This version of the form is not currently in use and is provided for reference only. Download this version of

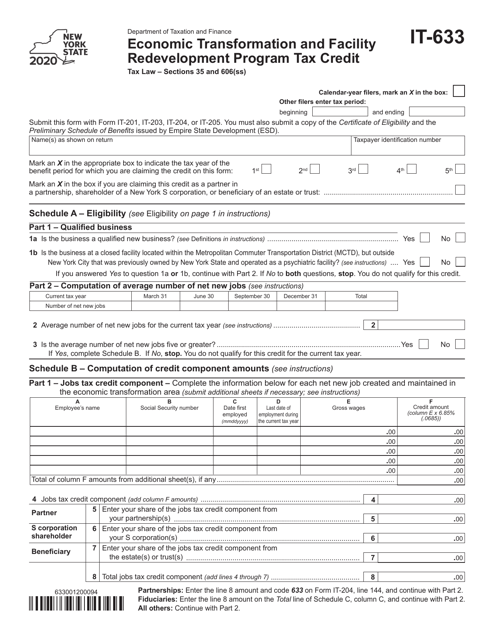

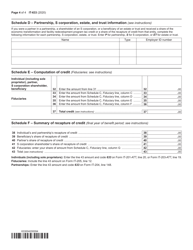

Form IT-633

for the current year.

