This version of the form is not currently in use and is provided for reference only. Download this version of

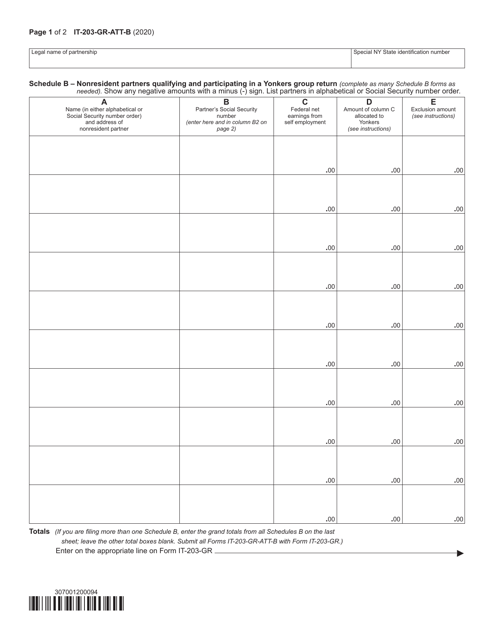

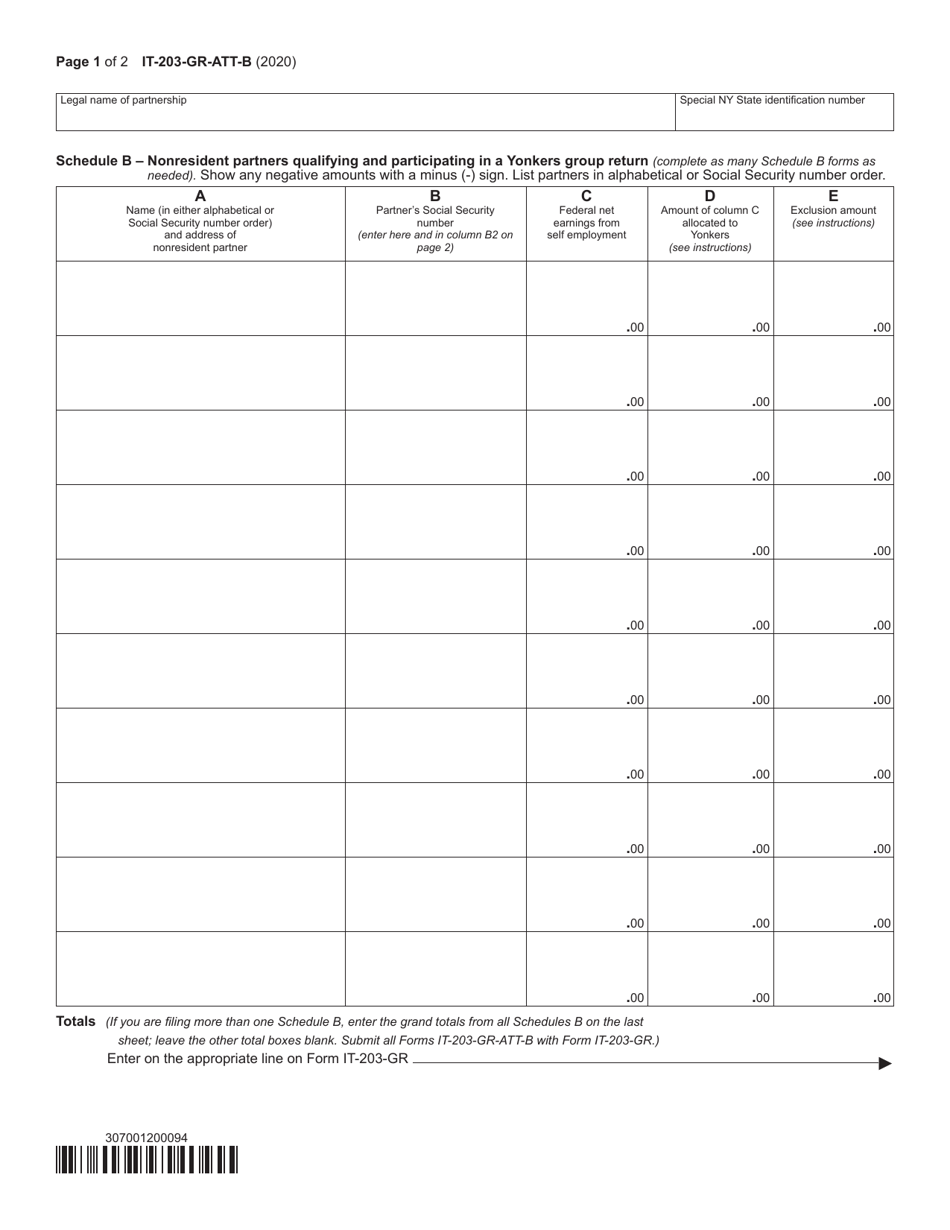

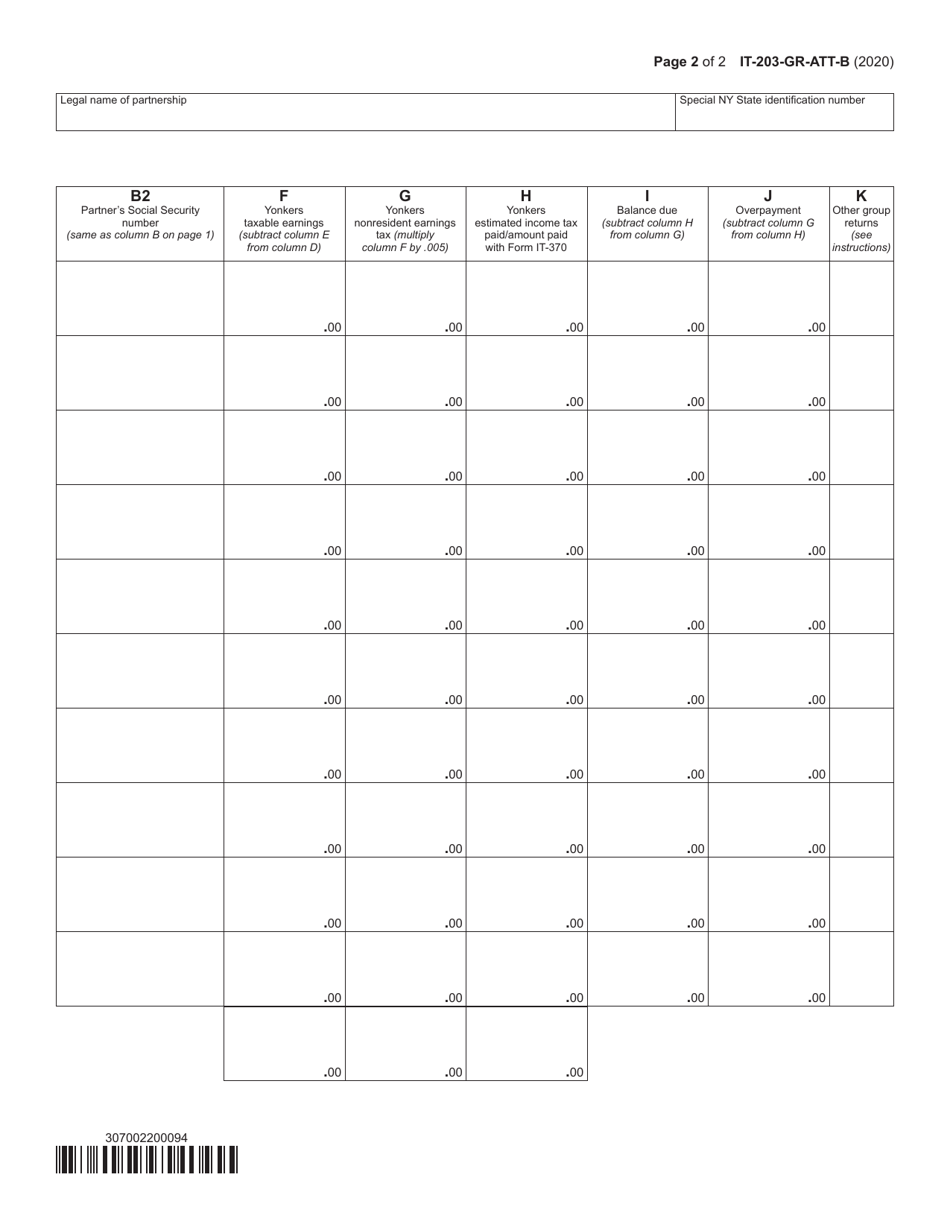

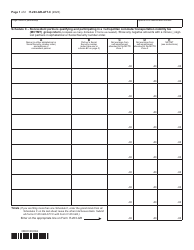

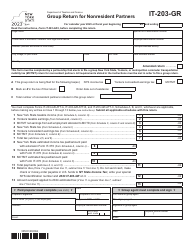

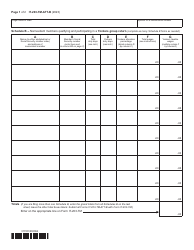

Form IT-203-GR-ATT-B Schedule B

for the current year.

Form IT-203-GR-ATT-B Schedule B Yonkers Group Return for Nonresident Partners - New York

What Is Form IT-203-GR-ATT-B Schedule B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form IT-203-GR-ATT-B Schedule B?

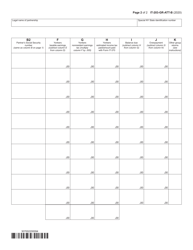

A: The purpose of Form IT-203-GR-ATT-B Schedule B is to report Yonkers income allocable to nonresident partners in a Yonkers nonresident partner group.

Q: Who needs to file Form IT-203-GR-ATT-B Schedule B?

A: Form IT-203-GR-ATT-B Schedule B needs to be filed by nonresident partners who are part of a Yonkers nonresident partner group and have Yonkers income to report.

Q: What is Yonkers income?

A: Yonkers income refers to income derived from sources within the city of Yonkers, New York.

Q: What is a Yonkers nonresident partner group?

A: A Yonkers nonresident partner group refers to a group of nonresident partners who have a partnership interest in a partnership that has Yonkers income to report.

Q: Is Form IT-203-GR-ATT-B Schedule B only applicable to residents of New York?

A: No, Form IT-203-GR-ATT-B Schedule B is applicable to nonresident partners regardless of their state of residence.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-GR-ATT-B Schedule B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.