This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-664

for the current year.

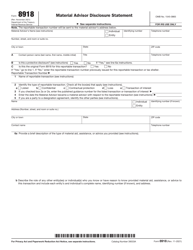

Form DTF-664 Tax Shelter Disclosure for Material Advisors - New York

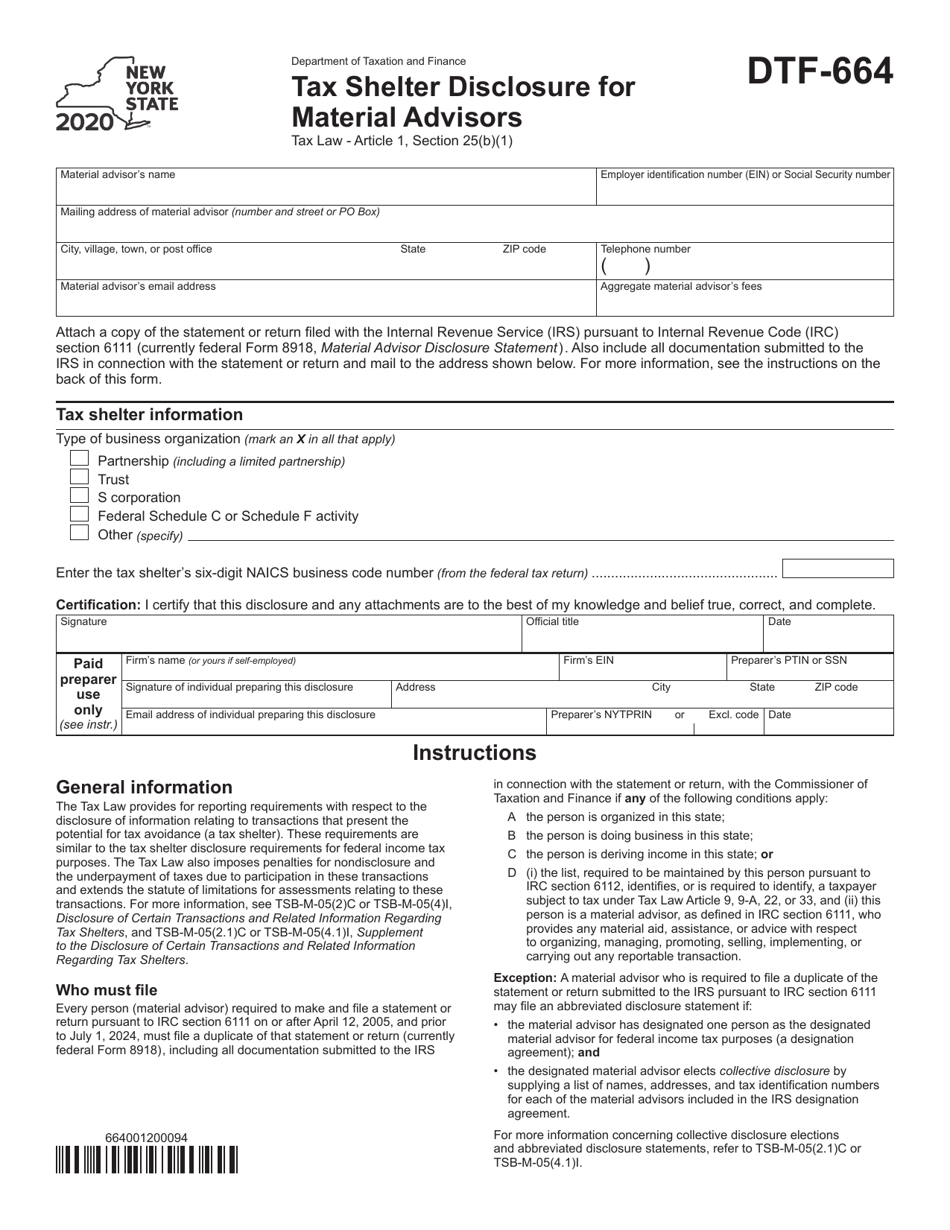

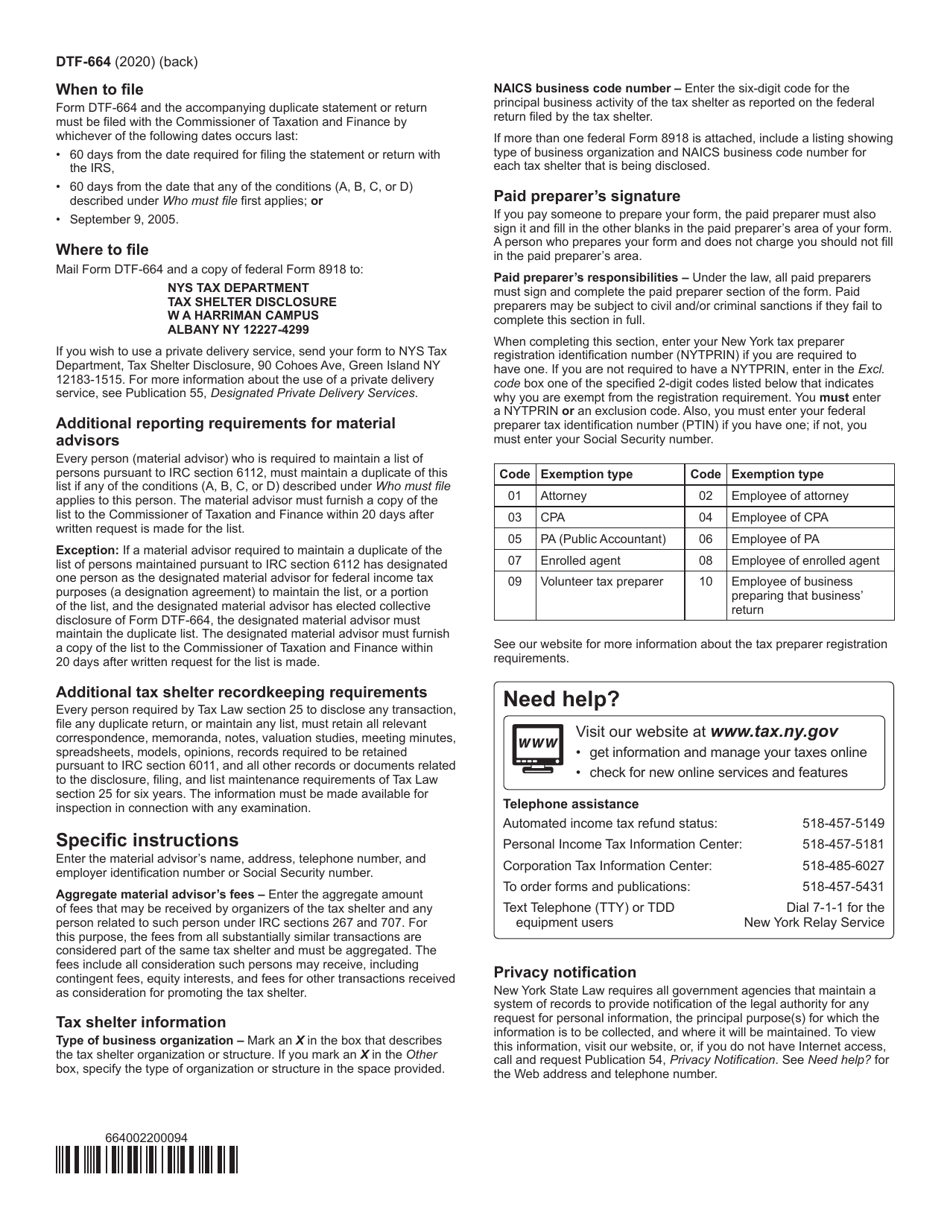

What Is Form DTF-664?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-664?

A: Form DTF-664 is the tax shelter disclosure form for material advisors in New York.

Q: Who is required to file Form DTF-664?

A: Material advisors are required to file Form DTF-664 in New York.

Q: What is a material advisor?

A: A material advisor is a person who provides material aid, assistance, or advice with respect to organizing, managing, promoting, selling, implementing, or carrying out any reportable transaction and directly or indirectly derives gross income in excess of a specified threshold.

Q: What is a reportable transaction?

A: A reportable transaction is a transaction with certain characteristics that the IRS has identified as having a potential for tax avoidance or evasion.

Q: What information is required to be reported on Form DTF-664?

A: Form DTF-664 requires information about the material advisor, the reportable transaction, and any related parties, among other details.

Q: When is Form DTF-664 due?

A: Form DTF-664 is generally due by the last day of the month following the month in which the person became a material advisor or became a material adviser with respect to the reportable transaction.

Q: Is there a penalty for failing to file Form DTF-664?

A: Yes, there is a penalty for failing to file Form DTF-664 in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-664 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.