This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-620

for the current year.

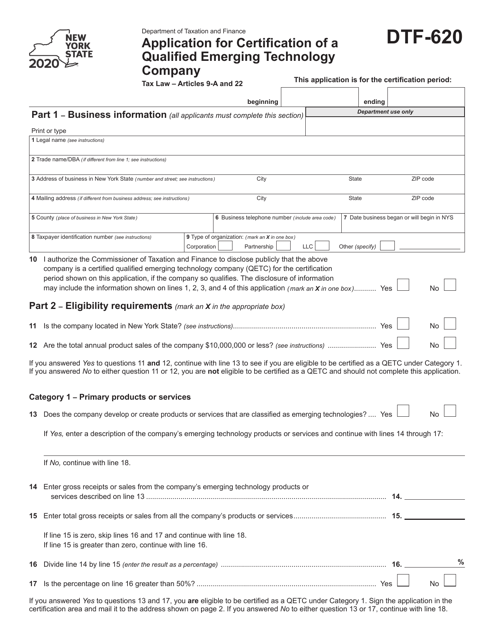

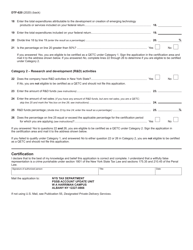

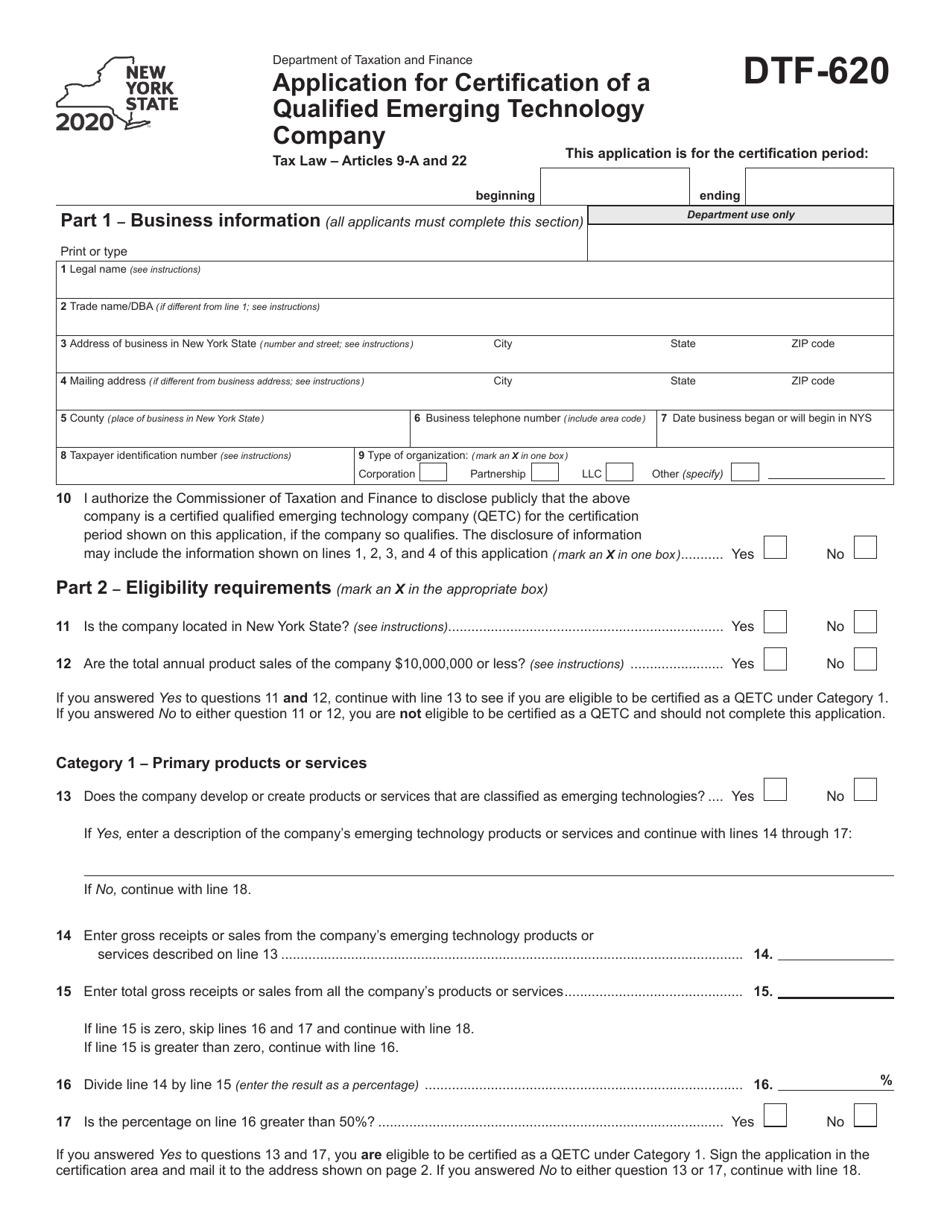

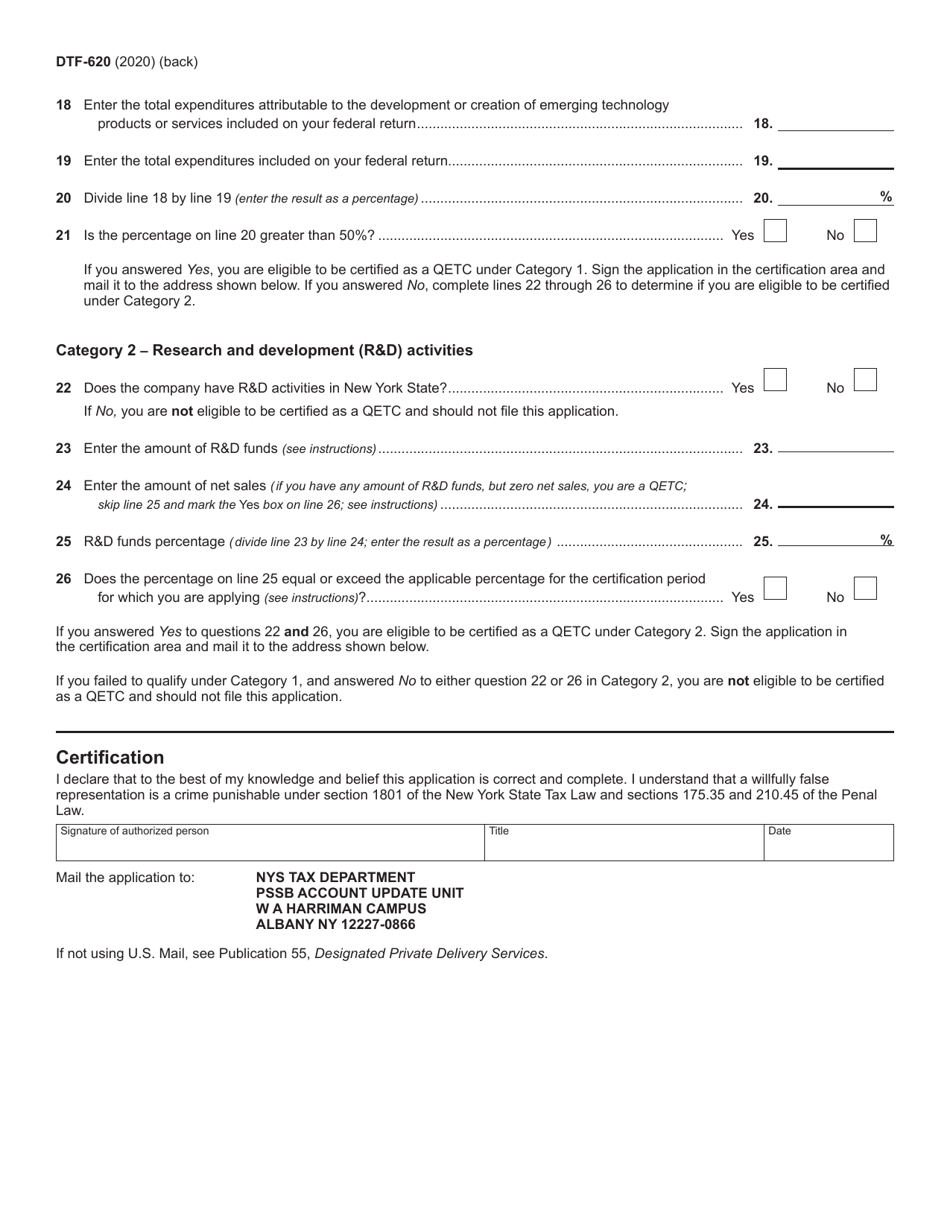

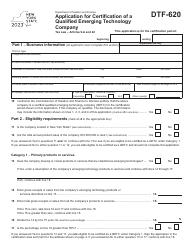

Form DTF-620 Application for Certification of a Qualified Emerging Technology Company - New York

What Is Form DTF-620?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-620?

A: Form DTF-620 is an application for certification of a Qualified Emerging Technology Company in New York.

Q: Who can submit Form DTF-620?

A: Any company seeking to be certified as a Qualified Emerging Technology Company in New York can submit Form DTF-620.

Q: What is a Qualified Emerging Technology Company?

A: A Qualified Emerging Technology Company is a company that meets certain criteria set by the New York State Department of Taxation and Finance.

Q: What are the benefits of being certified as a Qualified Emerging Technology Company?

A: Certified companies may be eligible for various tax benefits and incentives in New York.

Q: Is there a fee for filing Form DTF-620?

A: There is no fee for filing Form DTF-620.

Q: What documents are required to be submitted with Form DTF-620?

A: The required documents may vary, but generally include financial statements, ownership information, and other supporting documentation.

Q: How long does it take to process a Form DTF-620?

A: The processing time for Form DTF-620 can vary, but it may take several weeks or months.

Q: Can a company reapply if its application for certification as a Qualified Emerging Technology Company is denied?

A: Yes, a company can reapply if its initial application is denied.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-620 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.