This version of the form is not currently in use and is provided for reference only. Download this version of

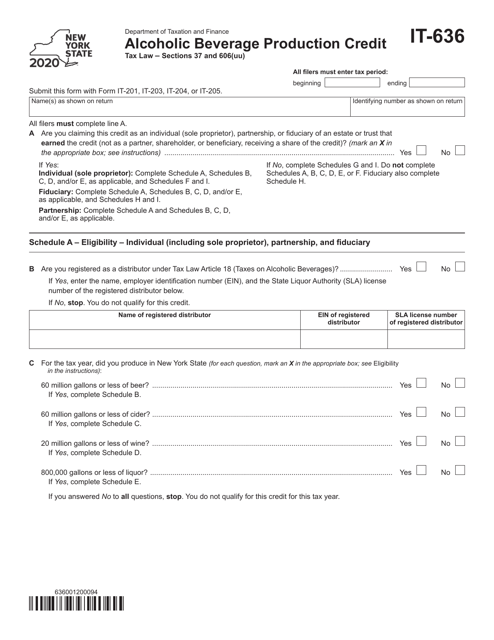

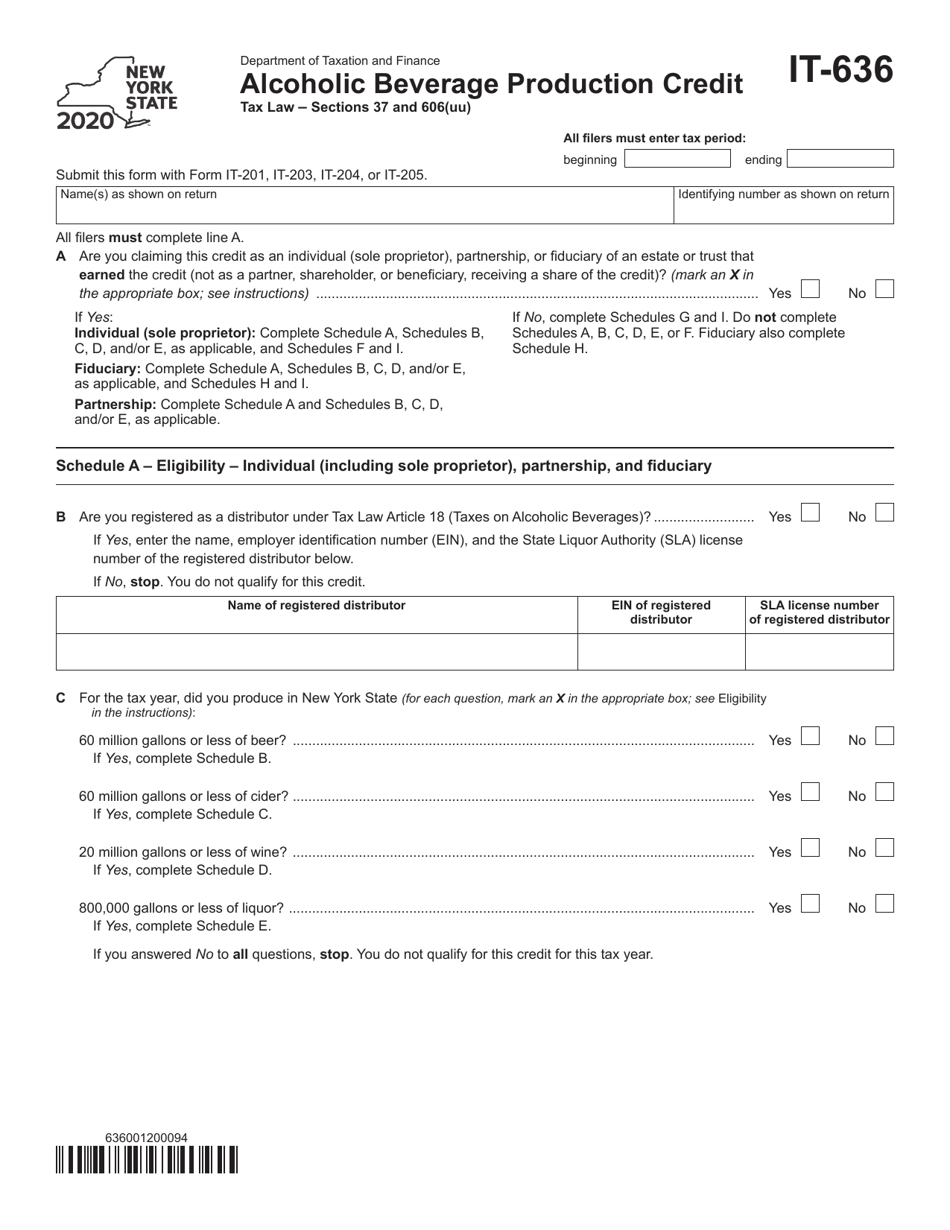

