This version of the form is not currently in use and is provided for reference only. Download this version of

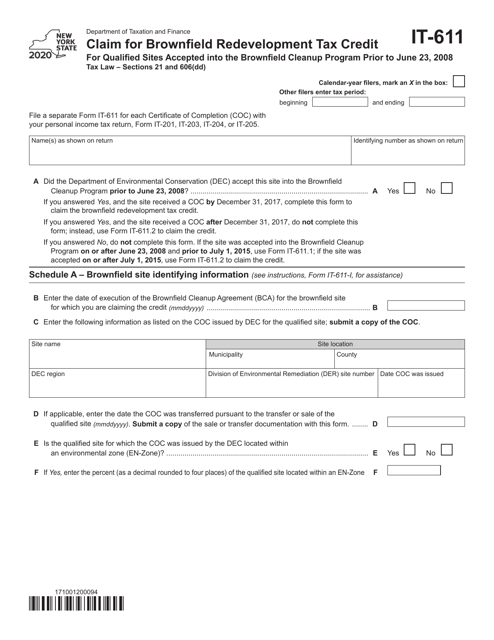

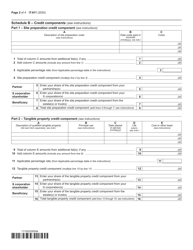

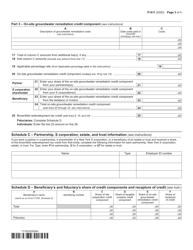

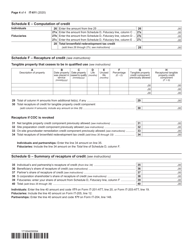

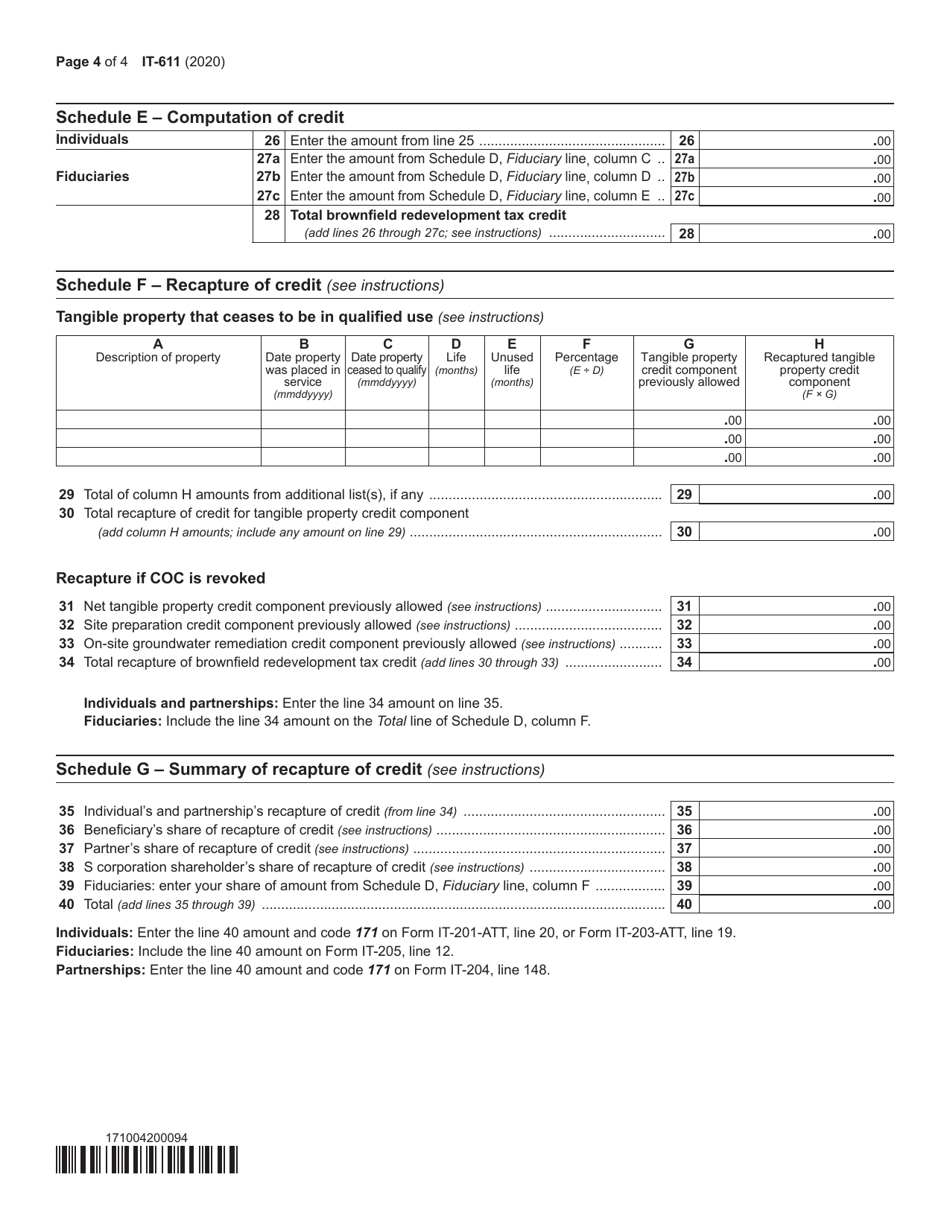

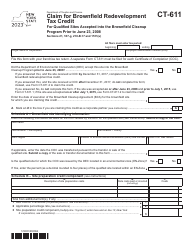

Form IT-611

for the current year.

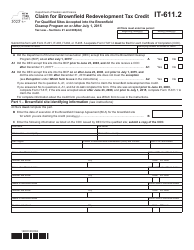

Form IT-611 Claim for Brownfield Redevelopment Tax Credit - for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

What Is Form IT-611?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-611?

A: Form IT-611 is the claim for Brownfield RedevelopmentTax Credit in New York.

Q: Who can file Form IT-611?

A: Anyone who has a qualified site accepted into the Brownfield Cleanup Program prior to June 23, 2008 in New York can file Form IT-611.

Q: What is the purpose of Form IT-611?

A: The purpose of Form IT-611 is to claim the Brownfield Redevelopment Tax Credit for qualified sites.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax incentive in New York for the cleanup and redevelopment of contaminated sites.

Q: When should Form IT-611 be filed?

A: Form IT-611 should be filed to claim the Brownfield Redevelopment Tax Credit before the due date of your tax return.

Q: Is there a deadline for filing Form IT-611?

A: Yes, Form IT-611 must be filed within three years from the date the credit is allowed to be claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-611 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.