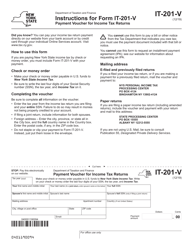

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-205-V

for the current year.

Form IT-205-V Payment Voucher for Fiduciary Income Tax Returns - New York

What Is Form IT-205-V?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-205-V?

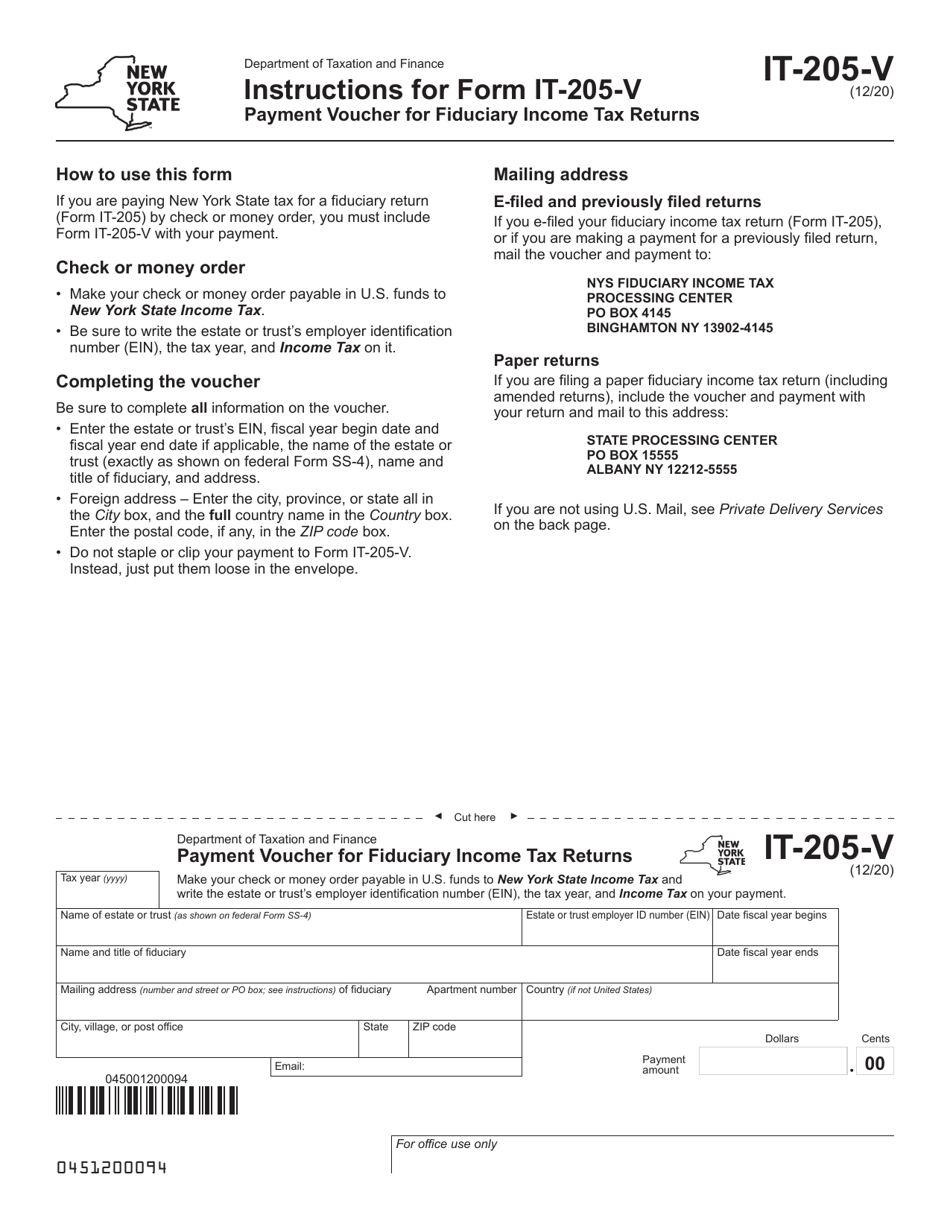

A: Form IT-205-V is a payment voucher used for Fiduciary Income Tax Returns in New York.

Q: Who needs to use Form IT-205-V?

A: Individuals filing fiduciary income tax returns in New York need to use Form IT-205-V.

Q: What is the purpose of Form IT-205-V?

