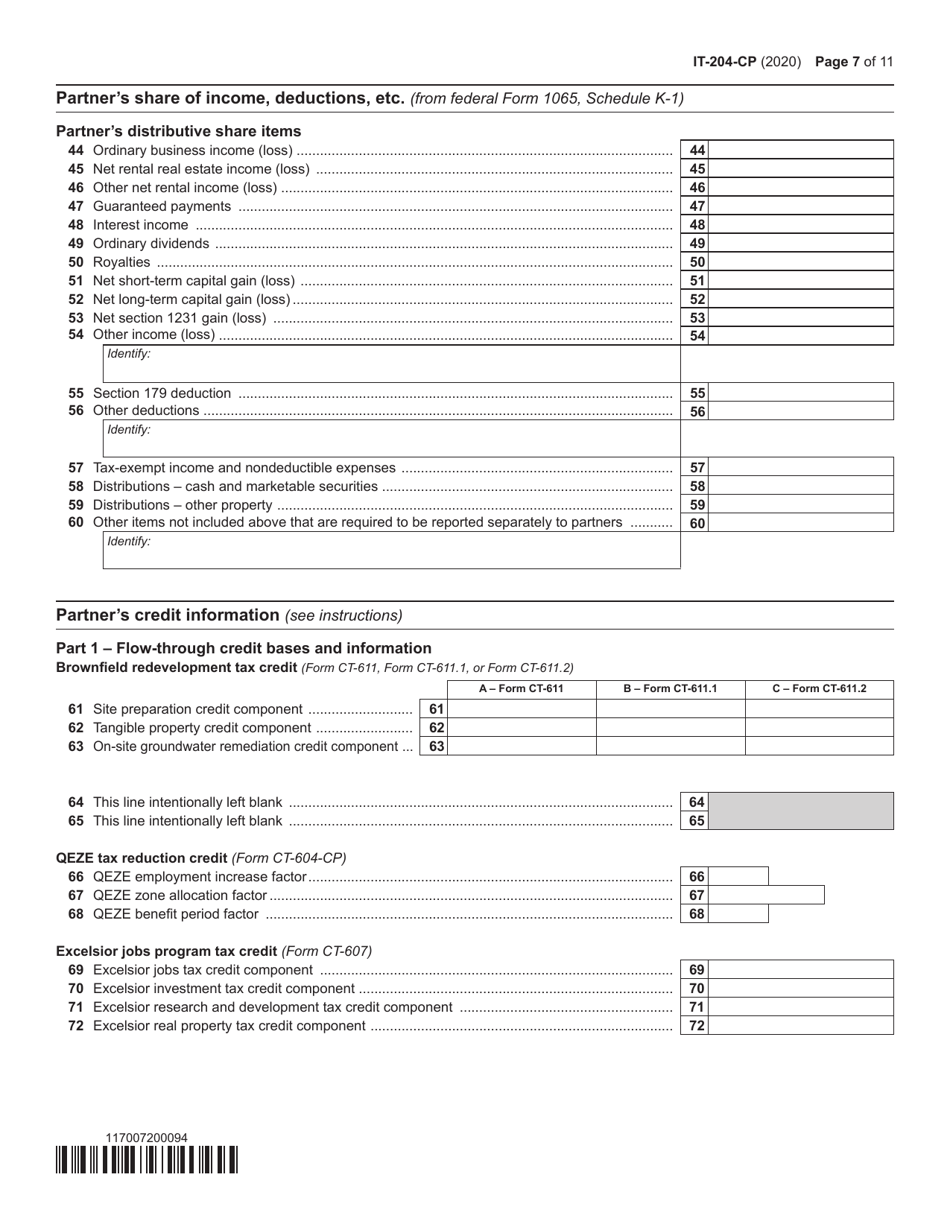

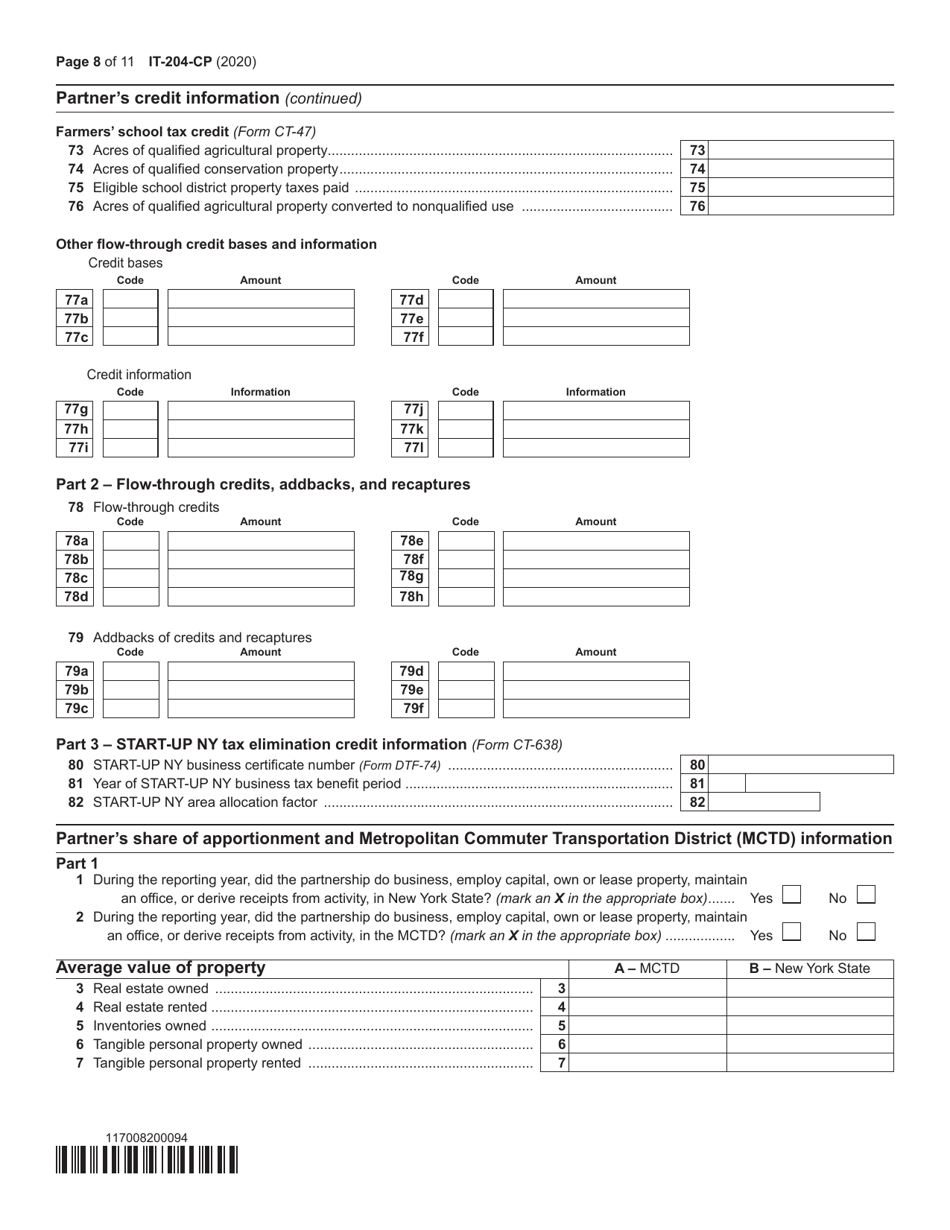

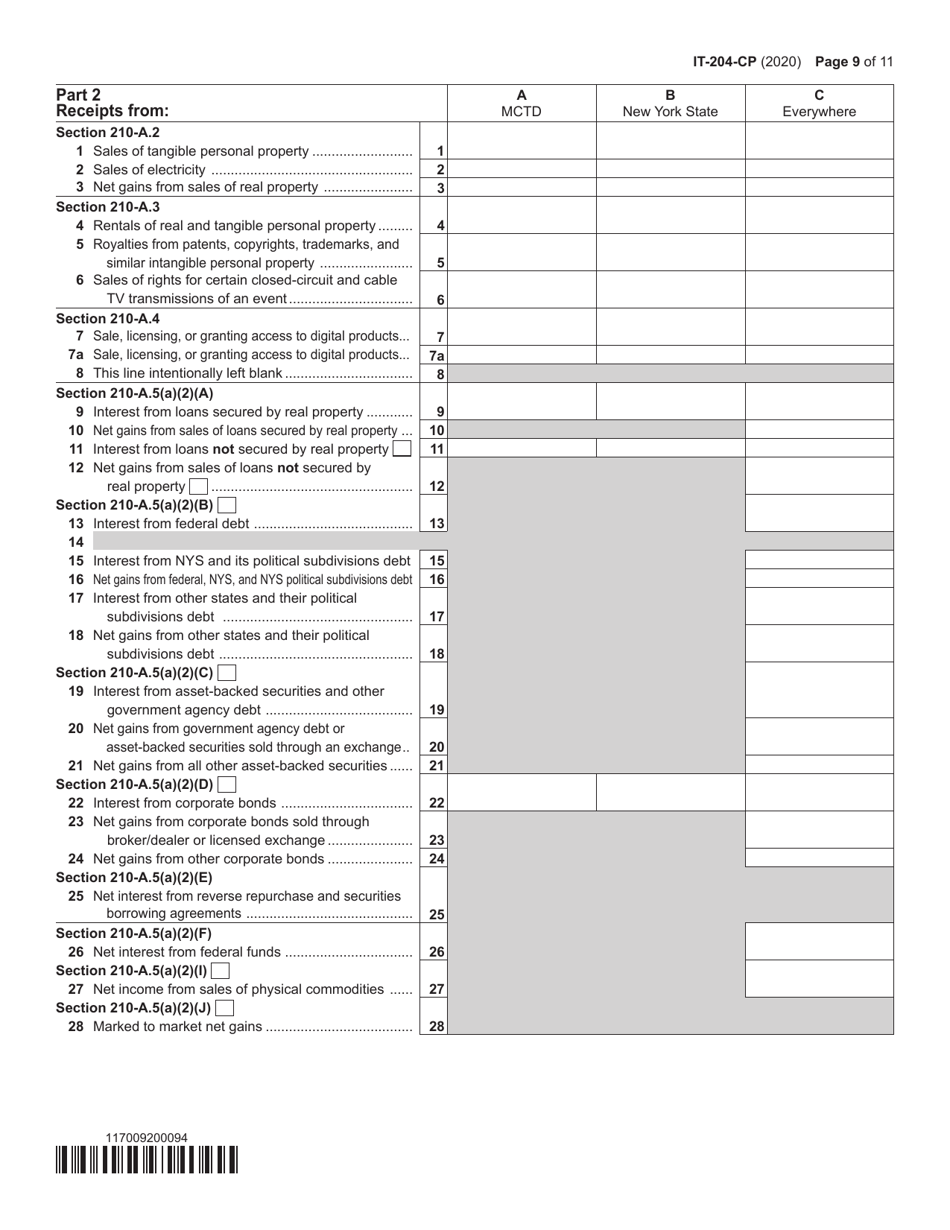

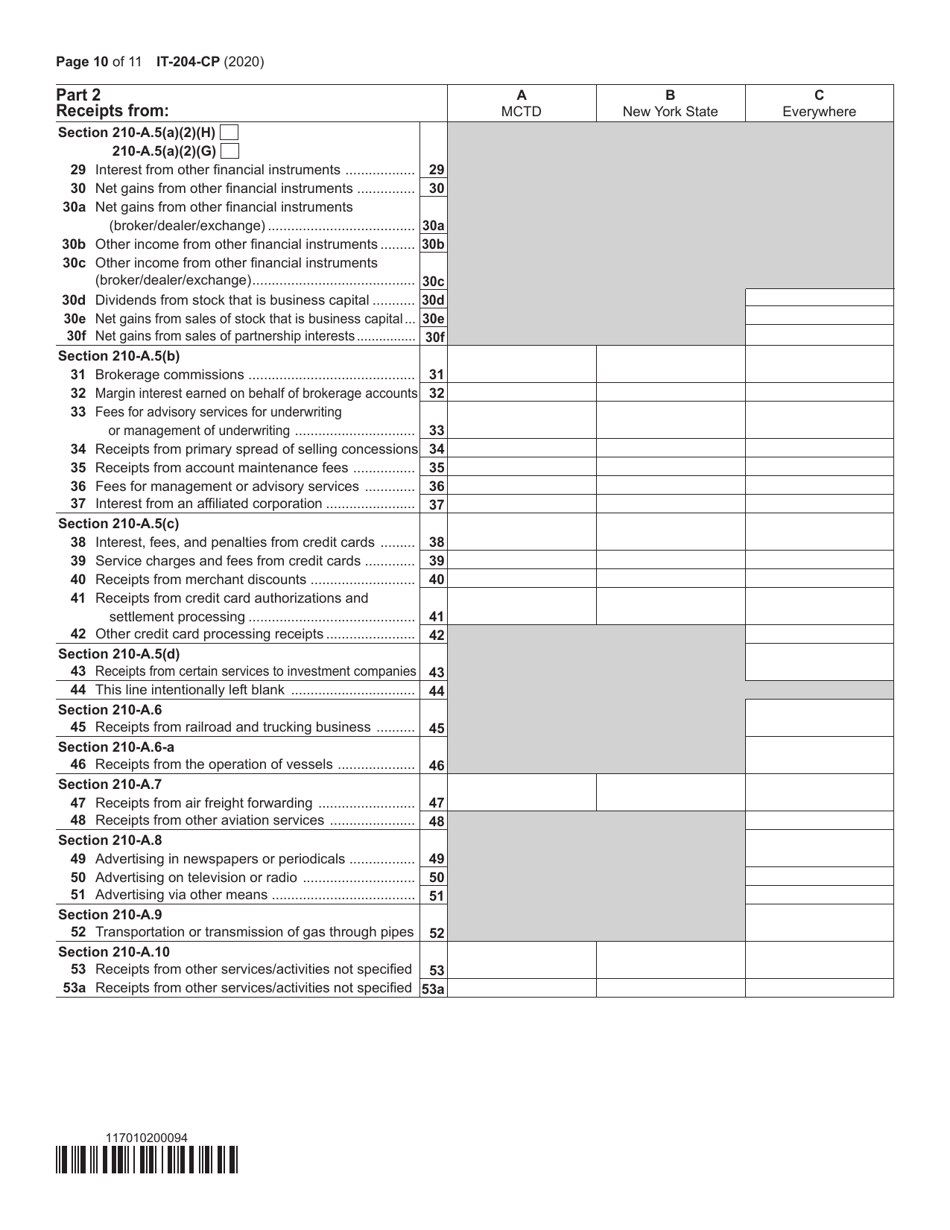

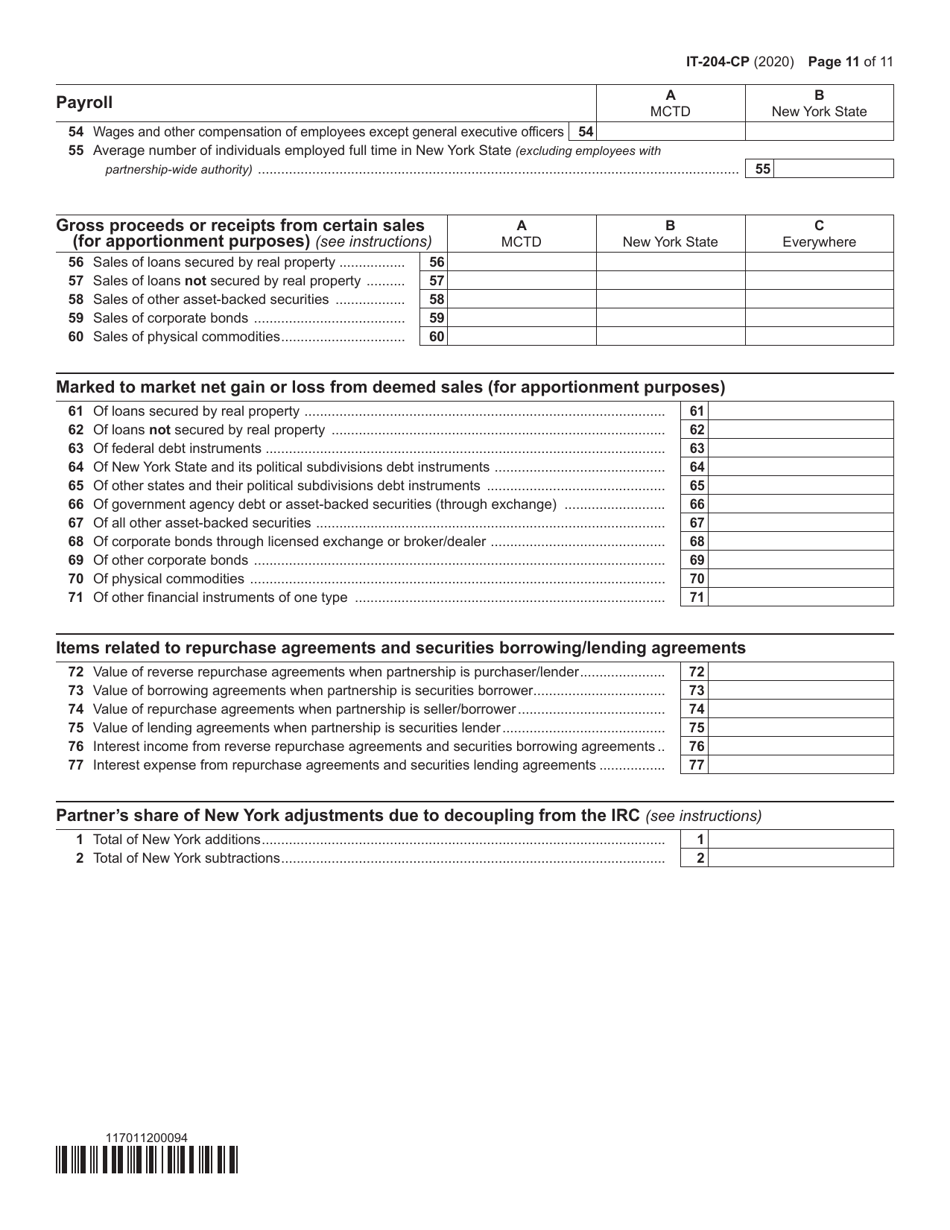

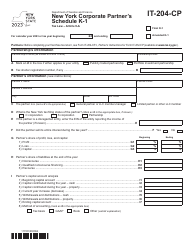

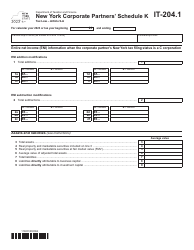

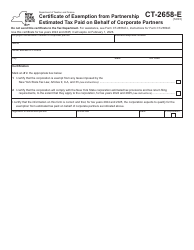

Form IT-204-CP New York Corporate Partner's Schedule K-1 - New York

What Is Form IT-204-CP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-CP?

A: Form IT-204-CP is the New York Corporate Partner's Schedule K-1.

Q: Who needs to file Form IT-204-CP?

A: Form IT-204-CP is filed by corporate partners who have income derived from or connected with New York sources.

Q: What is the purpose of Form IT-204-CP?

A: Form IT-204-CP is used to report a corporate partner's share of New York income, deductions, credits and other items.

Q: When is Form IT-204-CP due?

A: Form IT-204-CP is generally due on or before the 15th day of the fourth month following the close of the taxable year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-CP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.