This version of the form is not currently in use and is provided for reference only. Download this version of

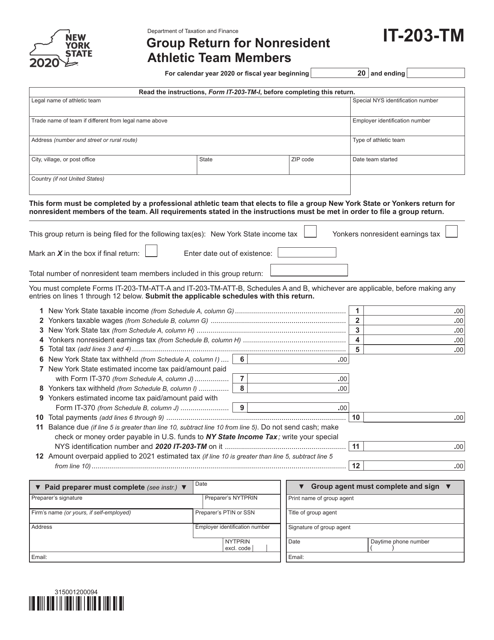

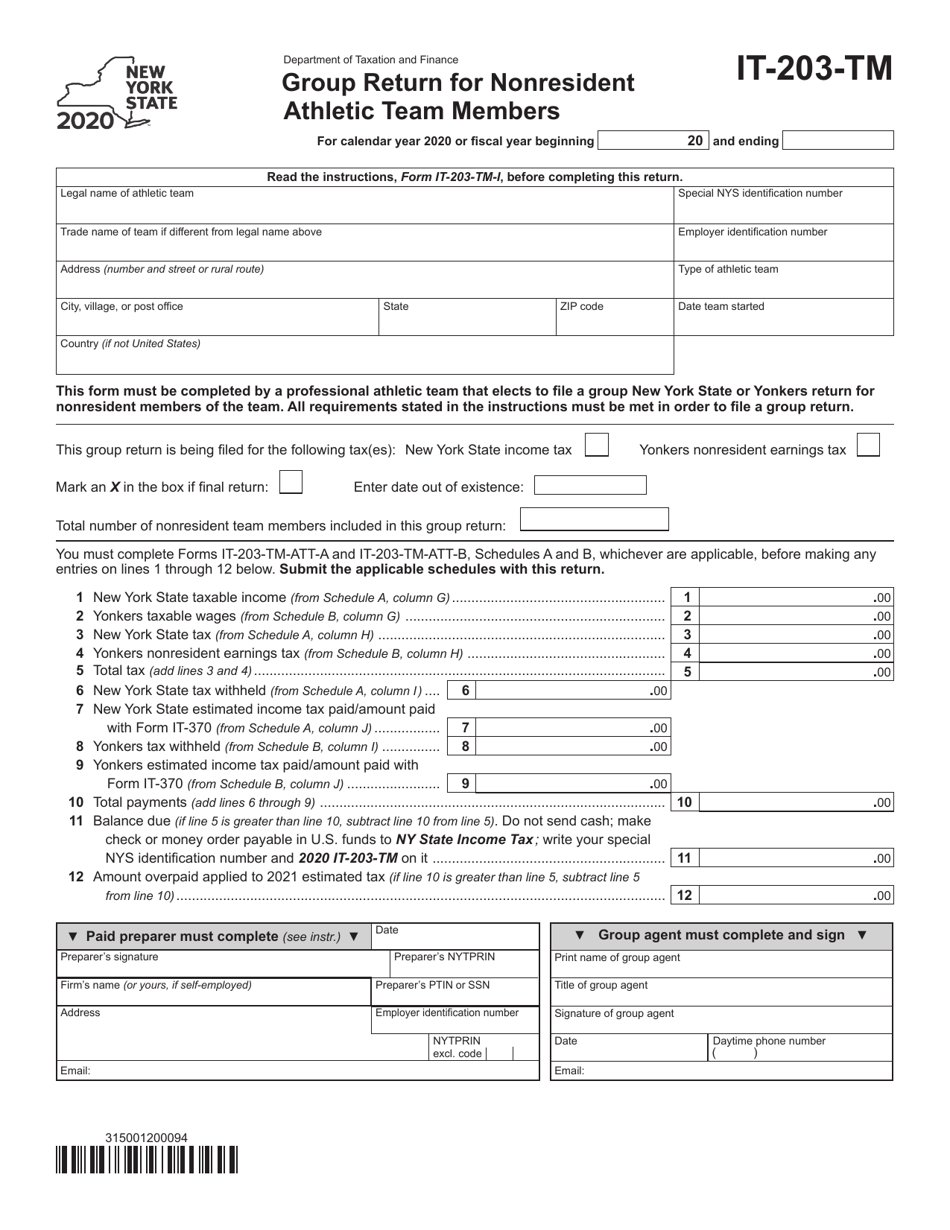

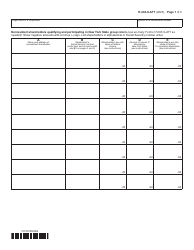

Form IT-203-TM

for the current year.

Form IT-203-TM Group Return for Nonresident Athletic Team Members - New York

What Is Form IT-203-TM?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-203-TM?

A: Form IT-203-TM is a form used by nonresident athletic team members in New York to file a group return.

Q: Who should file Form IT-203-TM?

A: Nonresident athletic team members who are part of a group or team that competed in New York should file Form IT-203-TM.

Q: What is the purpose of Form IT-203-TM?

A: The purpose of Form IT-203-TM is to report and pay the New York State income tax on earnings derived from athletic team activities.

Q: What information is required on Form IT-203-TM?

A: Form IT-203-TM requires information about the team, the individual member, and their earnings from athletic team activities in New York.

Q: When is the due date for filing Form IT-203-TM?

A: Form IT-203-TM is due on or before the 15th day of the 4th month following the end of the team's taxable year.

Q: Are there any penalties for not filing Form IT-203-TM?

A: Yes, failure to file Form IT-203-TM may result in penalties and interest being assessed on the unpaid tax amount.

Q: Can Form IT-203-TM be filed electronically?

A: No, Form IT-203-TM can only be filed by mail.

Q: Can I make changes to Form IT-203-TM after it has been filed?

A: Yes, you can file an amended return using Form IT-203-TM-ED if you need to make changes to a previously filed Form IT-203-TM.

Q: Is Form IT-203-TM only for nonresident athletes?

A: Yes, Form IT-203-TM is specifically for nonresident athletic team members in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-TM by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.