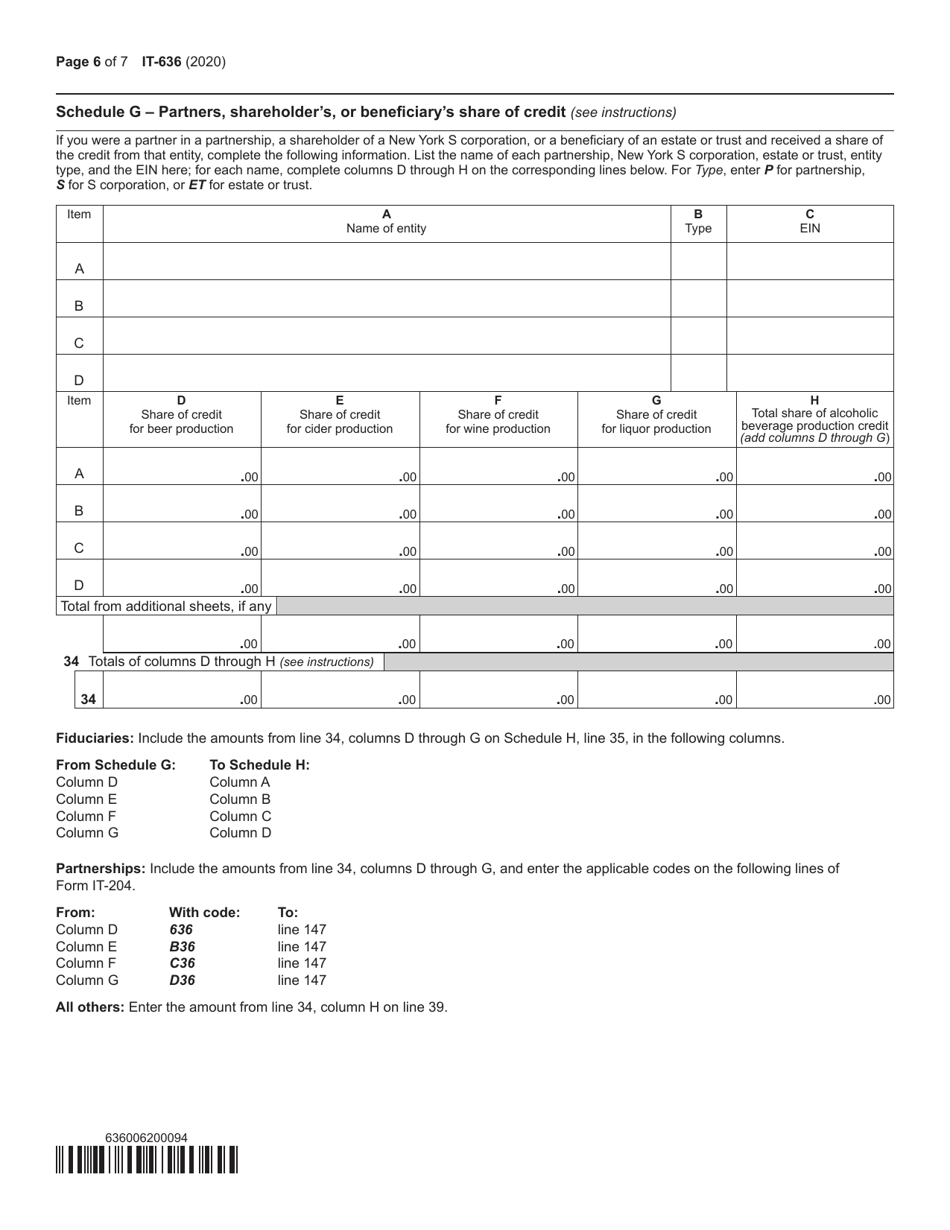

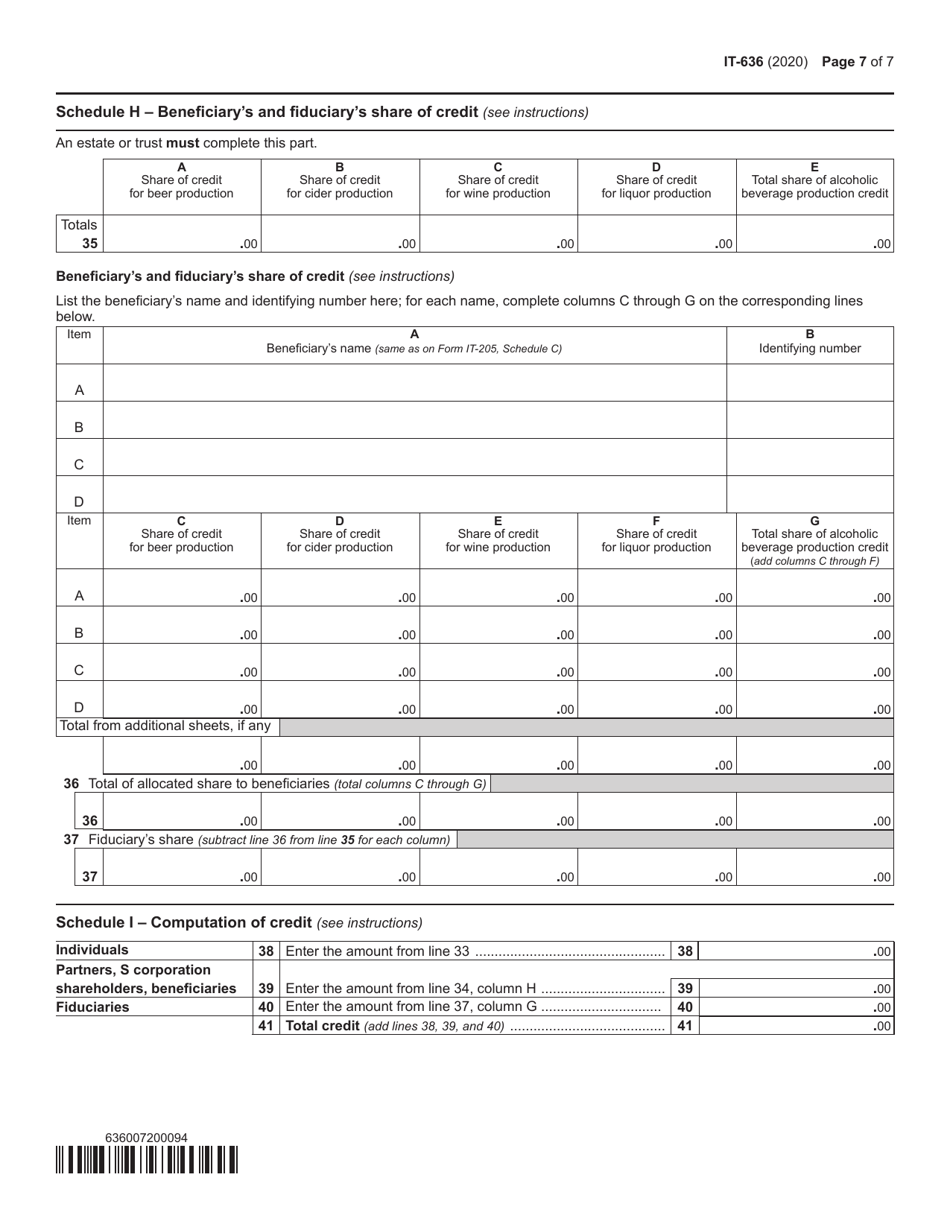

Form IT-636

for the current year.

