This version of the form is not currently in use and is provided for reference only. Download this version of

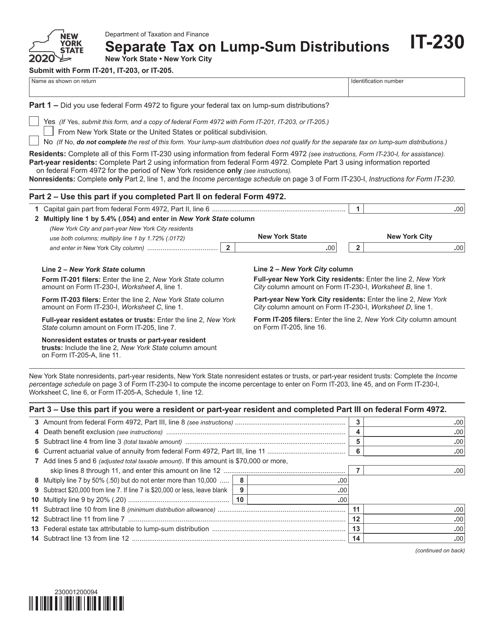

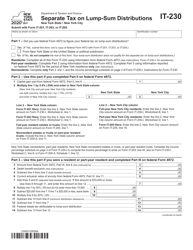

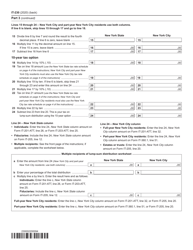

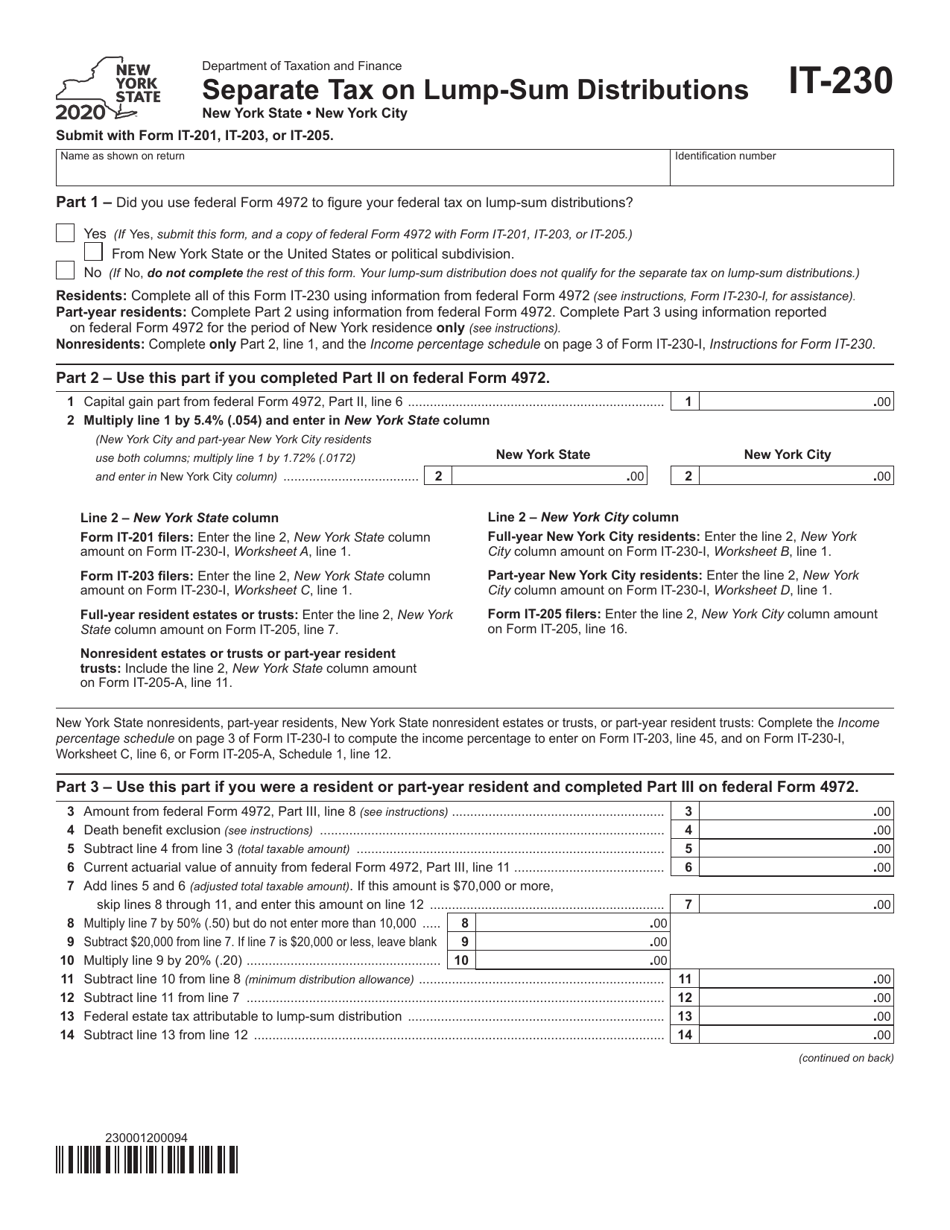

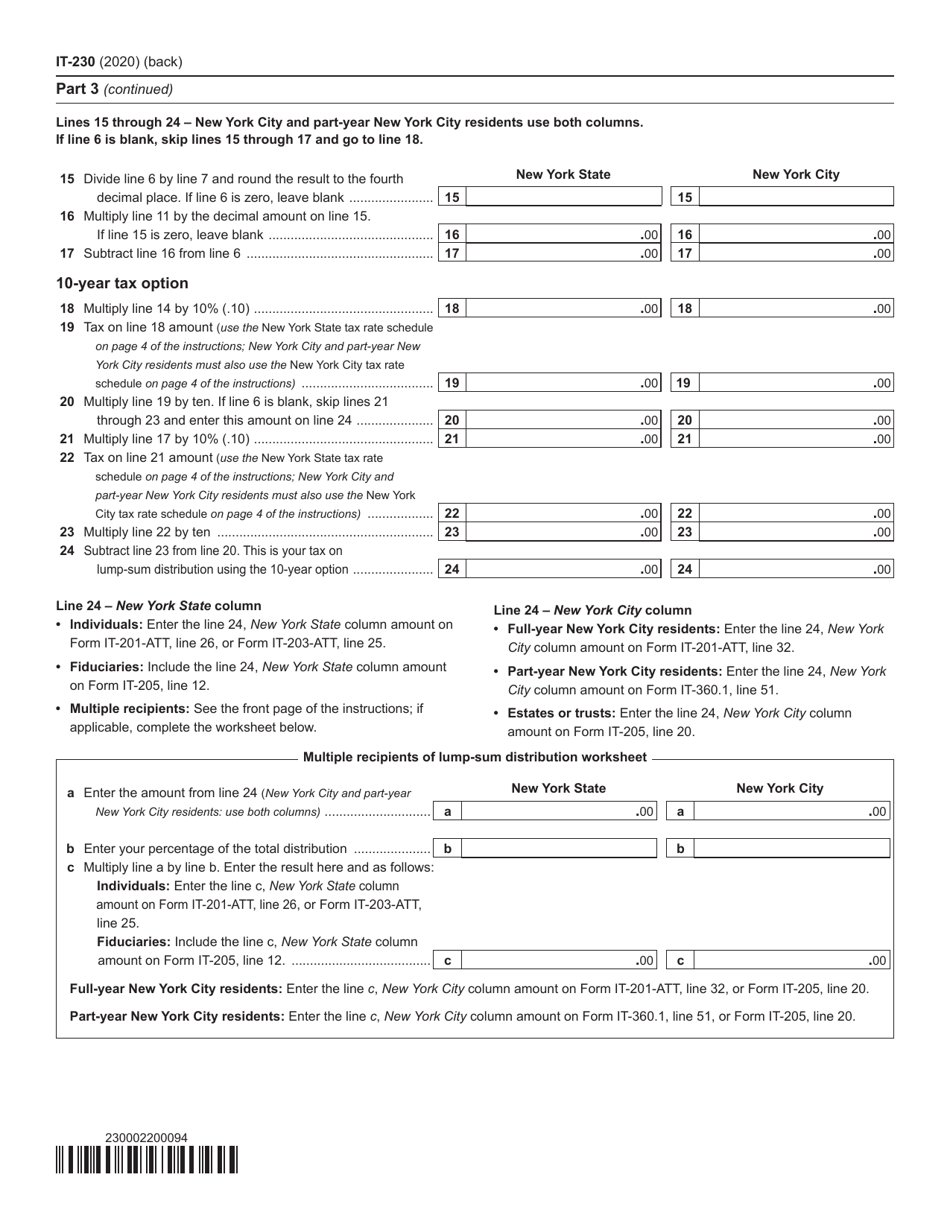

Form IT-230

for the current year.

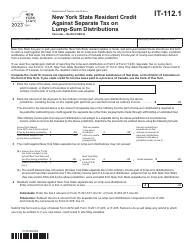

Form IT-230 Separate Tax on Lump-Sum Distributions - New York

What Is Form IT-230?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-230?

A: Form IT-230 is a tax form used in New York to report separate tax on lump-sum distributions.

Q: What is a lump-sum distribution?

A: A lump-sum distribution is a one-time payment of a retirement plan or pension benefit.

Q: When do I need to file Form IT-230?

A: You need to file Form IT-230 if you received a lump-sum distribution and it is subject to separate tax in New York.

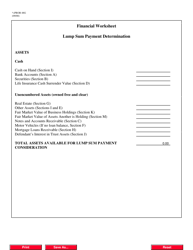

Q: What information do I need to complete Form IT-230?

A: You will need to provide details about the lump-sum distribution you received, including the amount, the year it was received, and any tax withheld.

Q: How do I file Form IT-230?

A: You can file Form IT-230 by mail or electronically using the New York State e-file system.

Q: Is there a deadline for filing Form IT-230?

A: Yes, Form IT-230 must be filed by the due date of your New York State income tax return, which is usually April 15th.

Q: Are there any penalties for late filing of Form IT-230?

A: Yes, if you fail to file Form IT-230 on time, you may be subject to penalties and interest on the tax owed.

Q: Can I claim any deductions or credits on Form IT-230?

A: No, Form IT-230 is specifically for reporting separate tax on lump-sum distributions and does not provide for any deductions or credits.

Q: Do I need to include a copy of Form 1099-R with Form IT-230?

A: Yes, you must attach a copy of Form 1099-R, which you received from the payer of the lump-sum distribution, to your Form IT-230.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-230 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.