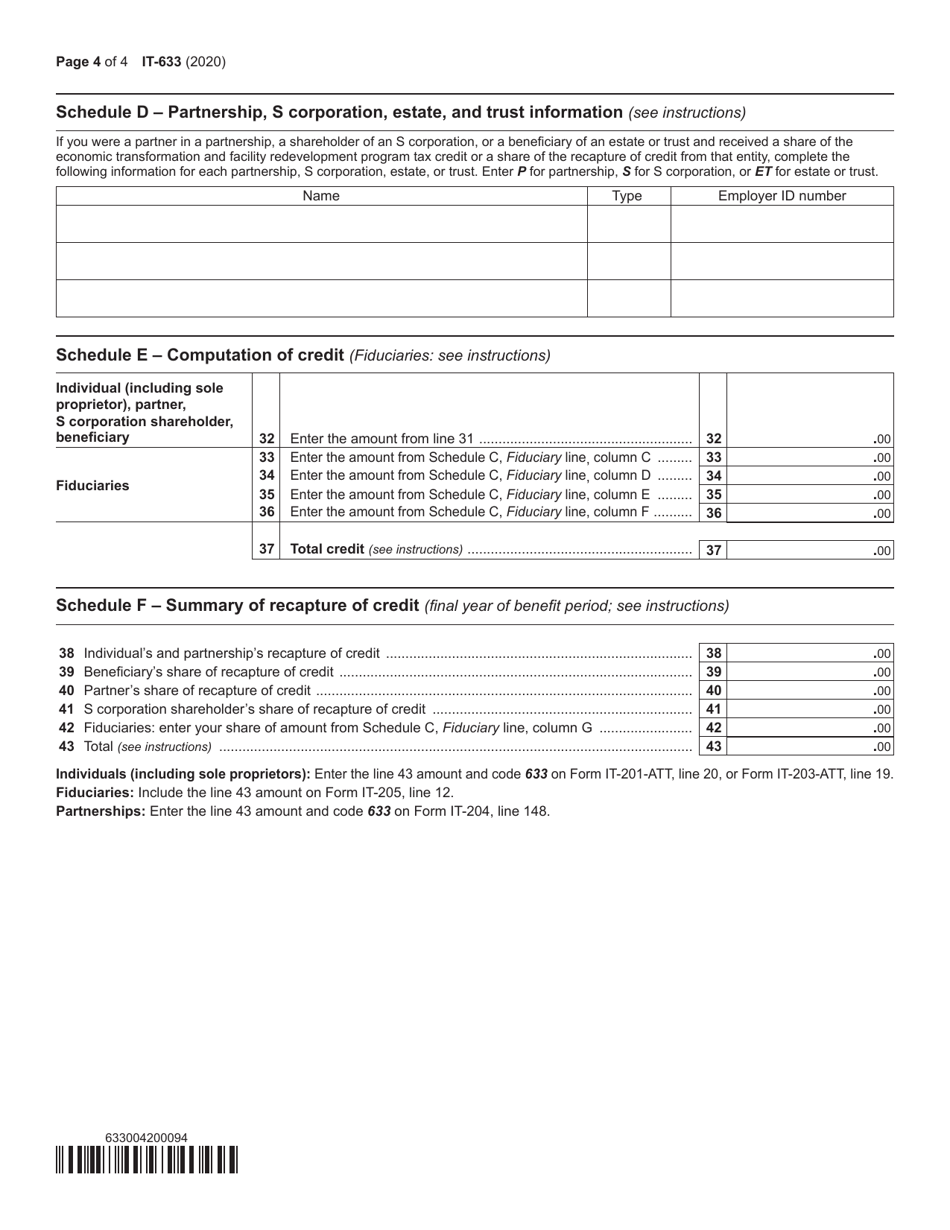

Form IT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form IT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-633?

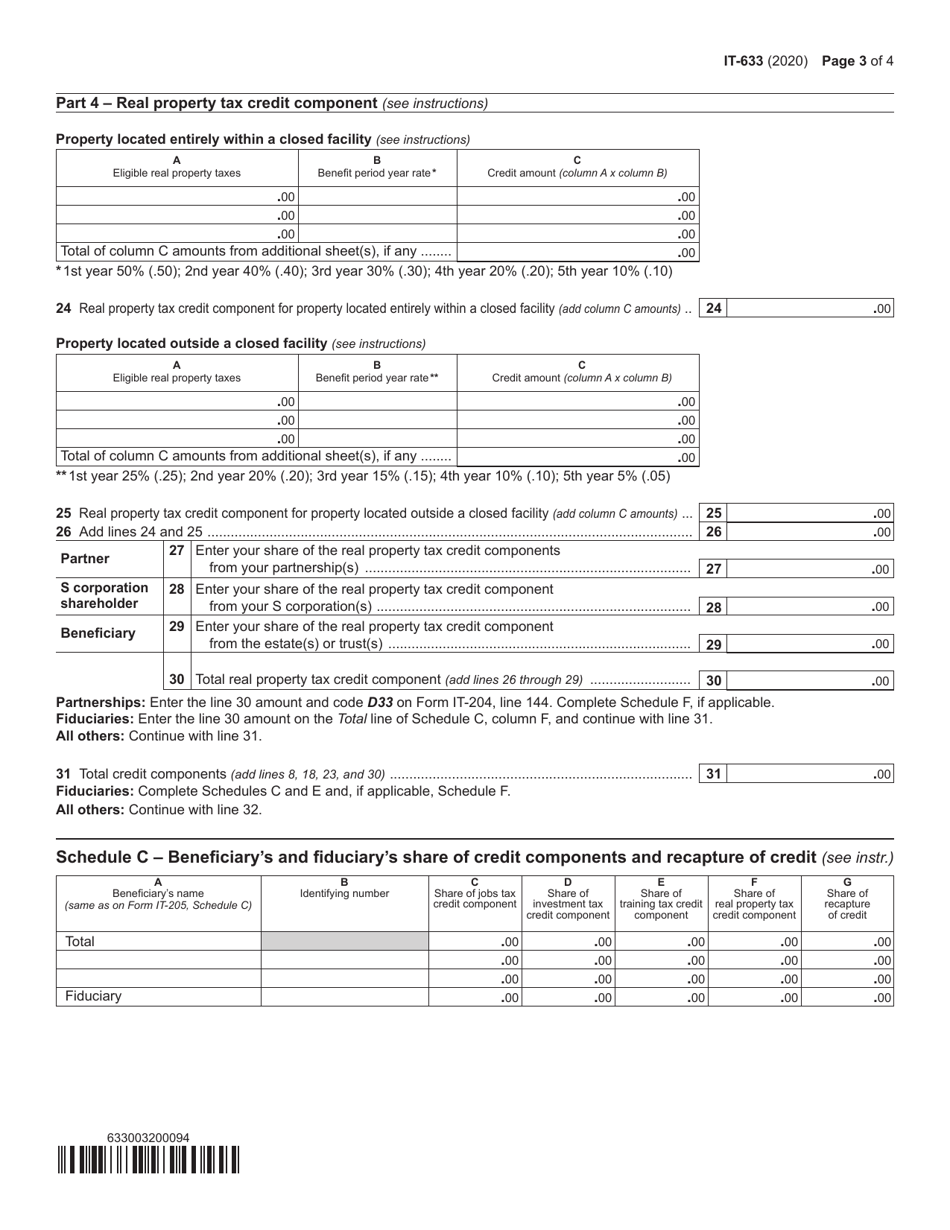

A: Form IT-633 is the application form for the Economic Transformation and Facility Redevelopment Program Tax Credit in New York.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

