This version of the form is not currently in use and is provided for reference only. Download this version of

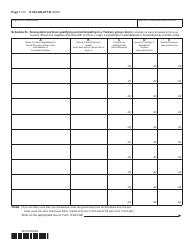

Form IT-203-GR-ATT-C Schedule C

for the current year.

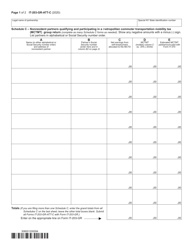

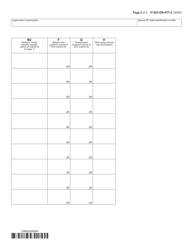

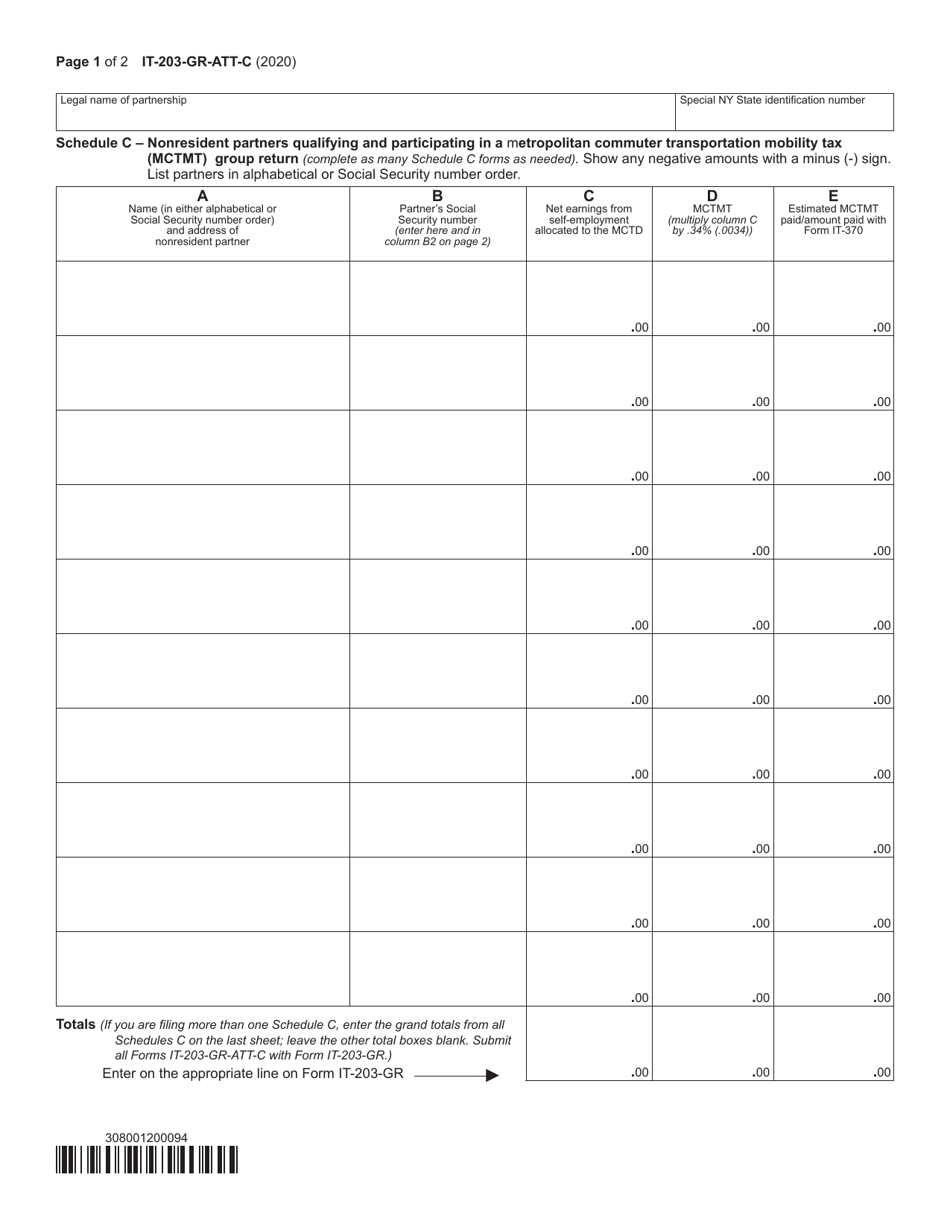

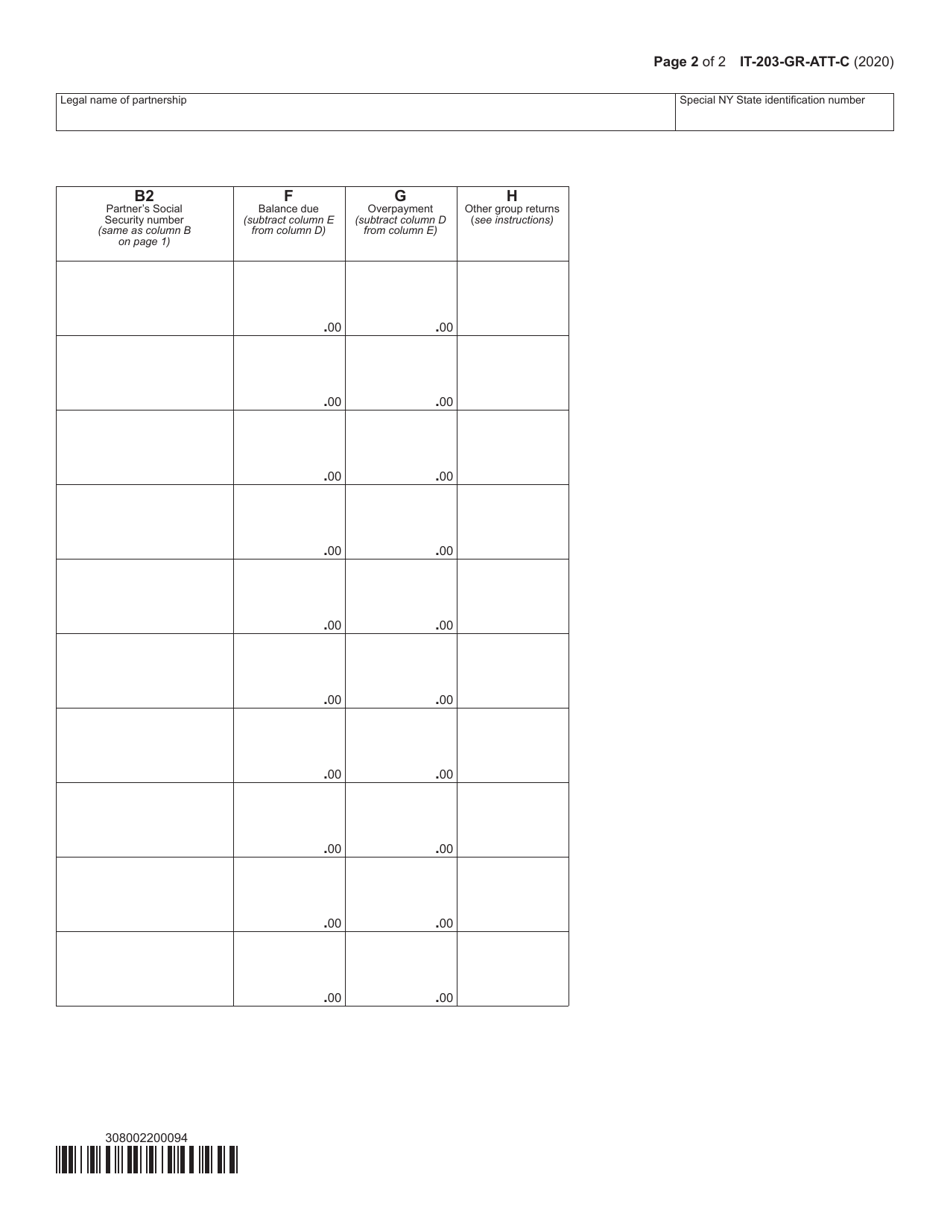

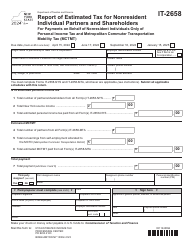

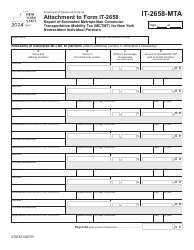

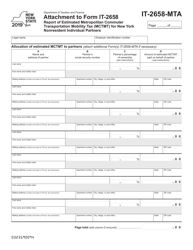

Form IT-203-GR-ATT-C Schedule C Nonresident Partners Qualifying and Participating in a Metropolitan Commuter Transportation Mobility Tax (Mctmt) Group Return - New York

What Is Form IT-203-GR-ATT-C Schedule C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-GR-ATT-C?

A: Form IT-203-GR-ATT-C is a schedule for nonresident partners to qualify and participate in a Metropolitan Commuter Transportation Mobility Tax (MCTMT) group return in New York.

Q: What is the purpose of Form IT-203-GR-ATT-C?

A: The purpose of Form IT-203-GR-ATT-C is to report the participation of nonresident partners in a group return for the MCTMT.

Q: Who needs to use Form IT-203-GR-ATT-C?

A: Nonresident partners who qualify and wish to participate in a group return for the MCTMT in New York need to use Form IT-203-GR-ATT-C.

Q: What is the MCTMT?

