This version of the form is not currently in use and is provided for reference only. Download this version of

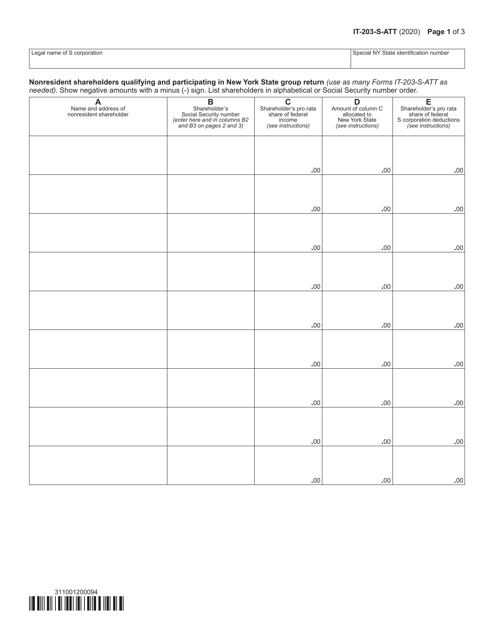

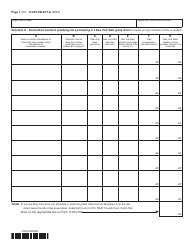

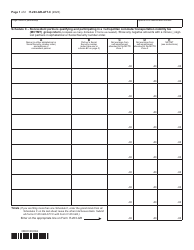

Form IT-203-S-ATT

for the current year.