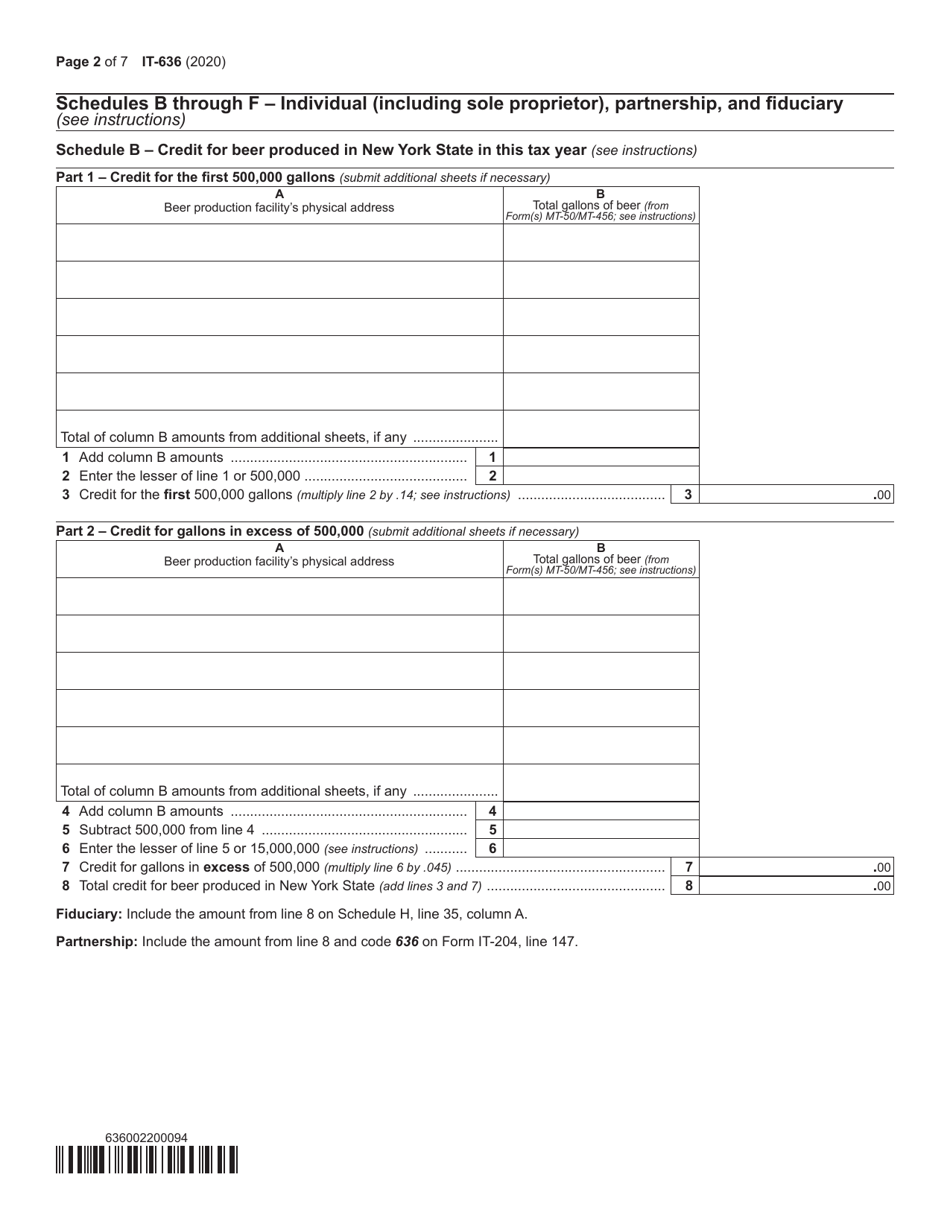

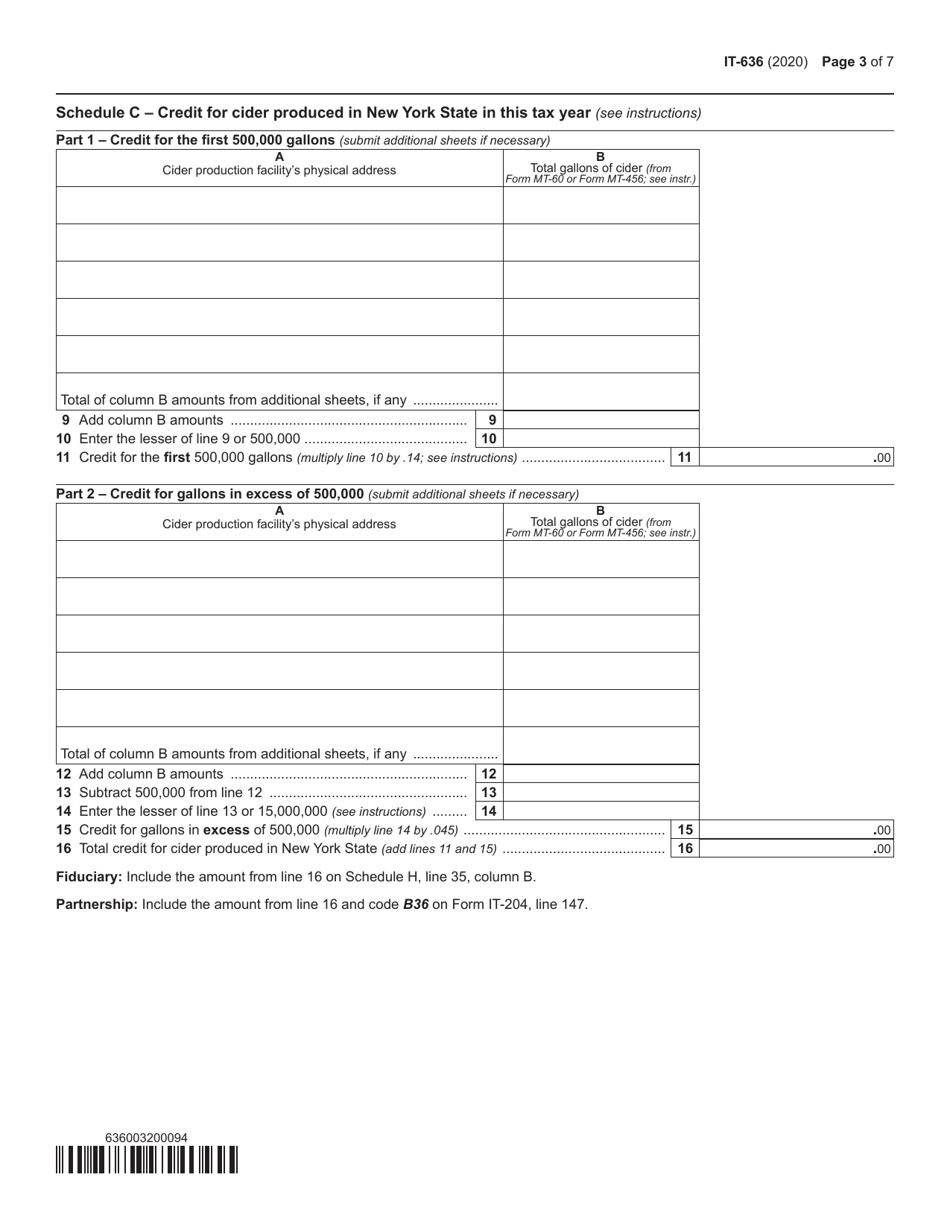

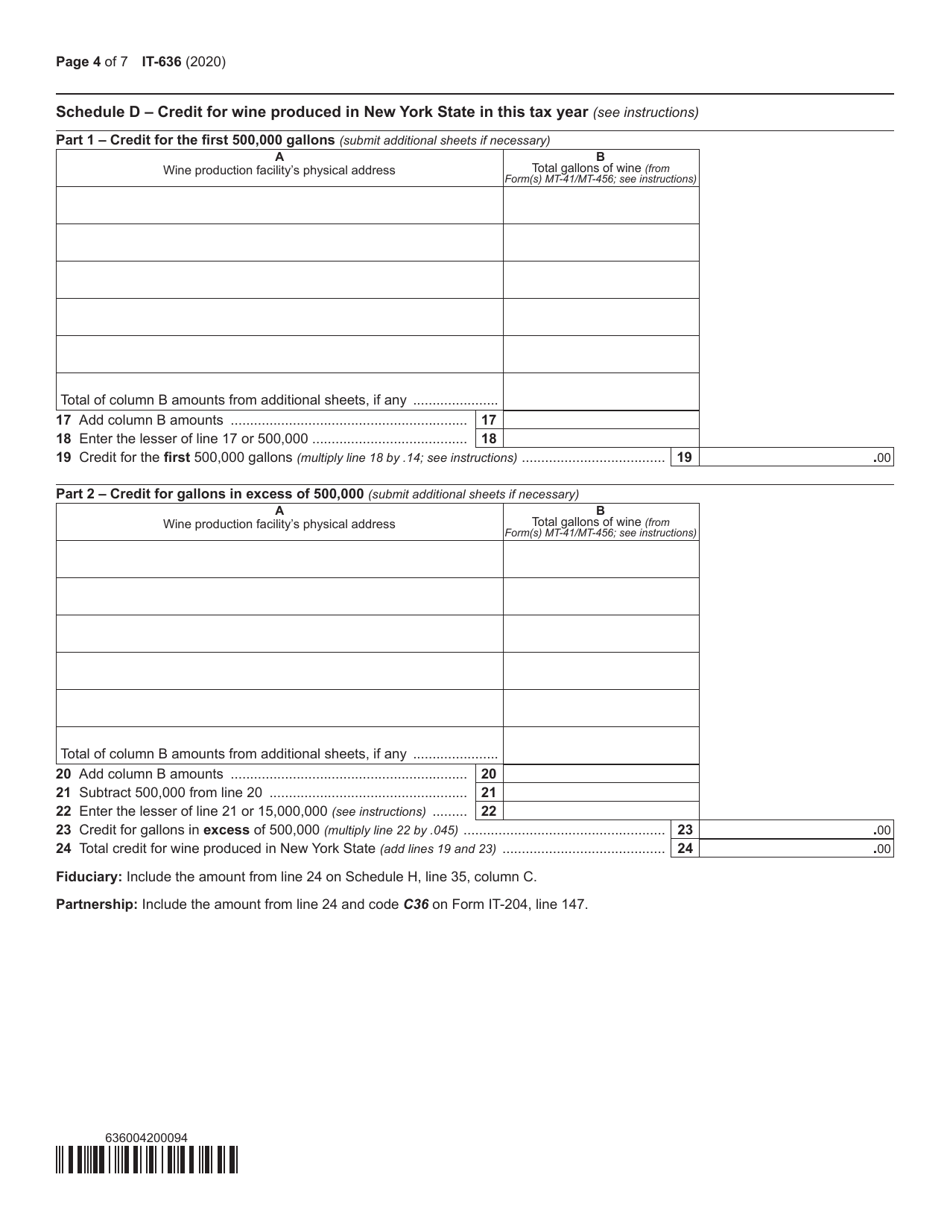

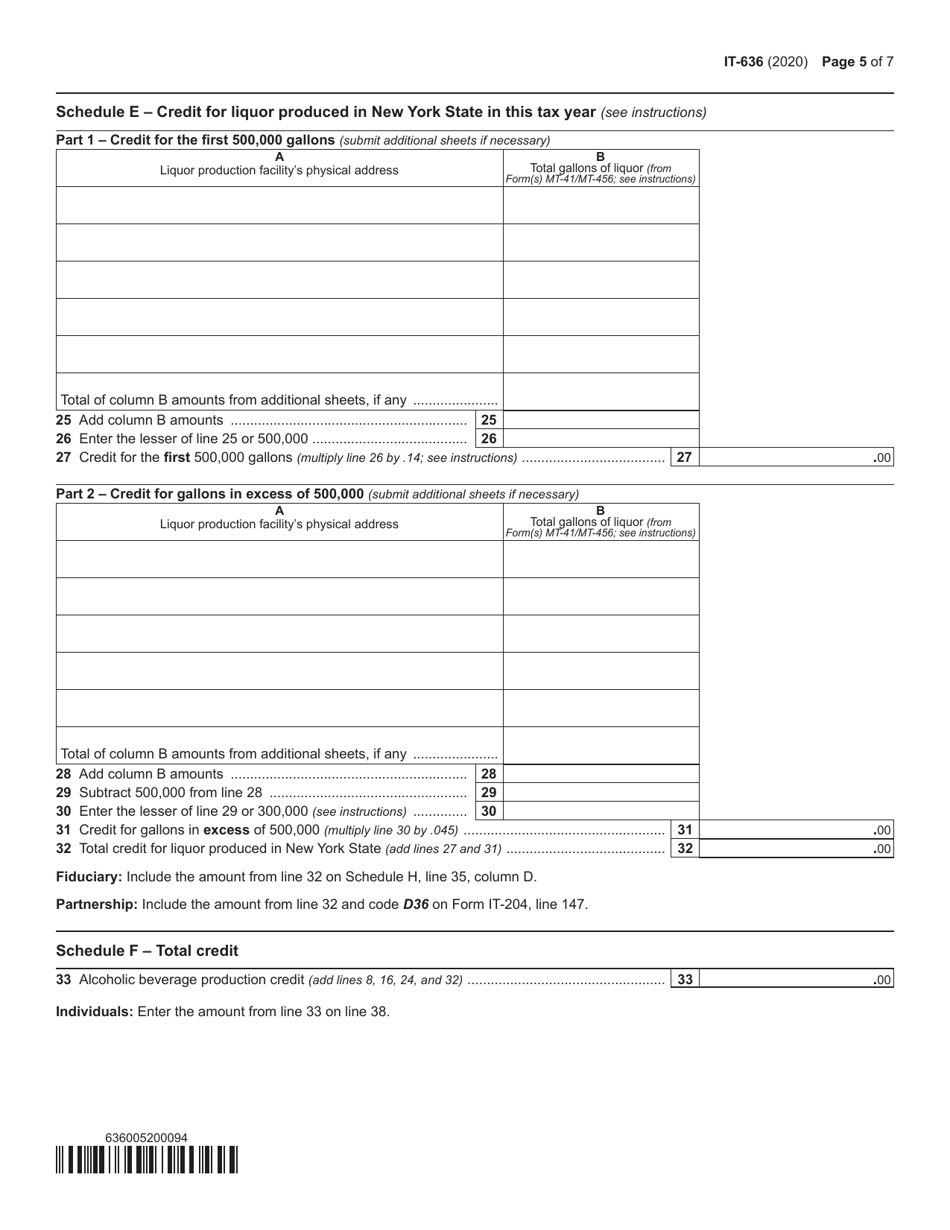

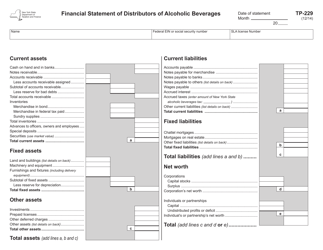

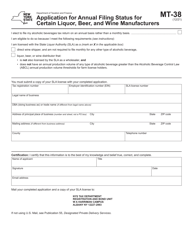

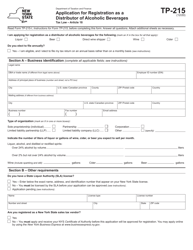

Form IT-636 Alcoholic Beverage Production Credit - New York

What Is Form IT-636?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-636?

