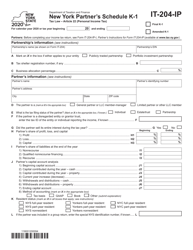

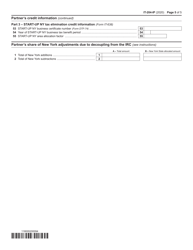

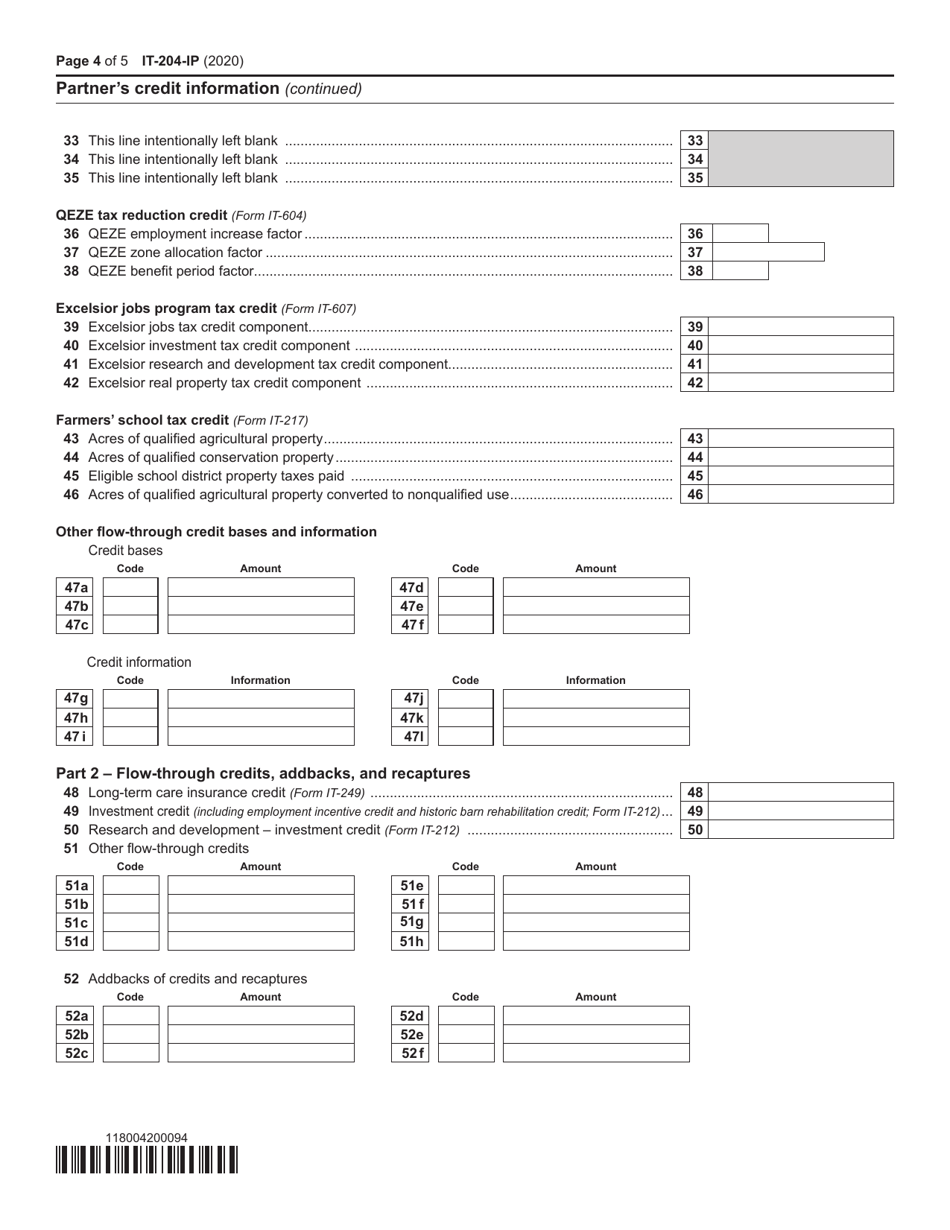

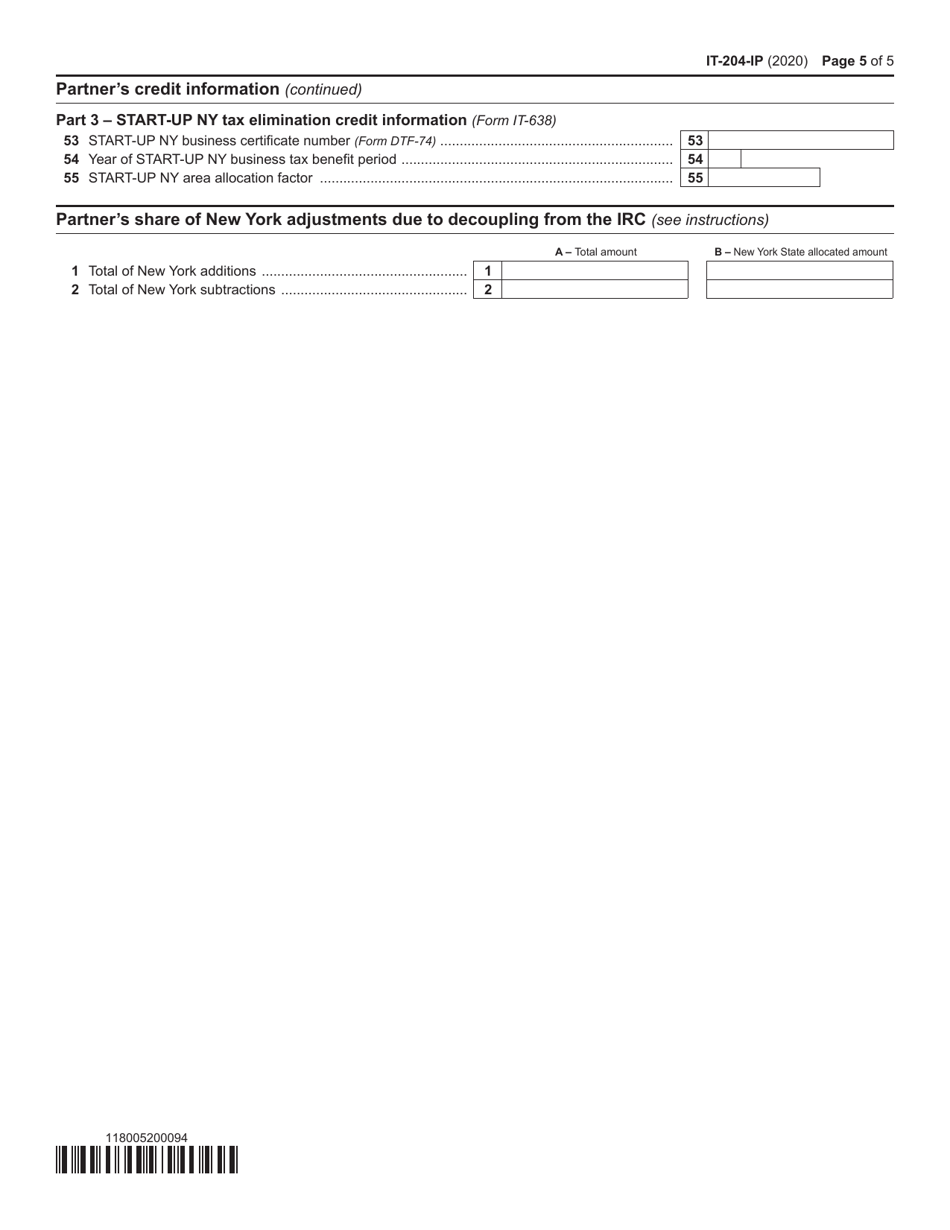

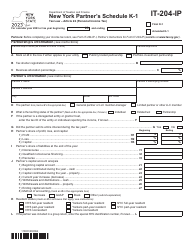

Form IT-204-IP New York Partner's Schedule K-1 - New York

What Is Form IT-204-IP?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-IP?

A: Form IT-204-IP is the New York Partner's Schedule K-1.

