This version of the form is not currently in use and is provided for reference only. Download this version of

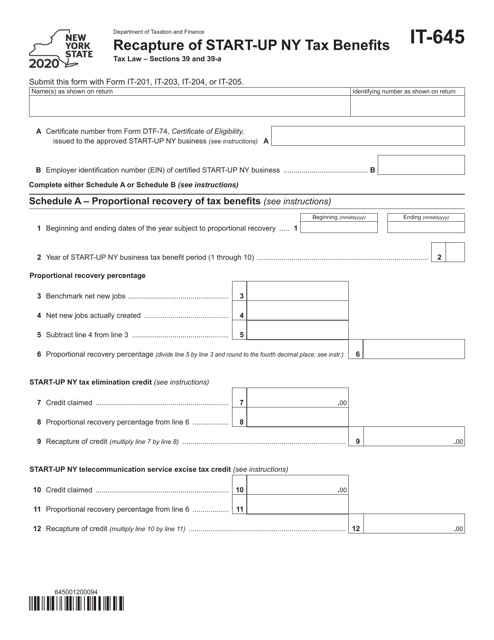

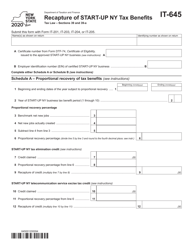

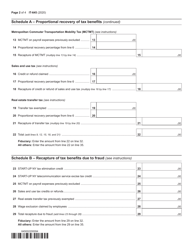

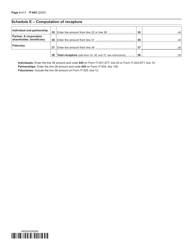

Form IT-645

for the current year.

