This version of the form is not currently in use and is provided for reference only. Download this version of

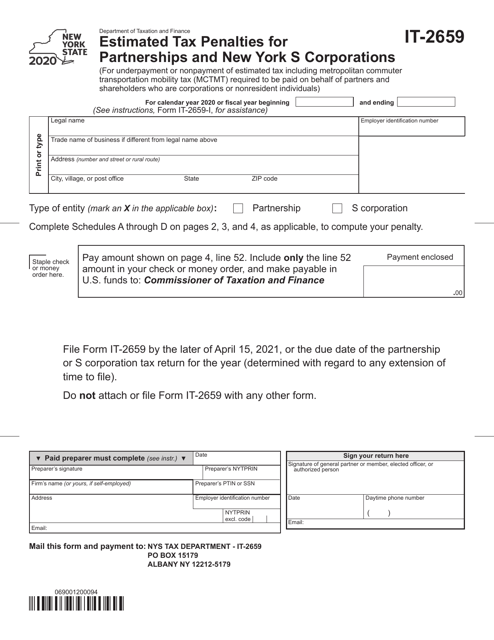

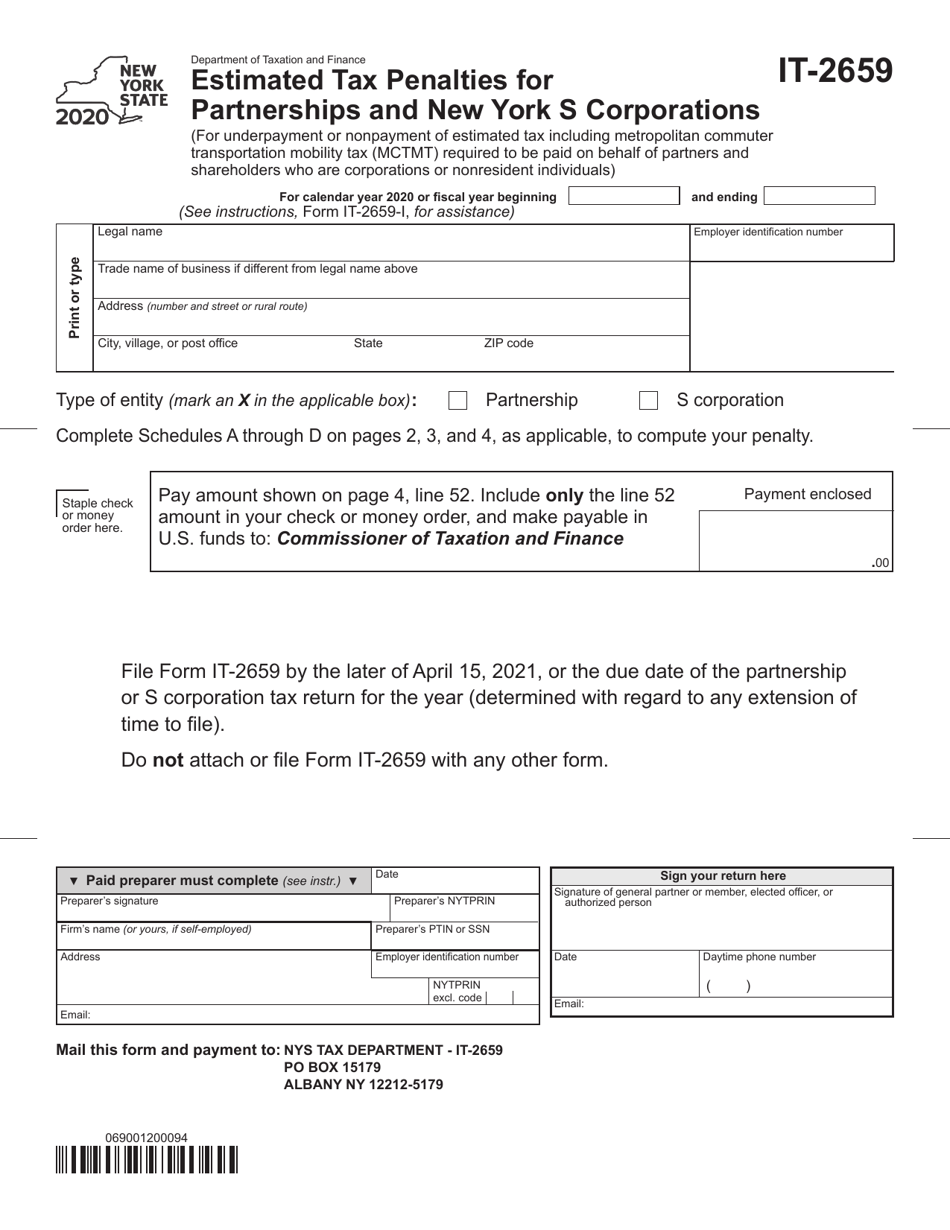

Form IT-2659

for the current year.

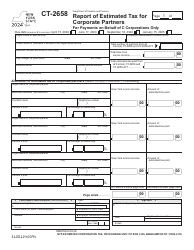

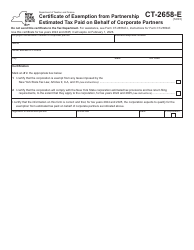

Form IT-2659 Estimated Tax Penalties for Partnerships and New York S Corporations - New York

What Is Form IT-2659?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2659?

A: Form IT-2659 is used to calculate and report estimated tax penalties for partnerships and New York S corporations in New York.

Q: Who needs to file Form IT-2659?

A: Partnerships and New York S corporations are required to file Form IT-2659 if they owe estimated tax penalties in New York.

Q: What is the purpose of Form IT-2659?

A: The purpose of Form IT-2659 is to calculate and report the amount of estimated tax penalties owed by partnerships and New York S corporations in New York.

Q: When is Form IT-2659 due?

A: Form IT-2659 is due on the 15th day of the 4th month following the end of the tax year for partnerships and New York S corporations.

Q: Do I need to include payment with Form IT-2659?

A: Yes, if you owe estimated tax penalties, you must include payment with Form IT-2659.

Q: What happens if I don't file Form IT-2659?

A: If you are required to file Form IT-2659 and fail to do so, you may be subject to penalties and interest charges.

Q: Can I amend Form IT-2659?

A: Yes, if you need to make changes to your previously filed Form IT-2659, you can file an amended return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2659 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.