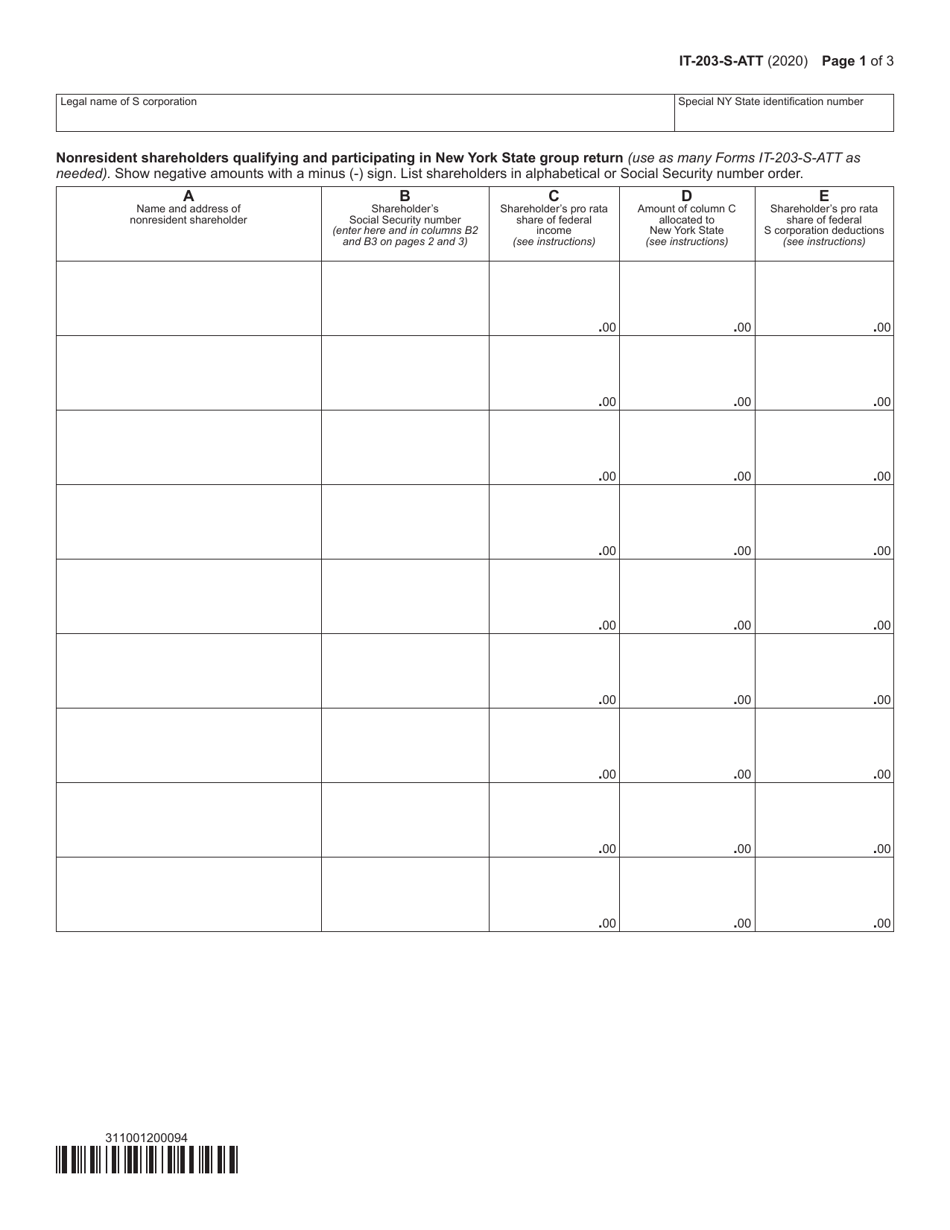

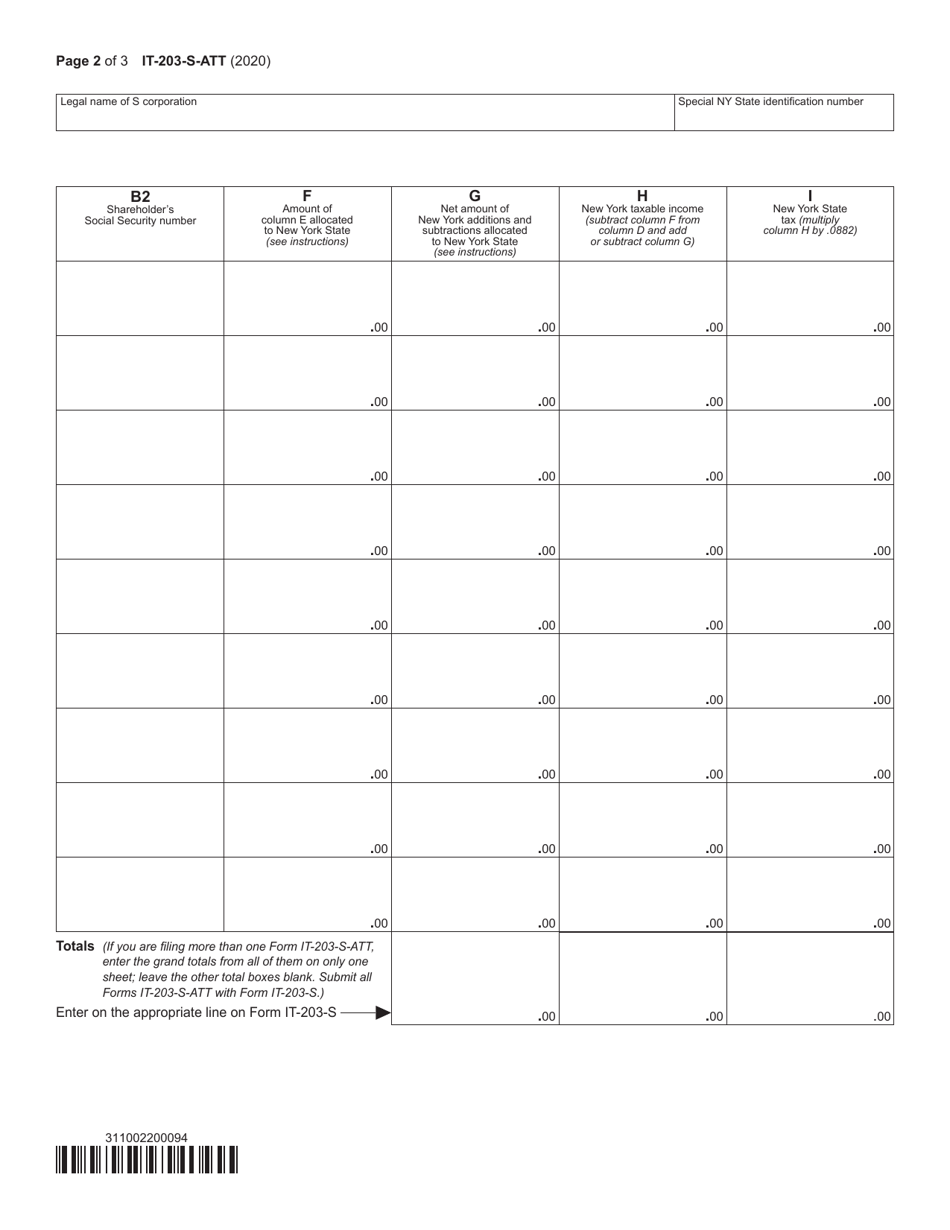

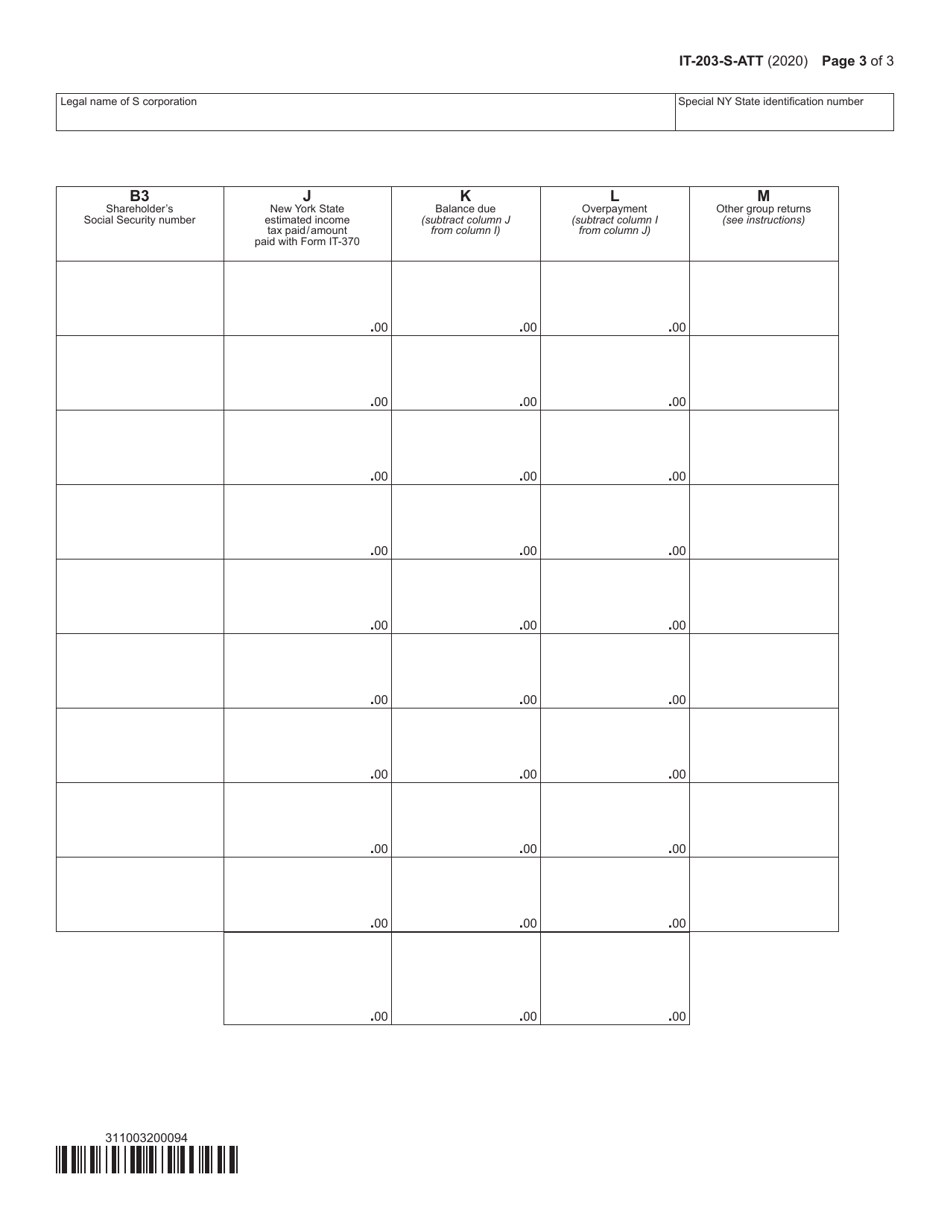

Form IT-203-S-ATT Nonresident Shareholders Qualifying and Participating in New York State Group Return - New York

What Is Form IT-203-S-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-S-ATT?

A: Form IT-203-S-ATT is a tax form for nonresident shareholders who are qualifying and participating in a New York State Group Return.

Q: Who needs to file Form IT-203-S-ATT?

A: Nonresident shareholders who are qualifying and participating in a New York State Group Return need to file Form IT-203-S-ATT.

Q: What information is required on Form IT-203-S-ATT?

A: Form IT-203-S-ATT requires information related to the nonresident shareholders and their qualifying and participating status in the New York State Group Return.

Q: Is Form IT-203-S-ATT only for nonresidents of New York?

A: Yes, Form IT-203-S-ATT is specifically for nonresidents who are participating in a New York State Group Return.

Q: When is the deadline to file Form IT-203-S-ATT?

A: The deadline to file Form IT-203-S-ATT is the same as the deadline for the New York State Group Return, which is generally March 15 of the following year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-S-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.