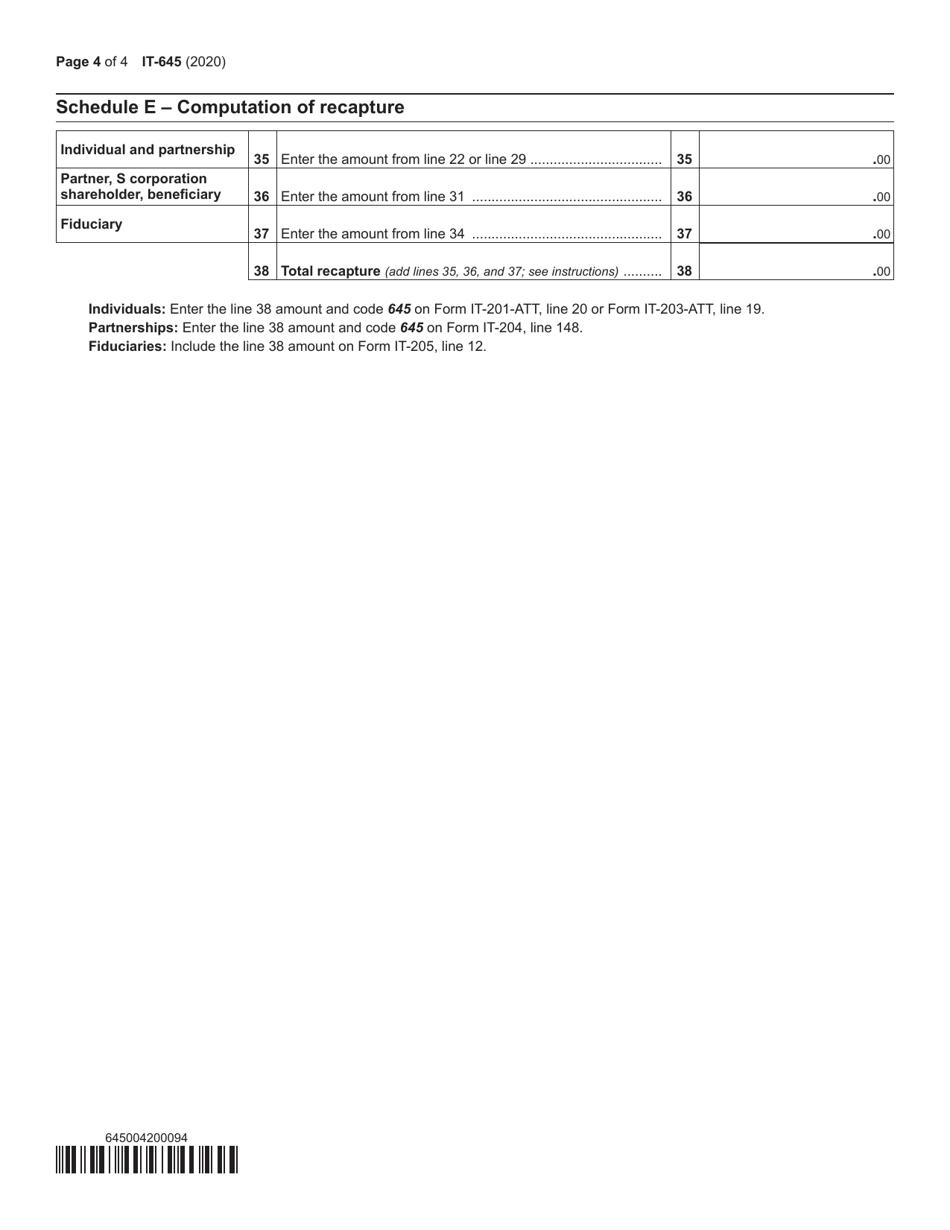

Form IT-645 Recapture of Start-Up Ny Tax Benefits - New York

What Is Form IT-645?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-645?

A: Form IT-645 is the Recapture of Start-Up NY Tax Benefits form specific to New York.

Q: What does Form IT-645 do?

A: Form IT-645 is used to recapture or recover tax benefits that were claimed under the Start-Up NY program.

Q: What is the Start-Up NY program?

A: Start-Up NY is a program in New York that offers tax incentives to businesses that locate or expand in certain designated areas in the state.

Q: Who needs to file Form IT-645?

A: Businesses that have claimed tax benefits under the Start-Up NY program and no longer meet the program's requirements may need to file Form IT-645 to recapture those benefits.

Q: Why would I need to recapture tax benefits?

A: You would need to recapture tax benefits if your business no longer meets the requirements of the Start-Up NY program, such as if you have relocated to a non-qualifying area or no longer meet the employment obligations.

