This version of the form is not currently in use and is provided for reference only. Download this version of

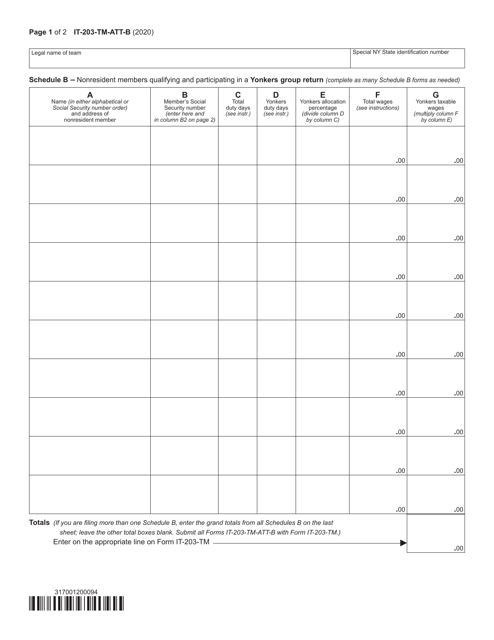

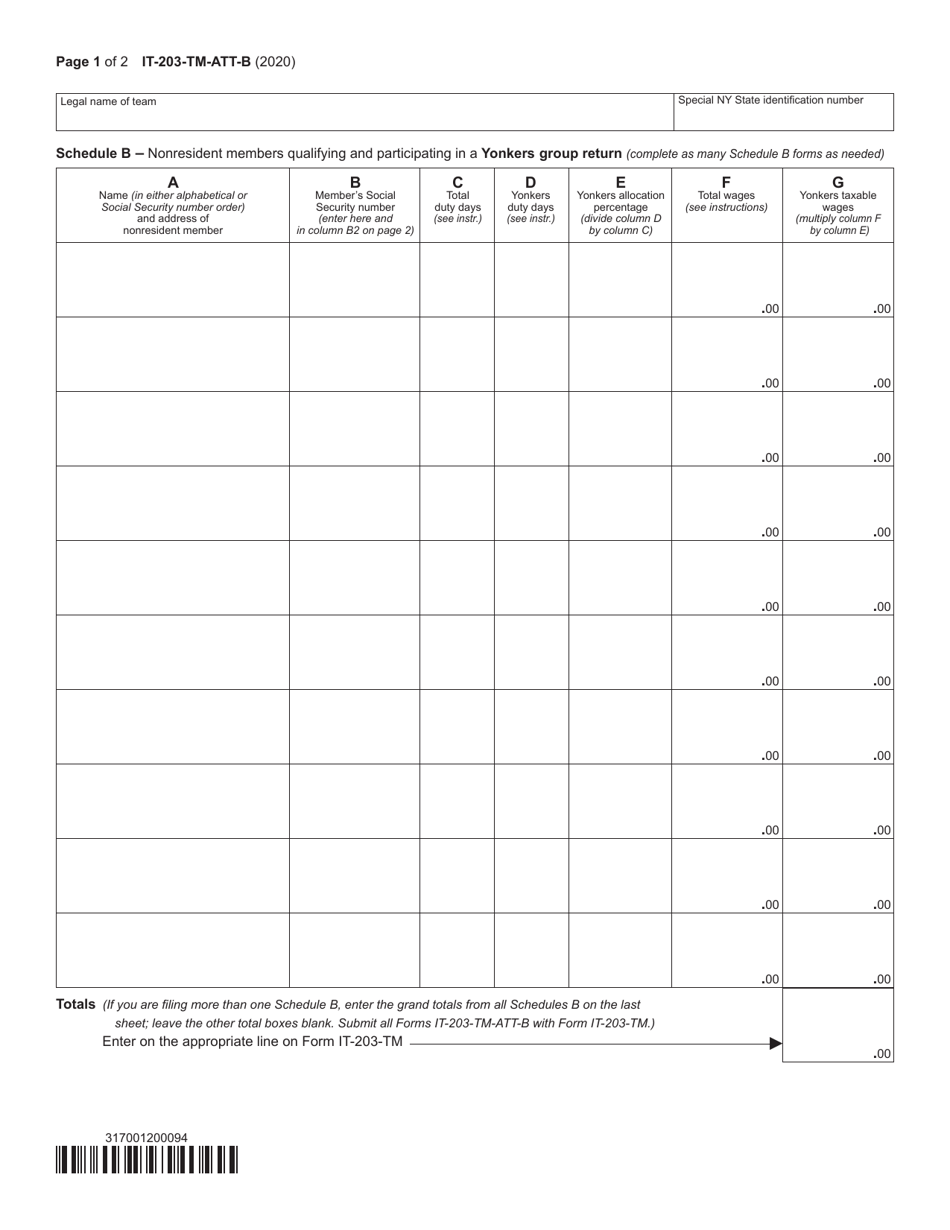

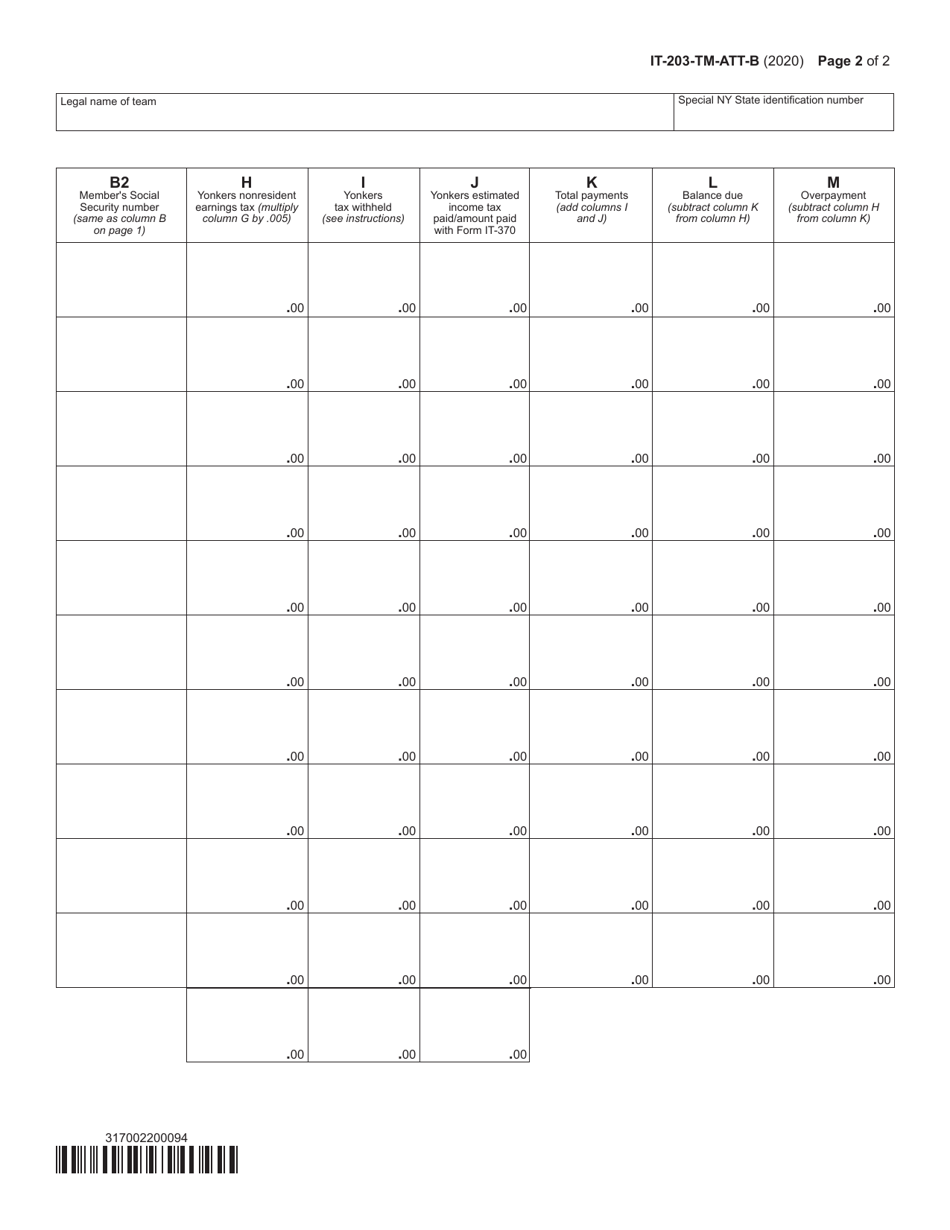

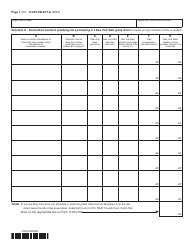

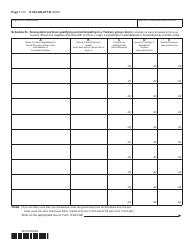

Form IT-203-TM-ATT-B Schedule B

for the current year.

Form IT-203-TM-ATT-B Schedule B Yonkers Group Return for Nonresident Athletic Team Members - New York

What Is Form IT-203-TM-ATT-B Schedule B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

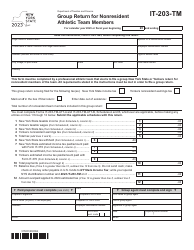

Q: What is Form IT-203-TM-ATT-B?

A: Form IT-203-TM-ATT-B is a schedule used for filing Yonkers Group Return for Nonresident Athletic Team Members in New York.

Q: Who needs to file Form IT-203-TM-ATT-B?

A: Form IT-203-TM-ATT-B must be filed by nonresident athletic team members participating in Yonkers-based teams.

Q: What is Yonkers Group Return?

A: Yonkers Group Return is a tax return filed by multiple nonresident athletic team members as a group for their Yonkers income.

Q: What is the purpose of Form IT-203-TM-ATT-B?

A: Form IT-203-TM-ATT-B is used to report the Yonkers income of nonresident athletic team members and calculate their Yonkers tax liability.

Q: Is Form IT-203-TM-ATT-B specific to New York?

A: Yes, Form IT-203-TM-ATT-B is specific to nonresident athletic team members in New York participating in Yonkers-based teams.

Q: Are there any additional schedules or forms required with Form IT-203-TM-ATT-B?

A: Yes, nonresident athletic team members must also include Form IT-203-TM-ATT-A and the appropriate federal forms with their filing.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-TM-ATT-B Schedule B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.