This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-642

for the current year.

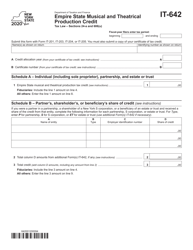

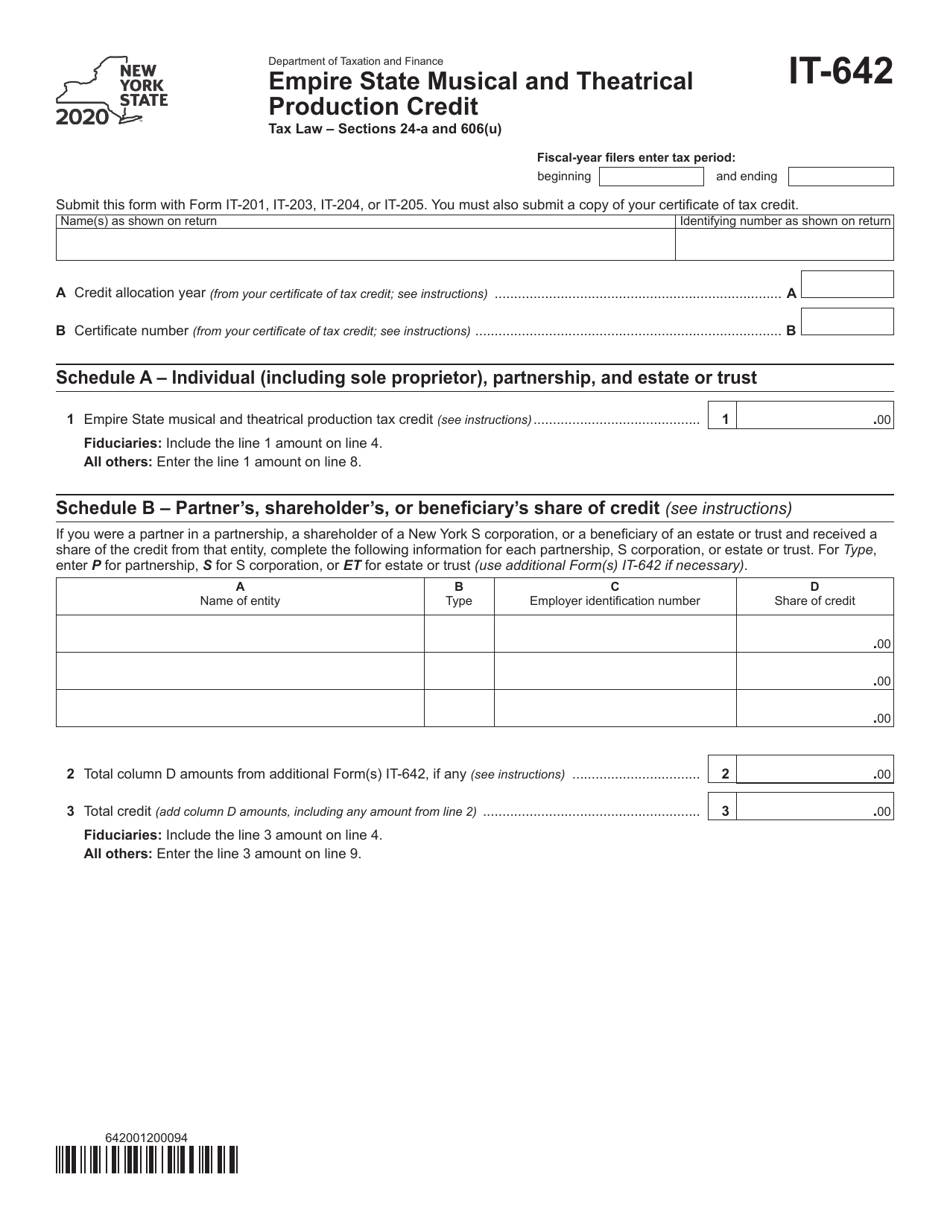

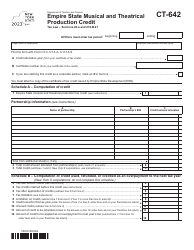

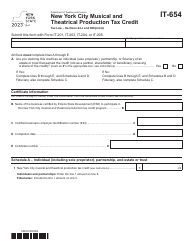

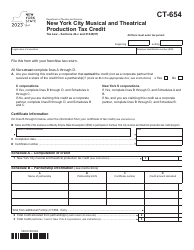

Form IT-642 Empire State Musical and Theatrical Production Credit - New York

What Is Form IT-642?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-642?

A: Form IT-642 is the Empire State Musical and Theatrical Production Credit form in New York.

Q: What is the purpose of Form IT-642?

A: The purpose of Form IT-642 is to claim the Empire State Musical and Theatrical Production Credit in New York.

Q: Who can use Form IT-642?

A: Producers of qualified musical and theatrical productions in New York can use Form IT-642.

Q: What is the Empire State Musical and Theatrical Production Credit?

A: The Empire State Musical and Theatrical Production Credit is a tax credit available to qualified productions in New York.

Q: What are the eligibility requirements for the credit?

A: To be eligible for the credit, the production must meet certain criteria, such as having a minimum budget and employing New York residents.

Q: How do I file Form IT-642?

A: Form IT-642 should be filed with your New York State income tax return.

Q: Is there a deadline to file Form IT-642?

A: Yes, Form IT-642 should be filed by the due date of your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-642 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.