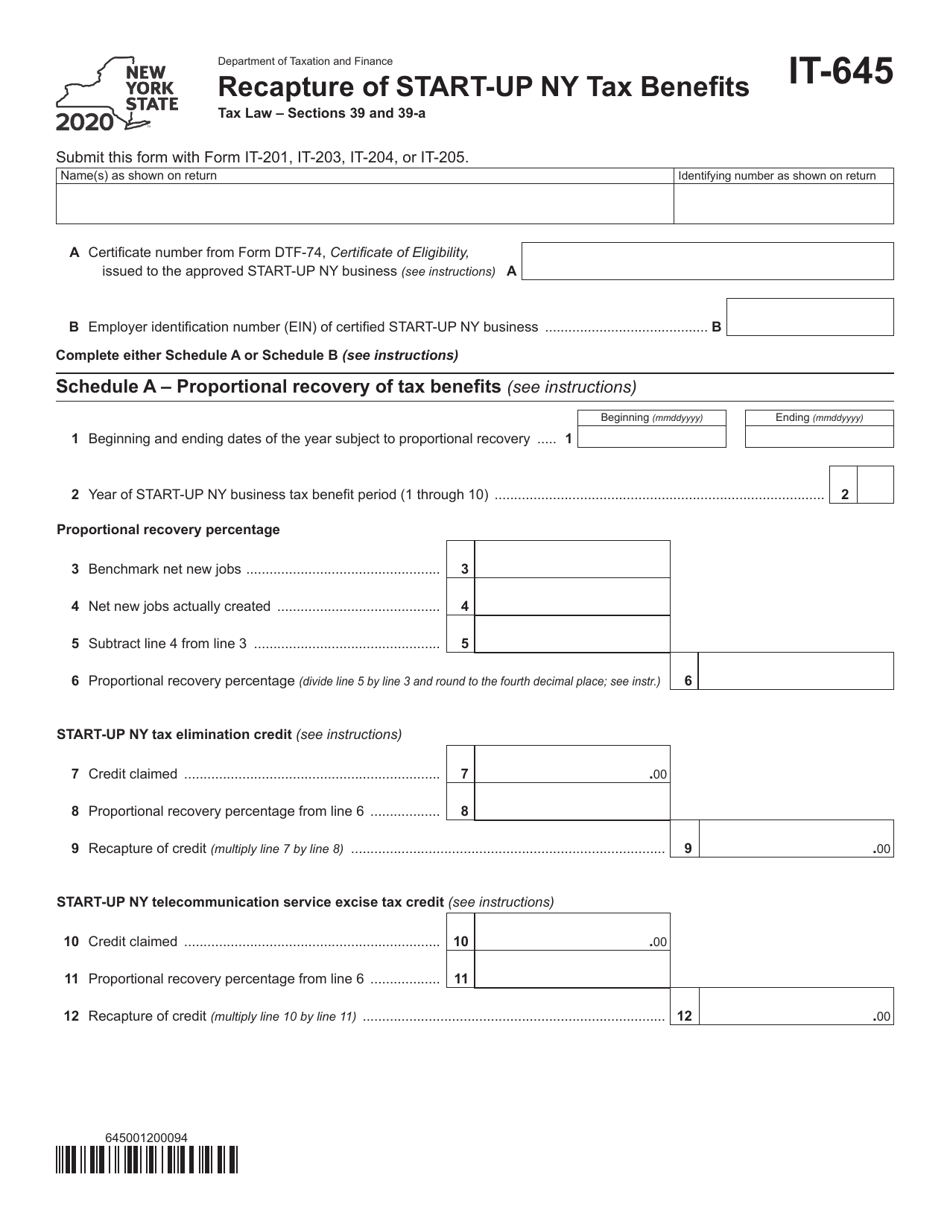

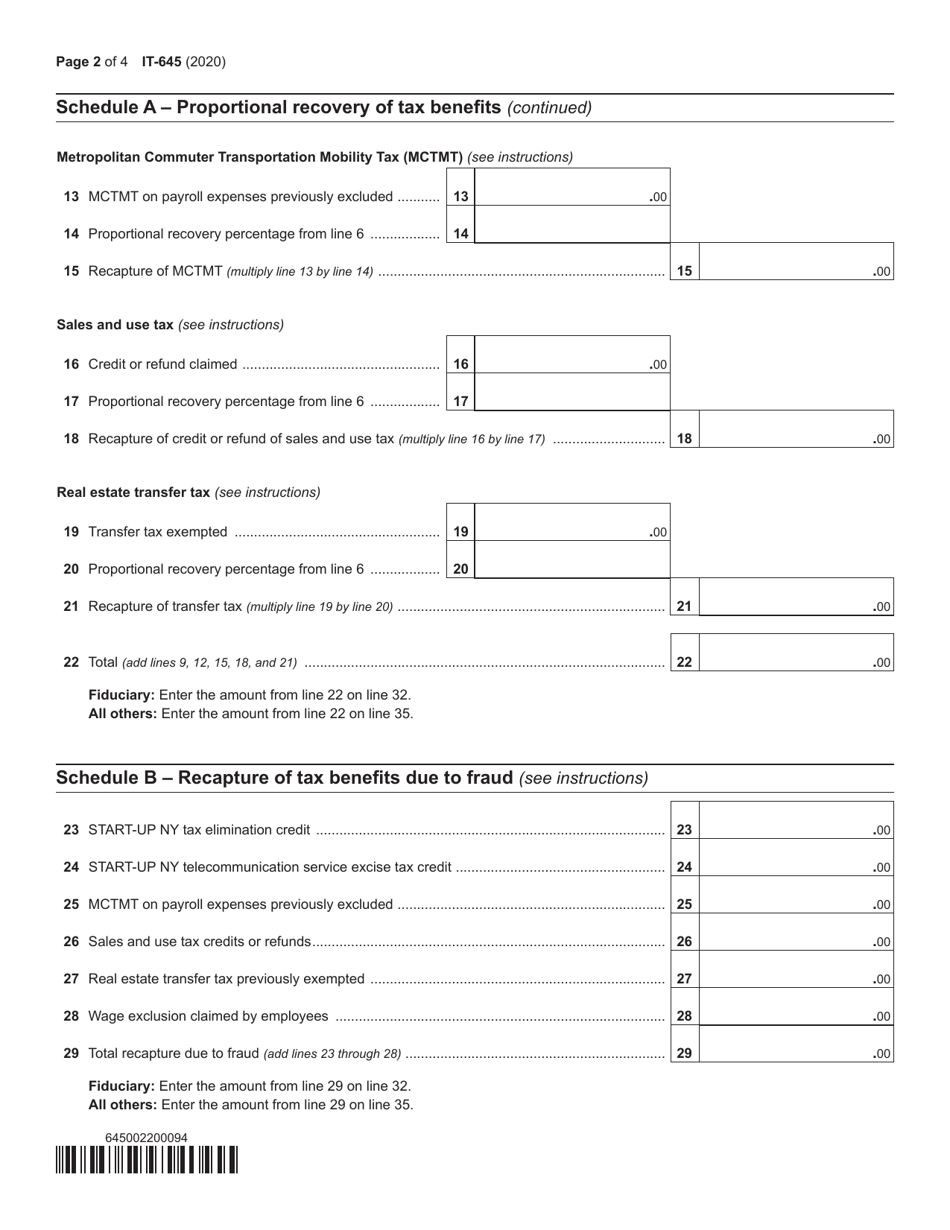

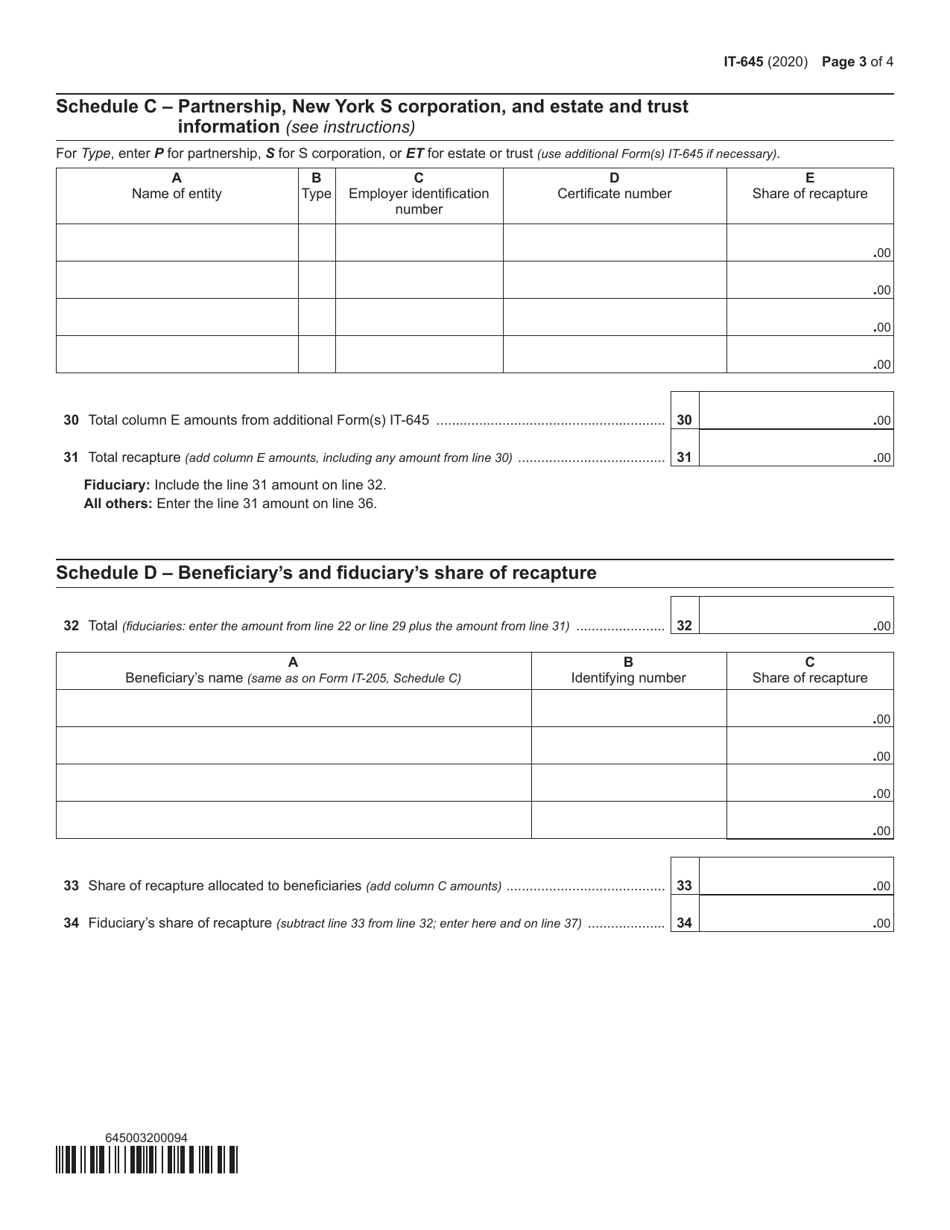

Q: What information do I need to provide on Form IT-645?

A: You will need to provide details about your business, the tax benefits previously claimed, and the reason for recapture.

Q: When is the deadline to file Form IT-645?

A: The deadline to file Form IT-645 is generally the same as the deadline for filing your New York State business tax return.

Q: Is there a fee for filing Form IT-645?

A: There is no fee for filing Form IT-645.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-645 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.