A: Form IT-636 is a tax form used in New York for claiming the Alcoholic Beverage Production Credit.

Q: What is the Alcoholic Beverage Production Credit?

A: The Alcoholic Beverage Production Credit is a tax credit available to eligible producers of alcoholic beverages in New York.

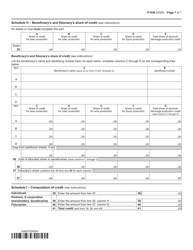

Q: Who is eligible to claim the Alcoholic Beverage Production Credit?

A: Eligible producers of beer, cider, wine, or liquor in New York may claim the Alcoholic Beverage Production Credit.

Q: How do I claim the Alcoholic Beverage Production Credit?

A: To claim the Alcoholic Beverage Production Credit, you must complete and file Form IT-636 with the New York Department of Taxation and Finance.

Q: What is the deadline for filing Form IT-636?

A: The deadline for filing Form IT-636 is the same as the deadline for filing your New York state tax return, which is usually April 15th.

Q: Is there a fee for filing Form IT-636?

A: No, there is no fee for filing Form IT-636.

Q: Can I e-file Form IT-636?

A: Yes, you can e-file Form IT-636 using approved tax software or through a tax professional.

Q: Can I amend my Form IT-636?

A: Yes, you can file an amended Form IT-636 if you need to make changes or corrections to your original filing.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-636 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.