This version of the form is not currently in use and is provided for reference only. Download this version of

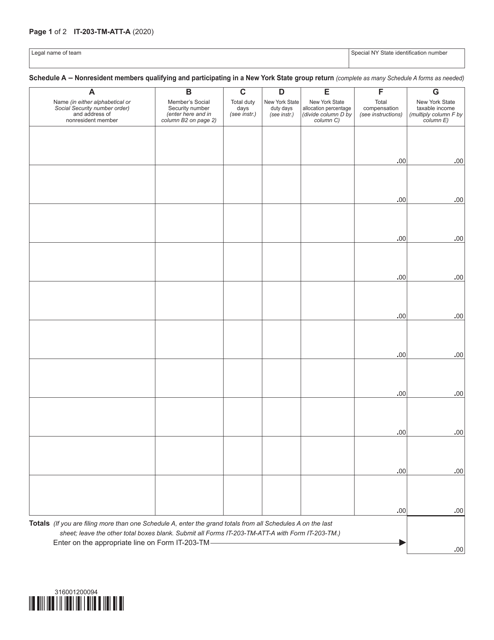

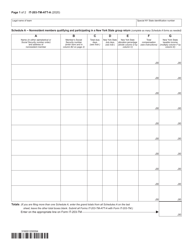

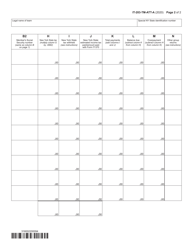

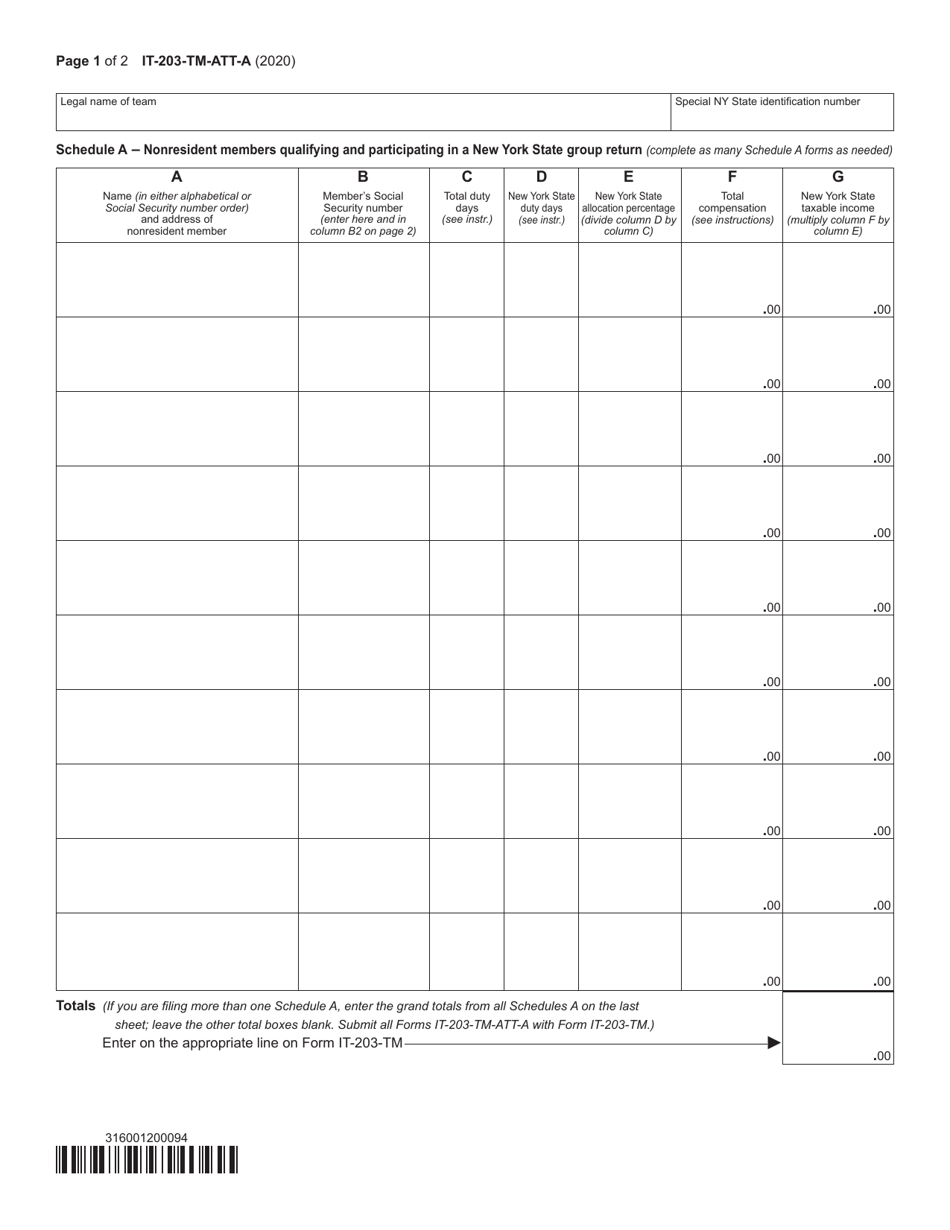

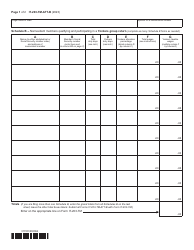

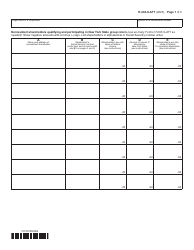

Form IT-203-TM-ATT-A Schedule A

for the current year.

Form IT-203-TM-ATT-A Schedule A New York State Group Return for Nonresident Athletic Team Members - New York

What Is Form IT-203-TM-ATT-A Schedule A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-TM-ATT-A?

A: Form IT-203-TM-ATT-A is the Schedule A for New York State Group Return for Nonresident Athletic Team Members.

Q: Who needs to file Form IT-203-TM-ATT-A?

A: Form IT-203-TM-ATT-A is specifically for nonresident athletic team members who need to file a New York State Group Return.

Q: What is the purpose of Form IT-203-TM-ATT-A?

A: The purpose of Form IT-203-TM-ATT-A is to report the nonresident income and deductions of athletic team members participating in a New York State Group Return.

Q: Is Form IT-203-TM-ATT-A specific to New York State?

A: Yes, Form IT-203-TM-ATT-A is specifically for reporting nonresident income and deductions related to New York State.

Q: Can I electronically file Form IT-203-TM-ATT-A?

A: Yes, you can electronically file Form IT-203-TM-ATT-A if you meet the eligibility requirements for electronic filing.

Q: Are there any other forms or attachments required along with Form IT-203-TM-ATT-A?

A: Yes, along with Form IT-203-TM-ATT-A, you may also need to file Form IT-203-TM and any other required tax schedules and attachments.

Q: What information do I need to complete Form IT-203-TM-ATT-A?

A: To complete Form IT-203-TM-ATT-A, you will need information pertaining to your nonresident income and deductions as an athletic team member.

Q: Can I file Form IT-203-TM-ATT-A if I am not a nonresident athletic team member?

A: No, Form IT-203-TM-ATT-A is specifically for nonresident athletic team members.

Q: Are there any penalties for not filing Form IT-203-TM-ATT-A?

A: Yes, if you are required to file Form IT-203-TM-ATT-A and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-TM-ATT-A Schedule A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.