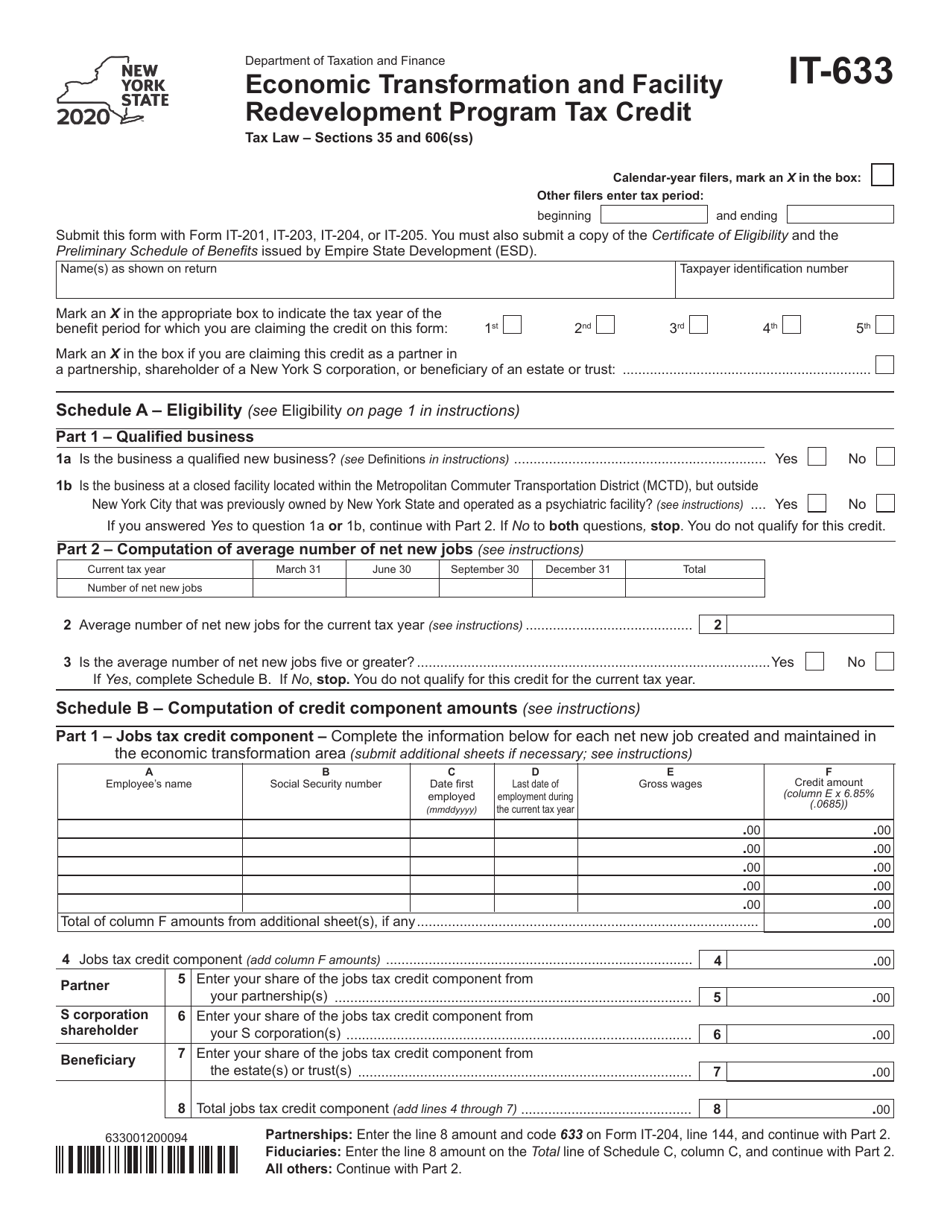

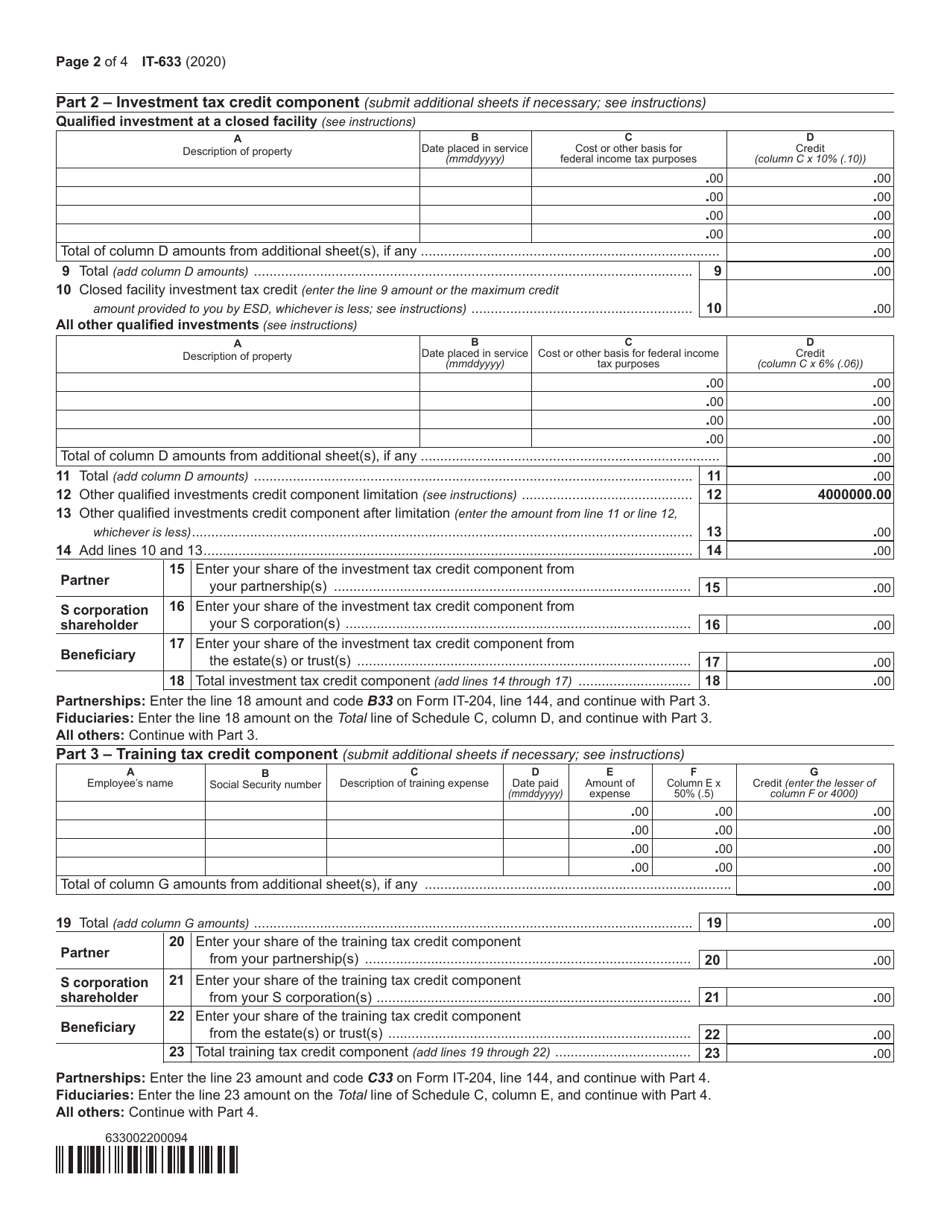

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax credit designed to incentivize projects that lead to economic revitalization and redevelopment in New York.

Q: Who is eligible for the tax credit?

A: Eligible entities include both businesses and individuals who are engaged in eligible projects that meet the program's criteria.

Q: How much is the tax credit?

A: The tax credit amount varies depending on the project and is determined by the New York State Department of Economic Development.

Q: What types of projects are eligible for the tax credit?

A: Projects eligible for the tax credit include those related to the transformation or redevelopment of facilities in New York that result in job creation and economic growth.

Q: How can I apply for the tax credit?

A: To apply for the tax credit, you need to complete and submit Form IT-633 to the New York State Department of Economic Development.

Q: Are there any deadlines for applying?

A: Yes, there are specific deadlines for submitting the application, which can vary depending on the program's requirements. It is important to check the latest deadlines from the official sources.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.