This version of the form is not currently in use and is provided for reference only. Download this version of

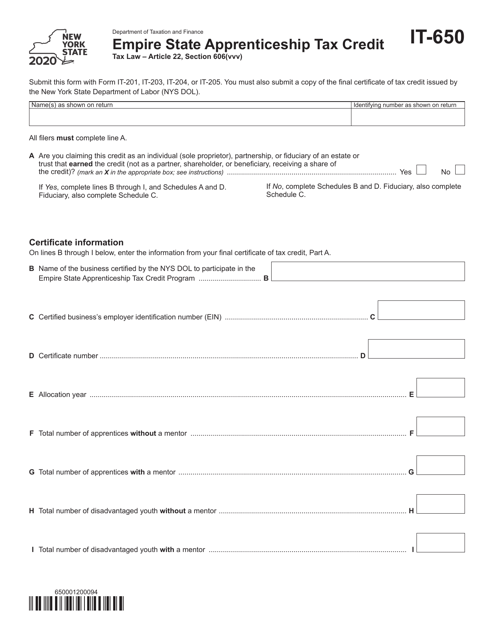

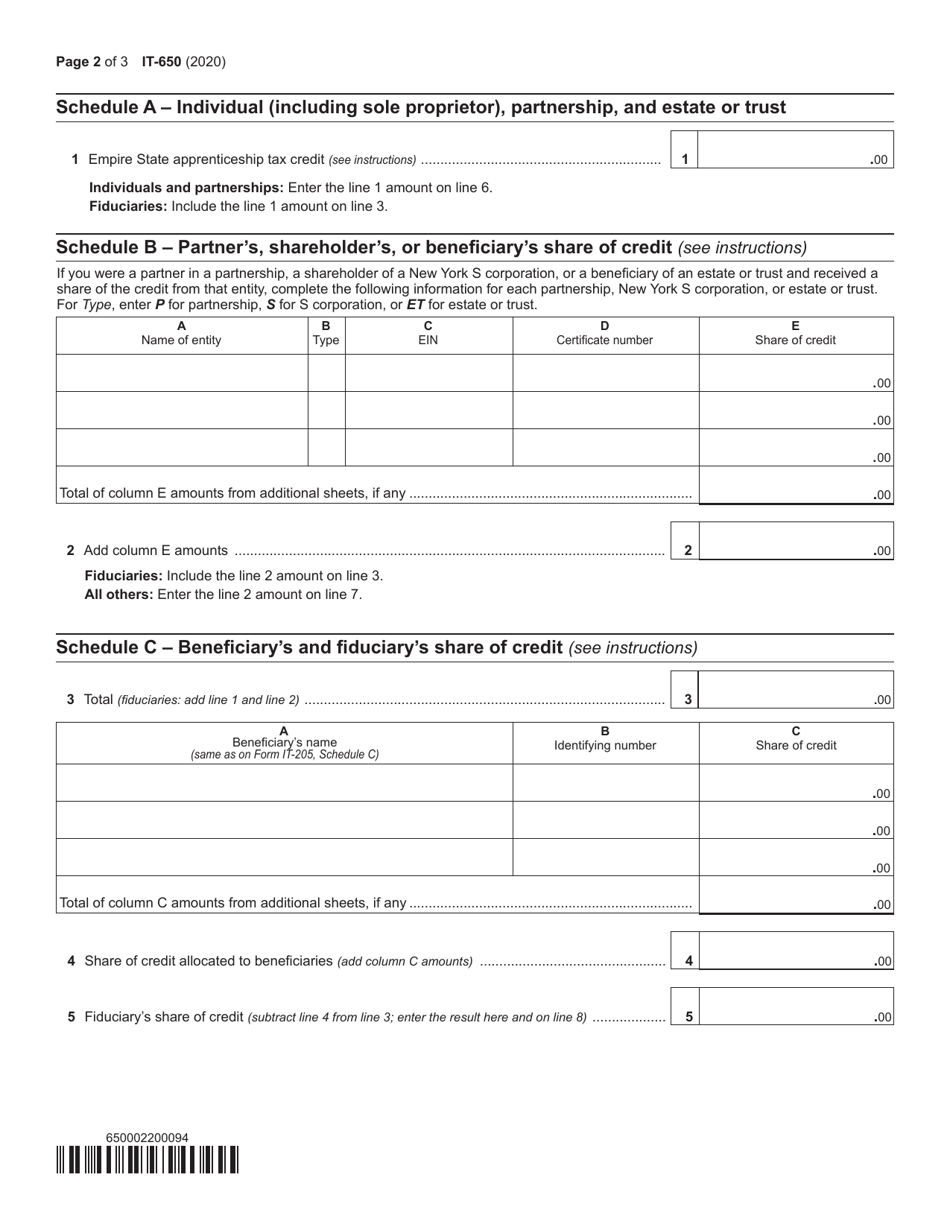

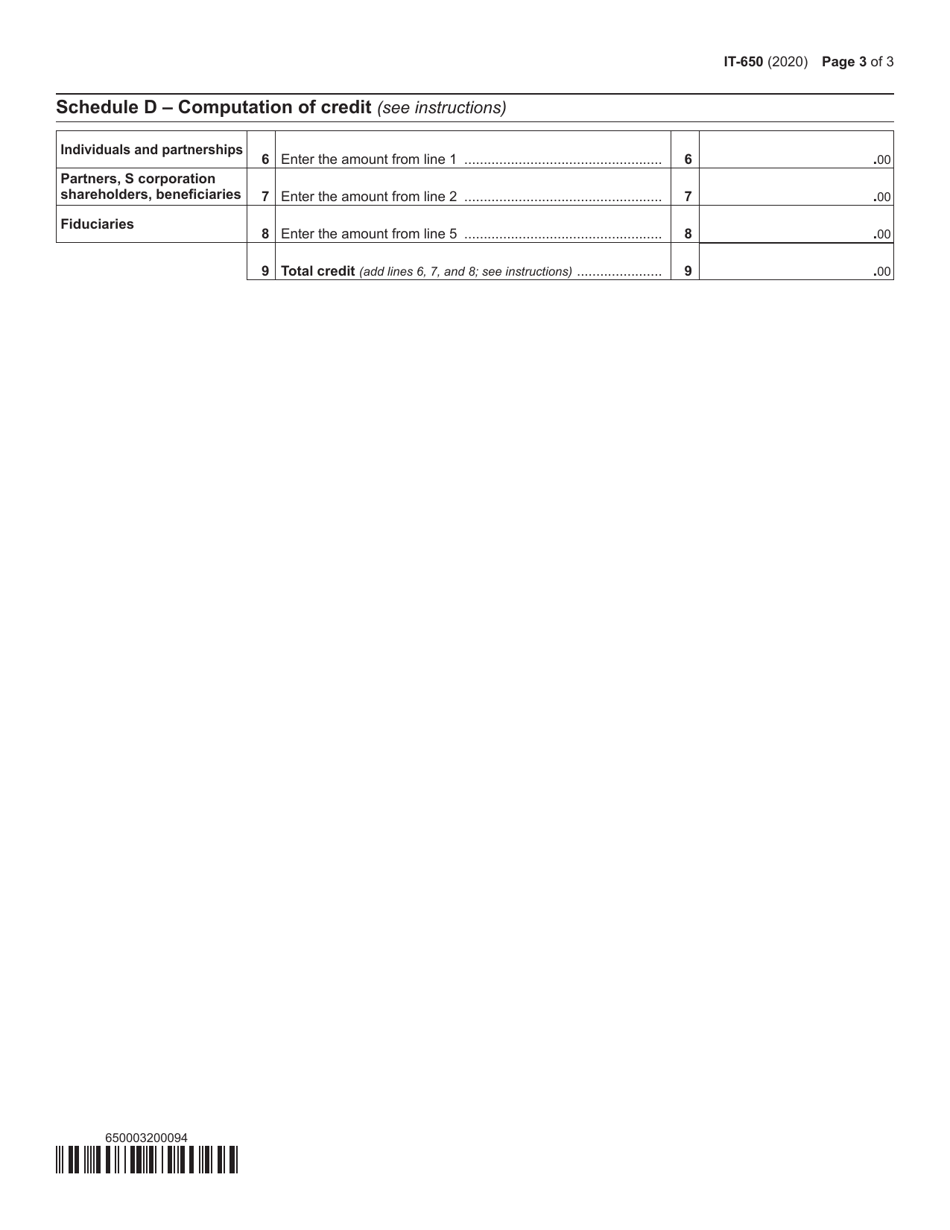

Form IT-650

for the current year.

