This version of the form is not currently in use and is provided for reference only. Download this version of

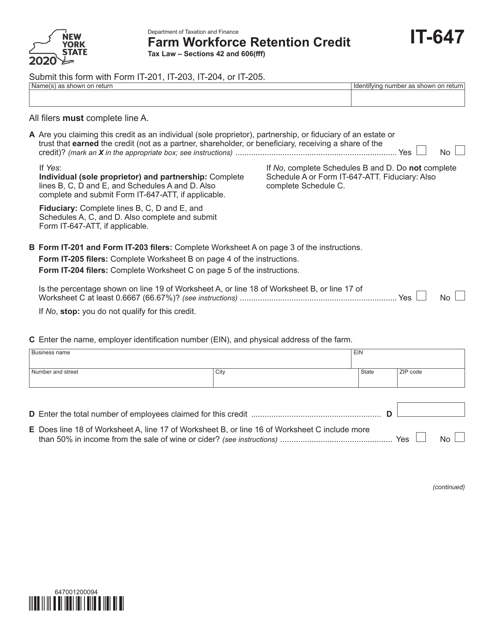

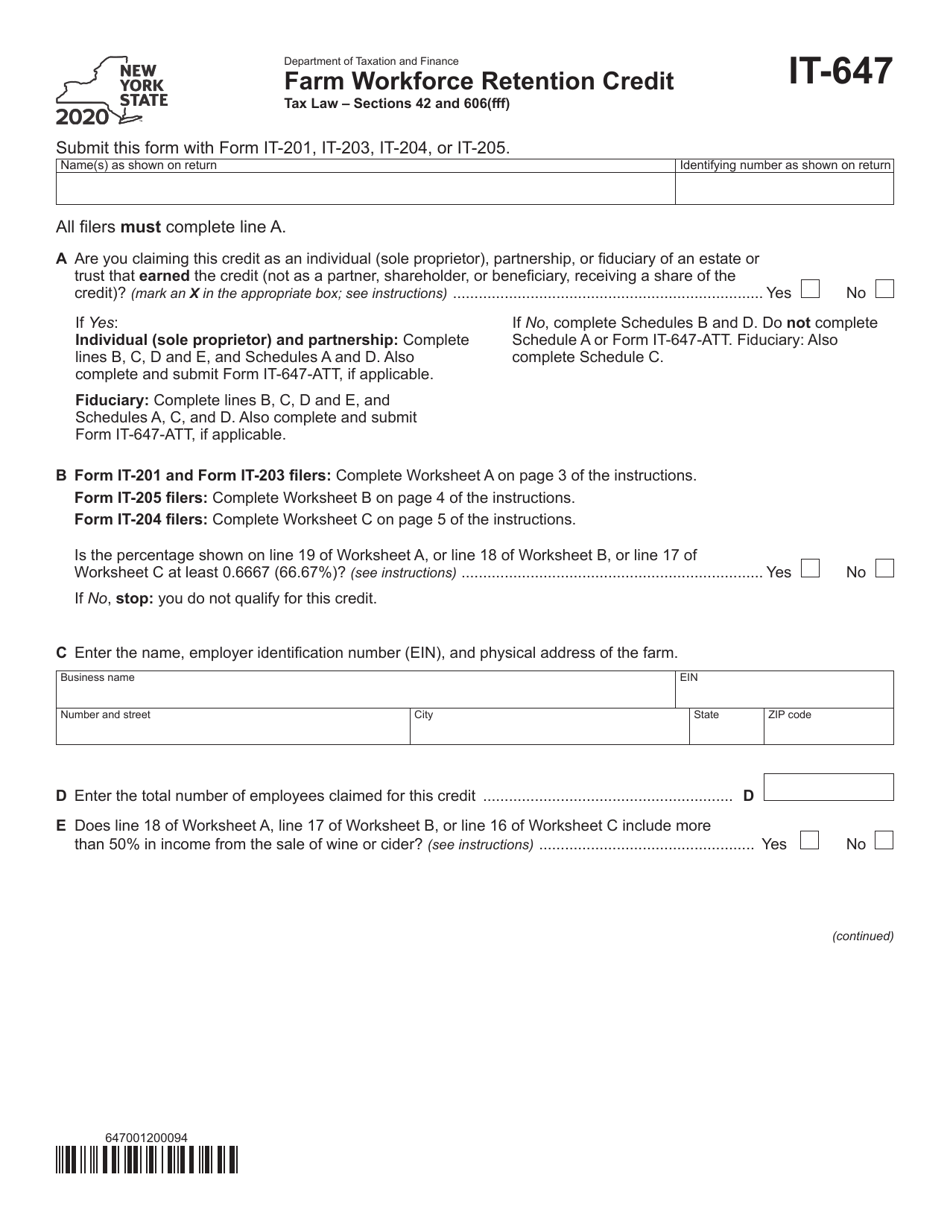

Form IT-647

for the current year.

Form IT-647 Farm Workforce Retention Credit - New York

What Is Form IT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647?

A: Form IT-647 is a tax form used to claim the Farm Workforce Retention Credit in New York.

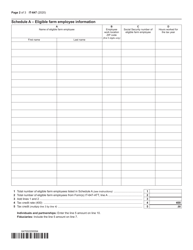

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to agricultural employers in New York to offset labor costs.

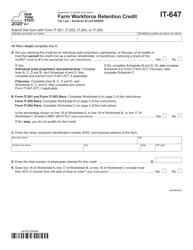

Q: Who is eligible to claim the Farm Workforce Retention Credit?

A: Agricultural employers in New York who meet certain criteria, such as employing eligible farm laborers, are eligible to claim this credit.

Q: What is the purpose of the Farm Workforce Retention Credit?

A: The purpose of the credit is to help agricultural employers offset their labor costs and encourage the retention of farm laborers.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.