This version of the form is not currently in use and is provided for reference only. Download this version of

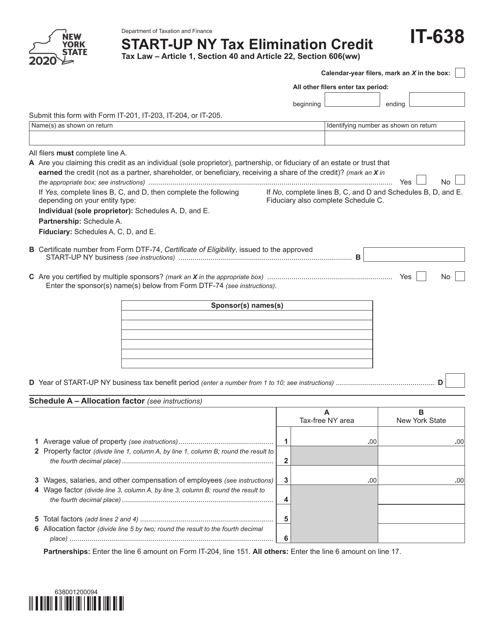

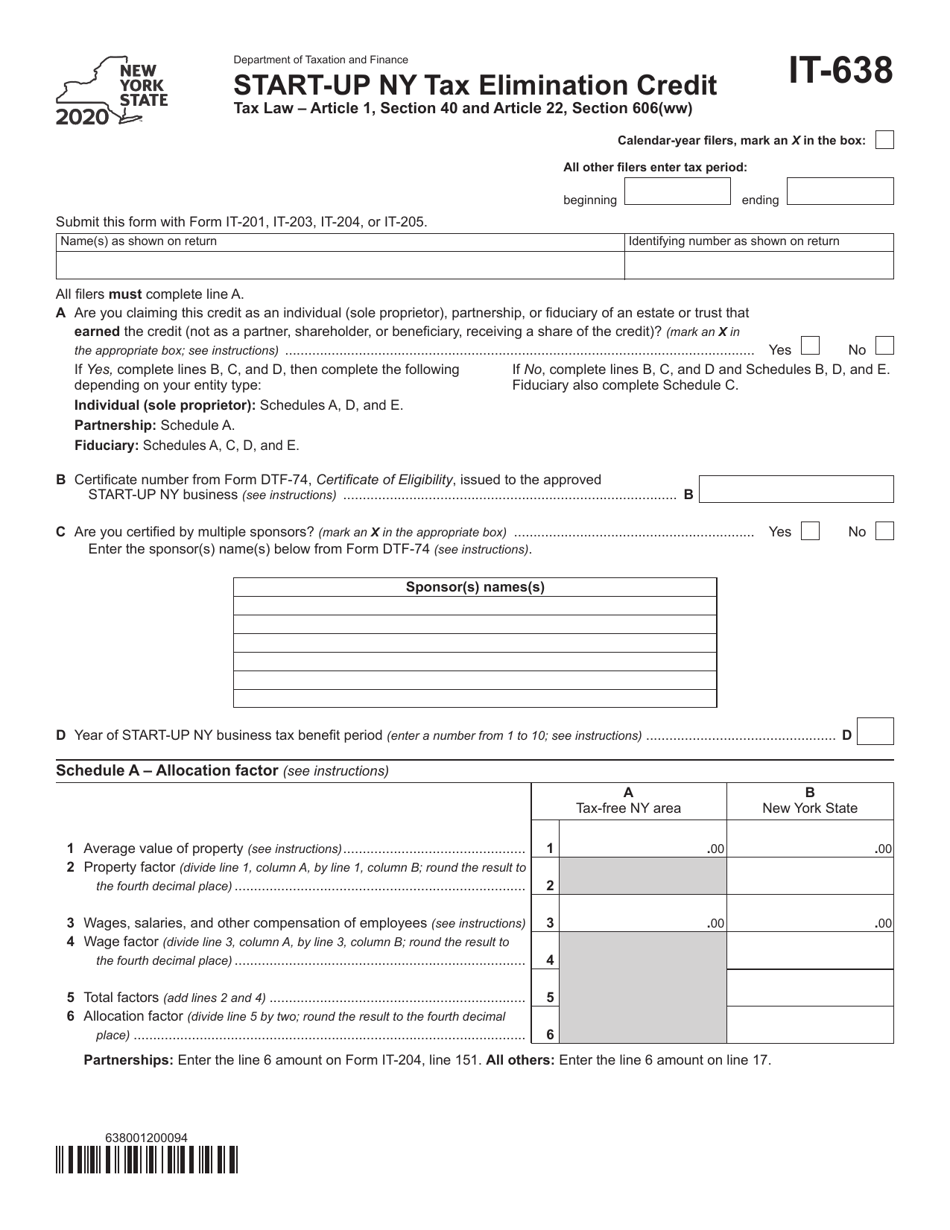

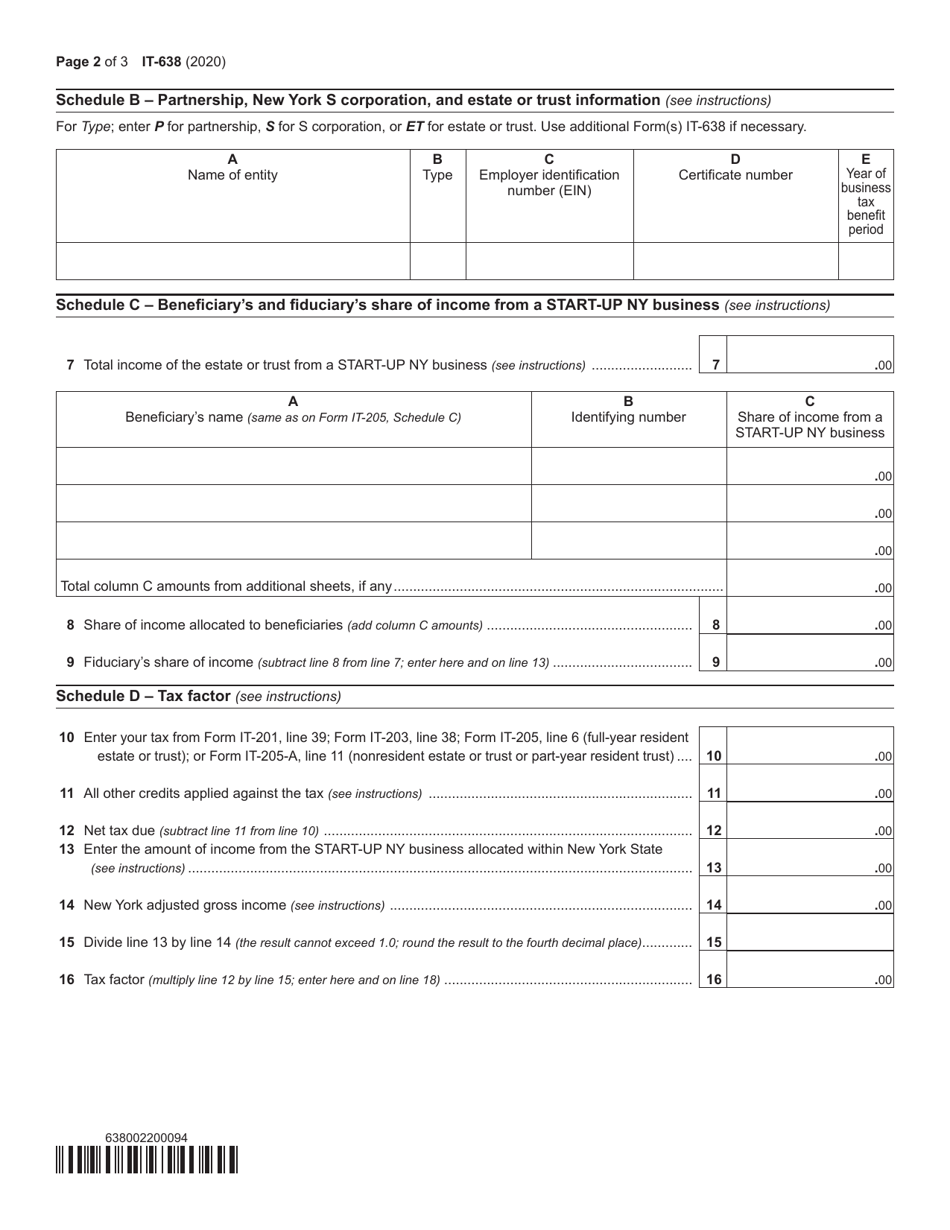

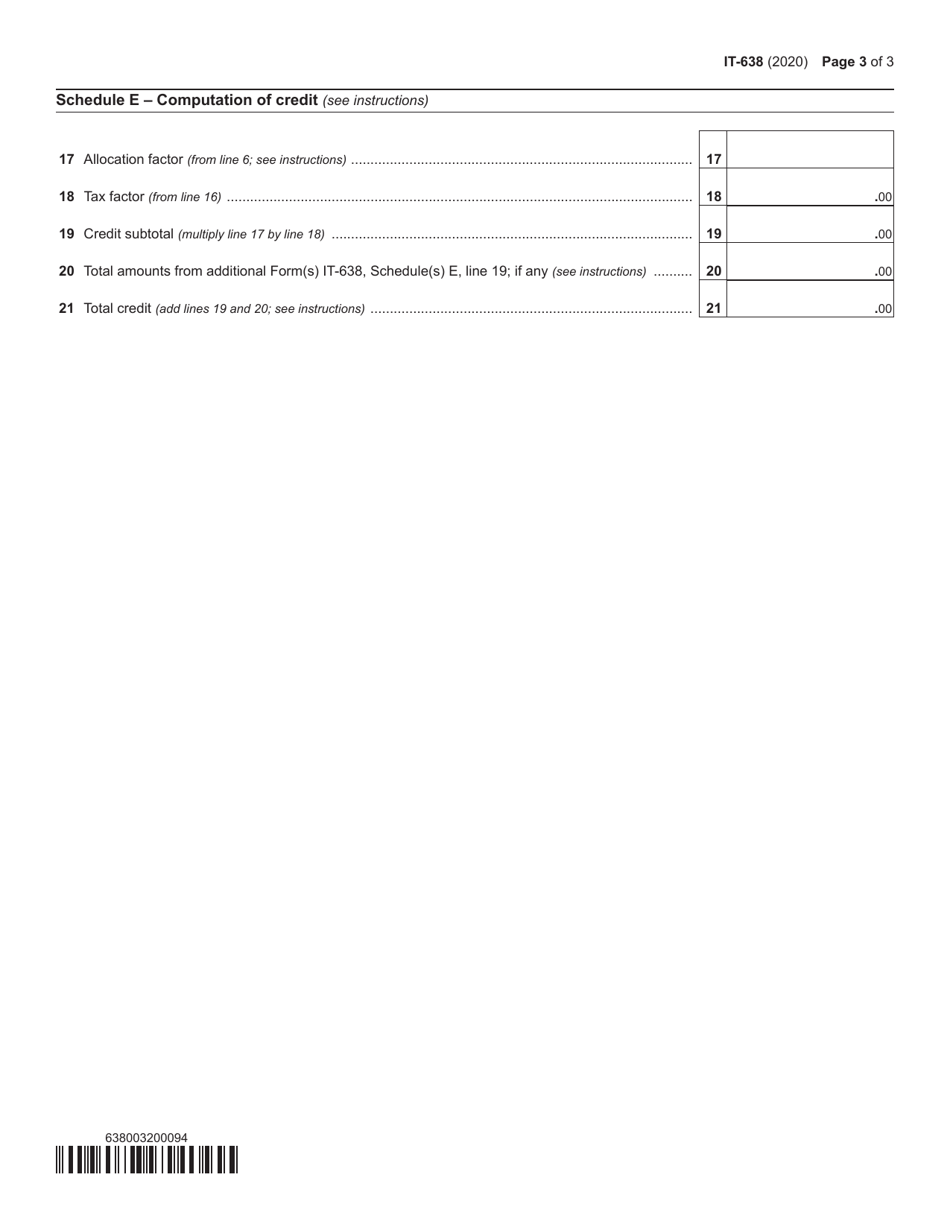

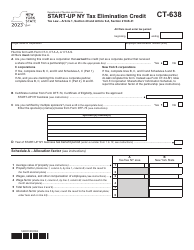

Form IT-638

for the current year.

Form IT-638 Start-Up Ny Tax Elimination Credit - New York

What Is Form IT-638?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-638?

A: Form IT-638 is a tax form used in New York to apply for the Start-Up NY tax elimination credit.

Q: What is the Start-Up NY tax elimination credit?

A: The Start-Up NY tax elimination credit is a program in New York that provides qualifying businesses with a credit that eliminates their state and local taxes for a specific period of time.

Q: Who is eligible for the Start-Up NY tax elimination credit?

A: To be eligible for the Start-Up NY tax elimination credit, businesses must be approved to participate in the Start-Up NY program and meet certain criteria set by the program.

Q: How can I apply for the Start-Up NY tax elimination credit?

A: To apply for the Start-Up NY tax elimination credit, businesses must complete and submit Form IT-638 to the New York State Department of Taxation and Finance.

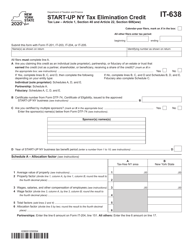

Q: What documents should be included with Form IT-638?

A: Businesses should include supporting documentation with Form IT-638, such as a Start-Up NY certificate and any other required documentation outlined in the instructions for the form.

Q: When is the deadline to submit Form IT-638?

A: The deadline to submit Form IT-638 and apply for the Start-Up NY tax elimination credit is generally the same as the annual due date for filing the business's New York state tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-638 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.