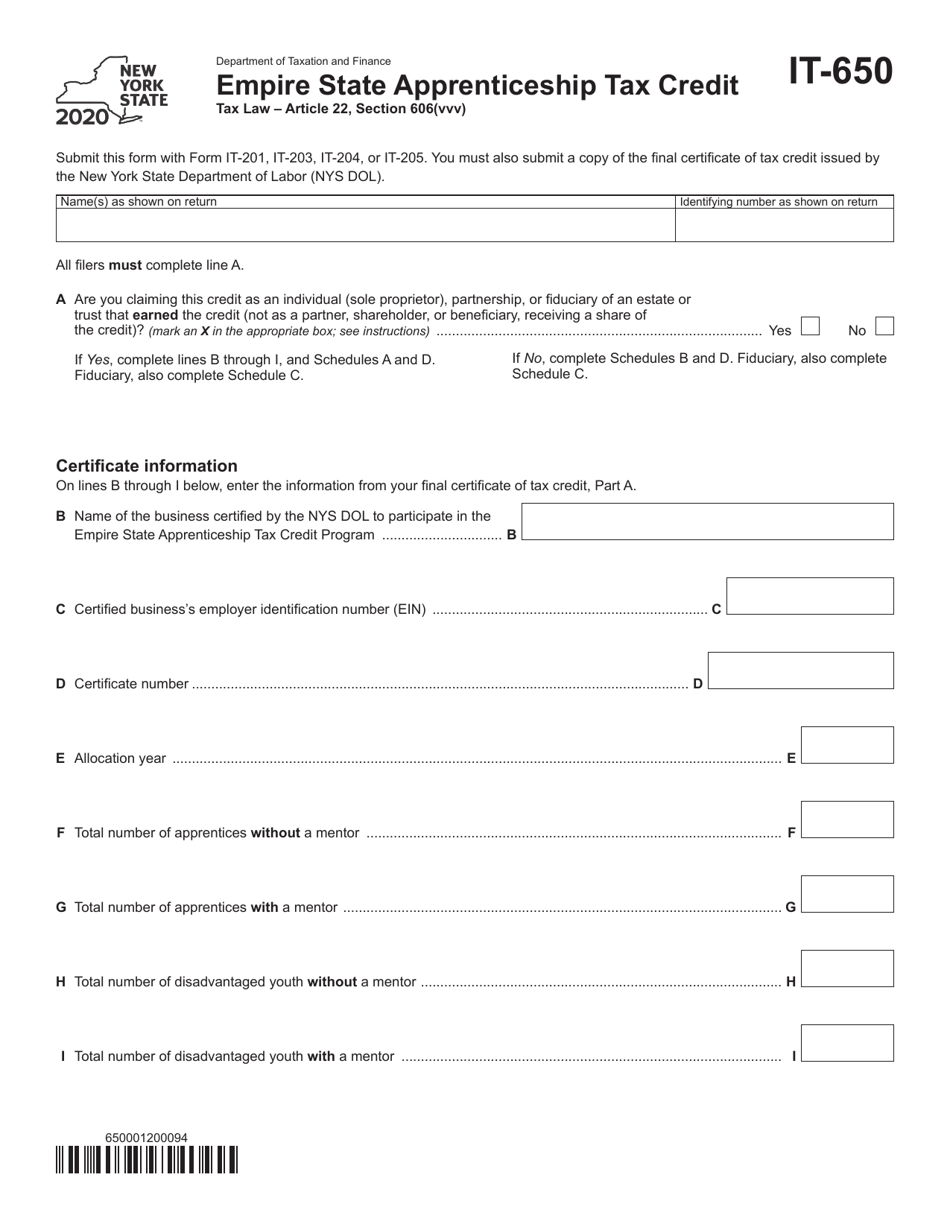

Form IT-650 Empire State Apprenticeship Tax Credit - New York

What Is Form IT-650?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-650?

A: Form IT-650 is the Empire StateApprenticeship Tax Credit form for the state of New York.

Q: What is the Empire State Apprenticeship Tax Credit?

A: The Empire State Apprenticeship Tax Credit is a tax credit available to employers in New York who hire and train apprentices.

Q: Who is eligible for the Empire State Apprenticeship Tax Credit?

A: Employers in New York who hire and train eligible apprentices are eligible for the tax credit.

Q: How can I claim the Empire State Apprenticeship Tax Credit?

A: You can claim the tax credit by completing and filing Form IT-650 with the New York State Department of Taxation and Finance.

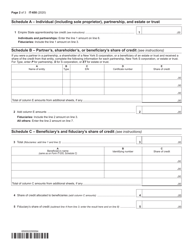

Q: What information do I need to provide when filling out Form IT-650?

A: You will need to provide information about your business, the apprentices you hired and trained, and the number of hours they worked.

Q: Is there a deadline for filing Form IT-650?

A: Yes, Form IT-650 must be filed annually by the employer no later than the due date of their franchise tax return for the taxable year.

Q: Are there any other requirements to be eligible for the Empire State Apprenticeship Tax Credit?

A: Yes, in addition to hiring and training eligible apprentices, employers must also comply with the requirements of the New York State Department of Labor's Registered Apprenticeship Program.

Q: What is the benefit of claiming the Empire State Apprenticeship Tax Credit?

A: Claiming the tax credit can reduce the employer's tax liability and provide financial incentives for hiring and training apprentices in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-650 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.