Q: What is the purpose of Form IT-204-IP?

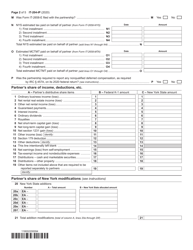

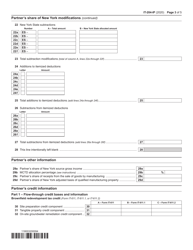

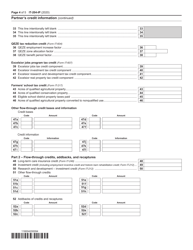

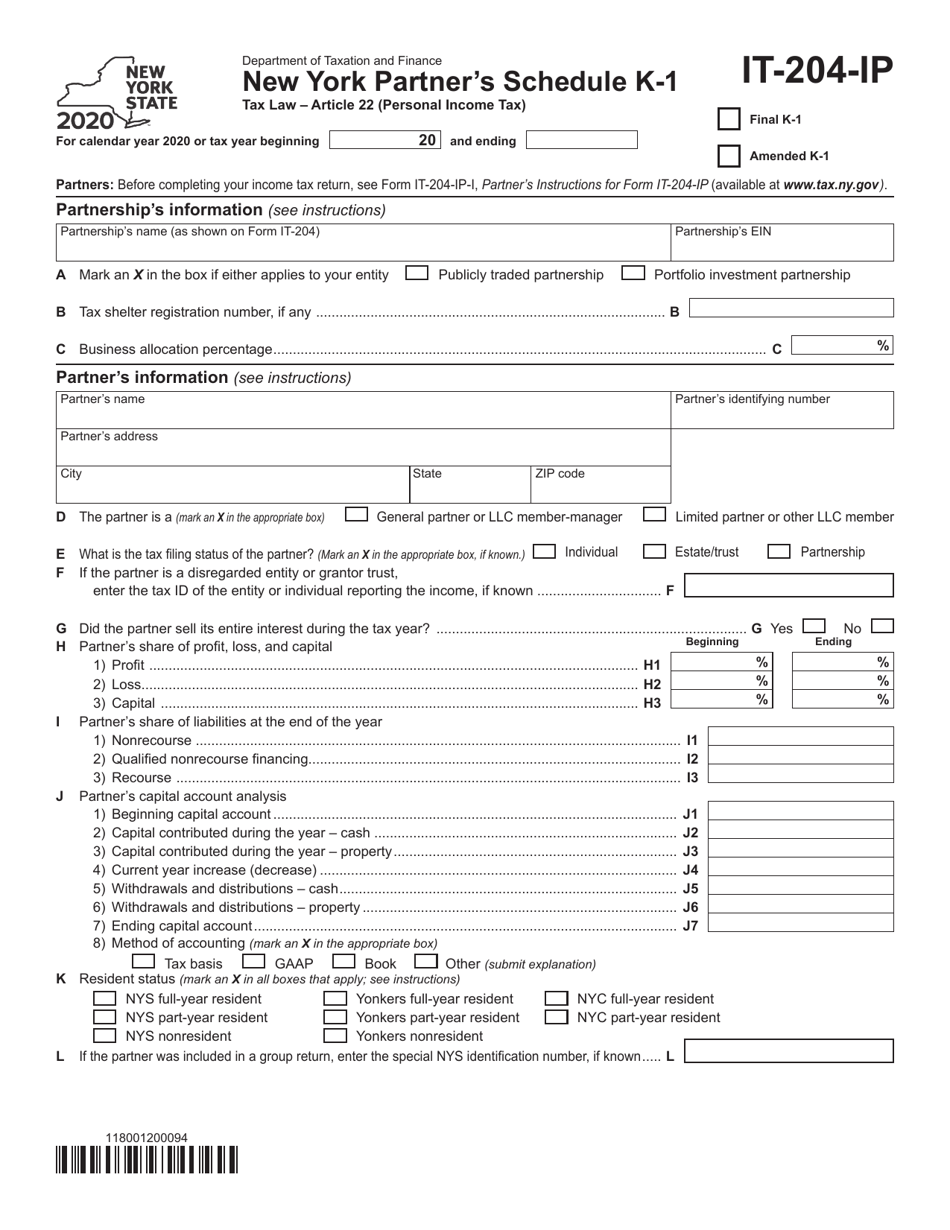

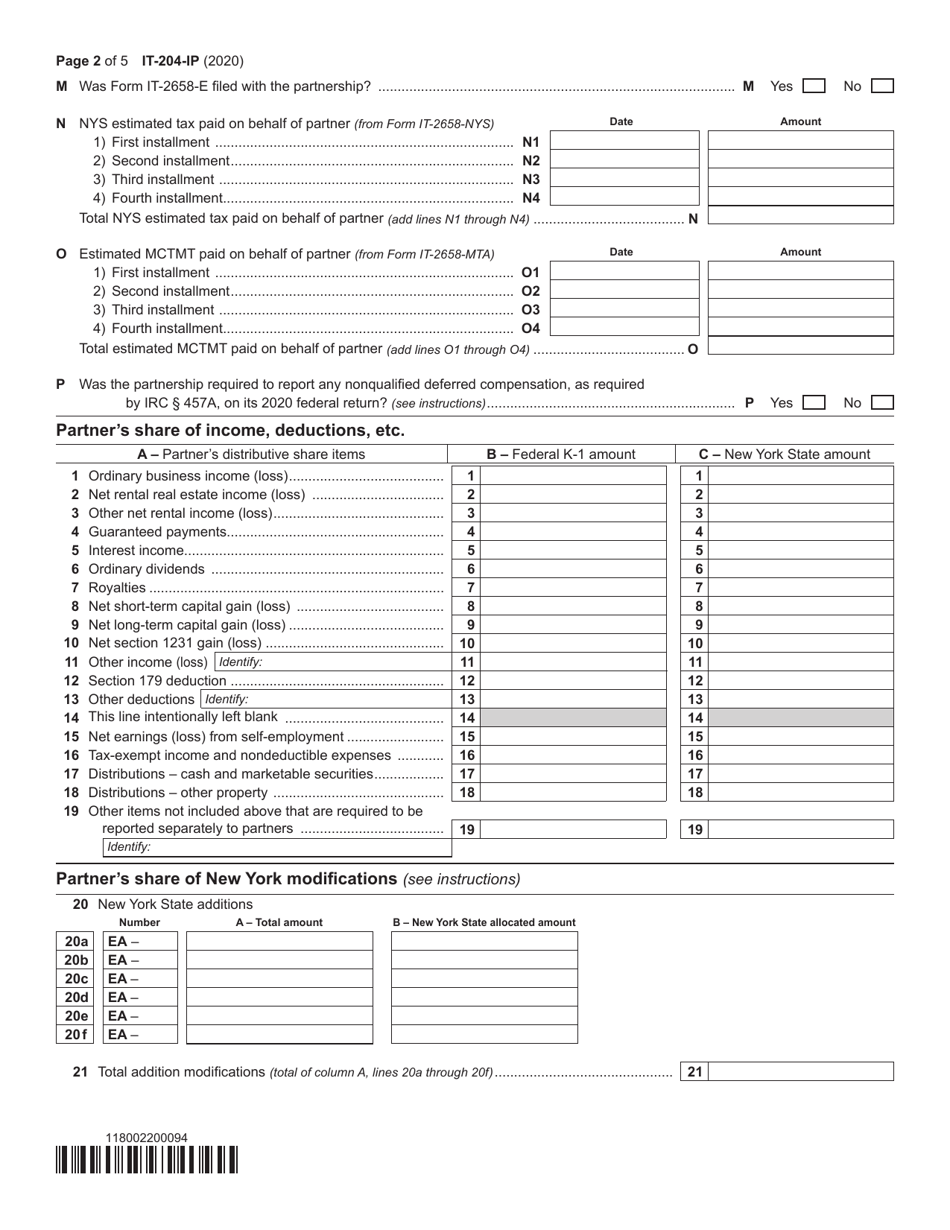

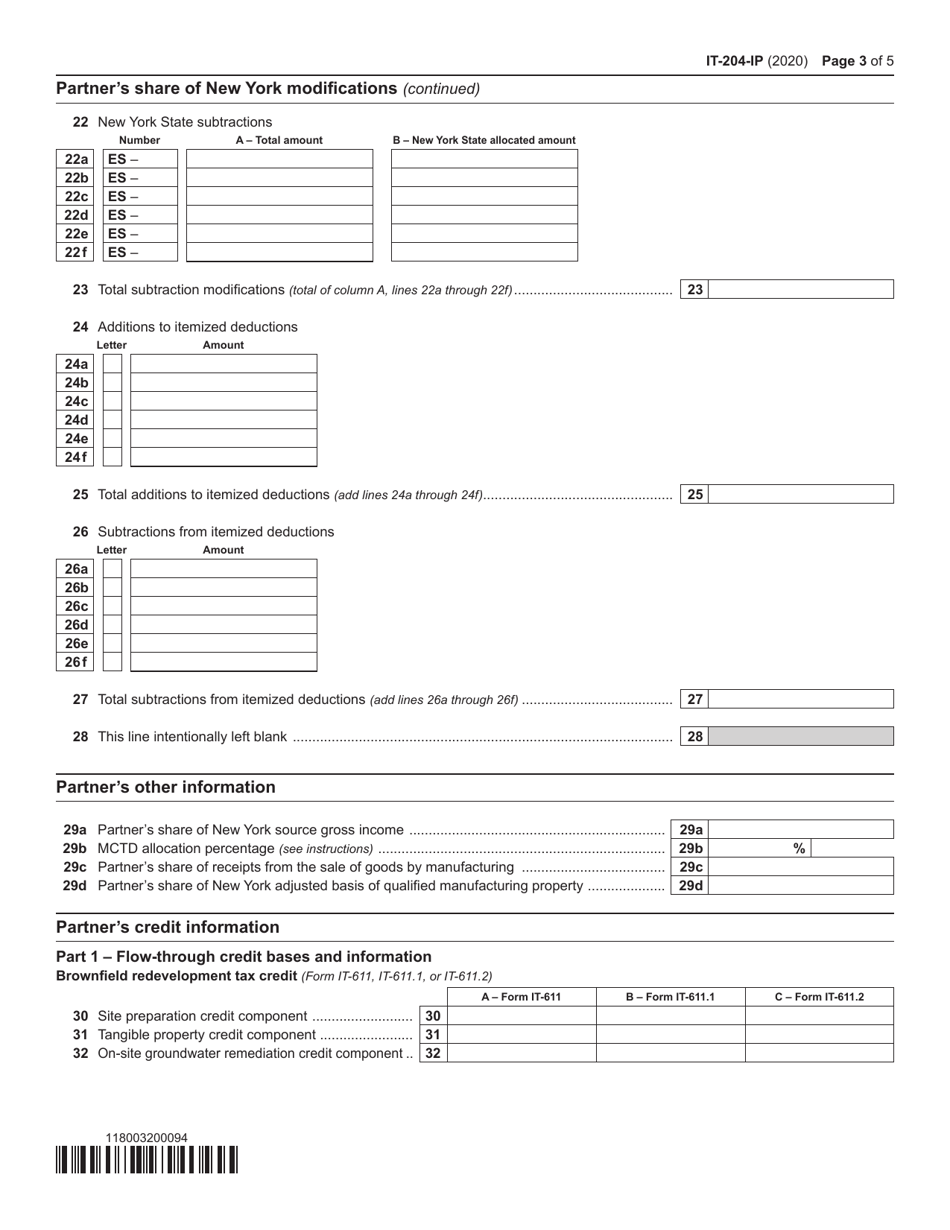

A: Form IT-204-IP is used by partners of partnerships and members of limited liability companies (LLCs) to report their share of income, deductions, credits, and other items for New York State income tax purposes.

Q: Who needs to file Form IT-204-IP?

A: Partners of partnerships or members of LLCs that operate in New York State and have New York source income or loss need to file Form IT-204-IP.

Q: When is Form IT-204-IP due?

A: Form IT-204-IP is generally due on or before the 15th day of the fourth month following the close of the partnership's or LLC's tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-IP by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.