This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-398

for the current year.

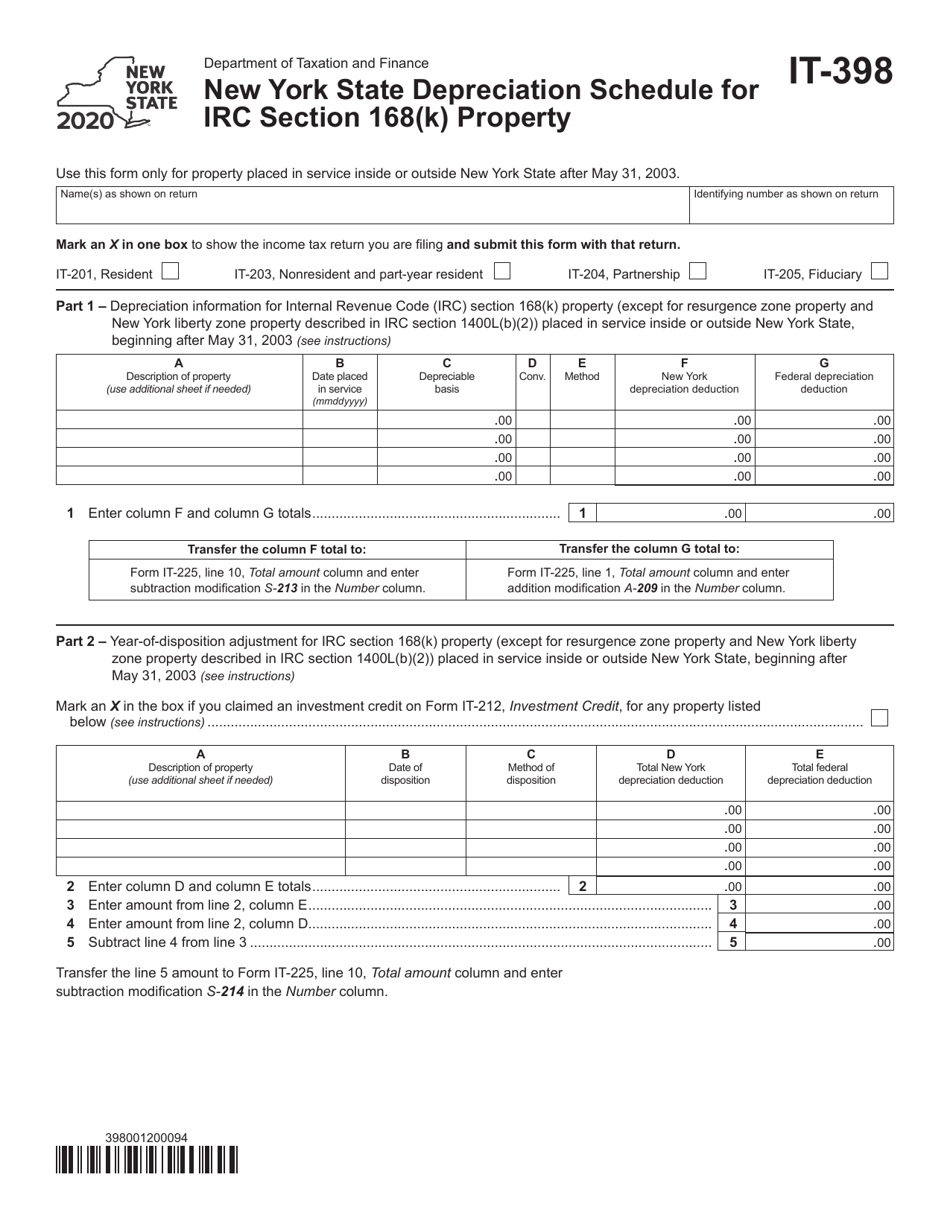

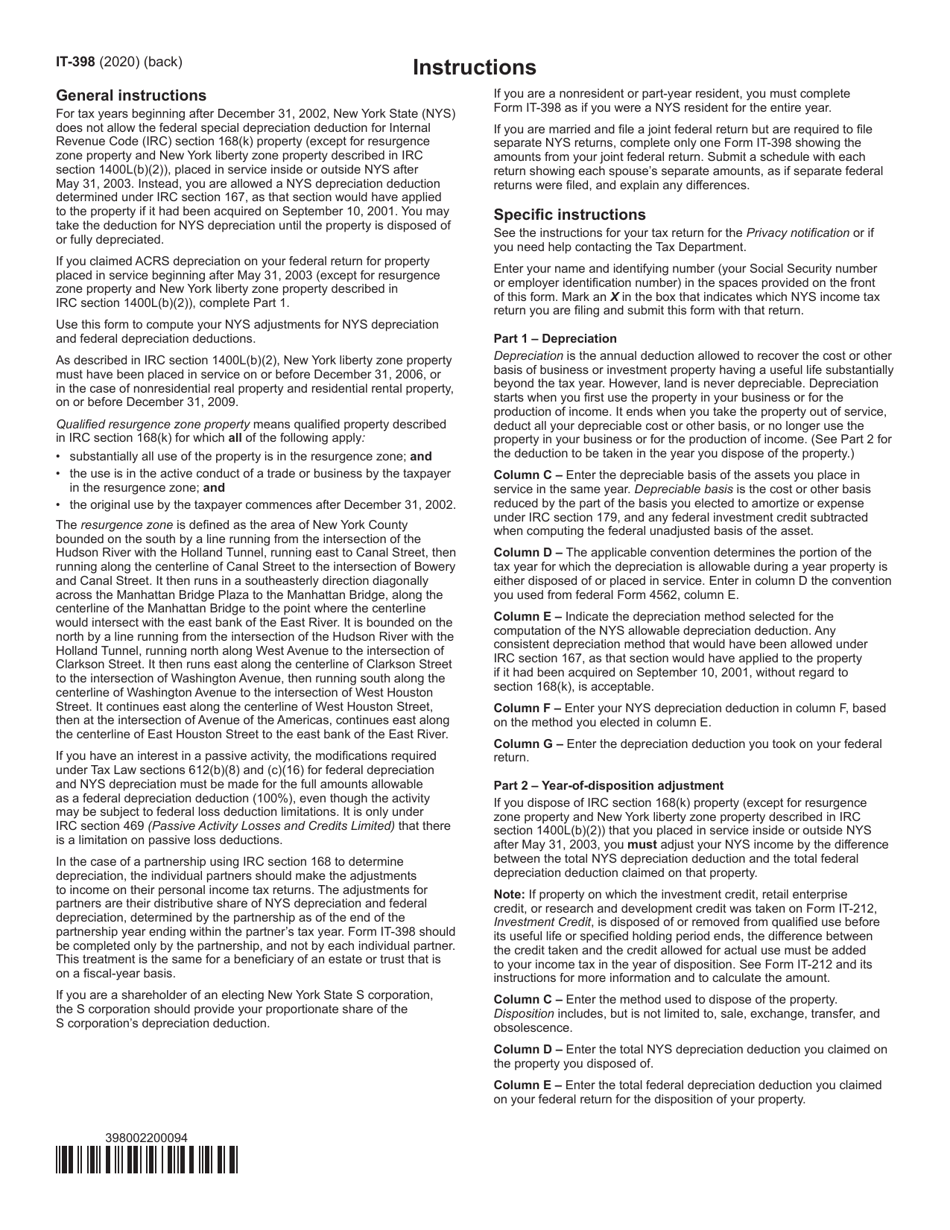

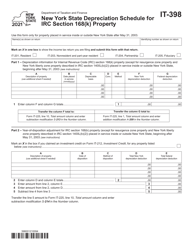

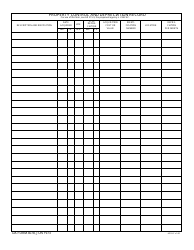

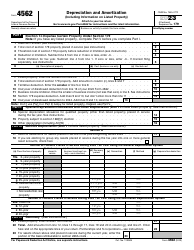

Form IT-398 New York State Depreciation Schedule for IRC Section 168(K) Property - New York

What Is Form IT-398?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IT-398?

A: Form IT-398 is the New York State Depreciation Schedule for IRC Section 168(K) Property.

Q: Who needs to fill out form IT-398?

A: Taxpayers in New York State who have qualified property for which they are claiming federal bonus depreciation need to fill out form IT-398.

Q: What is the purpose of form IT-398?

A: Form IT-398 is used to calculate and report the depreciation deduction for qualified property eligible for federal bonus depreciation in New York State.

Q: What is IRC Section 168(K) property?

A: IRC Section 168(K) property refers to qualified property for which taxpayers can claim federal bonus depreciation.

Q: Is form IT-398 only for New York State residents?

A: Yes, form IT-398 is specifically for taxpayers in New York State.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-398 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.