A: Form IT-205-V is used to make payments towards your fiduciary income tax liability in New York.

Q: Do I need to include Form IT-205-V with my tax return?

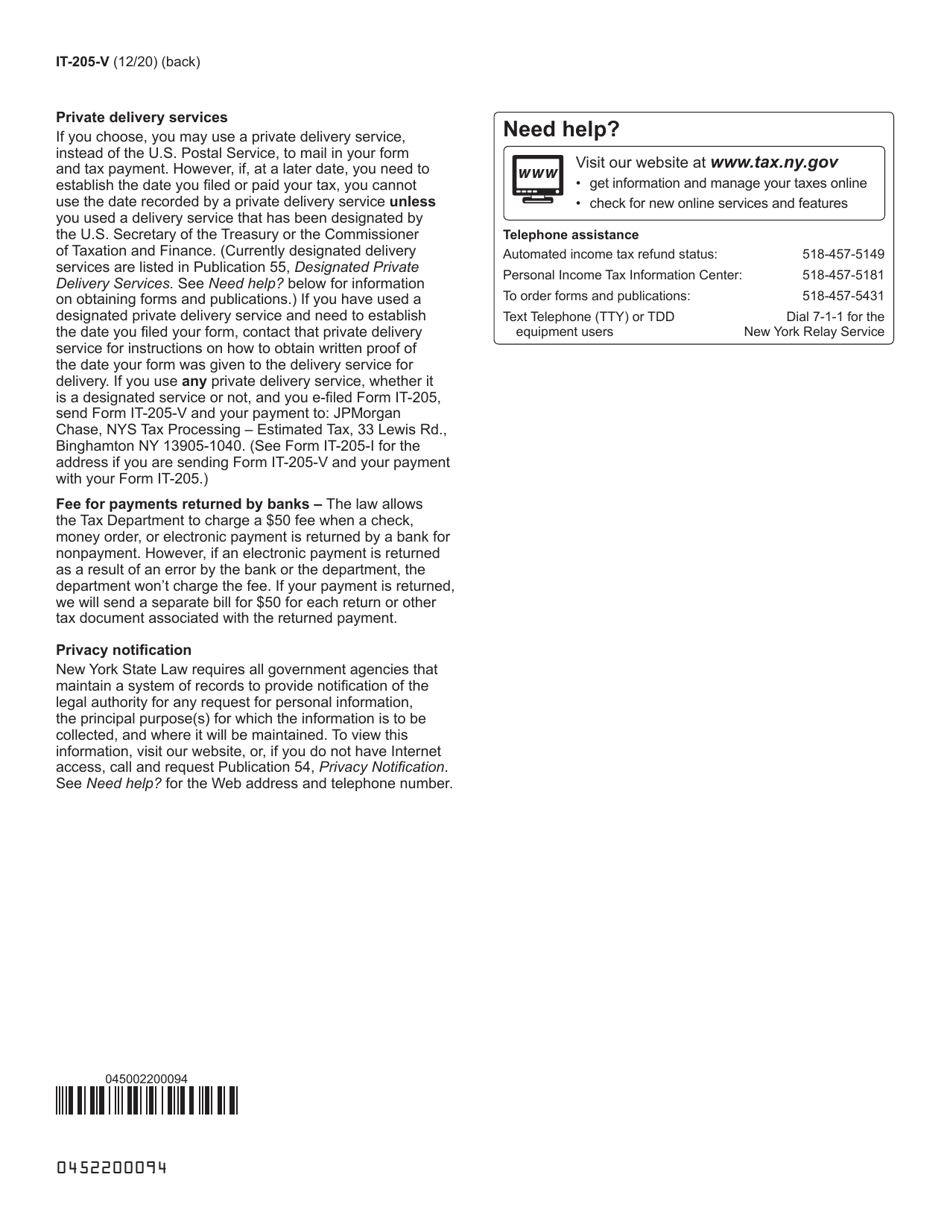

A: No, Form IT-205-V should be sent separately with your payment to the appropriate tax processing center in New York.

Q: What information should I provide on Form IT-205-V?

A: You need to provide your name, address, taxpayer identification number, and the tax year for which you are making the payment.

Q: When is the deadline to submit Form IT-205-V?

A: The deadline to submit Form IT-205-V and make your payment is typically the same as the deadline for filing your fiduciary income tax return in New York.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-V by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.