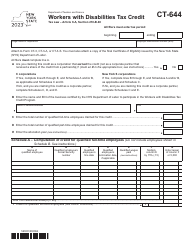

This version of the form is not currently in use and is provided for reference only. Download this version of

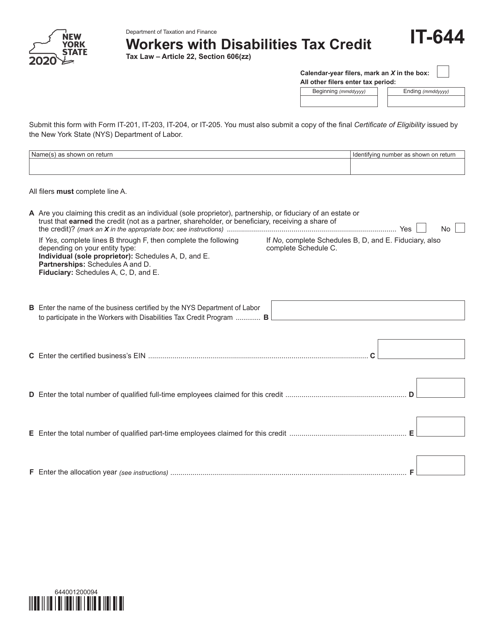

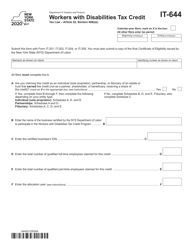

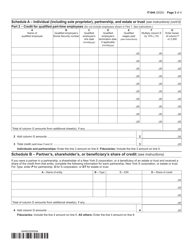

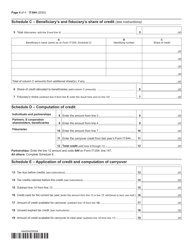

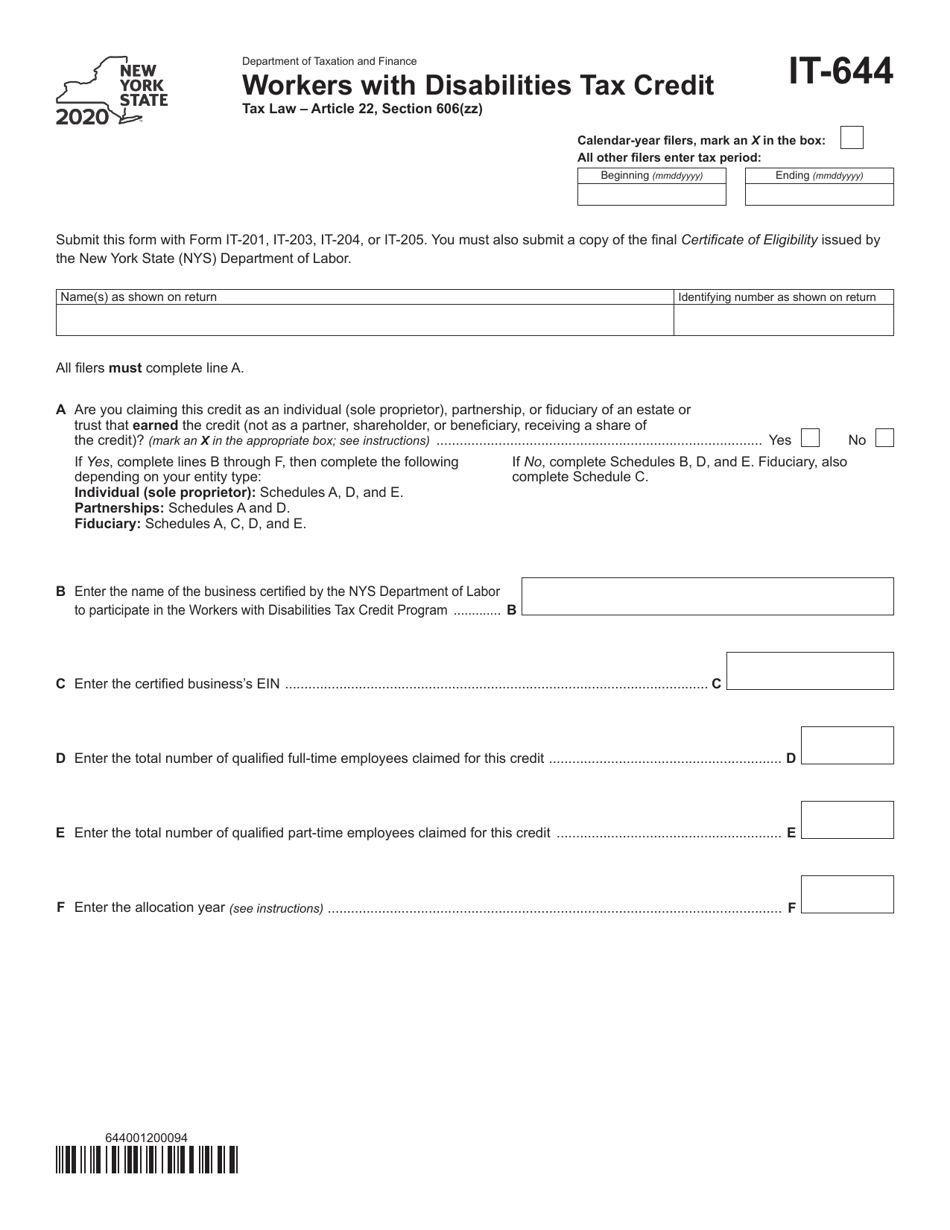

Form IT-644

for the current year.

Form IT-644 Workers With Disabilities Tax Credit - New York

What Is Form IT-644?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-644?

A: Form IT-644 is the Workers With DisabilitiesTax Credit form in New York.

Q: What is the purpose of Form IT-644?

A: The purpose of Form IT-644 is to claim the Workers With Disabilities Tax Credit in New York.

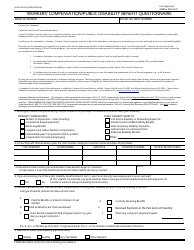

Q: Who can claim the Workers With Disabilities Tax Credit?

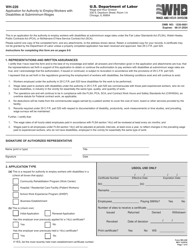

A: Individuals and businesses in New York who employ workers with disabilities can claim the Workers With Disabilities Tax Credit.

Q: What is the benefit of claiming the Workers With Disabilities Tax Credit?

A: Claiming the Workers With Disabilities Tax Credit can reduce your tax liability in New York.

Q: Are there any eligibility criteria for claiming the Workers With Disabilities Tax Credit?

A: Yes, there are eligibility criteria for claiming the Workers With Disabilities Tax Credit. These criteria include employing individuals with disabilities who meet certain requirements.

Q: Is there a deadline for filing Form IT-644?

A: Yes, the deadline for filing Form IT-644 is the same as the deadline for filing your New York State income tax return, which is typically April 15th.

Q: Can I claim the Workers With Disabilities Tax Credit if I am self-employed?

A: No, the Workers With Disabilities Tax Credit is only available to businesses that employ workers with disabilities. Self-employed individuals cannot claim this credit.

Q: Is the Workers With Disabilities Tax Credit refundable?

A: No, the Workers With Disabilities Tax Credit is non-refundable. It can only be used to offset your tax liability.

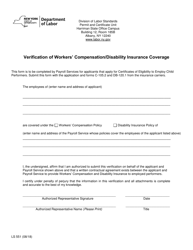

Q: What documentation is required to support a claim for the Workers With Disabilities Tax Credit?

A: Documentation such as disability certification and wage records may be required to support a claim for the Workers With Disabilities Tax Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-644 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.