This version of the form is not currently in use and is provided for reference only. Download this version of

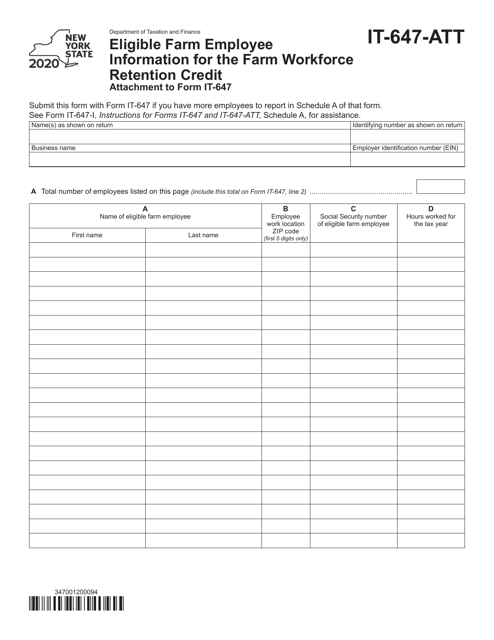

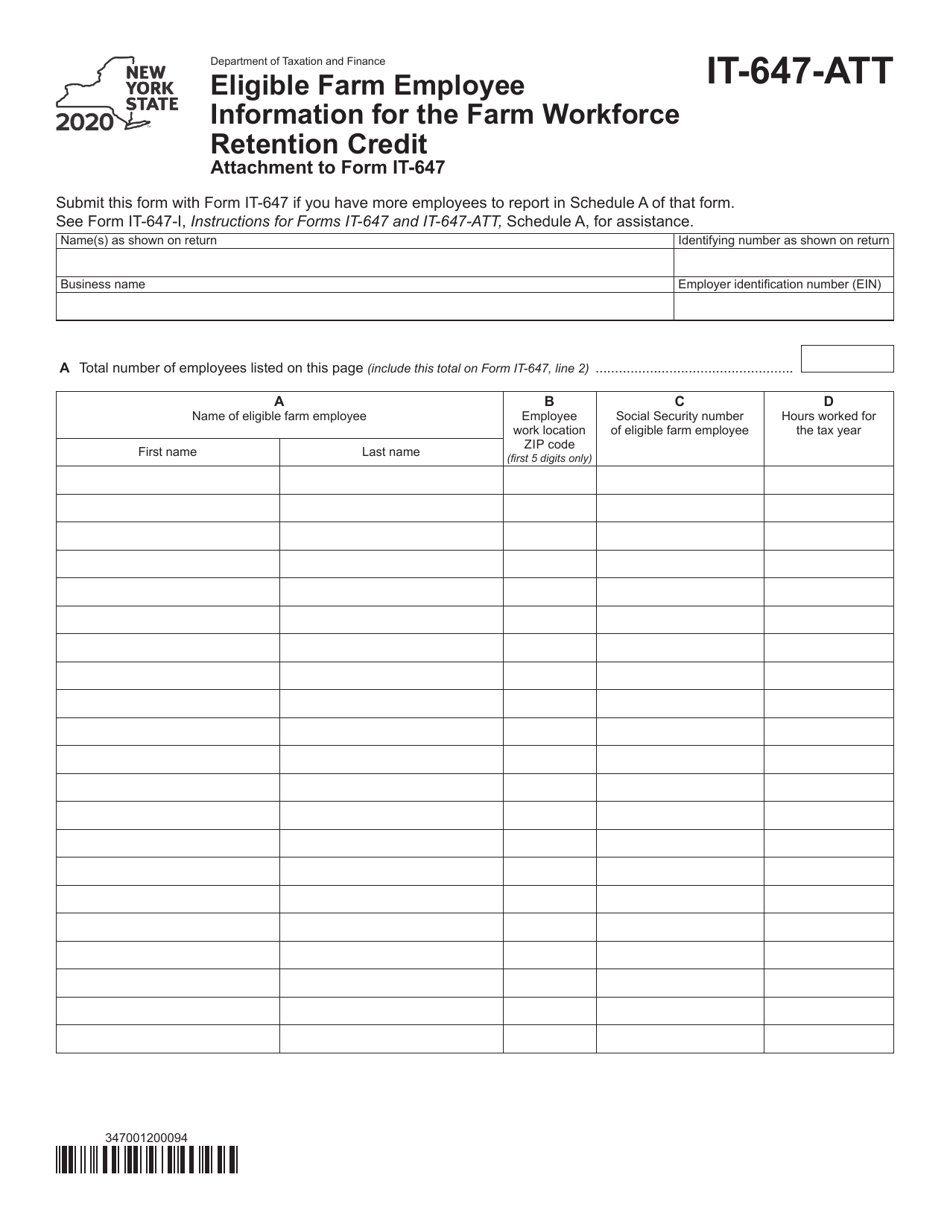

Form IT-647-ATT

for the current year.

Form IT-647-ATT Eligible Farm Employee Information for the Farm Workforce Retention Credit - New York

What Is Form IT-647-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647-ATT?

A: Form IT-647-ATT is a form used in New York to provide information about eligible farm employees for the Farm Workforce Retention Credit.

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to eligible farmers in New York.

Q: Who is eligible for the Farm Workforce Retention Credit?

A: Farmers in New York who meet certain criteria may be eligible for the credit.

Q: What information is required on Form IT-647-ATT?

A: Form IT-647-ATT requires information about eligible farm employees, such as their names, social security numbers, and wages.

Q: When is the deadline to file Form IT-647-ATT?

A: The deadline to file Form IT-647-ATT is usually the same as the deadline for filing your annual New York state tax return.

Q: Can I claim the Farm Workforce Retention Credit if I am not a farmer?

A: No, only eligible farmers can claim the Farm Workforce Retention Credit.

Q: Is the Farm Workforce Retention Credit refundable?

A: Yes, the Farm Workforce Retention Credit is refundable, which means you may receive a refund if the credit exceeds your tax liability.

Q: Are there any other requirements to qualify for the Farm Workforce Retention Credit?

A: Yes, in addition to meeting certain criteria, eligible farmers must also obtain a Farm Workforce Retention Credit Certificate from the New York State Department of Agriculture and Markets.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.