A: The Metropolitan Commuter Transportation Mobility Tax (MCTMT) is a tax imposed on certain employers and self-employed individuals who engage in business within the metropolitan commuter transportation district in New York.

Q: Can nonresident partners participate in a group return for the MCTMT?

A: Yes, nonresident partners who qualify can participate in a group return for the MCTMT by using Form IT-203-GR-ATT-C.

Q: What information is required on Form IT-203-GR-ATT-C?

A: Form IT-203-GR-ATT-C requires nonresident partners to provide their identifying information and the partnership's information as well as the details of their participation in the MCTMT group return.

Q: Is Form IT-203-GR-ATT-C accompanied by any other forms?

A: Yes, nonresident partners who use Form IT-203-GR-ATT-C must also file a Form IT-203-GR-ATT-R to report their share of the partnership's income allocable to the MCTMT and to claim any allowable credits against that tax.

Q: When is Form IT-203-GR-ATT-C due?

A: Form IT-203-GR-ATT-C is generally due by the same due date as the partnership's tax return, which is usually April 15th of the following year.

Q: What happens if I don't file Form IT-203-GR-ATT-C?

A: Failure to file Form IT-203-GR-ATT-C may result in nonresident partners not being able to participate in a group return for the MCTMT and potentially being subject to penalties and interest.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-GR-ATT-C Schedule C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.