This version of the form is not currently in use and is provided for reference only. Download this version of

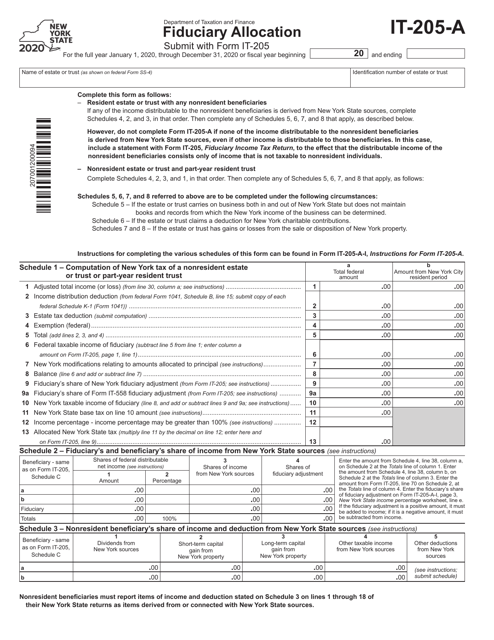

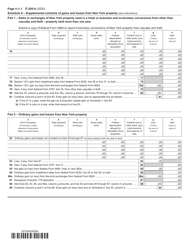

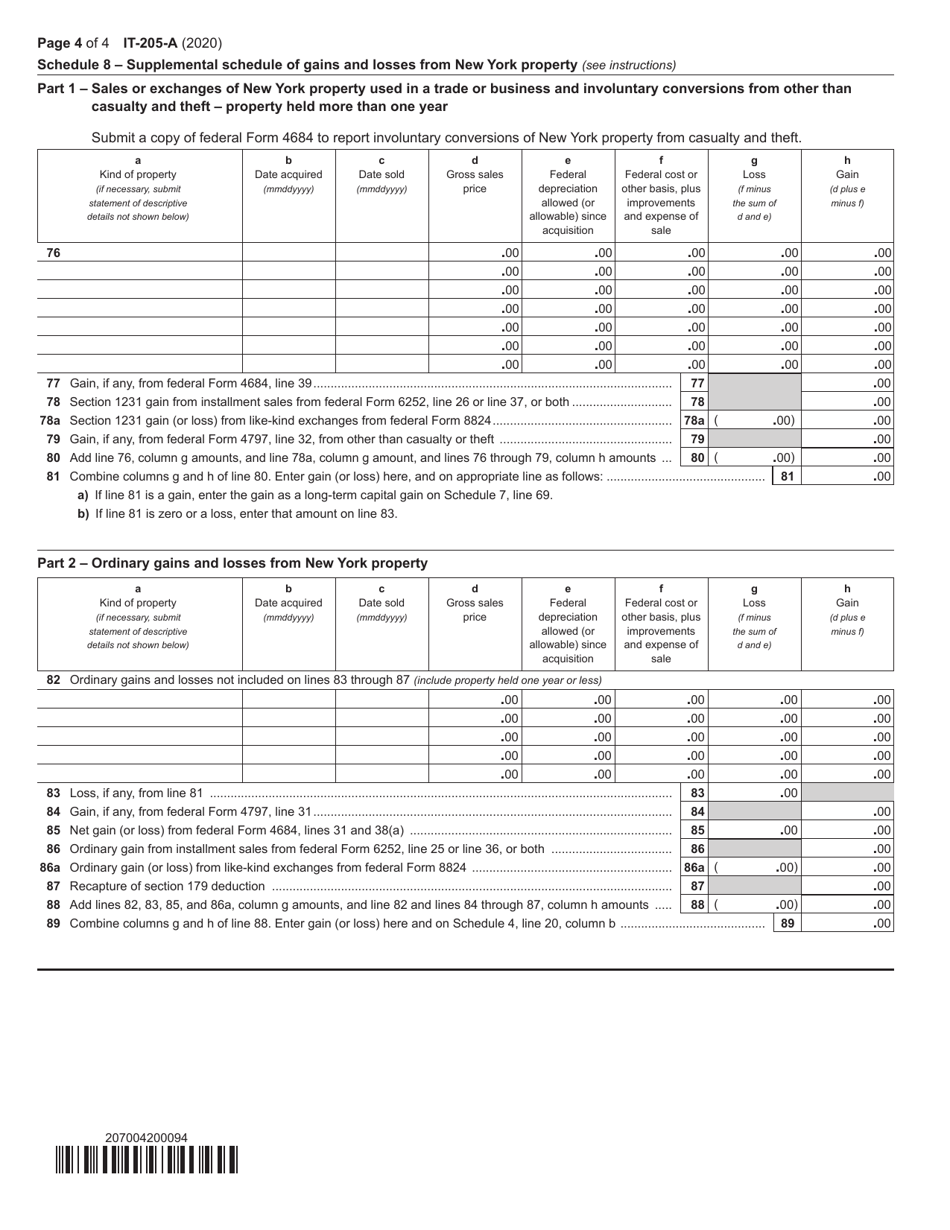

Form IT-205-A

for the current year.

Form IT-205-A Fiduciary Allocation - New York

What Is Form IT-205-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-A?

A: Form IT-205-A is the Fiduciary Allocation form used in the state of New York.

Q: Who needs to file Form IT-205-A?

A: Form IT-205-A is typically filed by fiduciaries, such as trustees or administrators, who are responsible for distributing income or deductions among multiple beneficiaries.

Q: What is the purpose of Form IT-205-A?

