This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-2102.6

for the current year.

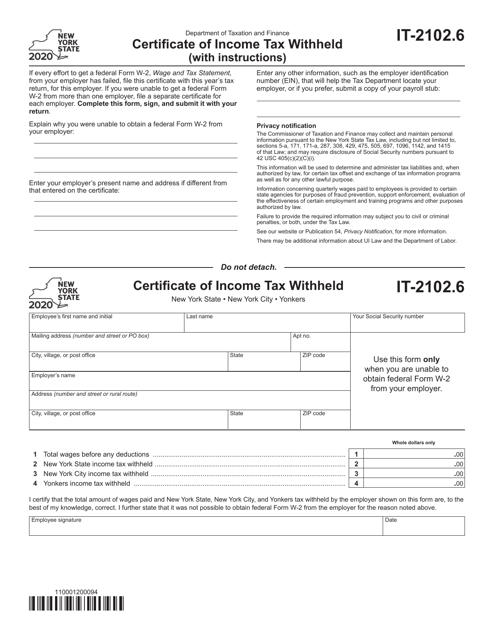

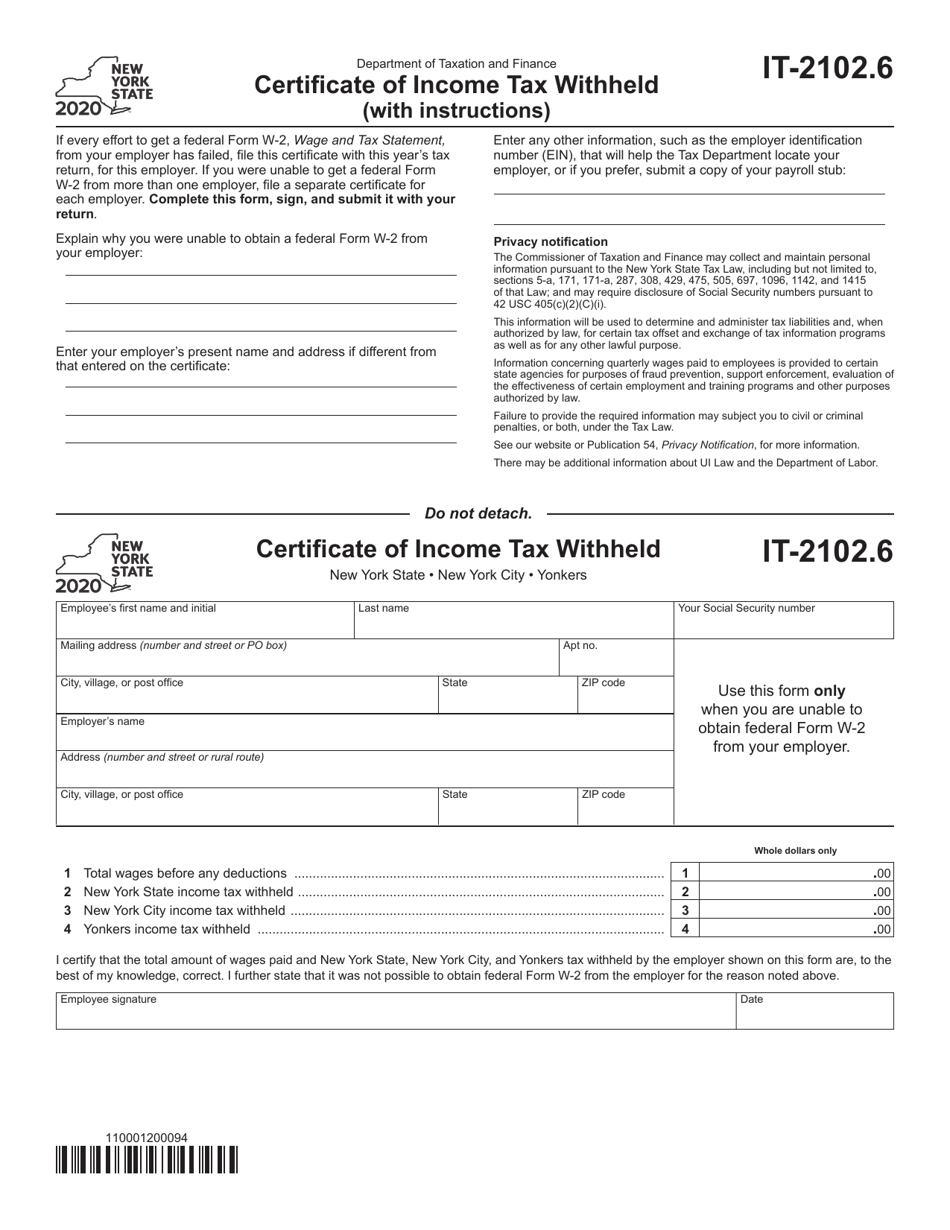

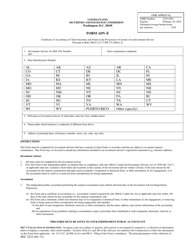

Form IT-2102.6 Certificate of Income Tax Withheld - New York

What Is Form IT-2102.6?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IT-2102.6?

A: Form IT-2102.6 Certificate of Income Tax Withheld is a document used in New York to certify the amount of income tax withheld from an employee's wages.

Q: Who needs to file form IT-2102.6?

A: Form IT-2102.6 must be filed by employees who have had income tax withheld from their wages in New York.

Q: When is form IT-2102.6 due?

A: Form IT-2102.6 is typically due at the same time as the employee's annual tax return, which is usually April 15th.

Q: What information is required on form IT-2102.6?

A: Form IT-2102.6 requires information such as the employee's name, social security number, employer information, and the amount of income tax withheld.

Q: Can form IT-2102.6 be filed electronically?

A: No, form IT-2102.6 cannot be filed electronically. It must be submitted as a paper document.

Q: Is form IT-2102.6 only for New York State income tax?

A: Yes, form IT-2102.6 is specifically for reporting New York State income tax withheld.

Q: What should I do with form IT-2102.6 once it is completed?

A: Once completed, form IT-2102.6 should be given to your employer for their records and for filing purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2102.6 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.