This version of the form is not currently in use and is provided for reference only. Download this version of

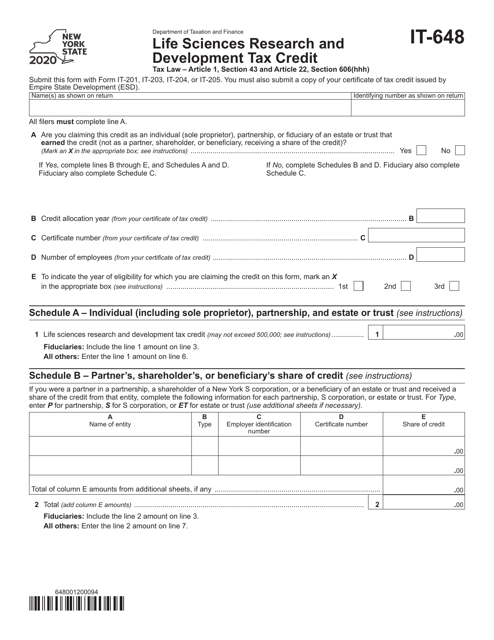

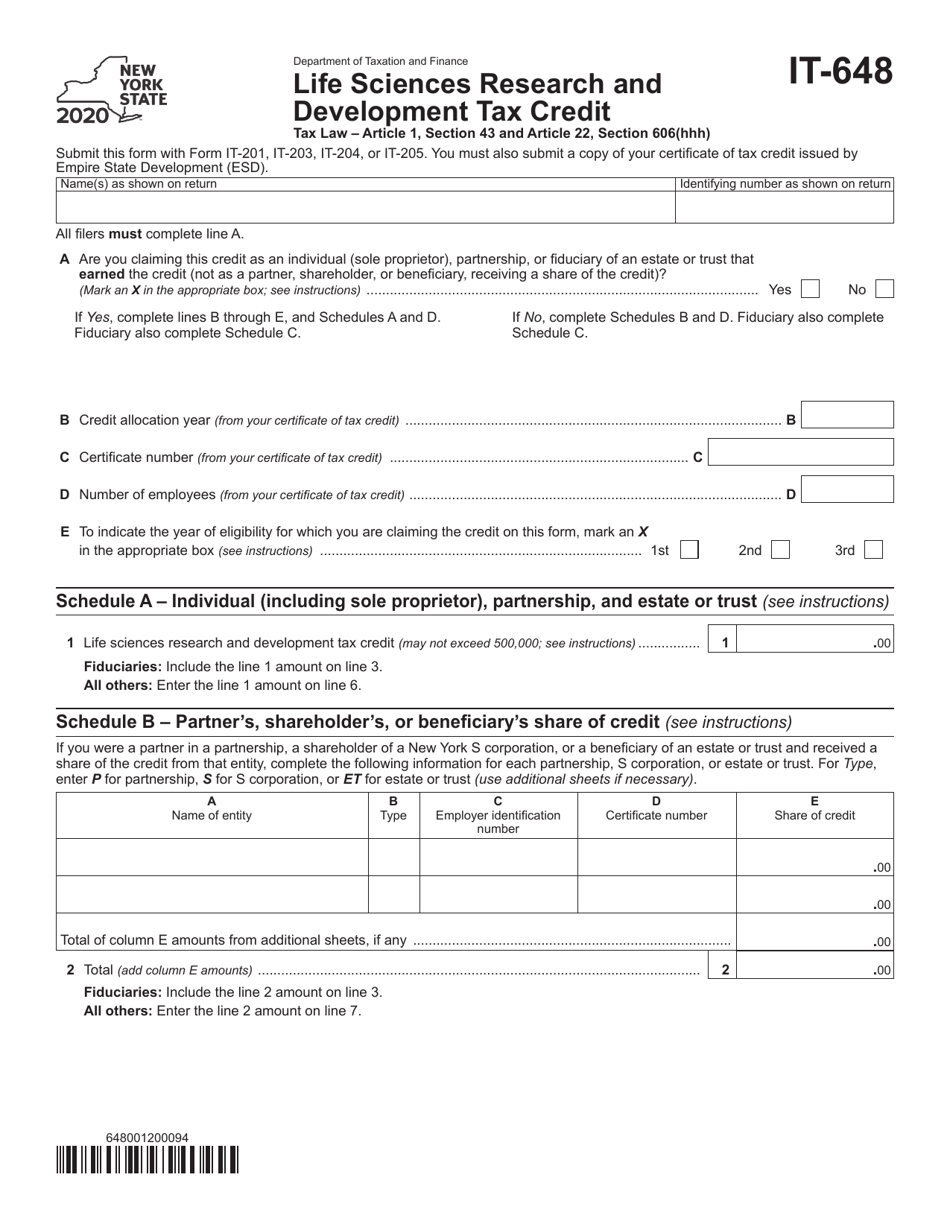

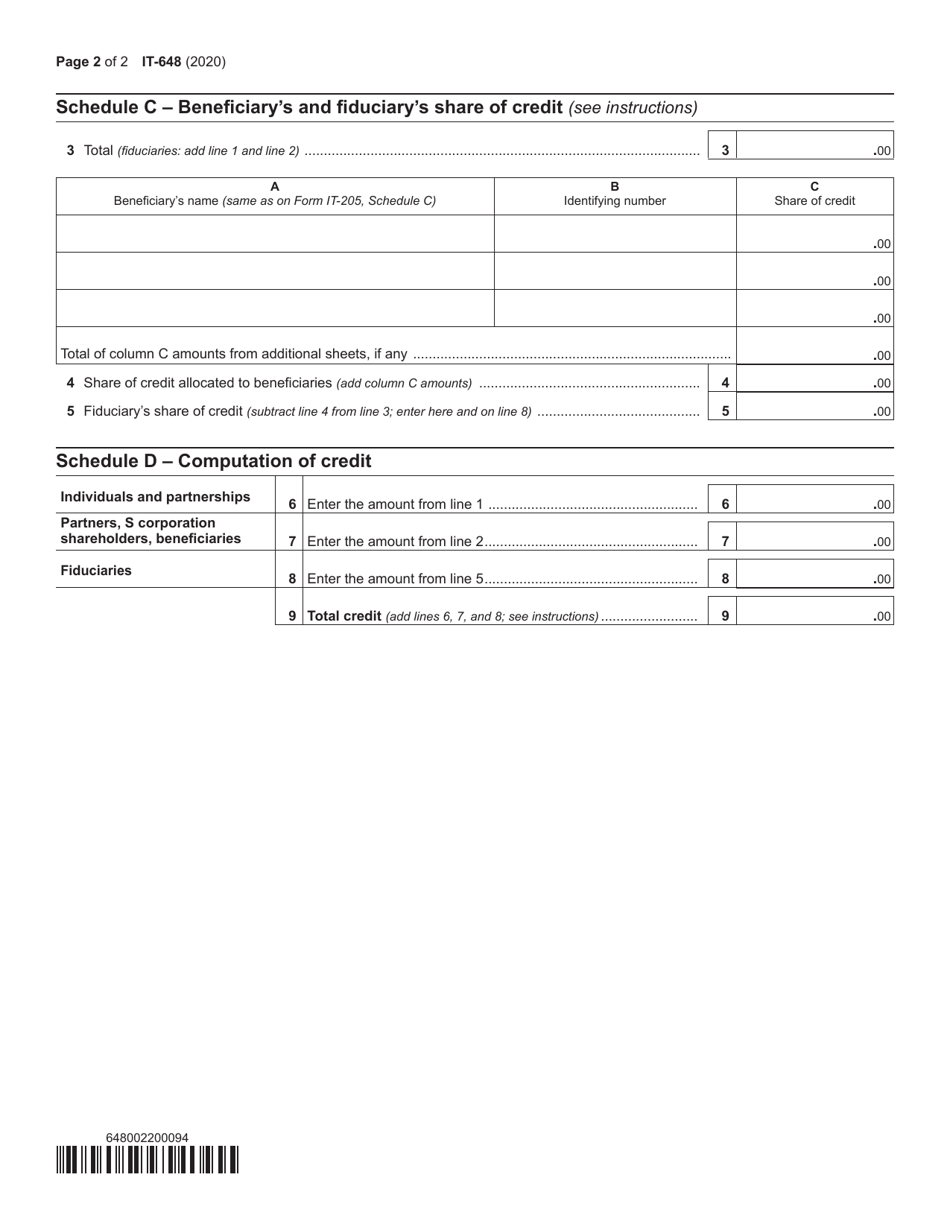

Form IT-648

for the current year.

Form IT-648 Life Sciences Research and Development Tax Credit - New York

What Is Form IT-648?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-648?

A: Form IT-648 is the Life Sciences Research and Development Tax Credit form for New York.

Q: Who is eligible to use Form IT-648?

A: Companies engaged in life sciences research and development in New York may be eligible to use Form IT-648.

Q: What is the purpose of Form IT-648?

A: Form IT-648 is used to claim the Life Sciences Research and Development Tax Credit in New York.

Q: What is the Life Sciences Research and Development Tax Credit?

A: The Life Sciences Research and Development Tax Credit is a tax incentive program designed to encourage companies involved in life sciences research and development in New York.

Q: What expenses can be claimed on Form IT-648?

A: Qualified research expenses related to life sciences research and development can be claimed on Form IT-648.

Q: How do I file Form IT-648?

A: Form IT-648 should be filed with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for filing Form IT-648?

A: Yes, Form IT-648 must be filed by the due date of the company's New York State tax return.

Q: Is the Life Sciences Research and Development Tax Credit refundable?

A: Yes, the Life Sciences Research and Development Tax Credit is refundable.

Q: Can the Life Sciences Research and Development Tax Credit be carried forward or transferred?

A: Yes, unused credits can be carried forward for up to 15 years or transferred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-648 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.