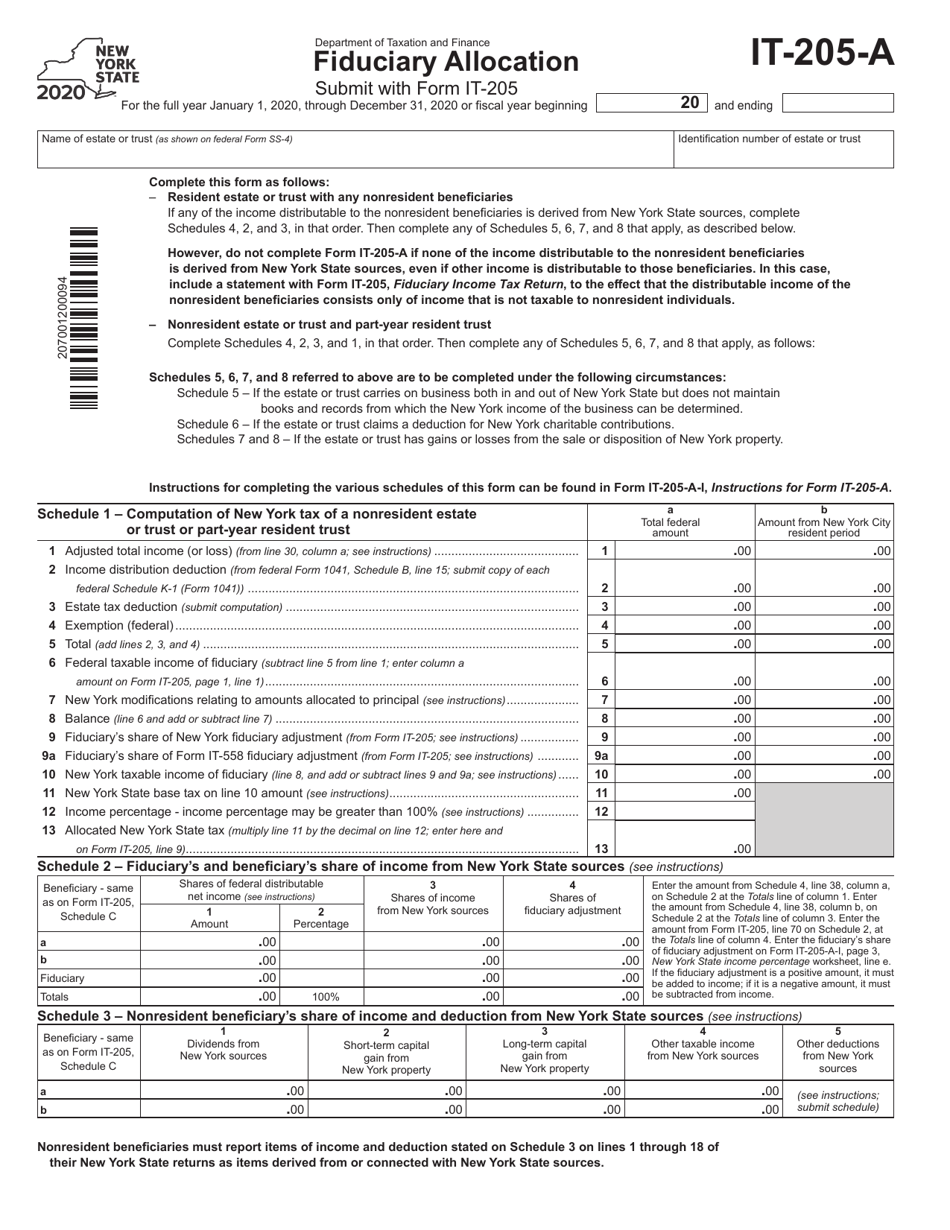

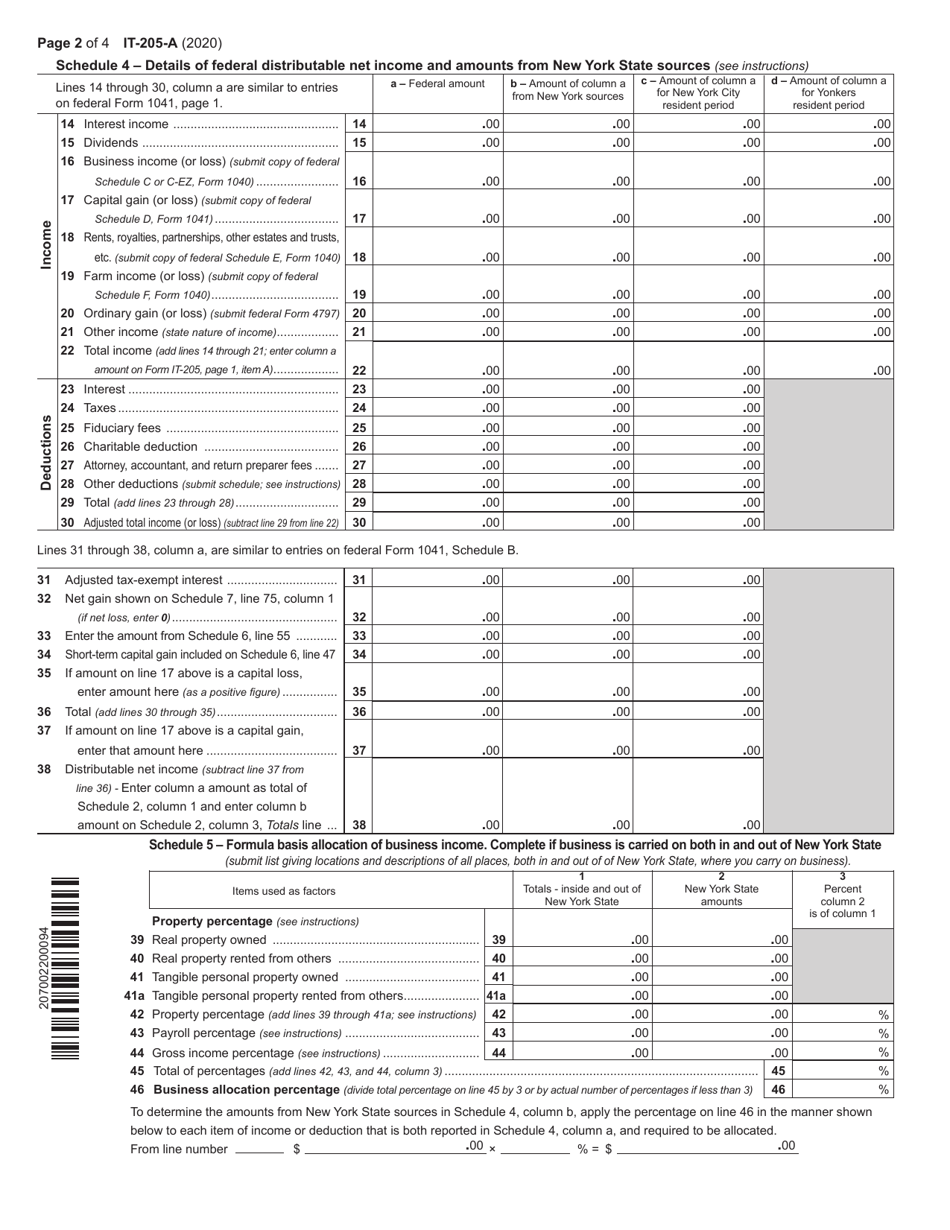

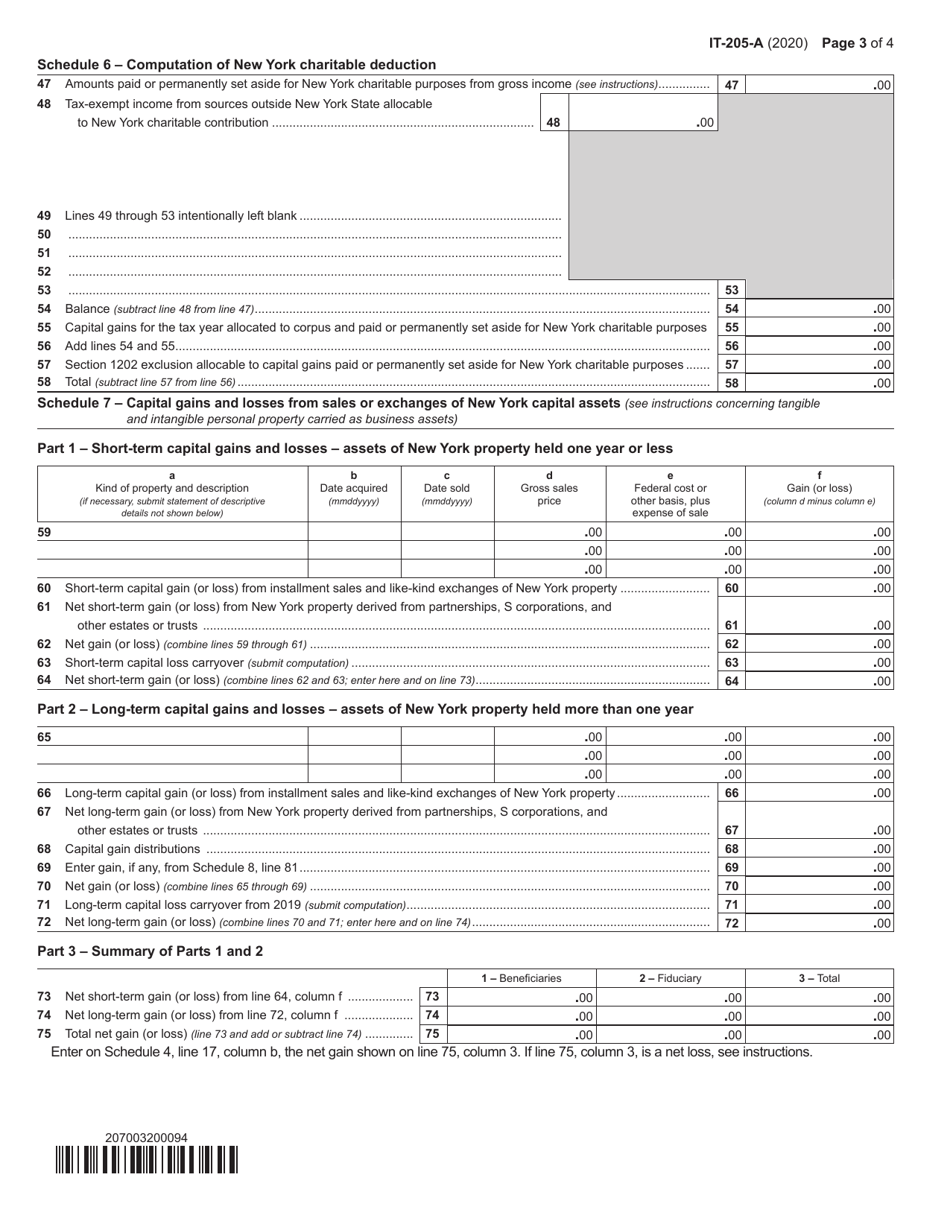

A: The purpose of Form IT-205-A is to allocate and report income, deductions, and tax liability among the beneficiaries of an estate or trust.

Q: When is the deadline for filing Form IT-205-A?

A: The deadline for filing Form IT-205-A in New York is generally April 15th, or the next business day if April 15th falls on a weekend or holiday.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.