This version of the form is not currently in use and is provided for reference only. Download this version of

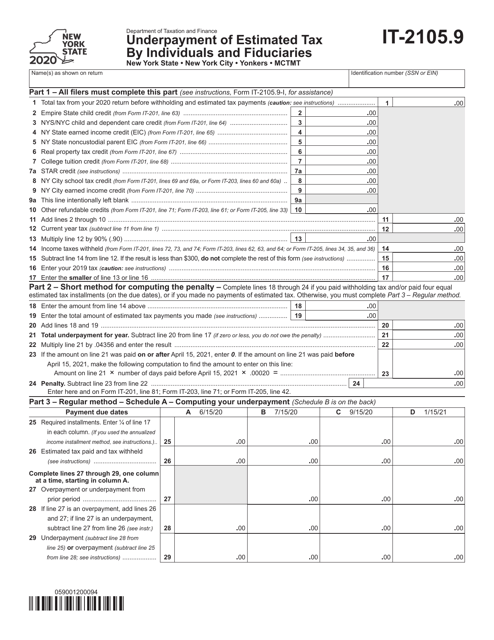

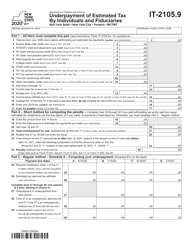

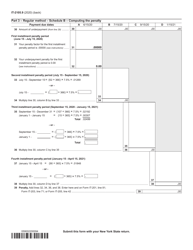

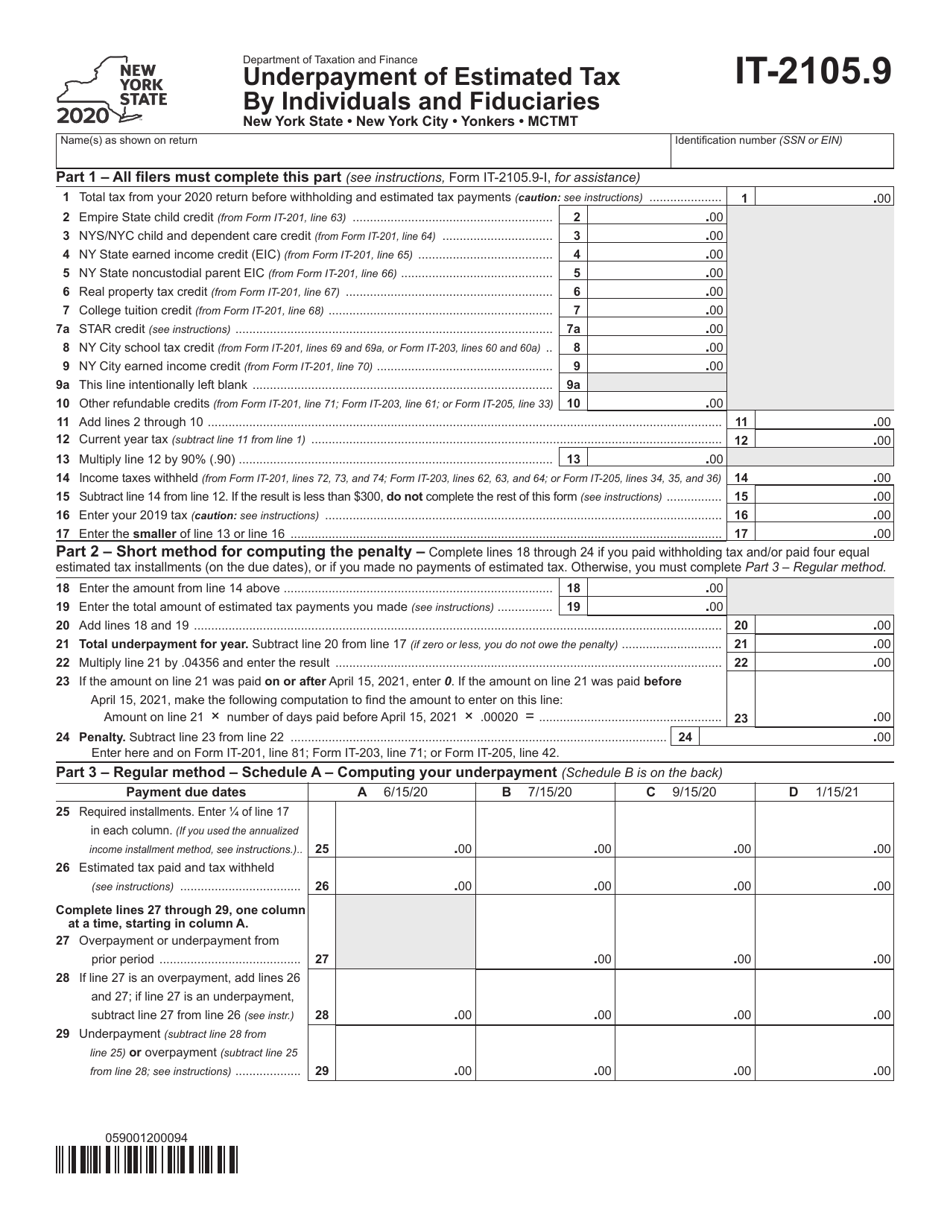

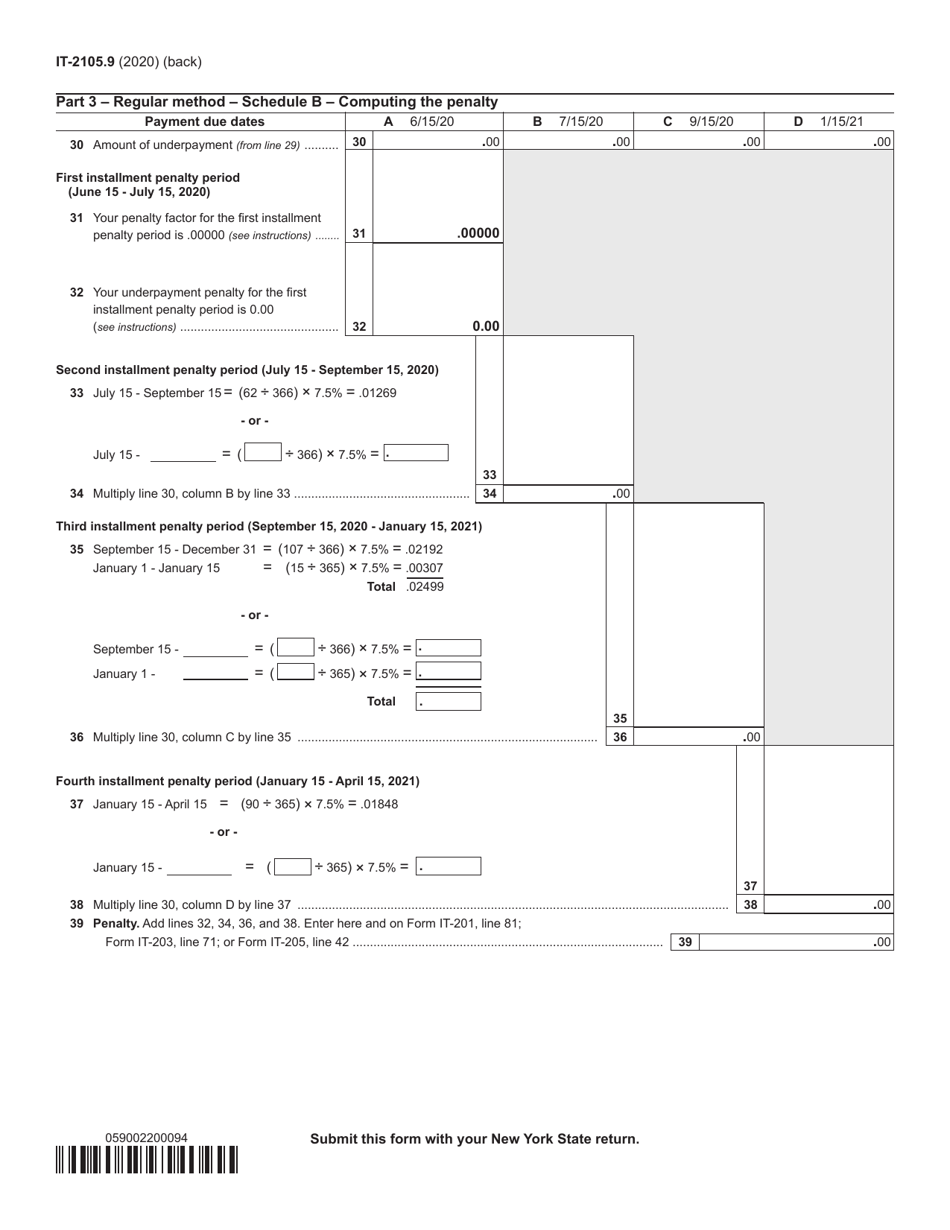

Form IT-2105.9

for the current year.

Form IT-2105.9 Underpayment of Estimated Tax by Individuals and Fiduciaries - New York

What Is Form IT-2105.9?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2105.9?

A: Form IT-2105.9 is a form used in the state of New York to report underpayment of estimated tax by individuals and fiduciaries.

Q: Who needs to file Form IT-2105.9?

A: Individuals and fiduciaries in New York who have underpaid their estimated tax may need to file Form IT-2105.9.

Q: When is Form IT-2105.9 due?

A: Form IT-2105.9 is typically due with your New York state income tax return, which is generally due on April 15th.

Q: What happens if I don't file Form IT-2105.9?

A: Failure to file Form IT-2105.9 when required may result in penalties and interest charges.

Q: Are there any special instructions for filling out Form IT-2105.9?

A: Yes, Form IT-2105.9 has specific instructions that must be followed carefully to accurately report underpayment of estimated tax.

Q: Can I e-file Form IT-2105.9?

A: As of now, e-filing is not available for Form IT-2105.9. You must file a paper copy by mail.

Q: What should I do if I realize I have underpaid my estimated tax?

A: If you realize you have underpaid your estimated tax, you should fill out Form IT-2105.9 and include it with your New York state income tax return.

Q: Can I make payments to cover my underpayment of estimated tax?

A: Yes, you can include payment with the Form IT-2105.9 to cover your underpayment of estimated tax.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2105.9 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.